As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 29, 2016

Fiat Lux

Featured Trade:

(FEBRUARY 3 GLOBAL STRATEGY WEBINAR),

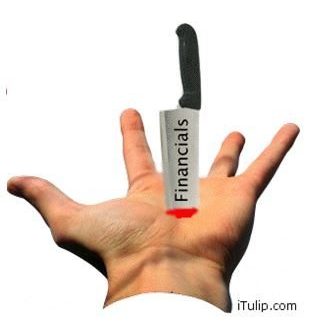

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS),

(ANOTHER NAIL IN THE NUCLEAR COFFIN),

(NLR), (CCJ)

Market Vectors Uranium+Nuclear Engy ETF (NLR)

Cameco Corporation (CCJ)

Southern California Edison (SCE/PF) has announced that it is permanently shuttering its controversial nuclear power plant at San Onofre, California.

The move is only the latest in a series of closures implemented by utilities around the country, and could well spell the end of this flagging industry.

This is further dismal news for holders of ETF?s in the sector, like the Market Vector Uranium + Nuclear Energy ETF (NLR) and Cameco (CCJ).

SCE?s problems started in July, 2012 when a faulty steam generator tube released a small amount of radioactive steam and the plant was immediately shut down.

An inspection revealed that 3,000 additional tubes were showing excessive wear, possibly due to a design flaw, or perhaps their exposure to 45 years of high intensity radiation.

Supplier, Westinghouse, owned by Japan?s Toshiba Group, rushed in with a replacement generator, which failed within a month. That prompted the Nuclear Regulator Commission to demand a full license reapplication, which promised to be a contentious and expensive multiyear legal slugfest.

That was all SCE needed to throw in the towel and move for permanent closure. About 1,100 workers will be laid off.

San Onofre has been a continuous target of environmentalist litigation since it was opened in 1968. You could have found a better place to build a nuclear power plant than the birthplace of the environmental movement.

After the Fukushima nuclear disaster in 2010, another Westinghouse plant, Senator Barbara Boxer was not too happy about it either.

It turns out there was no practical evacuation plan in the event of an emergency. Some 25 million people live within 100 miles of the facility, and there is no way you move these numbers anywhere in a hurry.

The region is totally gridlocked even in a normal rush hour. That prompted Boxer to lead a series of congressional hearings, not just about San Onofre, but the entire aging nuclear industry nationwide.

The development means that Southern California Edison will have to write off the $2.1 billion in capital investment and upgrades that it has carried out over the last 20 years. Decommissioning will cost another $2 billion.

These are the most expensive and toxic demolitions on the planet. Stored nuclear waste will remain on sight until a national solution is found. The costs will be entirely passed on to the region?s long-suffering electric power consumers.

I know the San Onofre plant well, as it is right on the border of the Marine Corps base at Camp Pendleton. My dad was stationed there during WWII and was followed by a long succession of descendants.

I used it as a landmark for inbound VFR flights to the base. I also practiced amphibious assaults on the beach, with traditional landing craft, light armored reconnaissance vehicles (LAR), and advanced hovercraft (LCAC). I also had to swim once. On R&R, San Onofre offered one of the best surfing beaches on the coast.

I am not holding my breath for the nuclear industry. It will be years before it can recover from the massive blow from Fukushima. And these days it has the additional problem in that (NLR) and (CCJ) are tied to the flagging price of oil and other commodities.

?You might as well tie lead weights to them.

For more depth on the topic, please see my earlier piece, ?New Nuclear Demolished by New Natural Gas?.

Not Exactly a Crowd Pleaser

Not Exactly a Crowd Pleaser

A Navy Assault LCAC

A Navy Assault LCAC

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 28, 2016

Fiat Lux

Featured Trade:

(WHY THE REAL ESTATE BOOM HAS A DECADE TO RUN),

(DHI), (LEN), (PHM),

(THE TECHNICAL/FUNDAMENTAL TUG OF WAR: WHO WILL WIN?)

DR Horton Inc. (DHI)

Lennar Corporation (LEN)

PulteGroup, Inc. (PHM)

Real estate brokers are still reeling from the news that December existing home sales rocketed by a blockbuster 14.7%, to an annualized 5.46 million units.

And now I hear that Apple (AAPL) is planning on building a second new research and development campus that will need 20,000 new high tech workers. The housing crisis here in the San Francisco Bay area just went from bad to worse.

It is all fresh fuel for a continuation in the bull market for US residential real estate, not just for this year, but for another decade.

Friends in the industry tell me the eye popping numbers were due to the implementation of the TILA-RESPA Integrated Disclosure (TRID) in October.

Dubbed the ?Know before you owe? requirement, TRID is the inevitable outcome of the 2008 subprime housing crash.

If you weren?t born yet in 2008, or were living in a cave on a remote Pacific island back then, go watch the movie ?The Big Short? for a further explanation of those dark days.

As a result, real estate closings now take at least a week longer, and sometimes more, thanks to a new requirement for several three day ?cooling off periods.?

When the new law kicked in, TRID nearly brought he industry to a halt, and firms were sent scurrying to their attorneys to draw up the new disclosure forms to stay within the law.

TRID undoubtedly was responsible for the slowdown in the market in the run up to December.

Although prices seem high now, I am convinced that we are only at the beginning of a long term secular bull market in housing. Anything you purchase now is going to make you look like a genius ten years down the road.

The best is yet to come.

The big driver will be demographics, of course.

From 2022 onward, 65 million Gen Xer?s will be joined by 85 million late blooming Millennials in bidding wars for the same houses. That will create a market of 150 million buyers, unprecedented in the history of the American real estate market.

In the meantime, 80 million baby boomers, net sellers and downsizers of homes for the past decade, will slowly die off and disappear from the scene as a negative influence. Only one third are still working.

The first boomer, Kathleen Casey-Kirschling, born seconds after midnight on January 1, 1946, will become 76 years old by then. A former school teacher, she took early retirement at 62.

The real fat on the fire here is that 5 million homes went missing in action this decade, thanks to the financial crisis. They were never built.

This is the result of the bankruptcy of several homebuilders, and the new found ultra conservatism of the survivors, like DR Horton (DHI), Lennar Homes (LEN), and Pulte Group (PHM).

Did I mention that all of this makes this sector a screaming ?BUY?, once the market moves into ?RISK ON? mode later in the year?

Talk to any real estate agent and they will complain about the shortage of inventory (except in Chicago, the slowest growing market in the country).

Prices are so high already that flippers have been squeezed out of the market for good. Bottom feeders, like hedge funds buying at the bankruptcy auctions, are a distant memory. Some now own more than 20,000 homes.

Income taxes are certain to rise in coming years, and the generous deductions allowed homeowners are looking more attractive by the day.

And let?s face it, ultra low interest rates aren?t going to be here forever. Borrow at 3% today against a long term 3% inflation rate, and you are essentially getting you house for free.

The rising rents that are turning Millennials from renters to buyers may be the first sign of real inflation beyond the increasingly dear health care and higher education that we're are already seeing.

And Millennials are having kids that demand a bigger living space! Who knew?

I may become a grandfather yet!

Looks Like a ?BUY? to Me

Looks Like a ?BUY? to Me

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.