While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 29, 2017

Fiat Lux

Featured Trade:

(STOCK POP, BANKS ROCK),

(BAC), (JPM), (GS), (MS), (WFC),

(PRINT YOUR OWN CAR),

(TESTIMONIAL)

Anyone who has listened to one of my Mad Hedge Global Strategy Webinars over the past six months has heard me recommend the same sector as the top market performer for the next three years:

Financials.

I am sticking to my guns, and it's not too late to get in.

If fact, I think leading names like Goldman Sachs (GS), JP Morgan (JPM), Citicorp (C), Bank of America (BAC), and Wells Fargo (WFC) could double over the next 2-3 years, and continue rising until the next recession hits.

Today, the market agreed with me in spades.

You can thank nominated Federal Reserve Governor Jerome Powell for the price action, who appeared in front of Congress today. The more he spoke, the higher bank shares rose.

He did his best to appear as a clone of outgoing governor Janet Yellen, who preceded over one of the most rapid increases in bank profits in history.

And what's good for Janet is good for the country.

One of the great appeals of the bull case for banks is that it is not all that hard to figure out.

I love banks, especially American ones.

I like those imposing, monumental edifices. I am attracted to those smooth marble surfaces. Those wrought iron grills at the teller windows are not to be trifled with.

They all reek of safety, stability, and certainty. What better place to park your life savings. And I never hesitate to grab one of those free breath mints on the way out the door.

What?

Didn't they get rid of those during a 1980's cost cutting binge? You always know that when they have to dump the breath mints to preserve their profit margin, there's a problem.

The airlines did it 40 years ago, and look what happened to them.

However, today, banks and financial shares in general offer some unique investment opportunities.

What is a manager to do when the stock market is at a century high valuation? You only buy cheap stuff.

What is a trader to do in a stock market characterized by rapid sector rotation? You only buy, you guessed it, cheap sectors.

Enter the banks.

You remember the banks, don't you? That was the sector that was priced for perfection in anticipation of eight consecutive quarter point interest rate raises starting in December 2015.

It only took a 10% stock market correction to rain on that parade, as the prospect of any further rate hikes was put on ice. Back stocks plunged 40% in a heartbeat.

Now that the April Open Market Committee minutes have put a rate rise back on the table, we're seeing that movie replayed one more time.

This time around, banks have attractions that were missing in past cycles.

Oversight is now at record levels of intensity.

Nearly a decade of new share issues has brought bank capital to record levels, and liquidity is at an all-time highs.

Book values are growing at a decent pace.

Energy loan losses were wildly over exaggerated by the rumor mill.

Share valuations are discounting a full scale recession that, worst case, is at least 2-3 years off. Earnings are at record highs.

Efficiencies are growing by leaps and bounds. One of the reasons that New York City has had the worst residential real estate market for the past couple of years is that bank layoffs have reached the hundreds of thousands.

Bank subleasing of office space has been so prodigious that is even starting to drag on the red-hot San Francisco commercial real estate market.

In fact, you could write off an entire new housing crisis now and still have more capital left over than last time.

Stocks could double over the next interest rate cycle. They offer a double discount in price to book value (70%) and earnings multiple to the main market multiple (9X versus 19X). Dividend yield are the highest in history.

Even Facebook (FB) and Apple (AAPL) are unlikely to beat that.

The fines and penalties that came out of the financial crisis are now a distant memory. They are even getting reversed in some cases, thanks to a friendly administration.

Bank shares are in fact a levered put on the bond market (TLT) and a call option on interest rates ($TNX).

There has been a lot of uninformed chatter about fintech eating the banks' lunch. But the reality is that the staggering regulation imposed on the banks by Dodd-Frank and the Treasury will act as an unassailable moat protecting the industry.

My guess is that entrepreneurs, developers, and coders will take one look at the morass of new rules and walk away to find some other industry to prey upon (real estate brokerage?).

