As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

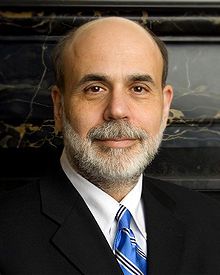

In view of Federal Reserve Chairman, Ben Bernanke, yesterday: ?it is time to reassess one?s investment strategy. ?The former Princeton professor didn?t give us QE3, he gave us QE3 with a turbocharger, on steroids, with an extra dose of adrenaline. ?He could spend another $1 trillion before all is said and done. ?If ever an economic theory was pursued to extremes, this is it. ?No doubt future PhD candidates will be writing theses on this move for the next 100 years.

If the QE3 guessing game was driving you nuts this year, you better sign up for frequent flier points with your psychiatrist. ?After the initial commitment, the Fed reserves the right to renew quantitative easing, with the decision to be rendered on the last business day of each month in any size to buy any securities. ?Yikes! ?Will the market now flat line every month and then gap up or down 500 points on the final day when the August decision is announced? ?Double Yikes!

I am not going to sit in my throne at the beach like King Cnut and order the tide not to rise and wet my feet and robes. ?It is not for us to trade the market we want, but the market we have. ?It is interesting listening to the commentary on all of this. The fundamentalists are pissed off because their hard work led to a near universal conclusion that the economy was tanking, only to be met by a stock market surging to a new five year high. ?The technicians are cautiously optimistic trumpeting new upside breakouts. ?The index players (what few are still in the market, anyway) are ecstatic, now that going to sleep is paying off once again.

