Global Market Comments

February 8, 2018

Fiat Lux

Featured Trade:

(SALESFORCE POWERS ON),

(CRM), (FB), (MSFT), (GOOGL), (AAPL)

Usually, when a company builds a new office tower that is the highest west of the Mississippi, it is a sign that business is great.

That is certainly the case with San Francisco based Salesforce, the overwhelming leader of the CRM industry.

The ever-ebullient CEO of Salesforce, Marc Benioff, sure made a splash at Davos World Economic Forum pointing the finger at Facebook (FB) and comparing it to carcinogenic like dangers.

Benioff certainly has the clout in Silicon Valley to make such bold statements. A home grown local hero, graduating from the peninsula's plebeian Burlingame High School, Marc has grown into a tech titan in his own right.

Marc is also the largest philanthropist in the San Francisco Bay Area. The UCSF hospital network has been the beneficiary of $300 million worth of munificence.

Benioff is currently offering $100,000 cash to every middle school in Northern California to buy new computers.

And here's the really amazing thing. Amazon tried to buy Salesforce for $50 billion 18 months ago, and Benioff turned them down! If Benioff had taken Amazon stock in the deal he would be worth some $120 billion today.

Salesforce usually doesn't receive the wow factor that a Facebook (FB), Alphabet (GOOGL), and Apple (AAPL) get, partially because it's less integrated into the realm of everyday consumer use.

What exactly is Salesforce? And what the heck is CRM?

Ask the average Joe and he would be befuddled and exasperated by the very question. Salesforce's own management describes itself as a "wall-to-wall software platform that manages every aspect of the customer journey from marketing to sales to service."

Marc Benioff inaugurated the software-as-a-service (SaaS) revolution in the late 1990's that has been adopted by virtually all other tech contemporaries.

Instead of paying a one-time fee like everyone used to do when they bought Microsoft Office 365, customers pay a reoccurring yearly subscription just like the services offered by the Mad Hedge Fund Trader.

I must confess that Marc beat me to this business model by a few years, but I can vouch for its effectiveness.

The revolutionary CRM (Customer Relationship Management) platform they provide does not exude glamour because it's usage is confined to highly specialized back office employees who rejoice in its easy functionality and innovative features.

For Netflix, only one metric is taken seriously for avid investors; total subscription growth.

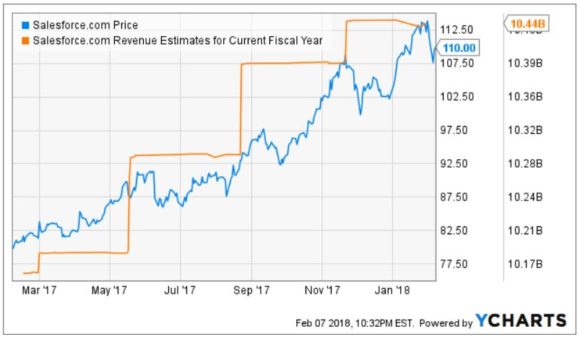

Salesforce is another tech growth company driven by one number: Total Revenue Growth. Anytime Salesforce publish data, investors flip to the only number that matters.

All high growth tech stocks must relentlessly push the accelerating growth narrative and keep earnings growing and share prices rising, or face shunning by investors.

A tech growth company simply cannot be a growth company if they aren't over delivering on total revenue expectations.

Salesforce is definitely not pussyfooting around when it comes to their performance. Revenues pierced the $10 billion mark in FY 2017. The encore did not disappoint, stating that Total Annual Revenue should soar to $20 billion by 2022, $40 billion by 2028, and $60 billion by 2034. The growth frenzy is music to investors' ears.

You'd be hard pressed to find any Wall Street analyst not super bullish about their revenue prospects.

How is Salesforce pulling this off?

Some 57% of Salesforce customers this year are brand new. Existing customers buy more products as the working relationships evolve and the grizzled old customers cannot switch to any other platform because de-integrating their business from Salesforce would be a living nightmare.

The Mad Hedge Fund Trader can vouch for this, when we moved over our email service and payment processing to incorporate the higher volume, our team of developers were about to tear their hair out. Can you imagine a Fortune 500 company of 50,000 employees smoothly switching platforms?

