While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 27, 2017

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE GREAT ONLINE MIGRATION HAS BEGUN),

(AMZN), (BBY), (SOXX),

(WILL YOUR HOME SURVIVE THE TAX BILL?),

(IYR), (DHI), (LEN), (PUL)

Holy smokes!

I was in the Reno, Nevada Best Buy (BBY) the day before Black Friday and I couldn't believe my eyes.

Stacked to the ceiling were piles of 65 inch 4k ultra smart LED HDTV's priced at only $799.99. That is $300 off the regular price.

I paid $4,000 for one of these four years ago. That's deflation, man!

Every square inch of the special retail outlet was similarly packed with mountains of inventory, and they expected to sell ALL OF IT!

I was speaking to a sales clerk when a big bruiser of a man, at least three hundred pounds and all muscle, asked when the doors would open.

12:01 AM was the answer.

I think I'll pass on that one and visit the website instead where the prices are the same, but the risk of getting trampled to death by an NFL reject is nil.

I was not the only one to reach that risk averse conclusion.

For Friday, November 24 was a seminal day in the history of retail, if not all of western civilization. It was the first time that Black Friday online sales exceeded brick and mortar sales.

The Great Online Migration has begun.

So is this also the start of the Singularity, where man and machine become one? I thought that wasn't supposed to happen for another 20 years? I'll have to ask my friend Ray Kurzweil.

A record of another sort was broken when the personal wealth of Amazon (AMZN) founder Jeff Bezos exceeded $100 billion. That is thanks to the meteoric rise of Amazon shares in the past month, up 22%.

Which makes you wonder what's in the water in Seattle, Washington. The previous holder of the "Richest Man in the World" title is Bill Gates, who only lives a few miles away from Jeff.

As for Best Buy, the share price was blind to the stampede of frenzied buyers in its stores, stuck in the same narrow range that has held it hostage for the past six months.

The stench of retail is a foul one, at least for equity investors.

It all provided a refreshing break from our new daily torture known as tax reform. My bet is that congressmen are getting an earful visiting constituents at home this week.

It is in effect an untradable backdrop, as no one truly knows what is going to happen. Or to quote Bush appointee Donald Rumsfeld, "it is unknowable."

It certainly doesn't give you much to hang your hat on as a trader.

The week was mercifully shortened to four days, as everyone's focus was clearly on the holiday and Black Friday.

The 25-basis point rate hike on December 13 moved forward another week. Congress will hold hearings this week with Jerome Powell where we may gain the first insight on the cut of the jib of the new Fed Governor.

Dove, or hawk? It makes a big difference to shareholders.

The financial media are now daily churning out statistics on how expensive stocks are.

The S&P 500 is now selling at 9.2 times book value, companies to 6.3 times the 2008 peak, and 8.7 times the 1999 bubble top.

Stocks responded by rising to new all-time highs....again.

Remember, the more you drink, the worse the hangover that follows. Are we setting up for one of those now? January maybe?

The only recent flutter was a down -2.3% in the Chinese stock market on Friday. We'll know in days if this is the start of something bigger.

As for my Trade Alert performance, it has been a real battle to add incremental performance.

Meteoric spikes have turned into one yard and a cloud of dust.

We are challenged by an atrocious risk/reward ratio which strongly augurs against opening new positions in any asset class.

The acceleration of the tax bill triggered a rip-your-face-off rally in the Russell 2000 (IWM), which I was short.

A settling of the political situation in Germany then robbed me of my profits in my short Euro position (FXE).

Still, we are making money in our gold (GLD) long, and prospects are good in January again.

That leaves us with a 54.31% trailing one year return, which handily beats every index, even the scalding hot Philadelphia Semiconductor Index (SOXX), (up 50.8%), and is better than a poke in the eye with a sharp stick.

On Monday, November 27, at 10:00 AM the October New Home Sales are published, a forward-looking basket of ten monthly data points.

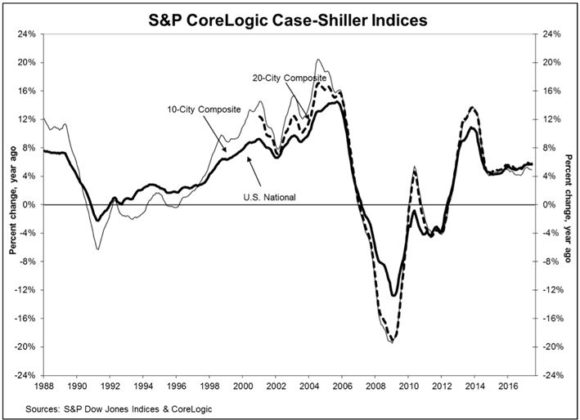

On Tuesday, November 28 at 9:00 AM EST we get a new S&P Corelogic Case Shiller National Home Prices Index for September. Since the data predates the Republican plan to deny mortgage interest and real estate tax deductions, the data should remain hot.

