Global Market Comments

August 7, 2009

Featured Trades: (NATURAL GAS), (UNG), (WHEAT), (TBT), (GOLD), (SILVER)

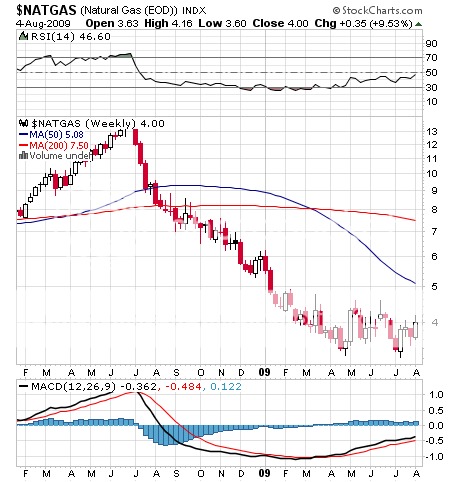

1) Where have all the cheap things gone? Now is the time to exercise your discipline and not behave like a stray dog chasing a fire engine in a crummy neighborhood. Only shop for the bombed out stuff, what stock picking icon Benjamin Graham called ?cigar butts left on the ground that still have one puff left in them.? I mentioned natural gas (UNG) yesterday (NG), which is seeing a major swoosh down today and could be the beginning of an entry point. Wheat is also popping up on my radar. We are witnessing the greatest growing season in history, with farmers reporting conditions near perfection. How do you improve on perfect? Prices got hammered, but seem to have found a floor around $5/bushel, off from last year?s spot high of $13.50. Once we get through the summer and the crop is in the silos, you can look for prices to start an uptrend into the winter. One December wheat contract (WZ09) on the CME buys you 5,000 bushels, worth $25,000 at $5.00/bushel, with a margin requirement of only $2,240. If the trade doesn?t work out, you can always take delivery and make a lot of croissants, or sourdough if you live in San Francisco. If you don?t have the futures account you need to strap on this position, e-mail me at madhedgefundtrader@yahoo.com and I?ll walk you through it.

2) Trade School

I am asked daily about my favorite financial books by the legions of subscribers who are using my blog to educate themselves about the markets. That is one of my goals. Below are my picks, which are entertaining if not insightful. I have left out books about specific trading systems guaranteeing windfall profits, because they all eventually blow up. The good books on the current financial crisis have yet to be written. The best trading strategies will never be written about, but only whispered of in poorly lit bars after work, the kind where your feet stick to the floor with the foul restrooms. Successful traders are a notoriously secretive bunch who don?t want copy cats hanging on to their coattails spoiling their markets. When I do hear about these I pass them on to you through my newsletter. Give yourself an edge and a descent education and foundation by reading the list below.

Security Analysis

by Benjamin Graham and David Dodd

The Bible of security analysis. If you are only going to read only one book, make this it.

A Random Walk Down Wall Street

Burton G. Malkiel

The history of risk analysis on Wall Street.

The Black Swan

by Nassim Nicholas Taleb

An iconoclastic, rock throwing, in your face rebuttal to convention risk analysis theory.

The Snowball: Warren Buffet and the Business of Life

by Alice Schroeder

The biography of the greatest investor of our time.

Extraordinary Popular Delusions and the Madness of Crowds

by Charles MacKay

The history of bubbles, from tulip mania, to the South Sea bubble, to the 1929 crash. Boy, does history ever repeat itself!

The Crash

By John Kenneth Galbraith

A must read history about the big one. You?ll be amazed by the parallels today.

Reminiscences of a Stock Market Operator

by Edwin Lefevre

Biography of one of the most famous speculators of the roaring twenties, who sadly committed suicide in a public bathroom in 1932. You won?t believe what they did in the pre-SEC days.

