The Market Outlook for the Week Ahead, or the Sweet Spot Continues

We just completed the best week in the 13-year history of the Mad Hedge Fund Trader.

Kudos have been coming in from all over the world, with stories of retirements financed, mortgages paid off, and college educations paid for. Some Mad Hedge Concierge clients are reporting windfall profits of $1 million a day.

The key was calling the GameStop (GME) fiasco the one hit wonder that it was, and using it as an opportunity to go 100% long, pedal to the metal, and bet the ranch. When the market gives you a gift, you grab it with both hands as if your life depended on it and don’t let go.

It worked.

That’s what 50 years of practice gets you, the ability to spot the gold coins lying on the street ignored by everyone else and pocket them immediately.

A record $4.2 billion poured into technology stock funds last week as investors call the end of the six-month big tech correction. The barbell approach is working like a charm, with buying bouncing back and forth like a ping pong ball between domestics, technology, or both sectors go up at the same time. It’s better than owning a printing press for $100 bills.

The Mad Hedge Technology Letter also spotted which way the gale force winds were blowing and piled on the longs as well. (AMZN), (QCOM), and (CRWD), it’s all music to my ears. My old friend Jeff retired, paving the way for another doubling in his stock (AMZN).

We now are getting a clearer picture of how 2021 will play out in the stock market. Periods of sideways action will be followed by big gaps up, eventually taking us to a Dow Average of 40,000.

The sweet spot continues. As low as interest rates and inflation remain low and a tidal wave of new money is pouring into the economy, you have a rich uncle writing you a check every month from the stock market.

We have not had a correction of more than 4% since October. This could go on for years.

Where will the next surprise come from?

When Joe Biden gets his full $1.9 trillion in upfront rescue spending. With the grim tidings of three disastrous monthly jobs reports out, it couldn’t go any other way. The cost of waiting is just too high, especially for the 18 million U-6 unemployed and millions of small businesses hanging on by their fingernails.

The Nonfarm Payroll Report came in very weak, at 49,000 in January. The headline Unemployment Rate was at 6.3%, a decline as more people are leaving the workforce. The U-6 broader “discouraged worker” unemployment rate is still at 11%. December was revised down to an even bigger 227,000 loss. Construction was down 10,000, Retail down 37,000, and Government Jobs were up 43,000. It’s the third disappointing month in a row so a double-dip recession is still on the table. We have a very long road to recovery.

Weekly Jobless Claims improved, dropping to 779,000, the lowest since November. The correlation with falling Covid-19 cases is almost perfect, which have declined by 35% in two weeks. Is the stock market getting ready to roar?

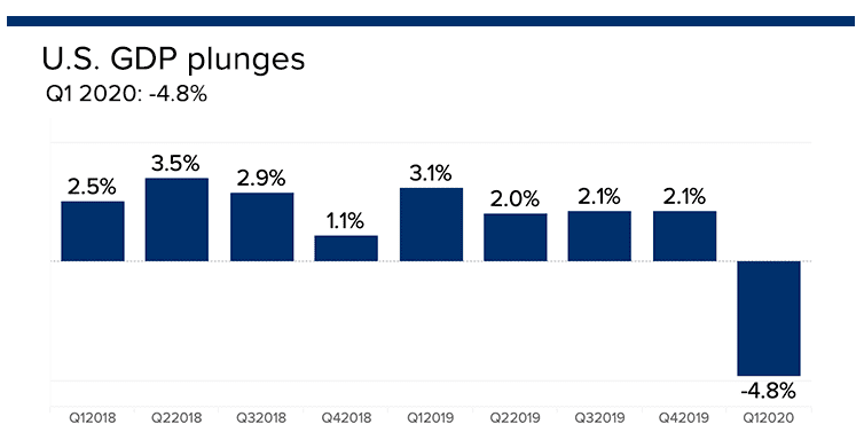

US GDP fell by 3.5% in 2020, wiping out all of 2019 and a good chunk of 2018 as well. The last quarter of 2020 came in at -4.8%, much worse than expected, and further downward revisions are coming, according to the Bureau of Economic Analysis. The economy won’t recover pre-pandemic levels until late 2022 or 2023. The biggest drags on the economy were dramatic falls in consumer spending, nonresidential fixed investment, and a trade war-induced plunge in exports.