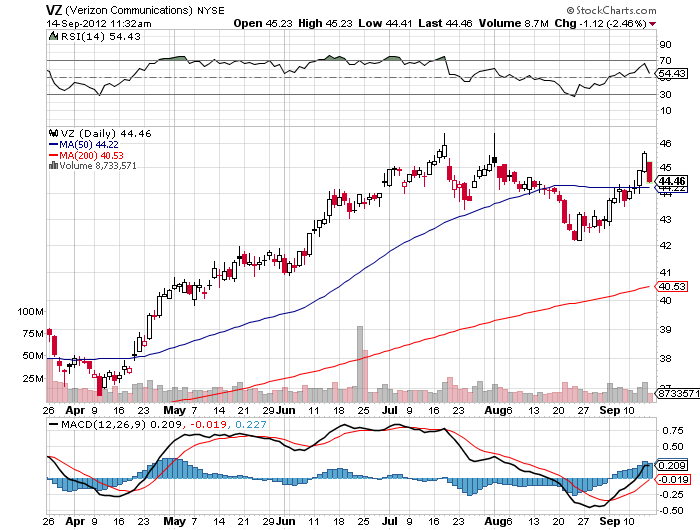

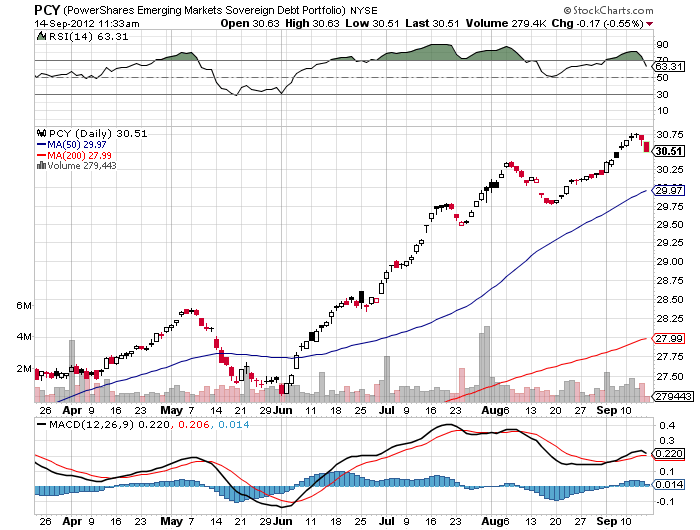

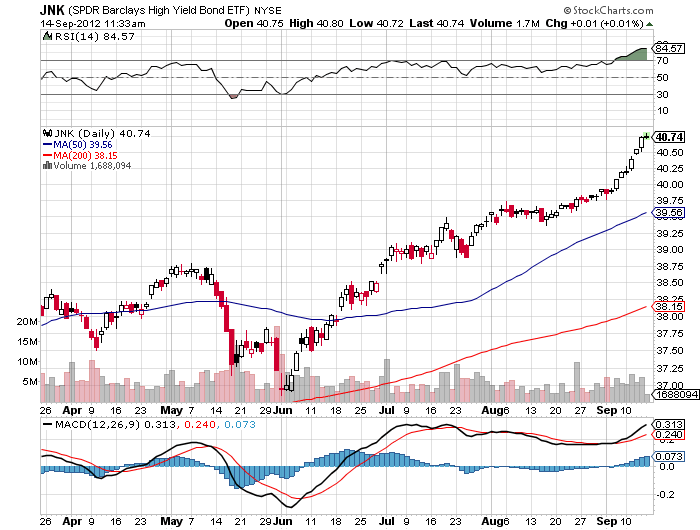

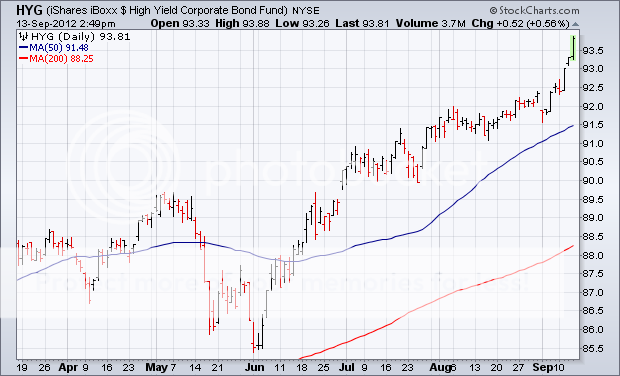

The basic strategy here is to throw risk out the window and gun for yield, which the Fed has put squarely back on the table. ?That means buying junk bonds (JNK), (HYG), at a 7.00% yield, emerging market sovereign debt (PCY) at a 4.72% yield, and high-yield equities like the telecoms, such as Verizon (VZ) and AT&T (T), which both yield around 4.70%. ?At least this way, you get paid for waiting out any heat on the downside.

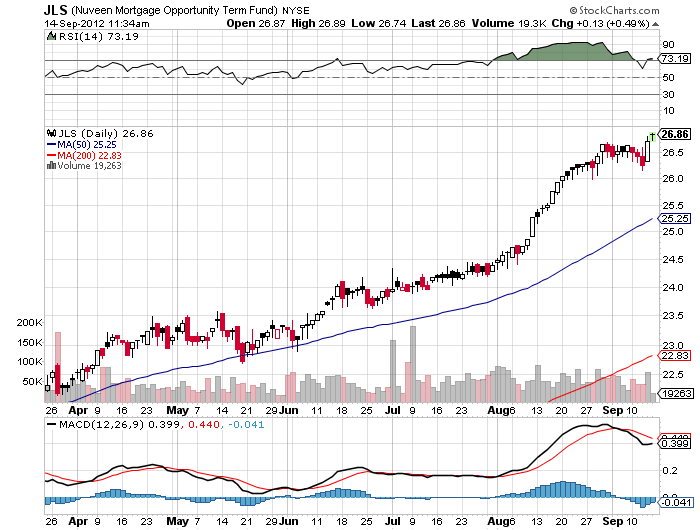

You could even buy exactly what Ben Bernanke is buying: mortgage-backed securities. The central bank will be purchasing half of the $140 billion a month in mortgage backed bonds that Fannie Mae (FNM), Freddie Mac, and Ginnie Mae sell to meet its new commitments. You can easily do that through picking up the Nuveen Mortgage Opportunity Term Fund (JLS), a closed end fund selling at a $2% premium to net asset value. It carries a hefty 7.7% yield, but not for long.

