Global Market Comments

January 31, 2013

Fiat Lux

Featured Trade:

(WHERE?S THE CRASH?)

(TAKING FORD OUT FOR A SPIN), (F),

(CHENIERE ENERGY GETS THE GREEN LIGHT), (LNG), (UNG),

(THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

That was the questions traders were scratching their heads and asking this morning in the wake of this morning?s shocking Q4, 2012 GDP figure.

While most analysis were expecting the government to report a more robust 1%-2% number we got negative -0.1%, the worst since 2009. With growth flipping from a positive 3.1% figure in Q3 many thought that a Dow down 500 points was in the cards. Instead we pared back a modest 44 points. What gives?

Ahhh, the devil is in the details. The main culprit was in defense spending, down a mind numbing 22.2%, the worst since the wind down of the Vietnam War in 1972. I remember it like it was yesterday. In fact, government spending was weak across the board as a quasi shut down in advance of the fiscal cliff brought spending to a grinding halt.

In the end, the fiscal cliff never happened. But the downshift shows you how severe such a slowdown would be, if we ever go over the cliff sometime in the future.

There were other one off factors. Hurricane Sandy put a dent into the economies of the US east coast, especially in the transportation sector. The effects of last summer?s drought, which triggered a serious shrinkage in a broad swath of the agricultural sector, were also felt.

What traders instead decided to focus on were the impressive strength of the private sector. Business investment rocketed 8.4%, while consumer spending jumped by 2.2%. It all confirms my theory that the passage of the presidential election broke the dam for private economy, and got people off their behinds once all the negativity and uncertainty was gone. Businesses suddenly began investing and hiring, while consumers stepped up consuming.

What this data tells us is that there will be a sizable postponement of growth from Q4 into Q1, 2013. The Pentagon will ramp up spending once again in the knowledge their budget is secure, at least for the time being. In the meantime, the private sector continues on fire. Q1 could well turn out to be a monster quarter. This is what the unremitting rise in share prices is shouting at us.

In the end, traders don?t really care what the GDP is. In fact, most can?t even spell it. The focus of the street is on the future, not the past. And the data promises to improve.

This morning we saw private sector job growth of 182,000 from the ADP. If Thursday morning delivers another five year low in jobless claims, the market will be primed for a hot January nonfarm payroll on Friday. It?s become ?a glass is half full, glass three quarters full? kind of market. Is either goes up, or up more.

Not Happening Here, Baby

I have been trying to buy this stock for a month. Not because I like their pedestrian cars (except the new, muscular, retro Mustang), but because it is one of the great turnaround stories in business history.

Today?s earnings announcement gives us that window. It delivered over $3 billion in profits during Q4, 2012. But the market decided to focus instead on the expectation of a loss from European operations of $2 billion in 2013, compared to only $27 million in 2011 and $1.7 billion in 2012. That was enough to drop (F) by 15% from its mid-January high.

Europe has definitely been a nightmare for the entire auto industry. When your economy crashes, your bank goes under, and you lose your job, the last thing you do is run out and buy a new car. Tough union rules prevent carmakers from downsizing to a level appropriate with current demand. Everyone is bleeding on their European operations, not just Ford.

Another problem is the collapsing yen, which is making Japanese vehicles much more cost competitive. Get the beleaguered Japanese currency above ?100 to the dollar and keep it there, and that could erode market share for the American makers.

Dig deeper, and you?ll find there?s more to the story. Half of the European losses come from one time only charges. That is far and away offset by a North American market that is absolutely on fire. Indeed, the total size of the US market could soar from 15 million units last year, to 16 million units this year, up from the 9.5 million nadir we saw in 2009. Ford is successfully cutting costs. The rocketing price of palladium (PALL), a key component of the catalytic converters that go into new cars, is telling you as much.

There is no doubt that Ford CEO, Alan Mulally, is a genius. Ford is also a high yield play, with a dividend of 2.90% off of today?s close, which is set to rise. Yet the shares are trading at a 38% discount to the S&P 500. That sounds like a bargain to me for the only US auto manufacturer to avoid a government bailout.

Think I?ll Take Ford Out for a Spin

I have been pounding the table on the attractions of Cheniere Energy (LNG) since last spring. Yesterday, the stock hit a new all time high of $21.50.

There is never any guarantee that a government agency will not do something idiotic. Last year it didn?t, thankfully. The Federal Energy Regulatory Commission (FERC) granted the final license needed by Cheniere Energy (LNG) to build the first of two liquefaction plants at Sabine Pass on the Texas Louisiana border on the Gulf of Mexico. These will be the first such plants built in the US in 40 years.

FERC gave to go ahead despite vocal opposition from the Sierra Club, which claimed that fracking caused environmental damage. This, of course, is complete bunk. MIT recently published a study of 50 incidents where gas made it into local water supplies. In every case, it was shown to be the cause of subcontractor incompetence and inexperience, not because of any fundamental flaws with the technology.