The long-promised breakups of the big banks will never happen, lest the US give away its competitive advantage with the rest of the world. If they do, it will unlock massive shareholder value, enabling the shares to double yet again.

You could diversify and buy the basket through the Financial Select Sector ETF (XLK) (click here for their prospectus).

The smart regional bank play here is Comerica (CMA).

As a result of all of this, bank stocks are offering the lowest entry point in a generation.

The big question is if this is yet another bull trap and fake out with the banks, or whether this is the beginning of a long-term sustainable trend up.

We may well find out on December 13 when the Fed announces its next 25 basis point interest rate rise, or not?

Will Yellen's final commentary be hawkish, dovish, neither, or both?

If's she's smart, she'll talk about the weather.

Sticking to My Guns on Financials

I can't tell you how much I enjoy your blog. It is the first place I go every morning and I miss you on the weekends.

I stumbled upon your site about 4 months ago and have been addicted to it since day one. I really appreciate not only your insight into the markets, but also your global and historical perspectives.

All of this served up with your great sense of humor makes it a must read! Thanks for all your hard work.

Chip

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Expect to hear a lot about ignition in the next year. No, I don't mean the rebuilt ignition for the beat up '68 Cadillac El Dorado up on blocks in your front yard.

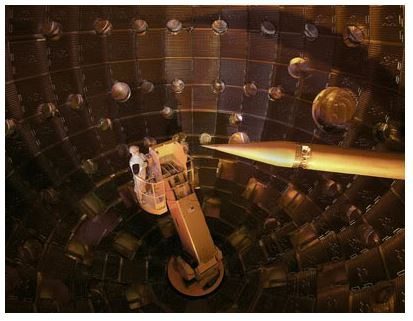

I'm referring to the inauguration of the National Ignition Facility next door to me at Lawrence Livermore National Labs in Livermore, California.

Mention California to most people, and images of love beads, tie died T-shirts, and Birkenstocks come to mind. But it is also the home of the hydrogen bomb, which was originally designed amid the vineyards and cow pastures of this bucolic suburb.

The thinking at the time was that if someone accidently flipped the wrong switch, it wouldn't blow up San Francisco, or more importantly, Berkeley.

The $5 billion project aims 192 lasers at a BB sized piece of frozen hydrogen, using fusion to convert it to helium and unlimited amounts of clean energy.

The heat released by this process reaches 100 million degrees, hotter than the core of the sun, and will be used to fuel conventional steam electric power plants.

There is no need for a four foot thick reinforced concrete containment structure that accounts for half the construction cost of conventional nuclear plants. The entire facility is housed in a large warehouse.

The raw material is seawater, and a byproduct is liquid hydrogen, which can be used to fuel cars, trucks, and aircraft. If this all sounds like it is out of Star Trek, you'd be right.

I worked with these guys in the early seventies, back when math was used to make things, and before it was used to game financial markets, and I can tell you, there is not a smarter and more dedicated bunch of people on the planet.

If it works, we will get unlimited amounts of clean energy for low cost in about 20 years. Oil will only be used to make plastics and fertilizer, taking the price down to $10 for domestic production only.

The crude left in the Middle East will become worthless. Lumps of coal will only be found in museums, or in jewelry, its original use. If it doesn't work, it will melt the adjacent Mt. Diablo and take me with it.

If you don't get your newsletter tomorrow, you'll know what happened. Now what is this switch for?

Global Market Comments

November 28, 2017

Fiat Lux

SPECIAL INFLATION ISSUE

Featured Trade:

(THE GREAT INFLATION HEDGE YOU'VE NEVER HEARD OF)

So, what am I talking about here?

Blue chip growth stocks? Diamonds? Residential real estate? Gold?

No, I am talking about grand pianos manufactured by Steinway & Sons of Queens, New York.

Did you say pianos?

Yup, the kind with which you sit down and play "As Time Goes By." (Casablanca).