On Wednesday, November 29 at 8:30 AM we get a new update for Q3 GDP. The last report came in at a relatively hot 3.0% annual rate.

The weekly EIA Petroleum Status Report is out at 10:30 AM.

Thursday, November 30 at 8:30 EST we get another Weekly Jobless Claims. Last week came in at a near four decade low.

On Friday, December 1 at 9:45 AM, the PMI Manufacturing Index is out, a survey of future month to month expectations.

We then receive the Baker-Hughes Rig Count at 1:00 PM EST, which lately has started to turn up again.

As for me, I will be driving home from Lake Tahoe this weekend with a gigantic ten foot tall Christmas tree tied to my roof.

Holiday hell has begun!

After riding the gravy train for six fabulous years, real estate agents are now wringing their hands over the futures of home prices.

The top question asked at open houses these days is whether the loss of home mortgage interest and local and state tax deductions will bring the market to a screeching halt.

Should you now be dumping your positions in homebuilders like Pulte Homes (PUL), DH Horton (DHI), and Lennar Homes (LEN). One of the top performing sectors of 2017?

As a result of these proposals now winding their way through congress the average Californian homeowner is looking at an average $10,000 jump in his tax bills.

Things are nearly as bad in New York, New Jersey, Illinois, Oregon, and Washington. Combined, these states account for nearly 50% of US GDP.

You would think having a real estate guy for president would be good for real estate.

That is not necessarily so.

Remember that Trump controlled entities went bankrupt four times with his high risk, junk financed property ventures.

You may lack his skills in extricating himself from these misadventures, let alone reap billions of dollars in tax benefits.

Suffice it to say, it's complicated.

This is important because most individuals' best performing investment over the past six years has been their home equity.

Depending on where you live, and the amount outstanding on their mortgages, the return could be as much as 1,000%.

I know this sounds insane and unbelievable, but pull out a calculator and run your own numbers and you'll see I'm right.

There is no doubt that that the initial impetus a Trump economy will have on residential real estate is positive.

The magnitude of deficit spending that Trump is talking about with jobless claims at all times lows is highly inflationary. Trump wants to throw gasoline on the fire and toss in a few sticks of dynamite for good measure.

Real estate is the best inflation hedge out there.

What's more, rising incomes will increase purchasing power in what is already an extremely supply constrained market.

As a result, home prices should break free from the current sedentary 5% annual increases to 10% or more, for at least for the next couple of years.

The dark side of Trump's economic policies is that interest rates are starting to look like they have put in a multi decade head and shoulder top, and higher rates will come.

This is the logic behind my current bond short.

This was already a work in progress as the entire world is expecting the Federal Reserve to raise interest rates at their upcoming December 13 meeting by 25 basis points. This will be the fourth consecutive rate rise in this cycle.

Yields on ten year Treasury bonds have leapt from 1.33% in July 2015 to 2.34% today, a near record increase of 1.00% in 17 months.

The initial phase of any rate hiking cycle creates a stampede, as buyers rush to beat interest rate rises and lock in low 30 year rates.

This is a big deal.

For the past six years, I have been advising readers to refinance their homes with ultra-low interest rates offered by 5/1 ARMS, or adjustable rate mortgages.

The assumption then was that rates would remain lower for longer under a Clinton administration, and that you could always refinance again at near zero rates during the next recession.

That assumption has gone into the ash can of history, so I changed my mind.

In the Trump world, you want a 30 year fixed rate mortgage. While the rates here have jumped from 3.45% to 4.01% since July 2016, this will appear laughably low in three years.

Despite the recent pops in rates, they are coming off 200 year lows for the US, and 5,000 year lows for the rest of the world.

They have a lot more to run.

Higher interest rates bring a stronger US dollar, so the inward flood of foreign investment from abroad, primarily from China and Europe should increase.

But it won't go into New York penthouses, the kind that Donald Trump sells, because new anti-money laundering statutes have moved a cloud over this market.

Instead, foreigners will flock to commercial real estate, or the McMansions that have recently proved so popular.