Peruse the financials and you can see that Salesforce is running on high octane fuel. Late last year, Salesforce launched the financial services cloud for retail banking to enable banks to deliver highly personalized intelligent and connected banking experiences for consumers.

They also further advanced their relationships with PNC Bank and KeyBanc. ING is also expanding its operations with Salesforce globally to meet their goal of becoming a one platform bank.

Once a financial firm gains entrance into the Salesforce ecosphere, they sooner or later invest in more Salesforce SaaS services because they desire better functionality and attempt to offer a better customer experience. In fact, today some 17 of the top 20 U.S. and European banks use Salesforce as their primary platform.

Other high momentum areas include health and life sciences. Some 15 of the world's 20 largest pharmaceutical companies rely on Salesforce as its CRM provider. Anthem (ANTM), one of the largest health insurers in the United States, deepened their commitment as well.

UnitedHealth Group significantly expanded with Salesforce to help build its next generation of patient and customer engagement for more than 125 million customers. (CRM)'s vision is to make healthcare more cost effective, efficient, predictive and intelligent, using the Salesforce platform.

A huge win for Salesforce was one of the largest public-sector deals to-date with the Department of Homeland Security; this follows a large transaction with the Veterans Administration.

Domestically, a good chunk of Fortune 500 companies have made the jump into CRM, and is the first software program employees see as they turn on their computers every day.

On the international front, growth mirrors the domestic invincibility.

Overseas, Salesforce has been gradually increasing distribution capacity, expanding their partner ecosystem, investing in offices and infrastructure, and opening new data centers. All of these investments are clearly paying dividends.

Europe was the fastest growing region powered by some great strategic victories with Cellcom from Israel, which is the largest cellular operator in that country. Another is PostNord Sverige, jointly owned by the governments of Sweden and Denmark, and employs over 40,000 Swedes who are all using Salesforce products daily.

Other companies that use the Salesforces holistic platform are TNT Express, a shipping company headquartered in Liege, Belgium, French insurance company AXA based in Paris, France employing 165,000 employees.

The list goes on in Europe with Swiss's food and beverage mainstay Nestle, headquartered in Vevey, Switzerland, employing 350,000 people world wide.

The Asia and pacific region saw major inroads with Japan's Shinsei Bank, Meiji Yasuda, South Korea's Samsung, and Australia's Telstra, a telecommunications and media corporation that operates telco networks and markets voice, mobile, internet access, and pay television. Telstra is by far Australia's largest telecommunications company.

In Latin America, Salesforce expanded their alliance with the largest private bank in Brazil, Banco Itau of Sau Paulo.

Salesforce has been thriving in Japan, strengthening relationships with Hitachi, Ebara, and Mitsui Sumitomo Insurance. Asia continues to be one of the fastest growing regions, with 27% quarterly growth.

In Europe, the Middle East, and Africa, Salesforce grew 33% in constant currency terms and continued to build relationships with marquee brands including BP, British Petroleum, headquartered in London, England, and France's Group PSA, the second largest car manufacturer in Europe. It is present in 160 countries and is the manufacturer of automobiles and motorcycles sold under the Peugeot, Citroen, DS, Opel and Vauxhall brands.

Salesforce has upped their international headcount by around 30% annually since FY 2014. That is a prolific rate of growth.

You do not need to be a rocket scientist to understand that this breakneck expansion phase is warranted. Salesforce has recently nudged up FY 2018 revenue guidance estimates to $10.44 billion.

Salesforce continues to improve its product mix by swallowing up smaller niche tech companies that add a smattering of specific functions that help companies run more efficiently.

Some recent acquisitions include cloud-based Quip. Quip is productivity software and allows groups to create and edit documents and spreadsheets as a team. This firm is led by Bret Taylor, the creator of Google Maps and also the former CTO of Facebook.

Taylor has created the next generation technology of live documents, bringing a new level of content, communication and collaboration right into the Salesforce platform. And yes, these are the add-ons that Salesforce customers must pay for.