The Strategic Bond Investor: Strategies and Tools to Unlock the Power of the Bond Market

by Tony Crescenzi

The bond side of the equation. You need to know where interest rates are going and how they will get there

Economics

by Paul Samuelson

What you missed by not going to the Harvard Business School. Your classic education about Keynesian economics that lets you ignore all that fluff in the broker reports. He got a Nobel Prize for this.

Hot Commodities: How Anyone Invest Profitably in the World?s Best Market

by Jim Rogers

The former George Soros partner tells you why you?ve been buying all that copper.

Crash Proof: How to Profit from the Coming Economic Collapse

by Peter Schiff

Nicely outlines the rationale for moving out of the dollar an into foreign stock markets, gold, and silver, although he is a little extreme in his views of the future of the US.

Market Wizards: Interviews With Top Traders

by Jack D. Schwager

How the pros do it.

The Complete Guide to Investing in Commodity Trading and Futures: How to Earn High Rates of Return Safely

by Mary B. Holihan

The abc?s of commodity investing.

When Genius Failed: The Rise and Fall of Long Term Capital Management

by Roger Lowenstein

Why you?re not shorting deep out of the money volatility in big size.

Against the Gods: The Remarkable History of Risk

by Peter L. Bernstein

How ancient trade routes grew into the global financial system we all know and love.

Liars Poker: Rising through the Wreckage on Wall Street

by Peter Lewis

My friend?s first book, what it is like to work at Goldman Sachs, except then it was Salomon Brothers. When it first came out many thought I had written this book with a nom du plume.

Beat the Dealer: A Winning Strategy for the Game of Twenty-One.

by Edwin O. Thorp

How to win at Black Jack by card counting. I put myself through college on this book, and so did Pimco?s Bill Gross. Not so easy now. Every trader at Morgan Stanley was required to read this book. A nice introduction to probability analysis under stress.

The Money Game

by Adam Smith

How Wall Street Works. A peek into the Wall Street I grew up in during the sixties. How little has changed.

The Little Book that Beats the Market

by Joel Greenblatt

The traditional value approach to picking stocks

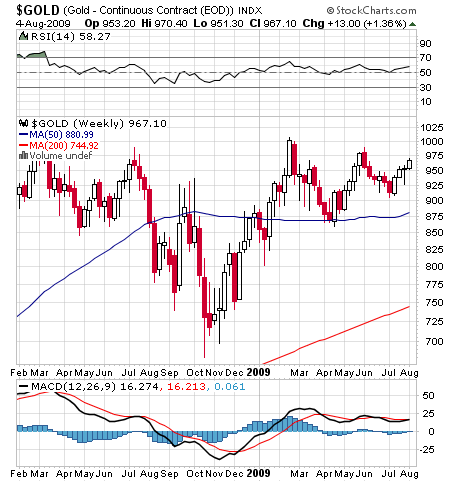

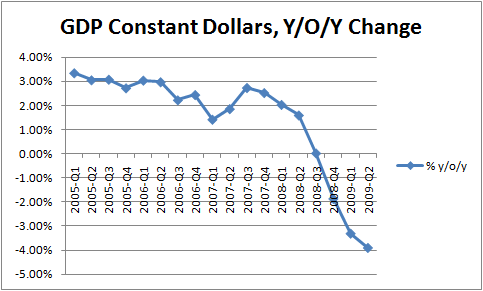

3) Ben Bernanke?s hands are so tightly tied that there is little he can do to head off stagflation, that recurring nightmare from the seventies. The $1 trillion he has added to the monetary base is certain to bite back the second there is an uptick in bank lending. Government crowding out has to push bond interest rates a lot higher. A budget deficit of 13% of GDP this year is about as inflationary as you can get. It?s time to take another look at gold, silver, and the short US Treasury bond ETF (TBT), which I recommended at the beginning of the year at? before its awesome 70% run. For more on the risks posed by the stagflation monster, please click here .

QUOTE OF THE DAY

?The Morons who are telling you to buy now are the same morons who were telling you to buy a year ago, just before the crash,? said a hedge fund friend of mine today.