It is 73% invested in residential mortgage-backed securities, 12% in commercial mbs, and 7% in agency collateralized mortgage obligations. ?It does use leverage and hedging strategies to achieve this acrophobic yield, and already had a big gap up in price yesterday. ?But what are the chances that it discounted the next year of Fed bond buying in just one day? ?About zero.

I don?t just think he hates me, he truly despises me. ?In fact, he does everything he can to put me out of business.

Take yesterday, for example, when the Federal Reserve Open Market Committee gave me and my views a complete thrashing. ?QE3 was the last thing in the world I was expecting because it was not justified by the current fundamentals. ?Most other independent analysts agreed with me, including several Fed govenors.

He could have let me off easy by announcing some minor back-door easings, like expanding his ?operation twist? to include mortgage-backed securities for the first time, or ceasing interest rate payments on deposits from private banks. ?But, no, Ben decided to make me look like a complete idiot, not by just announcing QE3, but one infinite in size that goes on forever. ?Talk about pouring salt on my wounds.

It?s not that I am not an all right guy. ?I am kind to children and small animals. ?I donate generously to many charities. ?I send my mother cards on her birthday (happy birthday mom!), even though she is 84 and not expected to last much longer. ?I even occasionally escort little old ladies across the street, although this is a holdover from my days as an Eagle Scout.

It?s just that Ben Bernanke and I don?t see eye-to-eye on a lot of important issues. He wants stocks to go up. ?As a hedge fund manager who plays from the short side more often than not when the economy is growing at a paltry 1.5% rate, I want them to go down. ?He wants bonds to go up too, as he clearly elicited with his ?twist policy? last year when he bought long term Treasury bonds and shorted overnight paper against it. ?I, on the other hand, want bonds to sell off because I know that when the bill comes due for all of this monetary easing, the crash will be momentous.

These are not the only matters we differ on. ?He wants to create jobs. ?He can wish this until the cows come home, but he?s not going to get them because of the gale-force demographic headwinds the country is now facing and the massive deleveraging by the public and private sector. ?The 6 million jobs we exported to China are never coming back.

However, all he has to do is make a mere mention of his desires, or even just mention the letter ?Q?, and asset prices go through the roof, forcing me to stop out of my shorts at losses. ?This is why I was in such a foul, acrimonious, and detestable mood during the first quarter, when stocks went up almost every day.

My problem is that Ben Bernanke isn?t the only person who dislikes me. ?President Obama doesn?t think much of me either. ?And it?s not because I refuse to buy a cold chicken dinner at his St. Francis Hotel fund raisers for $35,000, and $70,000 if I bring a date. ?He talks about jobs too. ?He frequently speaks about the need to improve our education system, even though I know he is poised to slash the budget for the Department of Education as part of some deal with the Republicans. ?Ditto for Social Security and defense.

Fortunately for me, I wrote off any prospect of getting a retirement check a long time ago and have made other arrangements, like becoming a hedge fund manager. Either the payments will be too small for me to live on, or they will be made in worthless Zimbabwean dollars.

I get along with Treasury Secretary, Timothy Geithner, OK, which keeps me on his ?must see? list whenever he stops in San Francisco on his way to Beijing to ask to borrow more money. ?But we go way back. ?There are only four people in U.S. history who can discuss Japanese monetary policy of the 1920?s in depth, and do it in Japanese just for laughs (it was clearly too easy, but they had to reflate after the 1923 Great Kanto Earthquake. ?Some things never change).

Two of them, Senator Mike Mansfield of Montana and Harvard professor, John K. Fairbank, died ages ago. ?So he is kind of limited in his choices. ?Besides, there are not a lot of people out there who can give him a 40 year view on the global economy, and I am one of them.