To improve Quip, Salesforce captured Attic Labs, inventors of open sourced decentralized database Noms. The technology is expected to remain open source and will be incorporated into Quip.

Attic Labs will contribute Quip with back-end support, allowing the function to pull more data onto the Quip pages. Salesforce doled out a derisory $11 million for this latest trinket.

Other AI firms bought by Salesforce will integrate into the platform, including RelateIQ, MetaMind, Implisit, PredictionIO, and Tempo AI.

The attention on AI as the next wave of the CRM industry has forced Salesforce to assemble a machine learning team of more than 175 of the best data scientists who built the amazing "Einstein" platform.

Salesforce is one of the biggest proponents of AI, and even their upper level management team has an AI manager critiquing their top-level managers at weekly meetings alongside Marc Benioff, surely a first at any firm.

Salesforce is bolstering its AI partnership with IBM. The two have been cooperating in tandem since last year and the latest announcement added to their partnership with Salesforce denominating IBM as its favored cloud service provider and IBM denominating Salesforce as its favored customer engagement platform for sales and services.

IBM's Watson AI and Salesforce's Einstein AI supplement sales leads by diagnosing the premium and inferior leads.

Artificial Intelligence (AI) is adding to their vast array of capabilities allowing Salesforce to retain and nurture customers while charging them more for better service offerings.

Salesforce remains a pillar of the tech revolution and best of breed in CRM. Each earnings report will be splattered with a smorgasbord of reputable companies that have adopted Salesforce as its go to CRM platform.

The pipeline looks luminous for Salesforce as the natural progression to enterprise cloud computing will get rid of exorbitant IT infrastructure and uneconomical maintenance costs.

As Salesforce's reinvests back into their service offerings, companies will clamor more for these sensational products. The Salesforce platform of next will appear mightily different from the past as it continues to evolve at warp speed.

Salesforce is a strong conviction "BUY". To learn more about Salesforce, please visit the company website by clicking here.

Gee, Which One is Salesforce Tower?

"The bubble is in the bond market, not the stock market" said Leon Cooperman, CEO of Omega Advisors, an original investor in my 1990's hedge fund.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 7, 2018

Fiat Lux

Featured Trade:

(HOW CREDIT SUISSE BLEW UP THE (XIV)

(VIX), (XIV), (ZIV), (SVXY)

(MAD HEDGE FUND TRADER CELEBRATES ITS TEN-YEAR ANNIVERSARY)

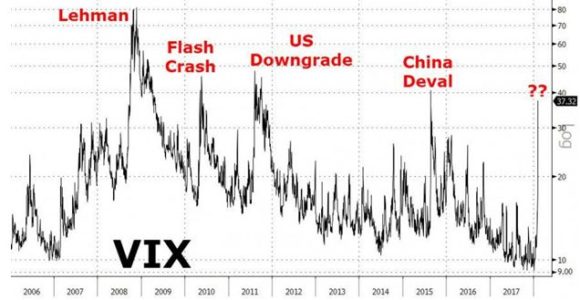

I feel like I have been robbed, and then robbed again.

