The Bull Case for Banks

Banks have become the call option on a US economic recovery.

When the economic data runs hot, banks rally. When it’s cold, they sell off. So, in recent months bank share prices have been melting up.

If we are falling into a recession, then unloading banks here is the right thing to do. If we’re not, and this is really a fake out, then you are looking at the buying opportunity of the decade for banks.

I fall in the latter camp.

There also is a huge sector rotation issue staring you in the face. Where would you rather put new money, stocks at all-time highs trading at ridiculous multiples, like energy stocks, or a quality sector in the bargain basement?

Big institutions have already decided what to do and are buying every dip in financials.

Banks certainly took it on the nose in 2022. Loan default rates soared, demanding a massive increase in loan loss provisions.

Much more stringent accounting rules also kicked in known as “Current Expected Credit Losses.” That requires banks to write off 100% of their losses immediately, rather than spread them out over a period of years.

So what happens next?

For a start, fall down on your knees and thank that Dodd-Frank, the Obama-era financial regulation bill, was passed.

Banks carped for years that it unnecessarily and unfairly tied their hands by limiting leverage ratios to only 10:1. Morgan Stanley reached 40:1 going into the Great Recession and barely made it out alive, while ill-fated Lehman Brothers reached a suicidal 100:1 and didn’t.

That meant the banks went into the pandemic with the strongest balance sheets in decades. No financial crisis here.

Thanks to government efforts to bring the pandemic hit to the economy to a quick end, generous fees have been raining down on the banks from the numerous loan programs they helped to implement, such as PPP.

And trading profits? You may have noticed that options trading volume is up a monster 100% so far in 2023. That falls straight to the banks’ bottom lines. If you’re wondering why your online trading platform keeps crashing that’s why.

I list below my favorite bank investments using the logic that during depressions you want to buy Rolls Royces, Teslas, and Cadillacs at deep discounts, not Volkswagens, Fiats, or Trabants.

JP Morgan (JPM) – is the crown jewel of the sector, with the best balance sheet and the strongest customers. It has over reserved for losses that are probably never going to happen, stowing away some $25 billion in the last quarter alone.

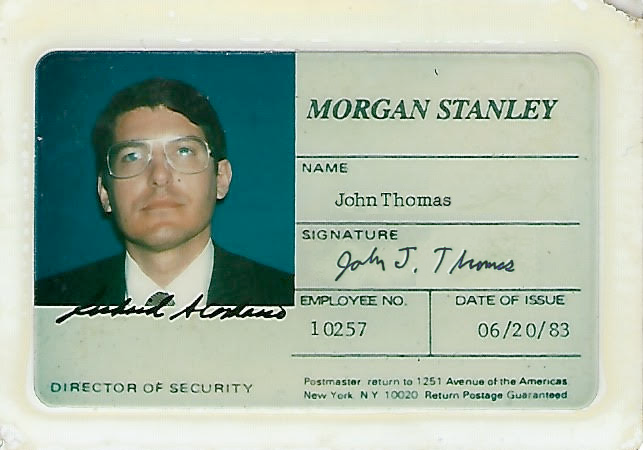

Morgan Stanley (MS) - Brokerage-oriented ones like Morgan Stanley (MS) and Goldman Sachs (GS) are benefiting the most from the explosion in stock and options trading. Morgan’s focus on asset management has made it the first pick among investors demanding a high multiple. I’ll pick my former employer (MS), where I once accounted for 80% of equity division profits.

Bank of America (BAC) - is another quality play with a fortress balance sheet.

Citigroup (C) – is the leveraged play in the sector with a slightly weaker balance sheet and a more aggressive marketing strategy. It seems like they’re always trying to catch up with (JPM). This is the high volatility play in the sector.

And what about Wells Fargo (WFC) you may ask, the cheapest bank of all? This year, it has shaken off hair suit because of its many regulatory transgressions, before, during, and after the financial crisis so I’ll give it a miss.

Here's My Pick