The move was a crucial step towards turning the US into a major natural gas (UNG) exporter. The company has already contracted to sell 89% of the plants? planned annual output of 16 million tons. Buyers include BG Group of the UK, Gas Natural Fenosa of Spain, Gail of India, and Kogas of South Korea. Initial deliveries are expected to commence at the end of 2015.

You may recall that I recommended this stock to readers back on March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)? at http://madhedgefundradio.com/take-a-look-at-cheniere-energy-lng/). I think it is just a matter of time before the stock surpasses its next hurdle at $30, especially if natural gas continues to stabilize here around $2/MM BTU.

Now, We?re Cooking With Gas

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great place to be.

I learned this the other day when I received a parking ticket in the mail. I didn?t recall finding a notice of violation tucked under my windshield wiper in the recent past, so I looked into it. To my chagrin, I learned that the city is now outfitting its busses with video cameras pointing forward and sideways. The digital recordings are then transmitted to parking control officers sitting behind computers for review.? They issue tickets which are mailed to the registered owner of the vehicles.

San Francisco suffers from one of the worst parking nightmares in the country. The streets were never planned, they just sort of happened on their own during the frenzy of the 1849 gold rush. They were built to handle the traffic of horses and carriages, and later cable cars, not the crush of traffic we get today.

Sky-high real estate prices have driven millions into the suburbs across the bridges over which they must commute. So parking has always been in short supply and it is very expensive. When I drive into the city for a Saturday night dinner, sometimes the parking tab is more expensive than the meal.

Newly minted millionaires from tech IPO?s are now buying vintage Victorian homes, and then retrofitting garages underneath them. Every time this is done, it eliminates another parking spot on the street to make room for the driveway. So while the traffic is increasing, the number of parking spots is actually declining.

The city originally installed the cameras to catch offenders driving in bus lanes during rush hour. When they discovered that the cameras also captured the license plates of illegally parked cars they expanded the program. Last year 3,000 such tickets were issued.

The program has been so successful that the cash strapped city will greatly expand it this year. And with a great San Francisco track record to point to, the firm selling the system is planning on going nationwide. Soon it will come to a city near you. Like I said, sometimes the future is not such a great place to be.

Parking in San Francisco Can be Tight

I don?t know that the retail investor matters anymore. They didn?t come back to the market after the 2000 crash. The idea that the individual investor believes in the stock market now is challenged. We have a market that is increasingly institutional investors trading back and forth with each other?, said Dan Greenhouse, chief global strategist at BTIG.

Global Market Comments

January 30, 2013

Fiat Lux

SPECIAL HIGH YIELD FOREIGN STOCK ISSUE

Featured Trade:

(TRADE ALERT SERVICE POSTS FIVE CONSECUTIVE ALL TIME HIGHS).

(SPY), (IWM), (FCX), (AIG), (TLT), (FXY), (YCS),

(REACH FOR YIELD WITH HIGH DIVIDEND FOREIGN STOCKS),

(FTE), (SAN), (BCE), (ECH), (VE), (AWC)

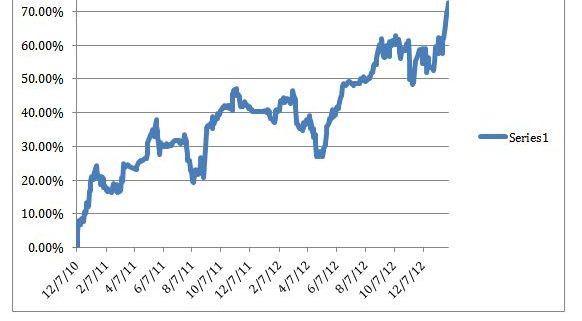

The Trade Alert Service of the Mad Hedge Fund Trader posted a new all time high today, pushing its two-year return up to 72.67%. The Dow average booked a miniscule 13% gain during the same time period. The industry beating record was achieved on the back of a spectacular January, which so far had earned readers a mind blowing 17.62% profit.

Right after the January 2 opening, I shot out Trade Alerts urging readers to take maximum long positions in the S&P 500 (SPY) and the Russell 2000 small cap index (IWM). Later, I piled on longs in copper producer Freeport McMoRan (FCX) and American Insurance Group (AIG). I balanced these out with aggressive short positions in the Treasury bond market (TLT), and the Japanese yen (FXY), (YCS).

After grinding around just short of the previous top for four tedious and painful months, the breakout was certainly welcome news for many. Once I racked up an unprecedented 25 consecutive profitable trades over the summer, things went wobbly. The Fed unleashed an early, surprise, pre election QE3. Then inventors stopped drinking the Apple (AAPL) Kool Aide en masse. The extent of the tax loss selling after the Obama win was also a bit of a shocker. Maybe I should take longer vacations.

Then the ?aha? moment came. I concluded at the end of November that the multiple political crises facing us were nothing more than hot air. This meant the risk markets were poised to launch multi month bull runs to new all time highs, and I positioned myself, and my followers, accordingly. In the end, that is exactly what we got.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

With the increase of globalization, investing in foreign stocks can be a smart move. Many Americans have low exposure to foreign equities in their portfolio believing that US stocks are safer and more reliable. However, investing in foreign stocks can help to decrease risk, diversify your portfolio, give you access to emerging markets, and deliver dividend yields that you can only dream about at home.