During the 19th century, there were over 1,200 US piano makers manufacturing a product which can include more than 12,000 parts. It was the technological Boeing 474 of its day.

Today, there are only five American piano makers, and just one, Steinway, is considered investment grade.

That's because when Carnegie Hall, London's Royal Albert Hall, or Beijing's Concert Hall National Grand Theater are in the market for a new concert grand piano, they only consider Steinways.

You can start with an entry level 5'1" Steinway Model M baby grand piano, or ostentatiously splurge with a opera house filling nine-foot-long concert grand Model D.

I received the bad news from my kids' piano teacher a few months ago. After six years of lessons, they had outgrown their piano, a modest entry level 1966 Wurlitzer spinet.

I approached the matter as I do everything, with exhaustive, no stone unturned research. What I learned was fascinating.

Given the available space in my home and the kids' commitment to the enterprise I decided that a seven-foot Steinway Model B would do.

My first visit was to the local Steinway dealer. For a mere $100,000, and $110,000 with tax I could buy a brand new 6'11" Model B.

For an extra $15,000 I could buy a model B with the Spirio technology that enabled the piano to play itself to incredible symphony standard.

Financing was available at a hefty 10%, compared to only 2% for my Tesla. Banks are not allowed accept pianos as collateral.

Steinway also sell used pianos, but will only go back 15 years, getting me down to the $70,000 range. I thought I'd look around more.

So I plunged into my favorite source of incredible, once in a lifetime deals, Ebay (EBAY).

The offerings were vast.

They included everything from a $13,500 1897 Model B in desperate need of a complete $30,000 rebuild, to a 2013 Model B in showroom condition for $87,500.

Obviously, I had my work cut out for me, especially since I am not a musician myself. Coming from a family of seven kids, there was never enough money for music lessons.

Thus, I have been a lifetime consumer of music, rather than a producer.

It turns out that, like Rolls Royce's (that other great unknown inflation hedge), no one ever throws a Steinway away. A fully restored 130-year-old model can almost cost as much as a new one.

And there is your inflation play.

The list price for a Steinway Model B in 1900 was $1,050. Some 117 years later, it is up 100-fold, giving you a compound annual growth rate of 3.97% a year.

This compares to 5.18% for ten year US Treasury bonds, and 9.71% for the S&P 500 over the same time period. But then you can't play a stock certificate, let alone make your kids practice on it.

A Steinway is in fact the perfect instrument with which to make these long-term inflation calculations.

Vintage cars, diamonds, and homes are all unique, have varying quality, and are all susceptible to overvaluation and hype from aggressive salesmen and dealers. Even gold coins can have huge differences in value based on grade and rarity.

Save for a few patents issued in the 1930's covering keyboard and soundboard manufacturing, Steinways are built almost identically to the way they were made 117 years ago. Tour their factory and you find workshops filled with primitive 100-year-old iron and wooden tools.

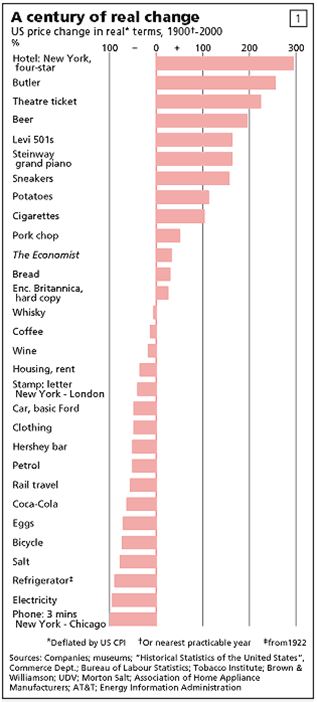

Every other manufactured product has seen massive productivity and technology improvements over a century that have caused real prices to completely collapse.

Take computers for instance, which have suffered an average annual price decline of 30% since 1950. The cost of telephone calls has fallen by almost 100% in real terms since 1900 (see table below which I lifted from my former employers at The Economist)

That is the source of the rise in our standard of living.

