I have worshipped legendary hedge fund manager, Bill Fleckenstein, as the trading God that he is, for decades. So I thought it was time to catch up with the noted bear to get his take on the New Year.

The sky high expectations for 2010 now endemic will disappoint, with the year ending substantially lower than we are now. In a stroke of genius, Fleck, as he is known to his friends, closed his short-only fund in March ahead of the coming onslaught of stimulus he saw.

When the Dow popped above 10,000, Fleck took out his ?Dow 10,000? hat and symbolically placed it on top of the six foot tall stuffed grizzly he keeps in his office. The same idiots who sold the bottom in March are now buying the top, and some fantastic short selling opportunities are setting up. He is in no rush, though, as it is tough to short against zero interest rates.

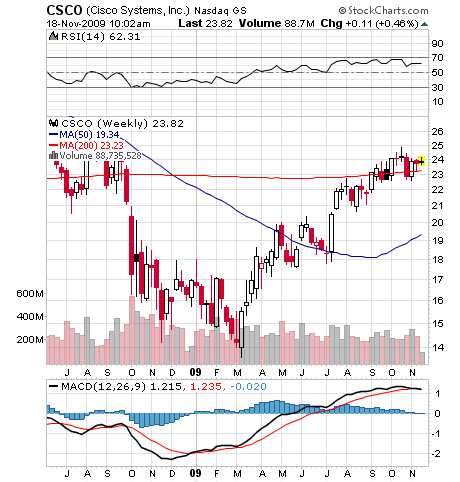

This could be the year when serious money is once again made on the short side. His favorite targets will be technology companies, where double ordering of components is now rampant, as Kool-Aid drinking managers rush to replenish depleted inventories. Research in Motion (RIMM) is a train wreck where he already has a big, successful short position. Retailers like high end department stores with weak balance sheets, such as Nordstrom (JWN), are also in his cross hairs, as are restaurant chains like IHOP (DIN).

?Anything with a bad balance sheet will get clubbed,? said Bill, with the subtlety of a 20 pound sledge hammer.

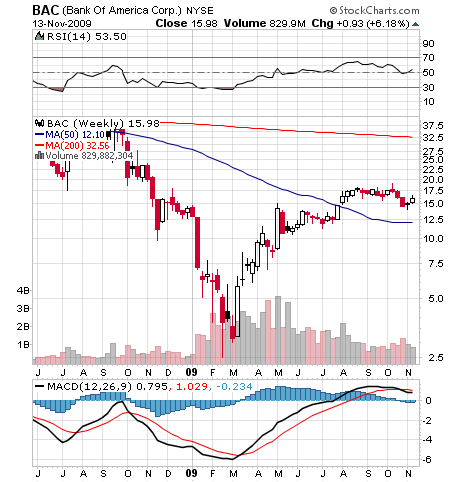

Big banks are one big fantasy in a world of make believe, but are really more of a macro call here. With the government changing the rules every day, he?ll stay away.

