As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 31, 2015

Fiat Lux

Featured Trade:

(WEDNESDAY APRIL 1 GLOBAL STRATEGY WEBINAR),

(ENTERING THE QUIET TIME),

(SPY), (IWM), (QQQ), (IJR), (GS), (FXE),

(CHINA?S COMING DEMOGRAPHIC NIGHTMARE)

SPDR S&P 500 ETF (SPY)

iShares Russell 2000 (IWM)

PowerShares QQQ Trust, Ser 1 (QQQ)

iShares Core S&P Small-Cap (IJR)

The Goldman Sachs Group, Inc. (GS)

CurrencyShares Euro ETF (FXE)

I?ll let you in on my top secret investment strategy that has brought me blockbuster results over the past six years.

Listen to the Wharton Business School?s professor, Jeremy Siegel.

The good doctor has been unremittingly bullish year in and year out, nearly pegging the stock index performance annually.

So, when he says that the Dow Average is going to rise to 20,000 by the end of 2015, that?s good enough for me. In fact Siegel thinks that at current price earnings multiple of 17 times, the bull market has years to run.

It would not be until we hit nosebleed levels of 25X or 30X earnings that he would get worried. And the current ultra low level of interest might even make these high multiple numbers justifiable.

So for the foreseeable future, we are going to see long periods of tedious range trading, followed by frenetic rounds of buying, once the market decides that it is time to discount the next rise in corporate earnings.

We happen to be in one of those range-trading periods right now, which my partner, Mad Day Trader Jim Parker, thinks could last all the way until September.

Actually, it is a little more complicated than that.

There is good reason for the stock market to go to sleep over the next two weeks.

Do you hear that great sucking sound? That is the noise of 170 million tax payers writing checks to the US Internal Revenue Service.

Foreign readers may not realize this, but tax payments are due in the United States on April 15 every year. I would ask for your sympathy, but I know all of you pay far more in taxes than we do. I know, because I used to pay them myself when I lived abroad for 23 years.

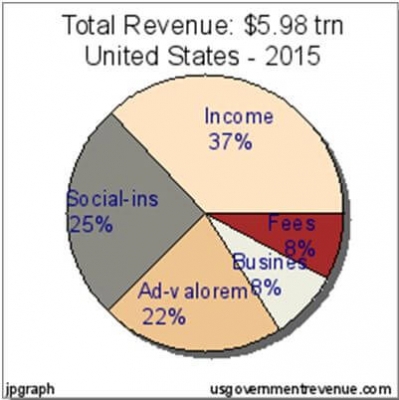

Of the $6 trillion in revenues from all sources due to Uncle Sam in 2015, 37%, or $2.2 trillion will come in the form of individual income taxes. That is a big hit for the financial system. That means for the next two weeks there won?t be any extra money lying around to put into the stock market.

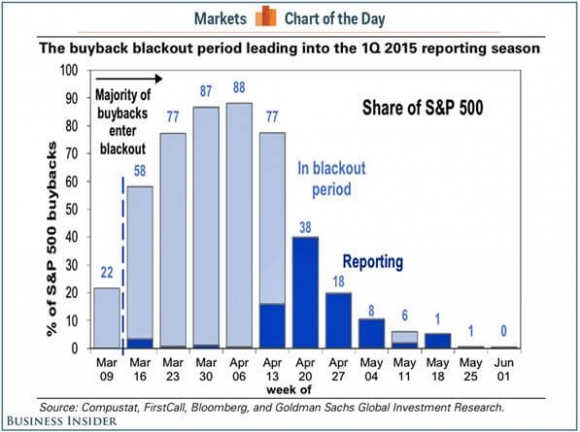

There is another reason why the stock indexes are stagnating here. The Q1, 2015 corporate earnings reporting season kicks off when Alcoa (AA) reports on April 8, or in six trading days. Until then, we are in the quiet period, and companies are not allowed the buy back their own stock.

This is a big deal, since companies buying back their own shares have provided major support for the stock market for many years. Possibly a quarter of all the net cash flow pouring into stocks since 2009 has come from this source.

Take it away, even for a short period, and the most bullish thing the market can do is move sideways, which is exactly what it has been doing for the past two months.

What happens when the tax payment deadline passes and the quiet period ends? Stocks take off like a bat out of hell. That will take us to the spring interim peak.

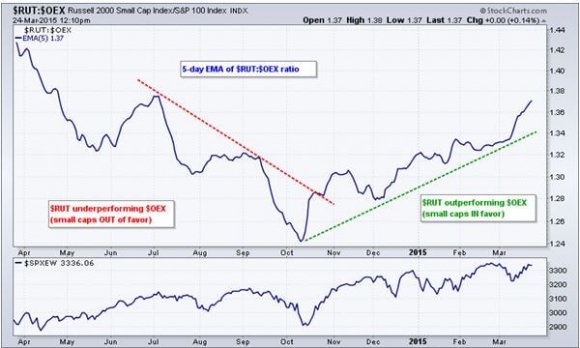

This is why I strapped on three new ?RISK ON? positions last Friday, longs in the Russell 2000 (IWM) and Goldman Sachs (GS) and a short in the euro (FXE).

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 30, 2015

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, APRIL 3 HONOLULU, HAWAII STRATEGY LUNCHEON)

(TAKE PROFITS ON CYTRX CORP. (CYTR)

CytRx Corporation (CYTR)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Honolulu, Hawaii on Friday, April 3, 2015. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $208.

I?ll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier hotel on Waikiki Beach, Honolulu on the island of Oahu. The precise location will be emailed with your purchase confirmation.