It gets better. The prices of Steinways are rising fairly dramatically in real terms relative to almost everything else thanks to a host of geopolitical reasons.

It turns out that the Chinese are taking over the global market.

While 200,000 pianos a year are sold in the US, the figure is over 1 million in China.

Many Chinese parents hope their children will achieve the international prominence of 35-year-old Lang Lang, who commands millions of dollars a year in global performance and licensing fees. Many aspiring parents drive their kids to practice eight hours a day.

As a result, the Chinese have been buying up all the used premium pianos in the world, including Steinways in the US, Bechsteins and Bosendorfers in Germany, Faziolis in Italy, and Yamahas and Kawais in Japan.

Whenever Chinese buy a luxury apartment in San Francisco, the first thing they do is outfit it with a Steinway grand piano, even if they don't play. It is the ultimate status symbol, not only because of the price they pay, but the space it takes up.

As a result, Steinways not only sell at a large premium to other pianos, but are dear relative to ALL manufactured products over the expanse of time.

Researching the history of Steinway, you find a storied company that has undergone the sad, but familiar travails of American manufacturing over the last century.

In short, it's a miracle that this company still exists.

The first pianos were sold by a German immigrant from Hamburg in 1856. By 1972, a lengthy strike and competition from Japanese imports forced the original Steinway family to sell out to CBS after five generations.

Then there was a brief, but disastrous experiment with Teflon parts in the 1970's. Suddenly Steinways didn't sound like Steinways.

A private equity deal followed in 1985. From 1996 to 2013 it traded on the New York Stocks exchange under its own ticker symbol (LVB) (for Ludwig von Beethoven).

Steinway was then bought by my friend and newsletter client, hedge fund legend John Paulsen, for $500 million. It produced its 600,000th piano in 2015.

If you want to watch a film about old fashioned American manufacturing, vanishing skills, the pride of craftsmanship and working with your hands, watch the highly entertaining documentary movie "Note by Note: The making of Steinway L1037."

It has won several awards.

It is wonderful to watch with the kids in that it shows what work was like in the old United States I remember, and can be streamed online for $4.99 by clicking here.

As for my own Steinway search, it had a very happy ending.

Ebay enabled me to find a local Craig's List listing in Jackson, Mississippi for a 1951 Model B that was originally purchased by the University of Mississippi Music Department. It had been played by every noted pianist touring the South for a half century.

Some 20 years ago, a local doctor then purchased it right off the stage at a university surplus equipment sale.

This year the doctor retired, sold his mansion, but had no room for a grand piano in his rapidly downsizing lifestyle.

He listed the piano for a low-ball price of $18,000, the cost of his 1997 ground up restoration. After I had a professional musician visit the house to check the condition and tone, I was the only bidder.

I figure if the kids ever get sick of practicing I can always flip it to the Chinese for double. That's me, always the trader.

I am totally comfortable buying big ticket items off of Ebay, as I have been trading there for 20 years. I have bought five cars there for assorted family members.

If you aren't comfortable with Ebay, there is always Bruno.

Dallas, Texas based Maestro Bruno Santo, is a Julliard graduate, former Steinway dealer, and the most knowledge individual I ran into during my far-ranging research. He is also quite the salesman.

He runs a high volume, low margin business model which I admire and can probably get you a very nice Steinway in the mid $30,000's.

You can reach him through his website by clicking here.

To learn more about the interesting and beautiful world of Steinway pianos, please visit the company's website by clicking here.

Getting an 800 pound finely tuned musical instrument from Jackson, Mississippi to San Francisco, California is a whole new story on its own.

What I learned about the national trucking industry was amazing, and boy, did I get a deal!

Watch for my future research piece on "What I learned Moving My Steinway Grand Piano."

As for the old Wurlitzer, it is now happily ensconced in my Lake Tahoe beachfront estate. Neighbor Michael Milken has already completed the quality of the play.

The Winning Bid

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.