Why Cash is the Best Hedge

Over the decades, I have been besieged by suggestions by various market players over how to hedge their downside risk in the stock market.

I have analyzed most of these, experimented with them, and even tried out a few. These range from buying equity put options to selling call options, investing in bear ETFs, and trading the volatility index (VIX).

My conclusion is always the same: Cash is always the best hedge.

Hedge fund managers like me are always under pressure to deliver positive returns whether the stock market goes up, down, or sideways. A lot make this promise but few are actually able to deliver. You can almost count them on one hand and I know all of them personally.

And here is a hedge fund manager’s worst nightmare: both your longs go down and your shorts go down, eroding capital at a double rate. This is often the result when you come to rely on these esoteric “hedges.”

This happens when you have done all the research in the world, have countless mathematical formulas to back you up, and you backtest your data for 30 years.

First of all, assets classes don’t always perform according to financial models because there is always one big variable that managers can’t quantify: human emotion.

While algorithms and computers are completely rational, people aren’t, even the most experienced ones. After watching markets for over 50 years I can tell you that there is only one certainty. That the natural tendency of most people is to buy at market tops and sell at market bottoms.

In order words, making money in the stock market is an unnatural act and fights against the long-term tide of evolution. We, humans, are predators and hunters evolved to track game on the horizon of an African savanna. Modern humans are maybe 5 million years old but civilization has been around for only 10,000 years. Our brains have not had time to make the adjustment.

In the market, this means that if a stock has gone up, you believe it will continue to do so. This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts. Some people are born with this ability while others can only learn it through decades of training. I am in the latter group.

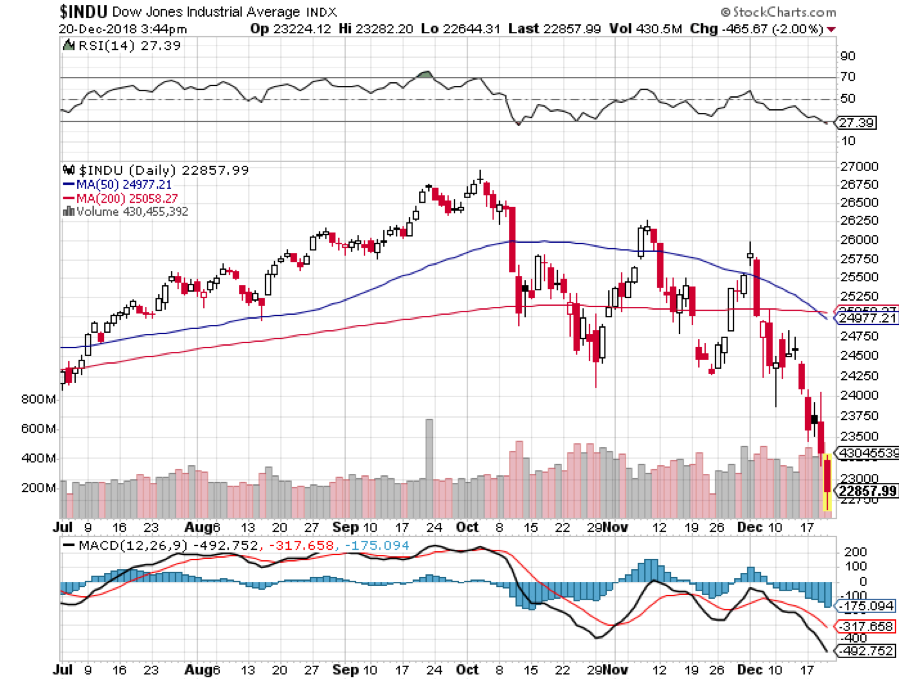

The 4,400-point decline we have all suffered over the last 2 ½ months is a classic example. Prices earnings multiples have given up half of their gains since the 2009 bear market bottom. It is one of the best buying opportunities in four years. So, what are investors doing? Selling.

Share prices are now discounting a severe recession in 2019 that probably isn’t going to happen. I don’t believe that we’ll get one until the end of 2019 and even then it will be a modest one. Essentially, we already have a recession in the price at these levels. If the recession doesn’t show, stocks will rocket.

What hedges worked during this time? Absolutely none. If you shifted from growth stocks to value ones, or from high beta ones to low beta shares, you still lost money, probably a lot. Those who hedged with volatility probably has some one-hit wonders, but add up their profit and loss for the entire year and it probably comes to negative numbers.

You know what didn’t lose money? Cash which in fact is now earning 2%-4% depending on where you have it parked.

This is why I have been running cash positions of 70%-90% for the past four months. Oh, how I love the smell of cash in the morning. Logging into my online trading account every morning and seeing a wad of cash is like getting a short rush of adrenaline.

Absolutely, cash is the best hedge.