A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well-heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war for one of the Bay Area?s premier hotties. Suffice to say, she has a sports stadium named after her.

The bids soared to $11,000, $12,000, $13,000. After all, it was for a good cause. But when it hit $13,200, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $13,200. I said ?no thanks.? $12,000, $11,000, $10,000? I passed.

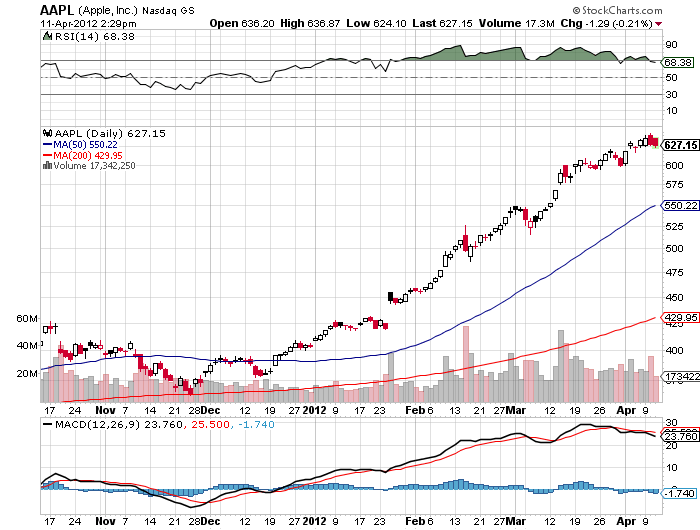

The current altitude of the stock market reminds me of that evening. The higher it goes, the more people love it, until they don?t. As the bidding becomes more frenzied, not an hour passes without another technical report hitting my inbox screaming that the market is overbought, high risk, and cruising for a bruising.

When I did the research for my webinar this week, I had to struggle to find a single positive economic data point over the previous two weeks. The only one I found was the weekly jobless claims, which fell 5,000. Well guess what? This morning jobless claims rose by 13,000. That was the last fundamental economic point the bulls could hang their hats on.

If the current rally fails in the next few days, it could set up the head and shoulders top needed to drive managers more aggressively to the sell side.? After all, they have to be seeing the same thing I am, that the economy runs off a cliff at the end of the year.

For a more sobering view of the market, take a look at the two charts below for the Dow Average. If we don?t clear the old support at 13,000 in the next few days, which is now resistance, we may have the makings of a serious head and shoulders top setting up. The fact that this is happening in the run up to May makes them even more interesting.

Who was the hottie in question, you may ask? She shall remain nameless, since she is now happily married to a tech titan and with kids, and gentlemen don?t talk. Suffice it to say, she has a San Francisco Bay Area sports stadium named after her. I?ll let you figure it out.