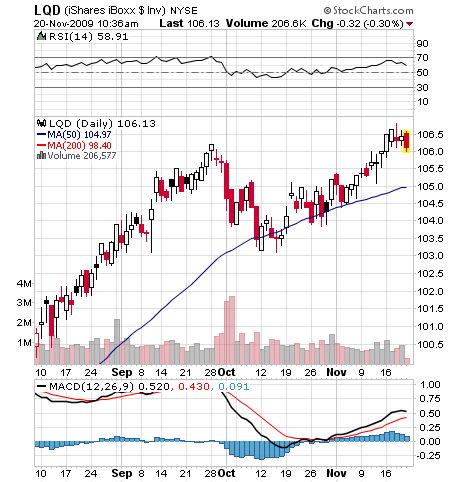

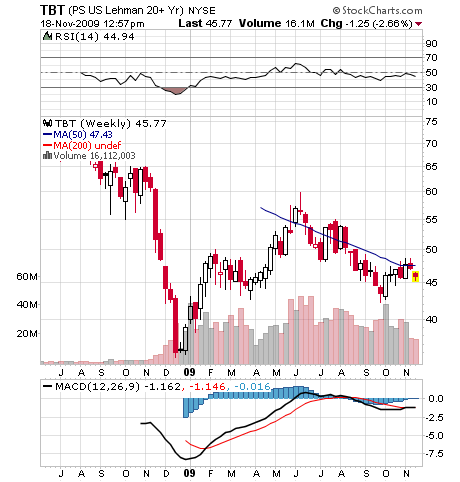

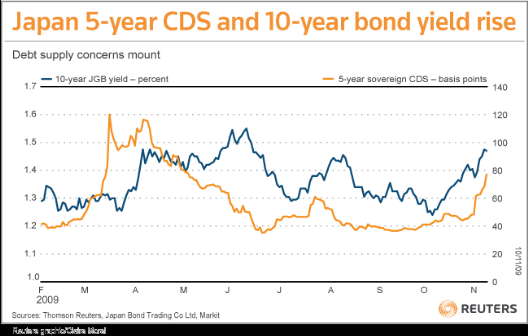

Long Treasury bonds are a bubble waiting to burst, and the TBT is a home run staring you in the face.

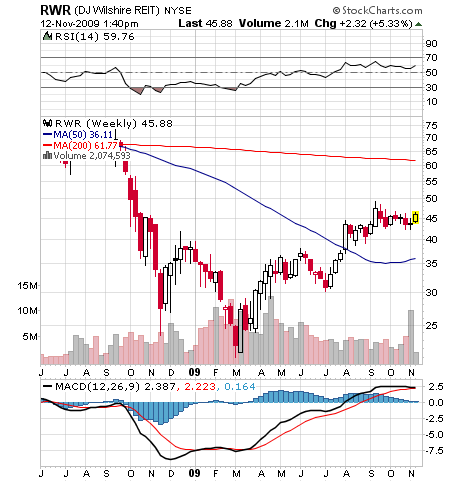

He can understand why the low end in residential real estate is holding up, since the government is offering a tax free bribe of $8,000 to all comers. But the high end is in serious trouble, and it is raining McMansions in tony neighborhoods everywhere. The nightmare won?t end until the banks foreclose on everything and then puke it all out, putting in the real bottom. This could be a long time off. He doesn?t see any way commercial real estate can avoid disaster. Commercial REITS are a screaming sell, which are falling off a cliff but haven?t felt any pain because they haven?t hit bottom yet.