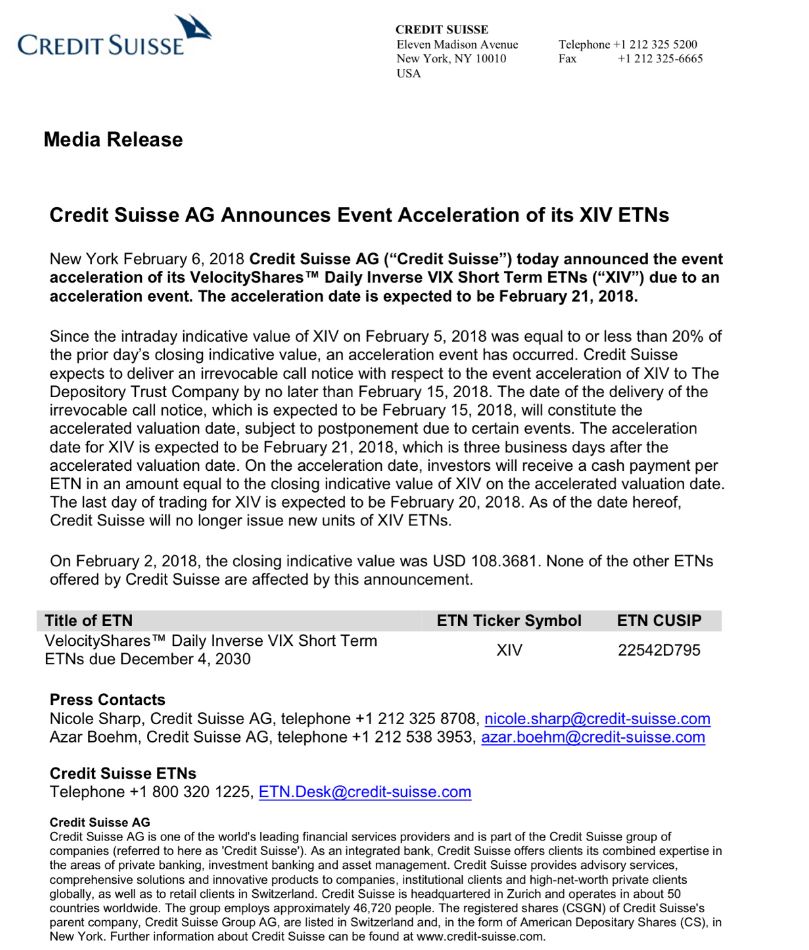

I received notice today from Credit Suisse, the issuer of the Velocity Shares Daily Inverse VIX Short term ETN (XIV), that it is resorting to a forced liquidation of the fund (see note from the company below).

All investors will receive cash value for their holdings sometime after February 20. The last NAV they had on their screen was $4.00 a share, compared to the previous day's close of $99.00. (XIV) is currently trading at $6.50.

Credit Suisse has the right to commit this theft thanks to a "poison pill" provision buried in the prospectus. This provides for a forced call of the shares during any single 80% decline of the net asset value in a single day.

And here's the part that makes you want to break down and cry and throw your empty beer can at the TV set.

It was Credit Suisse itself that triggered the overnight (VIX) spike from $39 to $52.50 through their own panic buying of futures. Credit Suisse, in effect, blew up their own fund.

I sent out a Trade Alert for Investors to buy the (XIV) at the close on Monday at $97.08. My expectation was that the Volatility Index was peaking, and that the (XIV) was due for a huge snap back rally. It closed at $99.00. and I was looking like a star.

On Tuesday morning, the Dow Average open down 700 points, and the (VIX) peaked at $52.50. Stocks then rallied to be up on the day, and the (VIX) collapsed all the way down to $22.50, some 57%.

The (VIX) should have increased in value enormously. It would have been a trade for the ages.

By closing the fund at the low for the day in the middle of the night Credit Suisse made it impossible for investors to profit from this rally.

Instead, it chose to wipe out thousands of investors in its fund. After 50 years in the financial markets, it is the dumbest thing I have ever seen.

In fact, the entire short volatility industry got obliterated last night.

Other closing funds include the Velocity Shares Daily Inverse VIX Medium Term ETN (ZIV), the ProShares Short VIX Short Term Futures ETN (SVXY), and a Tokyo Stock Exchange listed S&P 500 VIX Inverse ETN issued by Nomura Securities. The combined losses are several billion dollars.

This shouldn't have happened. I picked the (XIV) because they held 66% of their portfolio in short March expiration VIX futures, which have barely moved, and closed last night at only $18.88.

My guess is that the management of Credit Suisse panicked when they saw the February (VIX) double from $17 to $39 on Monday. If it had doubled again from $39 to $78, it might have taken the (XIV) NAV below zero, putting them on the hook of the balance.

I'm sorry, but I used to work for a Swiss bank, and this is how they think.

There are two other possibilities here.

One is that an algorithm went rogue, accidently wiping out the value of the fund with some kind of hedging mismatch. The other is that criminal mismanagement has taken place that will become obvious with the passage of time.

The math certainly does not add up. Credit Suisse should have completely hedged the move in the (VIX) from $9 to $39 with their end of the day rebalancing's.