As I am unlikely to make it down to Australia and New Zealand this winter, I urge my many followers there who are chock a block with frequent flier points to make the trip up to the balmy Hawaiian Islands to attend the lunch. So should readers in Alaska, British Columbia, Washington state, and Oregon. There are plenty of other things to do there besides listening to the dulcet tones of John Thomas speak.

You can?t lose by renting a car and spending a day driving around the island to experience the lush, fragrant jungle and gigantic crashing waves at Waimea Bay. Pineapple plantations offer an enticing lunch stop.

A visit to the USS Missouri at Pearl Harbor, the site of Japan?s surrender ending WWII, is a must see for history buffs. You can still see the dent in the hull from a crashing Kamikaze plane.

I always try to squeeze in a workout by climbing to the top of Diamond Peak. The surfing instructors at Waikiki Beach are always ready to tune up your skills. A trip to the Polynesian Cultural Center will set you up with dancing natives in grass skirts and a pig roasted on a spit.

While in America?s 50th state, I?ll be renewing my interisland flying skills, renting a plane to fly to Maui, Kauai, and the Big Island. Flying there is so dangerous that the state requires mainland pilots to obtain a special amendment to their licenses, which I have had for the last 40 years.

Among the many challenges there are erupting volcanoes, unbelievable wind shear, sudden tropical thunderstorms and enormous waves that threaten to hit your plane on takeoff and bend your propellers forward. If you crash on Mt. Haleakala, the Park Service will charge you (or your estate) for carting down the wreckage.

And the slightest miscalculation in fuel consumption will find you drifting back to Australia in a life raft, Unbroken style. Don?t worry, they closed the leper colony on Molokai a few years ago.

It?s all worth it just to see the torrential waterfalls cascading off the southern cliffs of Molokai, to catch a pod of migrating humpback whales, or witness one of those amazing tropical sunsets.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

It?s time to take profits on CytRx Corp., but only if you are a trader. The shares that I first recommended in June, 2014 have just tacked on a healthy 40% over the last three weeks.

However, if you are an investor, hang on. I believe that the biotech boom in the US is only just getting started. The sector should grow from 1% to 20% of US stock market capitalization over the next decade. All major diseases will get cured.

Yes, we will live forever.

CytRx Corp?s cutting edge technology will enable it to continue rising that tsunami.

If there is one complaint about the Diary of a Mad Hedge Fund Trader, it is that I am too short term in my orientation. My response is that this is the only way you can obtain a 163% trading return in 4 ? years.

I can skim off the cream when others can?t.

There is a reason why we are the only investment newsletter that publishes our performance on a daily basis. Basically, all our competitors lose money for their readers. It?s a lot like those Japanese restaurants that display plastic models of their food in the front window, which are inedible.

Still, I like to throw readers ten baggers when I find them. Long-term followers get that warm and fuzzy feeling when I mention Baidu (BIDU) ($12 to $190), Cheniere Energy (LNG) ($5 to $68), Molycorp ($12 to $80), and Tesla (TSLA) ($16 to $260) for a good reason.

Well, I found another ten bagger, one you can just buy and forget about for the next three to five years. I discovered this jewel at the SALT conference in Las Vegas last year organized by my friend, Anthony Scaramucci (click here for ?The Report on the 6th Annual Skybridge Alternatives (SALT) Conference).

At the keynote dinner, I randomly picked a table near the stage. One of the couple next to me wore a UCLA pin where she graduated, prompting a discussion of the Golden Age of Bruin basketball and the salad days of legends John Wooden and Bill Walton (four perfect 30-0 seasons and an 88 game winning streak!).

I casually mentioned I was there as a cancer researcher and DNA scientist during the early 1970?s and graduated in biochemistry. The ears perked up, and the dam broke.

The gentleman I was dining with turned out to be the CEO of CytRx Corp. (CYTR) a revolutionary innovator in the chemotherapy field. Through a top secret, patented chemical reaction, their chemists can add an acid sensitive linker molecule to pre existing generic chemotherapy drug.

That enables the drug to only kill the cancer cells and not the rest of you as well, eliminating side effects, and permitting a substantial ramping up of the dosage. I worked out the chemistry in my mind, and quickly figured out that it would work.

The net effect is to install a turbocharger on existing drugs, greatly enhancing their curative effects. That means lower doses that can cure, with no side effects.

Stage three trials will be completed by 2016, when the company expects full FDA approval. The company has $125 million in cash and no debt.

I lost a wife to cancer 12 years ago, and received a crash update on the state of the science since then. I have been following it ever since, awaiting my turn.

If CytRx is able to pass the FDA gauntlet, then they have found the Holy Grail.

To learn more about the company and obtain the details, please visit their website at http://www.cytrx.com.

Curing of cancer during the 2020?s is a major part of my Golden Age scenario for the coming decade (click here for Here Comes the Next Golden Age).

The kicker here is that there is not just one, but hundreds of companies developing ground-breaking treatments that will come out in the years ahead, many of them located just across the bridge from me. This should collapse the cost of health care for the government, and the rest of us as well.

Remember that buying the shares of a drug company before final approval is always a crapshoot. That last time I did this was with Genentech?s (DNA) Avastin, because I was dating the senior researcher there at the time (tall, long legs, blue eyes, brilliant).

The shares doubled the day they got the green light, and Bank of America flipped from a ?SELL? to a ?BUY? recommendation for the stock on top of a $30 move, tail between legs. That was good.

As we parted ways, the CEO even pushed over his desert, from which his doctor forbade him for health reasons. I gobbled that up as well.

Is CytRx (CYTR) Another Ten Bagger?

Is CytRx (CYTR) Another Ten Bagger?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.