There are plenty of others who don?t think I am so hot. ?Try making a fortune in a market crash when everyone else is losing their shirt. ?While others in the locker room at my country club are slamming doors, tearing their hair out, and breaking golf clubs in half when they see the price feed on CNBC, I am chirping happily away about selling short at the top. ?I might as well be letting out a loud fart in Sunday church service. ?This explains why I stopped getting invitations to dinners ages ago.

It?s not that my relationship with Ben Bernanke is totally hopeless. ?When the demographic picture turns from a headwind to a tailwind and individuals and corporations cease deleveraging and return to re-leveraging, we?ll probably be reading from the same page of music. ?But according to the U.S. Census Bureau, the earliest this can happen is 2022. ?By then, he probably won?t be the Fed governor anymore and I won?t care if he likes me or not.

Besides, I may be able to make a new friend or two in the meantime. ?If Mitt Romney wins the presidential election he says he?ll fire Ben Bernanke on his first day in office. ?He can?t really do that, but Ben?s term does expire a year later. ?His two most widely rumored picks to fill the post are president of the Federal Reserve Bank of Dallas, Richard Fisher, and Stanford University professor, John Taylor.

These two are not in the least bit interested in all this quantitative easing malarkey. They are much more similar in philosophy to Herbert Hoover?s Treasury Secretary, Andrew Mellon, who popularized the ?let the chips fall where they may? approach to economic policy. ?Kick the props out from under this market and all of a sudden Dow 3,000 is on the table, as argued by Global strategist and demographics maven, Harry Dent.

They might even go as far as unwinding the Fed?s hefty $2.7 trillion balance sheet. ?That would give the Chinese, who hold $1 trillion of these bonds, a heart attack. ?But who cares? It would create the mother of all trading windfalls for me. ?Hell, they might not even care if I torture small animals, beat children with a switch, and leave little old ladies in the middle of onrushing traffic. ?I think we would get along just great.

Screw Social Security, and Ben Bernanke too.

The Great Kanto Earthquake of 1923

?Let all men know how empty and worthless is the power of kings,? said King Cnut, a 10th century ruler of Denmark and England.

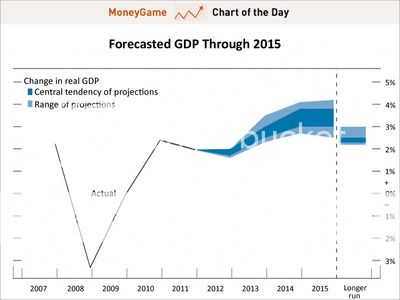

The big surprise today was not that the Federal Reserve launched QE3, but the extent of it. ?For a start, they moved the ?low interest rate? target out to mid-2015. ?They left the commitment to bond-buying open-ended. ?The first-year commitment came in at $480 billion, in-line with previous efforts.

Reading the statement from the Open Market Committee, you can?t imagine a more aggressive posture to stimulate the economy. ?You have to wonder how bad the data that we haven?t seen yet is, not just here, but in Europe and Asia as well. The big question now is: ?Will it make any difference??

