Who Was the Greatest Wealth Creator in History?

Who’s been buttering your bread more than any other?

Which publicly listed company has created the most wealth in history?

I’ll give you some hints.

The founder never took a bath, was a devout vegetarian, and dropped out of college after the first semester. The only class he finished was for calligraphy. And he was a first-class asshole.

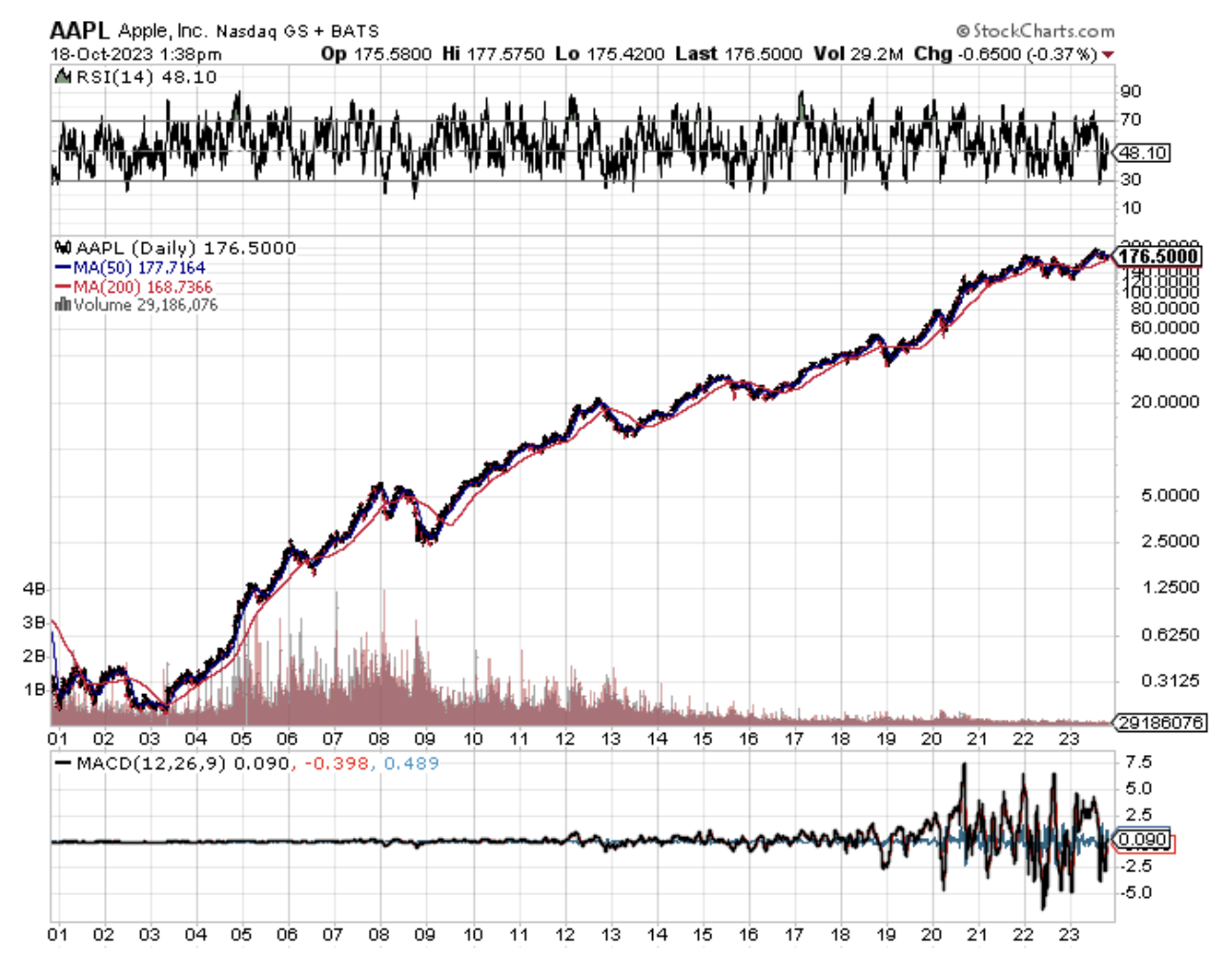

Silicon Valley residents will immediately recognize this character as Steve Jobs, the co-founder of Apple (AAPL).

In 43 years, his firm created over $3 trillion of wealth for his shareholders, making it the largest in the world.