Pending Home Sales fell, 0.3% in December, but are still up a staggering 21.4% YOY. It is the highest December reading on record, but the fourth straight month of declines. A historic shortage of supply is the main reason.

The short squeeze play moved to silver, with prices hitting an eight-year high. Many local dealers are seeing business rise tenfold over the weekend and are running out of inventory. The white metal was up 35% in two days. It’s the largest one-day volume every. This time, the kids may have got it wrong, since all short positions in the options market are fully hedged with long positions in silver futures or silver bars. The GameStop players only saw the short side. Long term, I love (SLV) for industrial demand from electric cars and solar panels and see it going from today’s $28 to $50, but not today.

Apple (AAPL) is boosting share buybacks and is borrowing to do it. It’s issuing $14 billion in bonds out to 40 years in maturity at 95 basis points above Treasuries. If Apple is so aggressive in buying its own stock, maybe you should too.

The Apple car is moving forward, as incredible as it may seem. The company is in talks with South Korea’s Hyundai to produce autonomous self-driving electric vehicles that will be available by 2024. I’ll believe it when I see it. I’ve seen Apple self-driving cars in the Bay Area for years. It’s an interesting combination: Apple software, a South Korean design, and non-union Georgian metal bashing combined. Sounds like a winner to me.

The GameStop (GME) game ends. Back to selling used video games in shopping malls. Millions were lost in the crash from $483 to $49. Back to buying real stocks with the systemic threat to the main market over.

Jeff Bezos retired, putting the operation of Amazon into the hands of Andy Jassy, the inventor and head of the cloud unit AWS. No move in the stock beyond the first few seconds. Jassy has been there since the beginning. If I were the second richest man in the world, after Elon Musk, I’d take some time off too. Now, maybe my former Morgan Stanley colleague will have drinks with me. Buy (AMZN) on dips. My two-year target is $5,000.

Bombs away for the bond market, as the (TLT) hits a new 2021 low, taking ten-year yields up to 1.13%. I’m taking profits on the last of my bond shorts and piling money into financials, which love higher interest rates. Buy (JPM), (BAC), (C), and (BLK) on dips. A 1.50% yield on the ten-year US Treasury bond here we come! This is the quality trade of 2021.

The ADP Private Employment recovered, up 174,000 in January after a 74,000 plunge in December. Leisure & Hospitality is the big variable.

PayPal transactions were up 25% in 2020, showing the incredible extent of the online migration of the economy. Keep going with Fintech. There’s another double in (PYPL).

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch earned an amazing 14.15% during the first week of February after a blockbuster 10.21% in January. The Dow Average is up 3.47% so far in 2021. This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 24.36%.

I absolutely nailed the market bottom created by the GameStop fiasco, which I didn’t expect to last any more than days. I went 100% leveraged long, which enabled me to achieve the astounding numbers I am reporting today.

Not only did I get the market right, I picked the perfect sectors as well. I jumped 60% into financials, 20% in Tesla, 10% for commodities, and 10% in chips. I used the bond market meltdown to cover the last of my bond shorts. But all of my financial longs are essentially bond shorts.