Trump has also promised to repeal the Dodd-Frank financial regulation bill. This will make it easier for banks to lend, especially to low income families with low incomes and minimal FICO scores.

Subprime is about to make a big comeback.

One potential threat to housing would be the demise of Fannie Mae and Freddie Mac, long a Republican goal.

These two quasi-governmental bodies recycle home loans from the private sector and went into receivership after the 2008 crash.

The United States is the only country in the world that engages in this kind of activity, which has delivered a long-term push on home prices upward.

Trump surrogates have promised to eliminate these two entities, or at the very least, privatize them. If that occurs the bulk of conforming mortgages will lose their de facto government guarantees.

That would bring much higher long-term interest rates, possibly 100-200 basis points, a definite buzz kill for residential real estate.

Unfortunately, this story does not have a happy ending.

While short-term stimulus will deliver a higher high in real estate prices, a lower low will follow when the stimulus ends.

Boom and Bust, that has been the never ending cycle since real estate was invented. Even Donald Trump can't repeal the Law of Supply and Demand.

I don't believe the tax bill will make it through congress in its current form. A transfer of $4.5 trillion over 10 years from blue to red states is just too much of a heavy lift for a Republican Senate with a two seat majority.

What is more likely is a compromise deal where homeowners can deduct the first $10,000 each in mortgage interest and real estate.

This still would create a drag for home prices, but not enough to offset massive structural demographic and inventory tailwinds that I have been writing about for yonks.

Last week, national Home Inventories fell to only 3.9 months, the lowest in history.

While the next bust is probably at least a couple of years off, the seeds of the next financial crisis are being sewn as I write this.

Just don't forget to sit down when the music stops playing, as millions did in 2008.

Global Market Comments

November 24, 2017

Fiat Lux

Featured Trade:

(MAD HEDGE WEBINAR Q&A FOR NOVEMBER 22, 2017),

(VIX), (VXX), (GE), (GILD), (GS), (JPM), (WFC), (TLT), (GLD), (ABX), (GDX), (AAPL), (UUP), (DXJ), (SQ)

Q: Is it time to take a punt on the volatility index with the Volatility Index (VIX) this low?

Paul in Florida

A: The answer is yes, but here's the rule of thumb on long (VIX) trades. Go deep out of the money, long dated, and small in size.

This kind of market has been crushing long (VIX) players, so when I say long dated, you want to go out to probably March. The time decay is minimized.

Look at the (VXX) and you probably want to go out to a $40 strike price, compared to the current $32.

That way if you get a sudden bounce back in volatility, you could get a quick double on the call options. We did that in August and that is your trade.

Remember, when you go long the (VXX), you are going against the long-term trend. This thing has gone from 10,000 to 32 in ten years. It is a classic falling knife situation.

Q: Would you buy General Electric (GE) now after the giant drop?

Bill in Amarillo, Texas

A: The answer is NO!

Their business structure is so out of sync with the state of the US economy that they don't have a chance to make a sudden big comeback.

Recovery will be a multiyear process, my guess is that we are setting up here for an L shaped chart. Huge sell off, then a small bounce, then a long flat line move at the bottom until we start to see real progress on the earnings front which is probably years away.

Don't confuse "gone down a lot" with "cheap," always a classic mistake that people make.

Q: Should i be shorting Gilead Sciences (GILD)? The chart looks terrible.

Karl in Midland, Texas

A: Absolutely not.

Never short a stock that is sitting on close to $100 billion of cash. They could do a takeover of another biotech company anytime and get a massive 25% move in a heartbeat. Don't think about shorting things even though they haven't done anything for a while.

Q: Do you love or hate financials and which one would you pick?

Robert in Seattle, Washington

A: My pick is Goldman Sachs (GS) as the laggard and JP Morgan Chase (JPM) as the frontrunner.

Interest rates are definitely going up next year, it's just a question of how much.

Deregulation is a big push and as we start to see the bond market sell off, trading volume increases and that has been a drag on Goldman Sachs' earnings for the past year. There has been poor performance in bond trading because of lack of volume, that will recover next year.

So I am looking for a double in financials over the next 2-3 years from these levels, and it's not too late to get in. You can pick any of these. Even Wells Fargo (WFC) is scandaled out so you can even make money on that one.

Q: Why have bonds not crashed yet?

Peter in Portland, Oregon

A: The reason is our impending Fed sale of $4 trillion in US Treasury bonds (TLT) is being offset by the $5 trillion in new QE created by Europe and Japan. This is why we have had such a dead market for the last couple of months stuck in narrow ranges.