That would have fully hedged for them the decline in the (XIV) from $146 to $93. This leads me to believe that someone at Credit Suisse made a tremendous mistake.

You can almost certainly bet there will be a class action suit against Credit Suisse on behalf of all (XIV) shareholders. You will be contacted by email when this is initiated by the plaintiff lawyers and you will have to sign a stack of papers.

Once the discovery is done showing that it was Credit Suisse's own actions that caused the destruction of the (XIV) they are going to be on the hook for the losses.

There will be a settlement substantially higher than the current $6.50. You might even get a shot at recovering the Monday close of $99.00 when the Credit Suisse malfeasance ensued. I think given the choice of jail time and paying up they'll pick the latter.

But it may take years to realize this. It took MF Global three years to pay off account holders. I know because I was one of them.

You can also bet that the SEC will take a magnifying glass to the whole affair, especially since it was a foreign bank that defrauded American individual investors.

The only consolation here is that Credit Suisse was the largest investor in their own fund and lost over $500 million of their own money. Their shares are down 3.70% today just on this one incident.

To collect your remaining $4, please contact your broker. Don't call today, as no one knows anything. I spent an hour on the phone with Interactive Brokers to learn this.

We should be able to make back the loss on this very quickly, as long as volatility remains high.

The Diary of a Mad Hedge Fund Trader is now celebrating its tenth year of publication.

During this time, I have religiously pumped out 1,500 words a day, or eight double spaced typed pages, of original, independent minded, hard hitting, and often wickedly funny research.

I've been covering stocks, bonds, commodities, energy, precious metals, real estate, and agricultural products.

You've been kept up on my travels around the world and listened in on my conversations with those who drive the financial markets.

I also occasionally opine on politics, but only when it has a direct market impact, such as with the recent administration economic and trade policies.

The site now contains over 10 million words, or 12 times the length of Tolstoy's epic War and Peace.

Unfortunately, it feels like I have written on every possible topic at least 100 times over.

So, I am reaching out to your, the reader, to suggest new areas of research that I may have missed until now which your believe justify further investigation.

Please send any and all ideas directly to me at support@madhedgefundtrader.com, and put "RESEARCH IDEA" in the subject line.

The great thing about running an online business is that I can evolve it to meet your needs on a daily basis.

Many of the new products and services that I have introduced since 2008 have come by way of your suggestions. That has enabled me to improve the product's quality, to your benefit.

This originally started out as a daily email to my hedge fund investors giving them an update on fast market moving events. This was at a time when the financial markets were in free fall, and the end of the world seemed near.

Here's a good trading rule of thumb: Usually, the world doesn't end. History doesn't repeat itself, but it certainly rhymes.

The daily emails gave me the scalability that I so desperately needed. Today's global mega enterprise grew from there. Today, the Diary of a Mad Hedge Fund Trader and its Global Trading Dispatch is read in over 140 countries.

I'm weak in North Korea and Mali, in both cases due to the lack of electricity.

If you want to read my first pitiful attempt at a post, please click here for my February 1, 2008 post.

It urged readers to buy gold at $950 (it soared to $1,920), and buy the Euro at $1.50 (it went to $1.60).

Now you know why this letter has become so popular.

Unfortunately, I also recommended that they sell bonds short. I wasn't wrong on that one, just early, about eight years too early.

I always get asked how long will I keep doing this?

The government tells me that the latest I can start drawing down on my retirement funds and Social Security is 70 1/2.. That's some 4 1/2 years off for me.

Then I'll reassess whether I want to carry on for another decade, or find something else more fun to do.

Given the absolute blast I have doing this job, that is highly unlikely. Take a look at the testimonials I get only an almost daily basis and you'll see why this business is so hard to walk away from (click here for those).

Fiat Lux (let there be light).

Mad Hedge Technology Letter

February 7, 2018

Fiat Lux

(SPECIAL TECH MARKET BOTTOM ISSUE),

Featured Trade:

(TEN TECH STOCKS TO BUY AT THE MARKET BOTTOM),

(AAPL), (AMZN), (GOOGL), (FB), (NVDA),

(BABA), (NFLX), (MU), (CRM), (MSFT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.