France Telecom (FTE), the largest telecom operator in France, is a favorite target of yield hungry hedge funds. Earlier this year, the company?s revenue and growth declined due to the entry of a lower cost mobile operator Iliad S.A. (ILD.PA). Iliad offers SIM-only plans, which bypass the cost of having to buy a new phone. In its first quarter ever, Iliad added 2.6 million subscribers, taking many from France Telecom and its competitors.

Although Iliad?s entrance into the wireless market was impressive, SIM-only customers account for less than 5% of total users. Despite the difficult competitive and economic conditions France Telecom faces, they have recently experienced large customer growth, as 320,000 domestic consumers have switched back to their mobile service.

Customer growth is occurring internationally as well, with strategic marketing campaigns targeted in Africa and the Middle East. In fact, their Africa and Middle East segments have become their key drivers of growth over the past year. France Telecom currently pays one of the largest dividends in the telecom industry, which was recently cut in November. Their dividend yield is an eye popping 13.10% and the company is selling for $11.60 a share. France Telecom is enticingly undervalued here.

Banco Santander (SAN) is the largest bank in the euro zone by market value. It has been instrumental in restructuring the Spanish financial system as the country plans to decrease the number of competitors to create stronger, more reliable institutions.

With its recent acquisition of the Spanish banks Banesto and Banif, Santander expects to save over ?520 million a year. Although Santander has cut its branches to 30,000, it has greatly benefited from the ?100 billion rescue plan provided by the European Union.

Thanks to the ongoing financial crisis in Europe, Santander?s stock has been crushed. Analysts expect to see earnings of at least $0.80-1.00 a share in 2013. The stock is trading at 9.65 times its forward earnings, which is low compared to the industry average of 17.35. Furthermore, the relatively cheap stock is trading at 0.75 times its book value in comparison to a higher 1.33 of most other Spanish banks.

While the banking sector in Spain saw an overall revenue decrease of 0.4%, Santander exceeded expectations, growing 3.7%. The company has projected steady revenue growth for 2013 and 2014. Their current dividend yield of 6.9% provides a nice cushion against any near term volatility.

CorpBanca S.A. (BCA) is one of Chile?s oldest and largest banks. The company has a strong presence in Latin America and is attempting to penetrate the U.S market as well. A recent ADR (American Depository Receipt) issue means more liquidity and more accessibility for U.S. investors. The company intends to use proceeds of the offering to buy out competitors in the region and to gain a stronger grasp particularly in the Colombian banking industry.

With a current GDP growth rate of 5.7%, Chile (ECH) is one of the fastest growing economies in Lain America and is one of the few countries that run a budget surplus. Due to mandatory saving systems established by most companies, Chileans save a sky high 21.6% of their income. Furthermore, Chile gives foreign investors the same rights as domestic investors, which adds safety to any. CorpBanca has a 31.2% profit margin and a quarterly revenue growth of 38.2% year-on-year.? Their recent dividend yield of 6.0% is expected to rise.

Veolia Environment (VE) is a multinational French company that provides water management, water supply, waste management, energy, and transport services. It is the world?s largest water company, operating in 77 countries with a market cap of $6.2 billion.

Through the Veolia Innovation Accelerator Initiative, the company works with the most promising start-up companies to identify and develop clean technology. Veolia is strongly involved with governments around the world to help preserve natural resources, develop alternative energy sources, and control environmental degradation.

Due to the European crisis, the company saw H1 2012 results weaker than expected. To fight back, Veolia has been undergoing significant restructuring which includes a partial buyback program of USD and Euro-denominated bonds. Veolia has become heavily involved in China due to the country?s miserable environmental conditions. It operates in 17 provinces, municipalities, and autonomous regions helping restructure water and wastewater services. Veolia?s large presence in China will continue to grow in the coming years, promising stable growth over the long term.

Veolia pays a dividend 5.90% off of today?s $12.85 price. With its involvement in countries across the globe and its ever-increasing presence in China, Veolia is likely to do well in the coming years.

Alumina Limited (AWC) is an Australian company that specializes in mining bauxite, alumina (aluminum oxide), and the smelting of pure aluminum. (AWC) produces around 17% of the alumina in the world and operates in the United States, Brazil, Spain, Suriname, Jamaica, and Guinea. It is your classic deep cyclical play.

Alumina has great thermal conductivity, making it a primary component of electrical insulation. In its crystalline form, it is used in sharp cutting tools making it essential for many manufacturing and production materials. Alumina Ltd?s very low debt to equity ratio and its estimated annual earnings growth rate of 35.10% for the next five years have attracted investors who focus on basic material commodities. Their forward dividend yield stands at a solid 6.10% with a payout ratio of 220%. (AWC) is selling well below its book value. There is one cautionary note: it is unusually sensitive to economic conditions of its main customer, China.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.