While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 20, 2016

Fiat Lux

Featured Trade:

(THE MATHEMATICAL IMPOSSIBILITY OF A TRUMP WIN),

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD ON FACEBOOK),

(FB)

Facebook, Inc. (FB)

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 19, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE COMING WEEK),

(T), (SPG), (HYG), (EEM), (ELD), (CYB), (FXY), (FXE)

(A CONVERSATION WITH THE BOOTS ON THE GROUND),

(OCTOBER 21st SAN FRANCISCO, CA GLOBAL STRATEGY LUNCHEON)

AT&T, Inc. (T)

Simon Property Group Inc. (SPG)

iShares iBoxx $ High Yield Corporate Bd (HYG)

iShares MSCI Emerging Markets (EEM)

WisdomTree Emerging Markets Lcl Dbt ETF (ELD)

WisdomTree Chinese Yuan Strategy ETF (CYB)

CurrencyShares Japanese Yen ETF (FXY)

CurrencyShares Euro ETF (FXE)

I think you can pretty much expect things to remain on hold until the Fed announces its interest rate decision next Wednesday afternoon.

That is when all financial markets will explode to the upside, the downside, or both.

So, I am going into the big day 100% in cash to take advantage of the sudden bouts of volatility.

Long-term portfolio managers should just turn off the TV and go to sleep. The moves are going to be too tight and rapid for you to trade, and we are going to new all time highs by year end anyway.

The really interesting thing about the charts below is that virtually the entire yield sensitive space is approaching major medium term support levels.

That means they could all rocket in unison if the Fed takes no action which is what I expect they will do.

That would include utilities (T), REITs (SPG), junk bonds (HYG), emerging market stocks (EEM), bonds (ELD), master limited partnerships and currencies: the Yuan (CYB), the Yen (FXY) and the Euro (FXE).

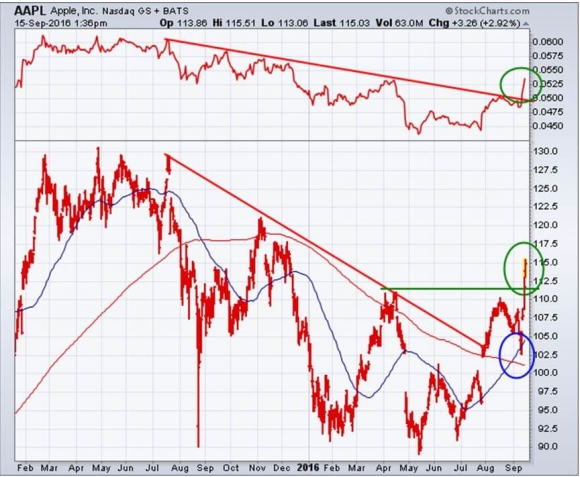

In the meantime, we have a market that has become incredibly concentrated. Of the 127 point move up in the Dow Average during the first four days of last week, an amazing 67% was accounted for by Apple (AAPL).

By the way, I have been predicting all year that Steve Jobs? creation would spike around now, and I have been proved dead on. You're welcome to those of you who bought in the spring at $92 on my advice.

If the Fed is truly data dependent, this is what the last raft of numbers looked like.

August Retail Sales dropped by 0.3%, Core Retail Sales by 0.1%, the Empire State by 1.99, Industrial Production by a heart rending 0.4%, and the Producer Price Index was unchanged.

It all adds up to a modest summer economic slowdown that kicked in during August.

Only Weekly Jobless Claims show continued strength, hovering at 43 year lows at 260,000. But there is barely a whisper of wage hikes historically seen at these employment levels.

The Fed Funds futures voted with their feet.

There is now only an 11% chance of a hike in September, and 44% in December, and the Fed NEVER votes against this key interest rate leading indicator.

It will be a big week for housing data, the most important single leg of the US economy.

But all else will pale in comparison to the Federal Open Market Committee Meeting (FOMC) concluding on Wednesday.

On Monday, September 19th at 10:00 AM we get a Housing Market Index that should show continued improvement.

On Tuesday, September 20th at 8:30 AM EST the August Housing Starts should be interesting, given the recent rise in mortgage interest rates.

On Wednesday, September 21 at 2:00 PM EST we get the Big Kahuna, the Fed interest rate decision. The comments in the press conference following the announcement will be more important than their decision NOT to raise rates, especially given presidential candidate Donald Trump?s vicious attack on Janet Yellen.

On Thursday, September 22nd we get a cornucopia of data releases. At 8:30 AM EST the Weekly Jobless Claims should confirm that employment remains at decade highs. August Existing Home Sales will be the most important housing related data release of the month.

Friday, September 23 delivers us the Purchasing Managers Index Flash Index at 9:45 AM EST. We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past two months, driving oil prices lower.

I have been going through old boxes of hard copy photos stored in my basement, scanning them to my computer to avoid total deterioration. I will be posting some of the more fun ones when there is nothing better to do.

John Thomas

The Mad Hedge Fund Trader

Refueling in Corsica in 1985

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 16, 2016

Fiat Lux

SPECIAL RAILROAD ISSUE

Featured Trade:

(THE BIG COMEBACK IN RAILROADS),

(UNP), (CSX), (NSC), (CP), (KSU)

Union Pacific Corporation (UNP)

CSX Corp. (CSX)

Norfolk Southern Corporation (NSC)

Canadian Pacific Railway Limited (CP)

Kansas City Southern (KSU)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.