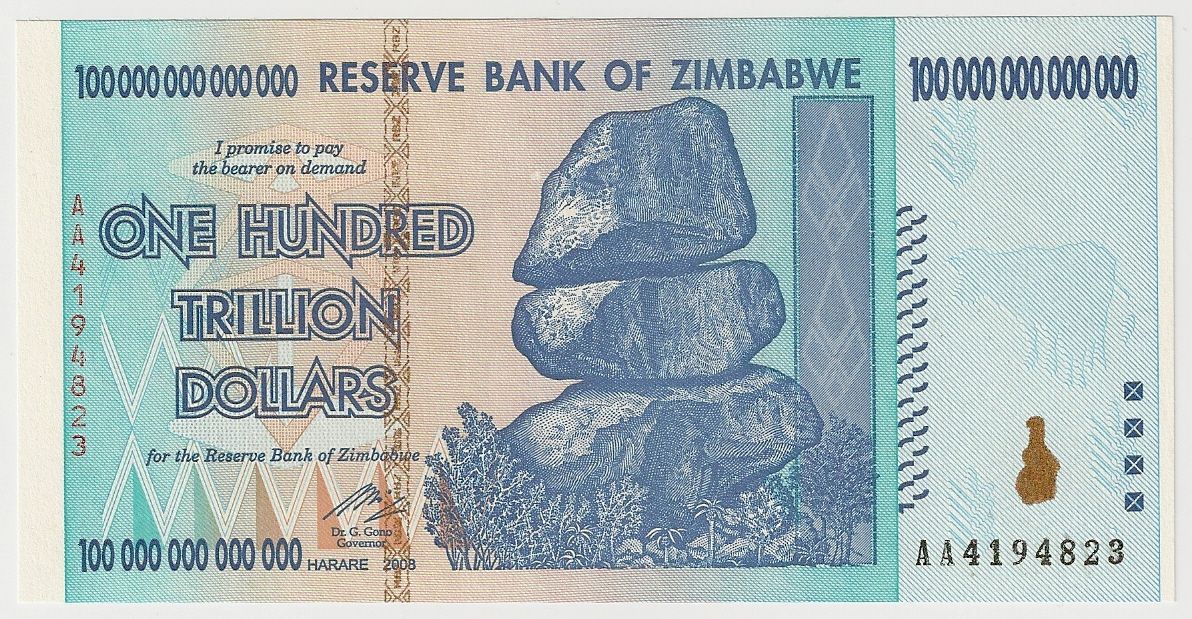

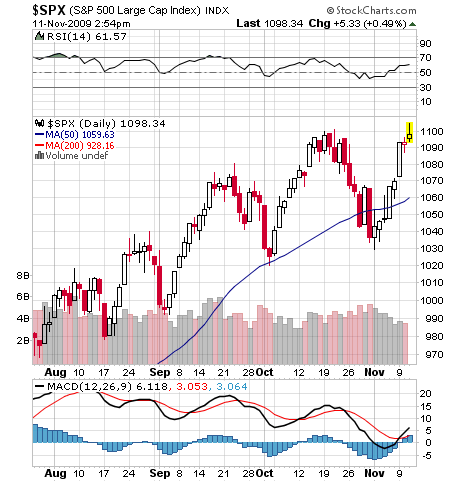

The current stock market bubble could continue for a few months, with Congress passing more stimulus projects to save their own skins in November. The bell will ring that the top is in when foreigners take away our printing presses by boycotting Treasury auctions, sending stocks, bonds, and the buck into a simultaneous tailspin. That will be the time to get aggressive.

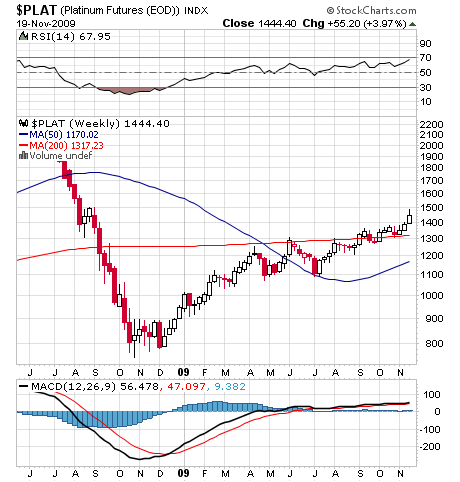

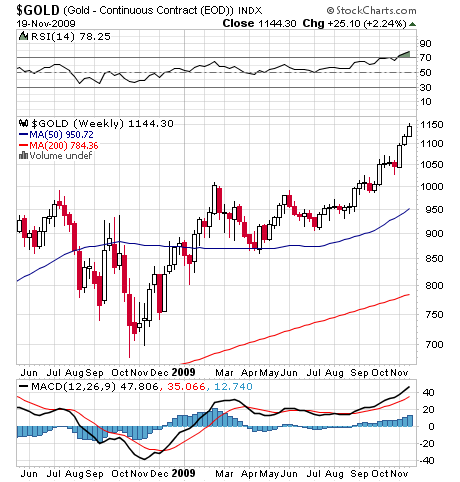

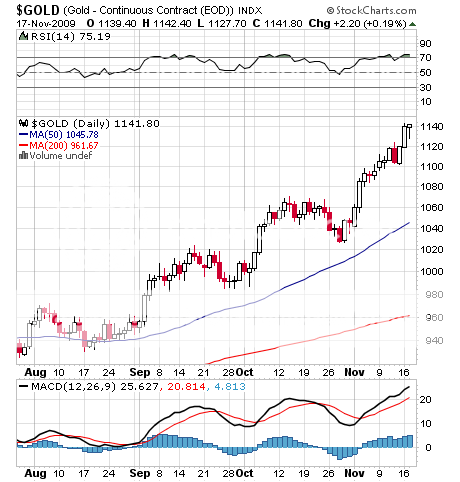

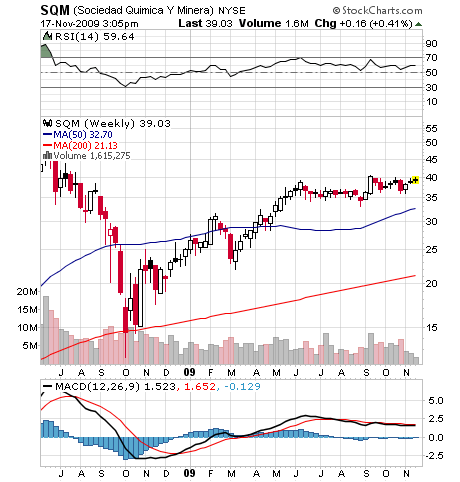

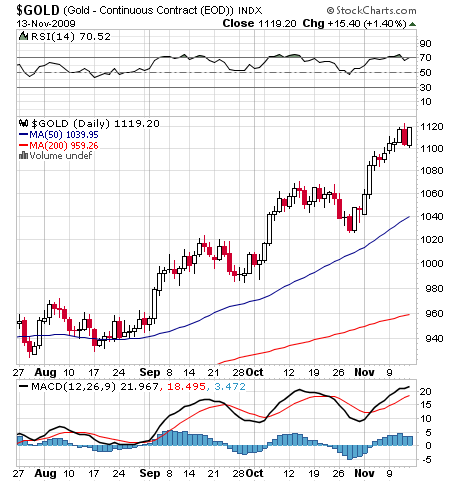

What Fleck does like is gold and silver. To meet the big increase in demand, either production or prices have to go up, and he votes for the latter. Fleck congenitally despises all fiat paper currencies, but hold a gun to his head and he?ll tell you to buy the Canadian dollar (FCX), where a wealth of energy, metal, and food exports will enable the looney to outperform the others.

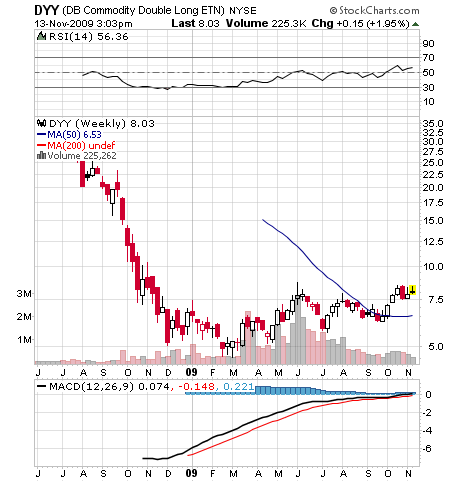

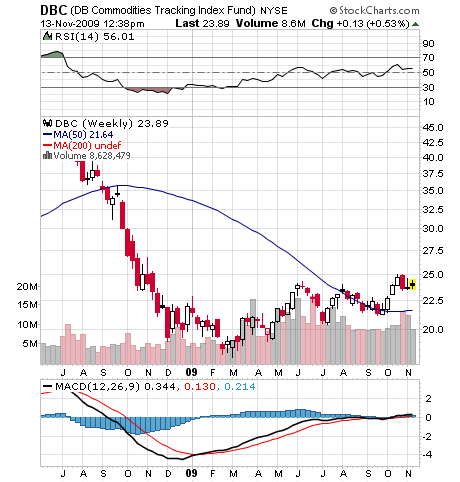

Buy wheat. Traders were transfixed by last year?s huge American crop and cratered prices, when in reality, 40% of the wheat producing areas of the world are suffering prolonged droughts, and $8/bushel is not out of the question. Heavy autumn rains caused much of that to rot in the field, and now a horrific winter auguring for even higher prices.

For more on Fleck?s views, go to his insightful and informative blog called the ?Daily Rap? by clicking here at https://www.fleckensteincapital.com/index.aspx , which is literally worth its weight in gold. You can also catch Bill?s weekly multi market review at MSN by clicking here at http://articles.moneycentral.msn.com/Commentary/ByAuthor/BillFleckenstein.aspx .

Hedge Fund Radio is a weekly program featuring one-on-one interviews with the titans of the hedge fund industry. The show is hosted by legendary hedge fund manager John Thomas, one of the most seasoned players in the industry. It is broadcast live on station KGOL 1180 AM in Houston, Texas as part of the BizRadio? network to 100,000 local listeners, and will be streamed online to a further 100,000 national and international listeners.

The show is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For pilots and the military, that is 17:00 Zulu time. For the online link to the show, please go to www.bizradio.com or? click here, click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.? For that added insight into the future of the markets tune in, or catch the show in my Hedge Fund Radio archives.