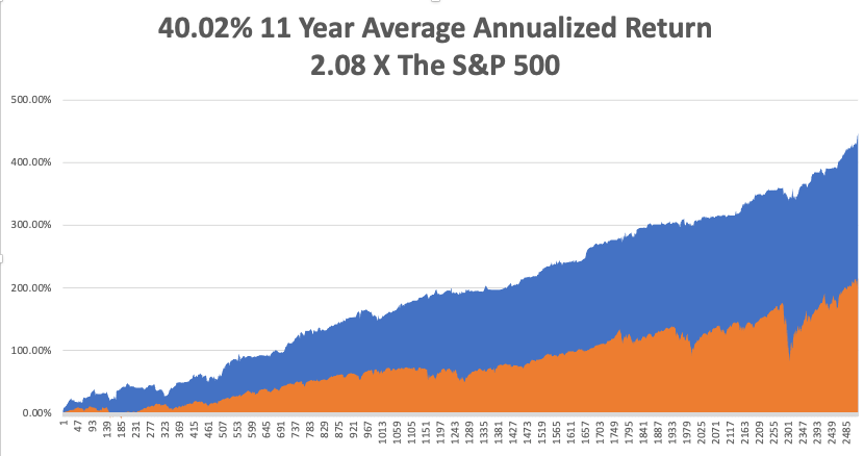

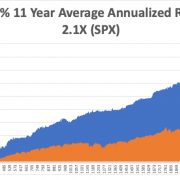

That brings my 11-year total return to 446.81%, some 2.08 times the S&P 500 over the same period. My 11-year average annualized return now stands at an Everest-like new high of 40.02%.

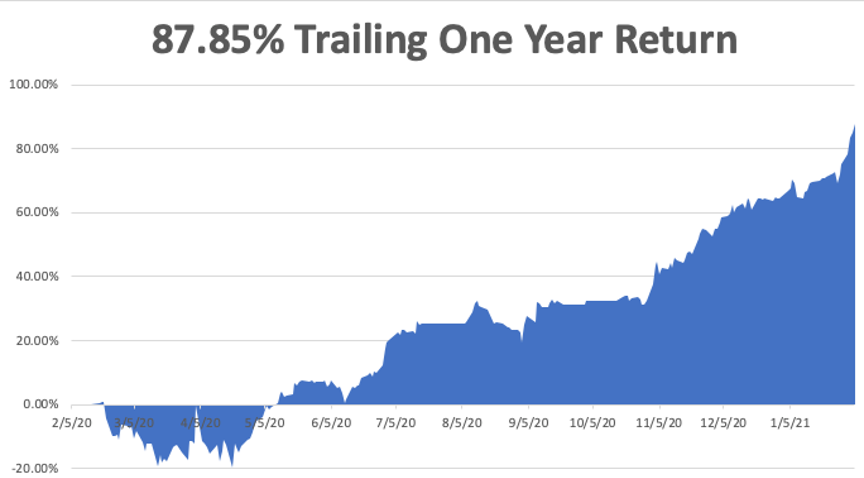

My trailing one-year return exploded to 87.85%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 105.58% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 27 million and deaths 465,000, which you can find here. We are now running at a heartbreaking 3,000 deaths a day. But that is down 35% from the recent high.

The coming week will be a boring one on the data front.

On Monday, February 8 at 11:00 AM EST, Consumer Inflation Expectations for January are out. Softbank (SFTBY) and KKR & Co. (KKR) report.

On Tuesday, February 9 at 6:00 AM, the NFIB Business Optimism Index is released. Cisco Systems (CSCO) and Twitter (TWTR) report.

On Wednesday, February 10 at 8:30 AM, the US Core Inflation Rate is announced. Coca-Cola (KO) and Uber (UBER) report.

On Thursday, February 11 at 9:30 AM, Weekly Jobless Claims are printed. Walt Disney (DIS) and AstraZeneca (AZN) report.

On Friday, February 12 at 2:00 PM, we learn the Baker-Hughes Rig Count. As we have a three day weekend following, option volatility should collapse. Moody’s (MCO) reports.

As for me, I went into Reno last week to replace the windshield on my Toyota Highlander, my Tahoe car, which below zero temperatures had cracked. One-third of the town was shut down and boarded up, while what remained was booming. A giant shopping mall near downtown has resumed construction, but with less retail and more residential. Reno is the third fastest-growing city in the US and has become a metaphor for the entire country.

Still waiting for my Covid-19 vaccination. I’m at the top of four lists. Even the military can’t get enough. With any luck, I’ll have it in weeks.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader