"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price? said Oracle of Omaha, Warren Buffett.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

The financial markets exploded to the upside overnight with news of Europe?s triple resolution of their sovereign debt crisis. As I predicted in my letter only yesterday, the move has caught traders by surprise, enabling markets to break out to the upside from the recent ranges, and give this fall rally longer legs than most expect.

As I write this piece, the (SPX) futures have popped to 1275, a new high for this move. Ten year Treasury yields have ratcheted back up to 2.26%, and the dollar is in full flight against a basket of currencies. Here are the details in summary:

*Capital for the European Financial Stability Fund will be increased to ?1 trillion.

*Greek debt will be written down 50%, halving the country?s debt to GDP ratio in one fell swoop.

*European bank capital ratios must be raised from 6% to 9% by June next year.

The package raises more questions than it answers. It delivers less than what the optimists were hoping for, but more than what the pessimists dreaded. You really have to wonder where banks are going to raise $120 billion in private capital in this environment. As a result, Asian sovereign debt funds will probably end up owning large stakes in European banks at fabulous discount prices.

While the cut in Greece?s debt load to only 120% of GDP is welcome, it offers no clear path on how the beleaguered country is going to cope with the heavy burden of the remaining balance. Of course, the deal is a total home run for the Chinese, who I have been advising to load up on as much Greek debt as possible at 30 cents on the dollar. This is only the first chapter in what is likely to become an epic restructuring of the European economy and financial system. Much work lies ahead, and many more gut churning headlines lie in our future.

The move has triggered a ?feel good? rally for the European currency, which has soared to the low $1.41?s. Herein lies the opportunity. Wait for this rally to exhaust itself, then sell the daylights out of the Euro. They next move on European interest rates has to be down. Now that the can has been kicked down the road on the debt problem the European Central Bank can now focus on the distressed economy.

With outgoing ECB president no longer around to justify his disastrous rate hikes in the first half of the year, the new president, the Italian Central banker Mario Draghi, has a free hand to initiate a rapid unwind. At the end of the day, interest rate differentials are the only thing that foreign exchange traders really care about, and such a move would pave the way for a dramatic weakening of the Euro against the dollar. Today?s bail out gives us a great entry point for such a trade.

For those who play in option land, the no brainer here is to buy the $1.40 puts on the (FXE) three months out. ETF investors should start nibbling on the (EUO), the double leveraged short play on the Euro. And to show how earthshaking this conclusion is, my house was at the epicenter of a 3.6 magnitude earthquake that just caused it to literally jump off its foundations with a giant roar.

Draghi: To Cut or Not to Cut, That is the Question

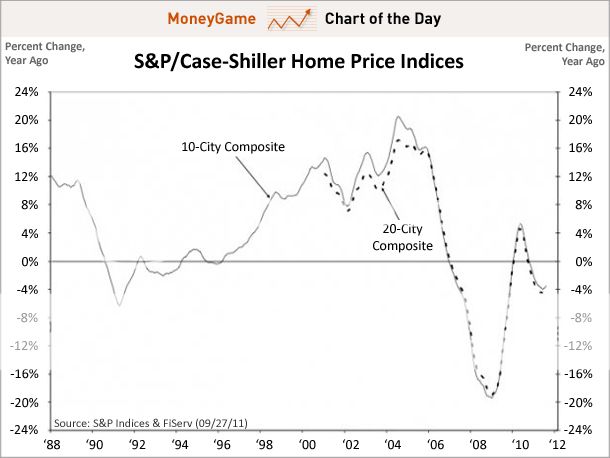

The Western US has found a new wrinkle in the housing collapse, where homeowners are desperately struggling to cut living costs to meet the next doubling of their adjustable rate mortgage payments on their underwater houses.

Raising horses can cost more than children, so Nevadans are turning them loose to join herds of wild mustangs, to dodge the $30,000/year it costs to board and care for these voracious animals. Local populations are exploding, eating local ranchers out of house and home, who depend on public grazing lands to feed commercial livestock.

Recently, the Bureau of Land Management held hearings on where to place 25,000 excess animals. Mustangs are the feral descendants of horses which escaped the conquistadores, and there are now thought to be 30,000 running wild, down from a 19th century peak of 2 million. The BLM has another 30,000 in pens, and is making 10,000/year available for adoption at $125/each.

The problem is that many adopt ?pets? who then flip them to Canadian slaughterhouses, which cater to the odd French taste for horseflesh. To see how this works, watch Clark Gable, Marilyn Monroe, and James Dean?s last film, The Misfits.

Madeleine Pickens, the wife of famed oil trader T. Boone Pickens, has offered to take the BLM?s entire herd and put them out to pasture at an undisclosed million acre location. If there is anyone who could have an undisclosed million acres, it is Boone. I have frequently run into majestic and beautiful mustang herds over the years while camping in the remote desert (no, I don?t go to Burning Man). Reminding me that there is still some ?wild? in the ?West?, I will miss them when they are gone.

My friend, Charles Githler, organizer of the hugely successful Money Shows, graciously invited me to appear as a keynote speaker at the recent Las Vegas event. You will never find more talent, useful tools, and new points of view under one roof than any other confab of this kind. And best of all, they are free to attend.

After my speech, I made a series of instructional videos for new, prospective investors on how to make money in these incredibly difficult and contentious markets. I have listed three titles below along with their links. If long term followers and friends want to have a laugh and see how much this business has aged me, please take a look. They run about ten minutes each. For a calendar of the next Money Show nearest you, please click here.

Video 1: How to Trade Like a Hedge Fund Manager - Play Video

Video 2: 3 Global ETFs Worth Watching - Play Video

Video 3: The Most Common Investor Mistake - Play Video

If you have any questions about the videos, please don't hesitate to contact me.

Thanks again,

?A bank is a place where they lend you an umbrella in fair weather and ask for it back when it begins to rain,? said the American poet laureate, Robert Frost.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Lunch, which I will be conducting in Portland, Oregon at 12:00 noon on Friday, November 25, 2011, the day after Thanksgiving. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $215.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. I expect a small group, so there will be plenty of opportunities to exchange ideas.

The lunch will be held at downtown Portland hotel that will be emailed to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, click the button below:

[button size="large" color="red"]Sold Out[/button]

I am writing TO you from my first class seat on Singapore Airlines, winging my way the 12 hours from Hong Kong to San Francisco. While most airlines jettisoned their first class sections years ago as a cost saving measure, Singapore carried on to maintain its reputation as the best airline in the world. The small section at the front of the bus is populated with a few Chinese billionaires, Taipans, and CEO?s flying at shareholder expense. They are transported in untold luxury with a fully flat bed almost the size of a regular single and a 24 inch high HDTV with a vast movie library. The plane carries double the number of stewardesses on American airliners.

They say a change is as good as a vacation, and this trip certainly fit the bill. I covered 23,000 miles in 17 days, which is really a trip around the world, touching down in New Zealand, Australia, Singapore, Hong Kong, and mainland China. The people I met were fascinating, and included a Maori chieftain, an Australian media mogul, gold miners from Queensland, sheep farmers in New South Wales, Chinese bankers, a Singaporean F-5 combat pilot, and senior officials from the People?s Republic of China. I even managed to track down a Chinese renegade rare earth miner on his day off, and the good news is that he didn?t shoot me, as long as I didn?t take pictures.

I heard some amazing stories and gained some first class intelligence, which I will translate into killer trading opportunities. I will be feeding these out as fast as these old, arthritic and scarred fingers can type them. Alas, I can only knock out about 1,500 words a day before it starts to turn to mush and my back gives out. I will be publishing a series of Pacific country reports over the next four Fridays.

The market? Ohhhh, you want me to talk about the market! Let me give you my quickie read here. My fall rally kicked in right on schedule, my call to cover all shorts coming within a point of the actual bottom in the (SPX). This is the closest I have ever come picking an absolute bottom. After that, it was off to the races with a ?RISK ON? trade with a vengeance. Corporate earnings are coming in much better than anticipated.

This has triggered a buying stampede for all risk assets as hedge fund traders rush to cover shorts and conventional managers frenetically readjust substantial underweight positions they only recently achieved. This has truly been the year from hell, and the word is that 40% of active managers are underperforming their benchmarks by 250 basis points or more.

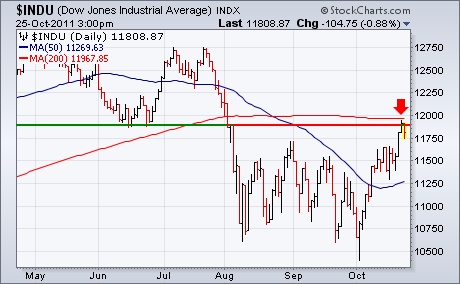

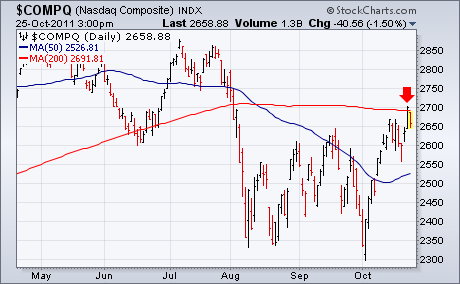

Having discounted a double dip recession that was never going to happen, Mr. Market is now backing that possibility out again. The net result of all this was to take the S&P 500 from a 1,075 bottom up 17% to just short of my target at the 200 day moving average of 1,275. The entire script unfolded exactly as I expected. Followers of my Macro Millionaire trading service got the memo in my October 8 webinar, The Short Game is Over, and have been laughing all the way to the bank since then. Their year to trade performance now stands at a new high of 42.13%.

The easy money in this move has been made, and we are now bumping up against 200 day moving averages across all equity classes. Expect a prolonged battle to be fought here. So this is not a great place to initiate new positions. Bonds have died, but yields have not risen as much as I would have thought, given the ebullience of the price action.

The (TBT) is the sole position I currently have in my portfolio, and it has only picked up a measly 23% in this move. I would have expected more.

Expect the rally to fail several times at these levels before they make further progress. There is a lot of hot money to flush out here before they can mount a break out to the upside. Take a look at the chart for crude oil and the (USO), which is telling you that this risk on will have longer legs than most expect. What will be the trigger? Surprise progress on the European sovereign debt crisis, or even a deliberate kicking of the can down the road.

One additional note. You have noticed some modifications to the website. No, it has not had a sex change operation to get even with me for my absence. I am launching a major upgrade, redesign, and improvement in functionality, plowing in new capital that thousands of new subscribers have afforded me. The final version will be up and running in a couple of days. But like all great birthing events, this was has not without surprises, difficulties, and setbacks.

Rather than willingly give up its toys to the new kid on the block, our hosting service has chosen to break them instead. In addition, moving over two War and Peace?s on the Internet, the extent of the content I have written over the past four years, is no piece of cake. It took Tolstoy seven years just to write it once, but that was in long hand with a quill pen, so I?ll forgive the old man.

For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put ?Macro Millionaire? in the subject line, as we are getting buried in emails.

?Seek the truth, and let the chips fall where they may,? Said White House Correspondent, Helen Thomas, about her profession, adding ?I?m a cynic with hope.?

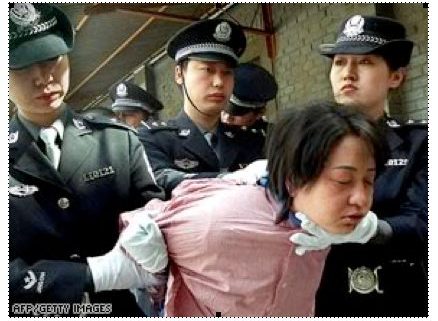

Yang Yanming was slowly led from his cell by two burly uniformed guards in Beijing?s central prison to a waiting van in the courtyard guards, his hands cuffed behind him and his head bowed. Once in the vehicle, he was strapped to a gurney, hooked up to an IV, and given a highly concentrated injection of sodium pentobarbitol. Minutes later, a technician checked his pulse, and pronounced him dead. He then pulled out a scalpel, made a long vertical incision down Yang?s abdomen, and deftly harvested his organs. Placed in ice chests, they were rapidly sold off on China?s booming organ market.

The unfortunate Yang was a former stock trader convicted of embezzling $9.52 million from Galaxy Securities during 1997 to 2003. Once arrested, his trial, conviction, and execution were carried out in rapid fire succession in a matter of months. No hanging around death row for decades here, as is common practice in the US. Yanming never revealed where the money went, according to the Beijing Evenings News, possibly because he never committed the crime. We, and Yang?s family, will never know.

The move was part of a broader effort by regulators in Beijing to crack down on rampant corruption in the securities industry. Still, the more people they execute in the Middle Kingdom, about 10,000 this year, the more they remain the same. Great for the human organ business, but not so good for white collar crime prevention.

During the last three decades, a series of politically inspired ?get tough on crime? campaigns in the US, started by Ronald Reagan, has produced one of the biggest lock ups is human history. Inmates held by federal and state penal systems has soared from 500,000 to 3 million, and the numbers are growing my 200,000 a year. The American prison system has grown so large that it rivals the old ?Archipelago? in the Soviet Union during the 1930?s. The urban legend about the government building a vast secret complex of concentration camps is true.

One out of 100 Americans is behind bars, and one out of 35 is either in jail, or on probation. The cull has been particularly severe among ethnic minorities, with one out of three African Americans either in prison, on probation, or related to someone who is.

There has been a vast expansion in America of the definition of criminality. For example, tax evasion only became an imprisonable offence in 1984. A Supreme Court ruling extended the meaning of ?cocaine? to include crack swooped up tens of thousands. Widening the scope of old laws lowering the bar for conviction has also occurred in firearms ownership, hate crimes, the environment, pornography, the collection of Indian artifacts on federal land, and of course securities offenses. The closure of dozens of state hospitals around the country has also dumped large numbers of the mentally ill into the penal system, making prisons the new de facto mental hospitals.

There has also been a huge bull market in retribution that has contributed to the upsurge. Thanks to three strikes laws, an offender who stole a 95 cent cassette tape from a Seven Eleven in California got 30 years. The judge said his hands were tied. Teenaged children in Florida, not old enough to drive, are getting life sentences. Bernie Ebbers and Ken Lay might have gotten away scott free in the seventies, or at worst, caught five year sentences. Today 25 to life is standard for such offenses, an effective life sentence for a CEO or senior hedge fund manager. Madoff?s 150 year sentence seems pointless. It is not going to get people their money back.

Law enforcement experts, social workers, and even mathematicians all agree that this ?get tough? stance is having absolutely no impact on crime prevention. For a start, no one commits a crime with the intention, or even the remote expectation of getting caught. You can raise sentences to 1,000 years and it will still make no difference.

Many, like Ralph Cioffi and Matthew Tannin, who ran the Bear Stearns hedge funds, are not even aware that their activities might be perceived as illegal. The war on drugs has been a complete failure, with prices lower, narcotics more available, and more kids addicted than 30 years ago, despite DEA budgets running in the tens of billions. With state and federal prosecutors now on the warpath against hedge fund managers, bankers, and aggressive deal makers in real estate, the realm of the illegal is about to undergo yet another enormous expansion. But try telling that to a politician running for office in a borderline district. Crooks are not allowed to vote.

Demographics are the true origin of crime. The number of young males in the population peaked in the early seventies and has been on a downtrend ever since, along with crime rates. Crime is even immune to the economic cycle. You may not have noticed that crime went down last year, even though we were facing the worst economic and employment crisis in eight decades.

Some attribute the fall off in male population to the legalization of abortion by Roe v. Wade in 1973, which led to an immediate drop in newborns tossed into dumspsters, raised by the state, and living a life of crime. Malcolm Gladwell even has a pet theory that falling crime rates are due to the removal of lead from gasoline, also in 1973, which caused lead poisoning, mental illness, and a propensity for violence.

The big problem with the war on crime is that, while generating no tangible results, it is massively expensive. Some $80 billion will be spent incarcerating America?s state and federal prisoners this year, a figure that is bleeding cash starved state and municipal governments white. California spends more on prisons than on teachers. Governor Jerry Brown has tried to cut corners by packing prisons to 300% of their legal capacity, offloading inmates to unwilling counties, and by offering health care that a Federal judge has ruled ?cruel and unusual punishment.? Most prison gyms and libraries have been converted to dorms packed with three bed bunks end to end. In a desperate measure, the state is freed 20,000 nonviolent prisoners because it can?t afford to house or feed them.

If we adopted Chinese style crime and punishment, we?d save the $65,000 a year it costs to lock up miscreants like Bernie Madoff in high security facilities. Just execute the sons of bitches. The US could recover leadership in the human organ business, and we could convert unused prisons into schools, killing three birds with one stone.

There is another alternative to locking people up and throwing away the key. How about reforming the legal system? Take punishment out of the hands of politicians and bring them more in line with the offense. Perhaps 20% of the Golden State?s 270,000 inmates are serving long terms for possessing small baggies of pot that would earn them at worst a traffic ticket in most other Western countries, or nothing at all. It might also be worth investing in some education for inmates to reduce the appalling rate of recidivism from the current 70%. Prisons officials now give released inmates $25, dump them on a street corner in a crummy neighborhood, and tell them ?See you when you come back.? Shorter prison sentences and longer probation might be another economical answer.

This would all require some brave political leadership around an unpopular issue. Don?t hold your breath. In the meantime, check out this cool link to the used kidney market. The next kidney up for sale may be yours.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.