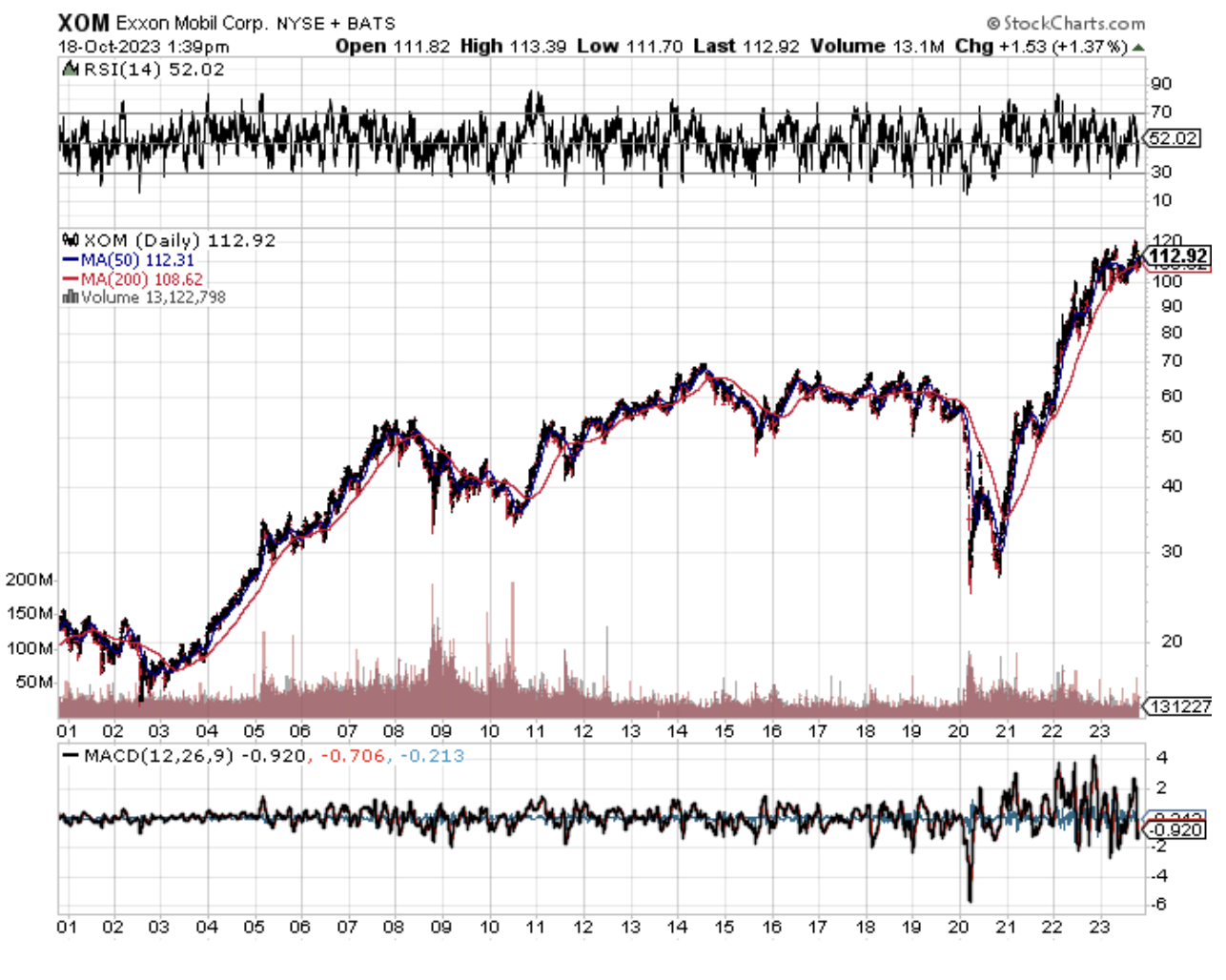

Until a decade ago, Exxon (XOM) held the top spot, creating $900 million in new wealth, although to be fair, it took 100 years to do it.

To be completely and historically accurate, most of the original seven sister oil companies are decedents of John D. Rockefeller’s Standard Oil Company.

Add the present value of these together, and Rockefeller is far and away the biggest money maker of all time. And he made most of this before income taxes were invented in 1913!

Reviewing the performance of other top-performing companies, it is truly amazing how much wealth was created from a technology boom that started in the 1980s.

Investors’ laser-like focus on the Magnificent Seven is well justified.