Q: Equities are getting so expensive, is this a good time to look at value stocks?

Miguel in Miami Beach, Florida

A: Value stocks have been utterly crushed this year. All the money has gone into high momentum growth stocks like the FANG's.

However, if you're setting up a long-term portfolio as opposed to a short term trade, value is not a bad idea right here. Buying stuff out of favor with a lot of great value and some of these things will come back big time. Energy is one area i am focusing on.

Q: Are gold miners a better way to play gold than gold (GLD)?

Vince in Salt Lake City, Utah

A: They are. By the way we are long the December $116-$119 vertical bull call spread and we have ample room there to make money.

We have the 200 day moving average as major support on that position to protect this from any weakness.

In fact, if you look at these charts, it's a very weird formation for gold, with a very narrow range and a very gentle move up.

There would of been a much sharper move up in the pre bitcoin world. If you look at the (GDX) and (ABX) the volatility of the miners relative to the underlying gold is about 3 or 4 to 1.

A 10% move up in gold can create a 30% to 40% move up in gold mining stocks. This a great place to get long Barrick Gold (ABX), and you can even go very low risk with something like a $12-$13 in-the-money vertical bull call spread. I will be running the numbers on that one.

Q: Is it smart to hold a small Fang position?

Steve in Carson City, Nevada

A: Absolutely yes, and if we do get a sell off, just add to them. This sector will go up 10 times in the next 10 years. As long as you can handle some pain they will be fine. Remember, Apple (AAPL) every couple of years, sells off 40-45%. As long as you can handle that kind of volatility, just keep on doing it forever.

Remember if you don't sell, then you don't pay any taxes. There is merit in that if you just ignore all the volatility on the FANGS and sit with them.

Everyone who has ever sold them, often never bought them back, or they had great difficulty buying them back after a big chase.

Q: Should a 5% correction in the stock market be bought?

Mike from Daytona Beach, Florida

A: Yes, it will certainly be bought by me. I am convinced that we have 18 months to go in this bull market, and probably no more than a 5% correction along the way.

Q: Is there stuff about energy in the tax bill?

Chase in Boise, Idaho

A: Absolutely yes, tons of it. One of the many things they are trying to slide past in the tax bill without no one noticing is massive new subsidies for investment in oil and gas infrastructure.

When the president talks about infrastructure bills, he is talking about energy infrastructure, not the kind of infrastructure you drive cars on or cross rivers with. It's basically an all oil government right now.

Q: Do you have an opinion on marijuana stocks?

James in San Diego, California

A: I don't want to touch them with a ten foot pole because they aren't allowed to use the banking system. It's still an industry that forces people to carry around suitcases or even truckloads of cash.

They are also still in violation of federal law and I would not be surprised if this government, looking to distract us from other things, suddenly clamps down hard on the legal marijuana industry at the state level.

It's not a good investment choice and I know there is a lot of stuff out there talking about marijuana stocks, but not with my money.

Q: Do you expect changes in the tax reform?

Sam in New York, New York

A: Absolutely yes. In fact, many of the major elements may not make it into law such as loss of deductibility of home mortgage interest or state and local taxes. What they may do is allow a deduction capped say a $10,000 per year for each one and make higher tax payers like me pay the balance.

Q: Are you bullish or bearish on the US dollar (UUP)?

Mark in Omaha, Nebraska

A: I am very bullish long term. The US will be raising interest rates faster than any other country in the world and that is always dollar positive.

Q: What is your long term call on Japan?

David in Laguna Beach, California

A: It will rise twice as fast as the US stock market for at least the next 18 months, and it's not too late to get in there. Do it with the (DXJ), the yen hedged Japan equity ETF.

Q: What do you expect with four Fed vacancies?

Jim in Nantucket, Massachusetts

A: They will be filled with dovish appointees, but I think they are waiting for the new Fed governor, Jerome Powell to take his seat on January 20th and then let him be in the driver's seat on the new appointments.

There is no way that the president is going to allow high interest rates to spoil his economic agenda.

Q: Do you have an opinion on Square (SQ)?

Lars in Sydney, Australia

A: It's up 450% in 18 months. Yes, I love the company. It's a rare example of an IPO that worked in tech. But has run too far, too fast, so don't want to touch it.

That's it for today, folks.

Good luck and good trading.

John Thomas

"I only invest in beer drinking countries, never wine drinking countries," said Ben Horowitz, co-founder of venture capital firm Andreeson Horowitz.

??

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.