While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 7, 2016

Fiat Lux

Featured Trade:

(APRIL 19 ATLANTA GLOBAL STRATEGY LUNCHEON),

(FEBRUARY NONFARM PAYROLL ROASTS THE SHORTS),

(WHAT HAPPENED WHEN APPLE ENTERED THE DOW?)

Sure, I was expecting a strong, 200K plus print for the February nonfarm payroll report from the Department of Labor on early Friday morning.

But 242,000? And another 30,000 in upward revisions for December and January? It boggles the mind.

The market hesitated for a few minutes and then it was off to the races. Those running premature short positions in stocks were roasted, dissected, fricasseed, and French-fried.

And that would include me.

As of today, I am up 5% on the year. I can?t remember ever having to work this hard to get such a pitiful return. And this is for the guy who nailed the bottom in gold, oil, and stocks, all in the right order.

At least I?m not hedge fund titan Bill Ackman, who is underwater by 20% already this year, in a market that is close to unchanged, and on the heels of humongous losses last year.

Thank goodness for small mercies.

Make a mistake in this market, and you are punished severely. One bad trade wipes out ten good ones.

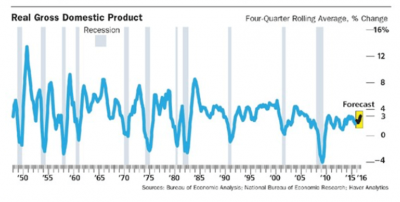

Of course, the nonfarm figures completely take a recession off the table.

As you recall, it was never there for me. I spent much of early February pleading with big clients not to sell stocks, right when the many talking heads were then urging them to do exactly that.

Dow 15,000, 12,000, 10,000, 3,000? Why not? There was an arms race underway where the Cassandras all tried to out-Cassandra each other, as they always do.

I told them instead to not look at stock prices, and to take a long cruise instead. It always works.

Let me tell you what?s going on here. After my friend, Federal Reserve Chairman Janet Yellen, raised interest rates by 25 basis points in December, the market then fully discounted an astonishing seven more such hikes.

That gave us an instant 10% selloff in stocks. Then when the S&P 500 (SPY) hit $181, and a 15X stock multiple safety net came within view right below them, traders suddenly realized that the risk of a bear market meant that there would be NO interest rate rises in 2016.

It also helped that the global commodity space hit bottom and started to bounce only a few days earlier, the nanosecond I sent out my Trade Alert to buy call options on oil (USO) on February 9, with Texas tea trading at $26.

Look at the nonfarm numbers closer, and they are nothing less than eye-popping.

The headline number unemployment stayed nailed to a 4.9% eight year low. The U-6 broader ?discouraged? worker rate fell to a new low at 9.7%.

Health care and private assistance, among the fastest growing sectors of the economy, jumped by 57,000.

Food & drink were up 40,000, and construction gained 19,000. As usual, mining fell by 19,000.

It all confirms a trading scenario that I neatly laid out for you at the beginning of the year. You are going to make all of your equity performance this year buying the 15% New Year dip.

The month we just completed in February was a picture perfect copy of the October price action.

After a ferocious bounce, we will spend the next six months building a giant sideways wedge formation. We will reach an apex by August, and them begin a blastoff to a new high that neatly coincides with the presidential election.

Trade around these moves, and you should be able to bring in a decent double-digit return in 2016.

And the heavy lifting is already behind you.

Apple holders (AAPL) were ecstatic and even apoplectic when they heard that their beloved company would be joining the Dow Average last year.

The move required thousands of portfolio managers to add Apple to their portfolios, like the $32 billion worth of Dow index managers, whether they wanted to or not. From then on it would be illegal for them not to own Apple.

At the very least it put the fear of Jobs into moneymen everywhere, especially if the Dow is the benchmark they are measured against.

The world?s now second largest listed company replaced tired and flagging AT&T (T), one of my perennial favorite short positions.

The symbolism couldn?t be more evident. A former monopoly with a literally rusting infrastructure is getting booted for iPhones, iPads, iTunes, Apps and the Cloud. Oh, how the mighty have fallen.

AT&T was one of the oldest Dow stocks, joining the closely followed index in 1916. The new listing then had a symbolic move of its own, taking place the year after the first-ever transcontinental telephone call was placed.

Who made that call? Alexander Graham Bell in New York telephoned his former assistant, Thomas Watson, in San Francisco in a replay of the first phone call in history 50 years earlier in 1876, from room to room at their lab. ?Mr. Watson, come here, I want to see you,? the first words ever uttered on a phone line, were repeated once more.

AT&T, or ?Ma Bell? as it was known, lost its listing in 2004 after it merged with SBC Communications. It was reinstated a year later when the new firm?s name was changed back to AT&T.

However, Apple shareholders should be careful what they wish for.

There is not exactly a great track record for share price performance after a company joins the Dow, especially a technology stock.

In 1999, Microsoft (MSFT) fell 43% after becoming a Dow 30 stock, while Intel (INTC) shed 52%. Cisco Systems (CSCO) lost 16% after joining the club in 2009.

The problem is that Apple entered the index after a meteoric 18 month, 130% run up. So the Dow, having missed the rise in Apple on the upside, fully participated on the downside in the stock meltdown that followed.

Apple is the second largest component in the Dow, with a hefty $575 billion market capitalization. This means that future Dow corrections will be bigger and more ferocious than they would have been without Apple and with boring AT&T.

The volatility of the lead index has just gone up, a lot.

I remember too well that the Japanese made a similar blunder in 2000. The government wanted to have a national stock index that reflected the economy of the future, not of the past.

They had watched with great envy America?s NASDAQ hog the global spotlight, soaring from 1,000 to 5,000 in just a couple of years.

So what did these geniuses do? They reconstituted the Nikkei Average from a 90% boring industrial, 10% technology index to a 50/50 weighting. And they did this mere weeks after NASDAQ peaked!

As a result, the Nikkei Average got the stuffing knocked out of it in the dotcom collapse. It fell a stunning 15% in the week just after the reconstitution announcement. It cratered from 21,000 to eventually bottom at 7,200. Without the reconstitution, it would have sold out at 10,000.

Having missed the dotcom boom on the upside, the Nikkei fully participated on the downside. Apple shareholders please take note.

Apple?s rise was amply chronicled by a steady series of Trade Alerts in this newsletter.

You can go back to my 2012 prediction that Apple would soar from $485 to $1,000 (click here). On a split adjusted basis we? already reached $931.

I followed that up with ?Apple is Ready to Explode? in October, 2013 (click here), when the post split share price was back at $70.

Indeed, I have issued more Trade Alerts to buy Apple over the seven-year life of this newsletter than any other single name.

It looks like I will be issuing a lot more Apple Trade Alerts in the near future as well.

Guess When the Index Reconstitution Took Place?

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy luncheon, which I will be conducting in Atlanta, George on Tuesday, April 19, 2016.

A three-course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I?ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $217.

I?ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive private club in the downtown area of Atlanta details will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.