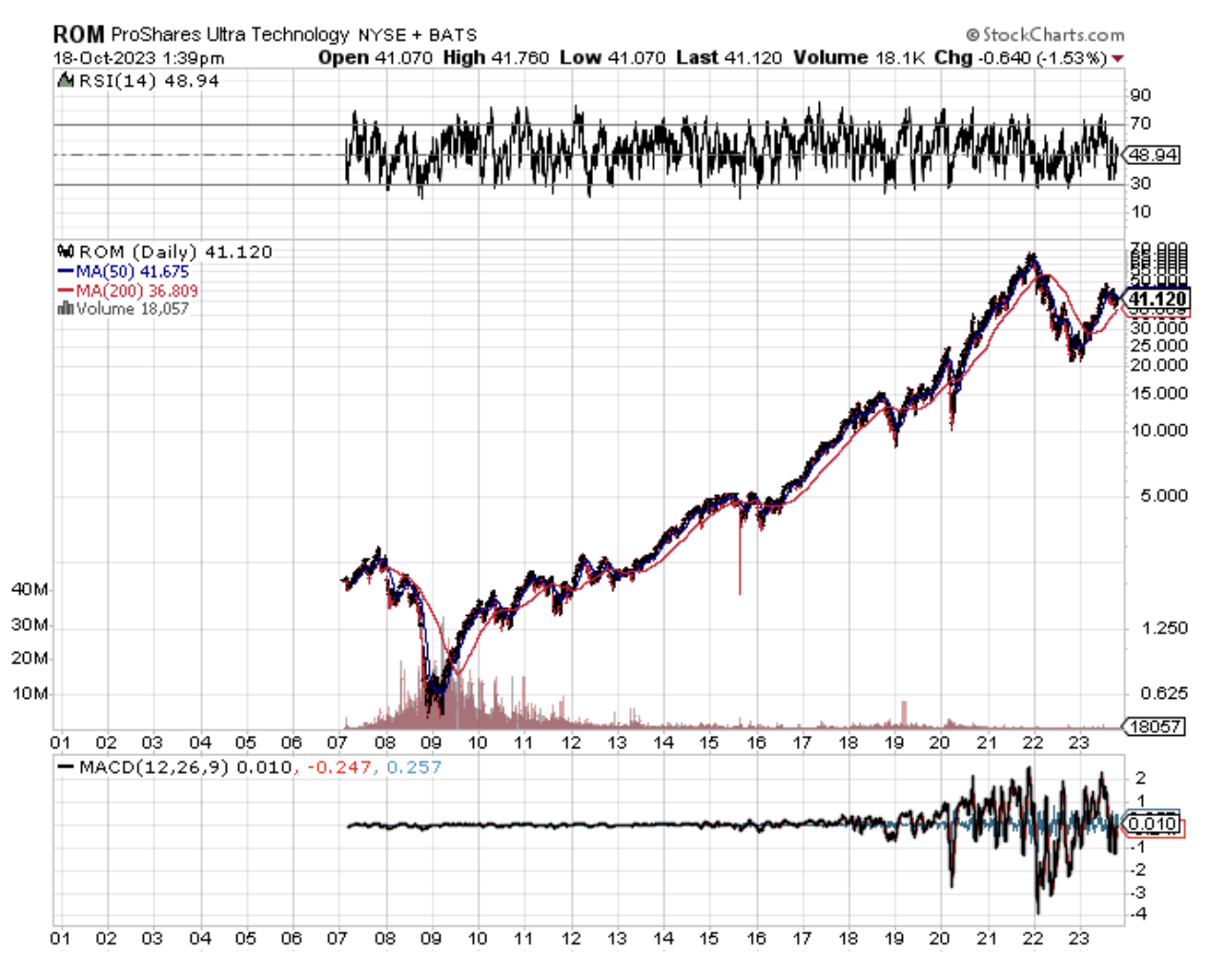

That’s why I often tell guests during my lectures around the world that if they really want to be lazy, just buy the ProShares Ultra Technology ETF (ROM) and forget everything else.

Another college dropout’s efforts, those of Bill Gates Microsoft (MSFT), produced an annualized return of 25% since 1986. That made him the third greatest wealth creator in history.

It also made him the world's richest man, until Jeff Bezos and Elon Musk came along. Gates is thought to have single-handedly created an additional 1,000 millionaires as so many employees were aided in stock options.

Facebook (FB) is the youngest on the list of top money makers, creating an annualized 34.5% return since it went public in 2012.

Alphabet (GOOG) is the second newest on the list, racking up a 24.9% annualized return since 2004.

Amazon (AMZN) is 14th on the list of all-time wealth creators and has just entered its 20th year as a public company.

Being an armchair business and financial historian, many runners-up were major companies in my day, but generate snores among Millennials now.

Believe it or not, General Motors (GM) still ranks as the 8th greatest wealth creator of all time, even though it went bankrupt in 2008.

Ma Bell or AT&T (T) ranks number 17th but was merged out of existence in 2005. A regrouping of Bell System spinoffs possesses the (T) ticker symbol today.

Among its distant relatives are Comcast (CCV) and Verizon Communications (VZ).

Warren Buffet’s Berkshire Hathaway (BRKY) ranks 12th as an income generator, with an annualized return of only 11.94%.

Its performance is diluted by the low returns afforded by the textile business before Buffet took it over in 1962. Buffet’s returns since then have been double that.

Analyzing the vast expanse of data over the last 100 years proves that single stock picking is a mug's game.

Since 1926, only 4% of publically traded stocks made ALL of the wealth generated by the stock market.

The other 96% either made no money to speak of, or went out of business.

This is why the Mad Hedge Fund Trader focuses on only 10%-20% of the market at any given time, the money-making part.

In other words, you have a one in 25 chance of picking a winner.

A modest 30 companies accounted for 30% of this wealth, while 50 stocks accounted for 40%.

You can only conclude that stocks make terrible investments, not even coming close to beating the minimal returns of one-month Treasury bills, a cash equivalent.

It also is a strong argument in favor of indexed investment in that through investing in all major companies, you are guaranteed to grab the outsized winners.

That is unless you follow the Diary of a Mad Hedge Fund Trader, which picked Amazon, Apple, Facebook, Google, NVIDIA, and Tesla right out of the gate.

If you want to learn more about the number crunching behind this piece, please visit the research of Hendrik Bessembinder at the W.P. Carey School of Business at Arizona State University.

Such a Money Maker!