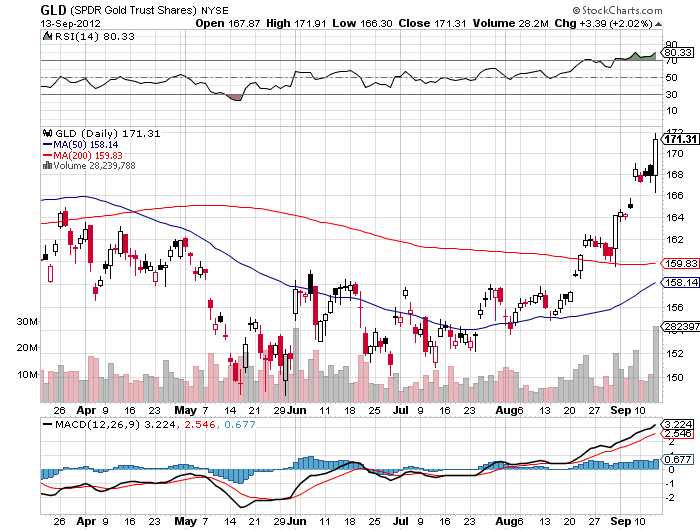

Asset markets certainly bought the ?RISK ON? story hook, line, and sinker in the wake of the Fed action. ?Gold leapt $30, the Dow soared 200 points, the dollar (UUP) was crushed, the Australian dollar (FXA) rocketed a full penny (ouch!), and junk bonds (HYG) caught a new bid at all-time highs. ?The real puzzler was the Treasury bond market, which saw the (TLT) fall 2 ? points. ?I guess this is because the new Fed buying will be focused on mortgage-backed securities at the expense of Treasuries.

I knew that if they were to do anything, it would be aimed at the residential real estate market, which has been a thorn in their side for the last five years. ?The reason we have 1.5% growth instead of 3% is real estate. Real estate is the missing 1.5%.

But what will be the impact? ?Some $480 billion of buying of mortgage-backed securities over the next 12 months will lower the 30 year conventional mortgage from the current 3.70%. ?But all that will do is enable those who refinanced for the last two years in a row to do so a third time. Those who are underwater on their mortgages and have only negative equity to offer banks as collateral will remain shut out. ?This will generate a big payday for mortgage brokers, but won?t trigger any net new home-buying which the economy desperately needs.

The harsh reality for the housing market is that the demographic headwind of downsizing baby boomers is so ferocious that the Fed is unable to piss against it. Here is the problem:

*80 million baby boomers are trying to sell houses to 65 million Gen Xer?s who earn half as much

*6 million homes are late or in default on payments

*An additional shadow inventory of 15 million units overhangs the market owned by frustrated sellers

*Fannie Mae and Freddie Mac are in receivership, which account for? 95% of US home mortgages.? Each needs $100 billion in new capital. Good luck getting that out of a deadlocked congress

*The home mortgage deduction a big target in any tax revamp. The government would gain $250 billion in revenues in such a move

*The best case scenario for real estate is that we bump along a bottom for 5 years. The worst case is that we go down another 20% when a recession hits in 2013.

It could be that 95% of the new QE3 is already in the market, and that the markets will roll over once the initial headlines and ?feel good? factor wears off. ?With the markets discounting this action for nearly four months, this could be one of the greatest ?buy the rumor, sell the news? opportunities of all time.

Whatever the case, I am not inclined to chase risk assets up here. Anyway, I am now so far ahead of my performance benchmarks for the year that I can?t even see them on a clear day.

Is That My Benchmark Out There?

My friends in the gold futures puts have been telling me that the Chinese have emerged as major buyers in recent months. ?Year-to-date imports have reached 458 tonnes, more than four times the amount during the same period last year ? that amounts to $25 billion in real money. ?This is on top of the country?s massive local gold production, which is kept entirely in country, the exact details of which are unknown.

Explanations run the entire gamut of possibilities. ?There is a concerted attempt by the People?s Bank of China to diversify away from Treasury bills, notes and bonds at a 60-year market high. ?Since the end of 2011, the Middle Kingdom?s holdings of Treasuries have increased by a mere $12.4 billion to $1.164 trillion.

The Chinese have been investing in the entire range of higher-yielding securities, including European sovereign bonds with near junk bonds and emerging market debt, like the bonds issued by Singapore. ?They have also aggressively stepped up their foreign direct investment, picking up important energy assets in Canada just last month.

The Chinese could be buying gold for the simplest reason of all: it?s going up. Private gold ownership carried a death penalty there four years ago. Today there are precious metals coin shops in every city center.? The government is now encouraging individuals to keep some savings in gold. ?With a middle-class now at 400 million, that adds up to a lot of buyers.

Gold remains my favorite asset class, and I?ll be looking to jump back in on the next dip.

?We don?t think the economy is going to be overheating anytime soon,? said Federal Reserve Chairman, Ben Bernanke.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.