When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 5, 2018

Fiat Lux

Featured Trade:

(STOCK TRADERS DISCOVER INTEREST RATES),

(SPY), (TLT), (GLD), (AMZN), (AAPL), (MSFT),

(THE NASCENT BULL MARKET IN GOLD),

(GLD), (GDX), (ABX)

Finally, finally, the stock market noticed that interest rates are rising, although they have been doing so unrelentingly since July. Call stock traders slow learners. All I can say is that no one here at the Mad Hedge Fund Trader is surprised, not even the furniture.

At the peak today, the ten-year Treasury yield (TLT) hit 2.855%, a four-year high, up a steep 45 basis points since December 31. My 2018 target of a 3.0%-3.50% range beckons.

I think we are either AT the bottom of this move down in the S&P 500 (SPY), or within a day of the final bottom.

Right here we have a 3.5% correction in the (SPY) and 3.7% in the Dow Average from the January 28 top.

I just don't see a true crash happening in the face of the 14% corporate earnings growth we are seeing in the current quarter.

To get a crash you would have to believe that the recently passed tax cut will have no net effect on the economy, with the short term benefits offset by rising interest rates, labor, and commodity costs.

Ooops!

Ironically, I think that the rising rates that triggered this week's debacle may be about to take a rest. That's why I covered all by bonds shorts. Will the coming rally in bonds bring a rally in stocks? We shall see.

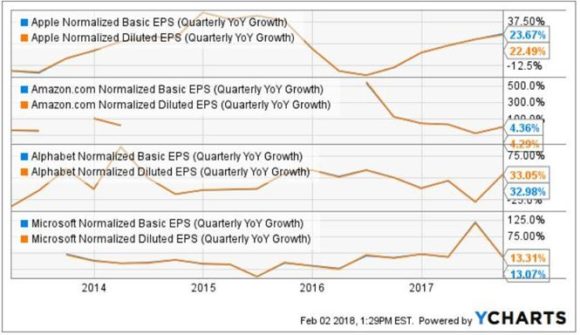

When you look at the entirety of the big tech earnings announced last week, you have to be dazzled, astonished, stupefied, and absolutely gob smacked.

The diluted earnings per share for Alphabet (GOOGL) soared by 33.05% Apple by 22.49%, and Microsoft by 13.31%. The dollar value of these profit increases are the largest in the history of global capitalism.

Not only were the high double-digit figures more than impressive, these are gigantic half trillion or nearly one trillion dollar companies that are showing the growth rates of small caps.

The Department of Labor Bureau of Labor Statistics added fuel to the fire today dropped their monthly bombshell with the January Nonfarm Payroll report at 200,000. Headline unemployment rate stayed steady at 4.1%. The reports for November and December were revised down 24,000.

Construction was the big gainer at up +36,000, followed by Food Services, up +31,000, and Health Care, up +21,000. The only losses came with Information Technology at -6,000. The U-6 "discouraged worker" unemployment rate is at 8.2%.

All that is fine and good. What really set the cat among the pigeons was the

Average Hourly Earnings growth at 0.3%. This is the first real sign of wage inflation we have seen in decades and immediately triggered a selloff in the bond market for the ages.

The ten-year US Treasury bond yield spiked up to 2.85%, prompting a gut churning $400 plunge in the Dow Average. Of course, your gut WASN'T churned if you were running a double short in bonds and a double long in gold (GLD) as I begged, pleaded, and beseeched you to do. A loss of a limb for others means only a mosquito bite for you.

As for the Mad Hedge Fund Trader Alert Service, we keep grinding up from one new all-time high to the next. We were up +4.09% in January, +0.96% so far In February, with a trailing 12 month return of +53.16%. Our eight-year profit stacks up to +281.52%.

I have been going pedal to the metal on the debt explosion theme, with a double short in Treasury bonds (TLT), double longs in gold (GLD), (NEM), and a long in commodities (FCX).

we are rolling out our new Mad Hedge Technology Letter in the coming week to take up the slack.

This week will be all about jobs data, which rolls out in rapid succession from Wednesday morning.

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, February 5, at 10:00 AM, the week kicks off with the January ISM Non-Manufacturing Index, a survey of 375 private firms across the country. Cirrus Logic (CRUS) reports earnings.

On Tuesday, February 6 the jobs data parade starts with the JOLTS Report of Job openings for January. Walt Disney (DIS) and SNAP (SNAP) reports earnings.

On Wednesday, February 7, at 7:00 AM EST, we get MBA Mortgage Applications for the previous week, which should be down because of sharply higher rates. Rio Tinto (RIO) Reports earnings.

Thursday, February 8 leads with the 8:30 EST release of the Weekly Jobless Claims. Cyber software company FireEye (FEYE) reports earnings.

On Friday, February 9 at 1:00 PM we receive the Baker-Hughes Rig Count, which should keep ticking up thanks to high oil prices.

Global Market Comments

February 5, 2018

Fiat Lux

Featured Trade:

(APPL)

Long-term gold bugs have at last been handed a new reason to love their favorite metal.

The recently passed tax cut bill.

If the new President's tax cutting and deregulating policies become law, risk assets will take off like a scalded chimp.

If he proves unable to navigate the tricky byways of the Washington swamp, they will crash. And it may be 6-18 months until we get a real answer.

So in the meantime, institutional investors and individuals have quietly been scaling up their ownership of gold as a hedge against Armageddon.

Hedge funds longs in gold, gold ETF's, gold futures, and the gold miners have suddenly shot up to new all-time highs.

Can I point out here that my long positions in gold options are all nicely profitable?

If it turns out that the new administration policies succeed, inflation will rocket, sending gold through the roof.

Bottom line: gold and other precious metals have become a "Heads I win, tails you lose" trade.

A number of other fundamental factors are coming into play that will have a long-term positive influence on the price of the barbarous relic.

The only question is not if, but when the next bull market in the yellow metal will accelerate.

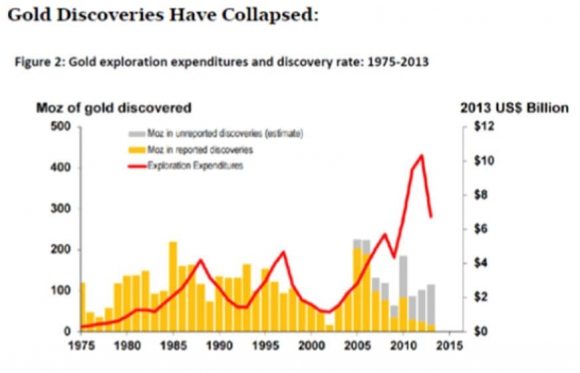

All of the positive arguments in favor of gold all boil down to a single issue: they're not making it anymore.

Take a look at the chart below and you'll see that new gold discoveries are in free fall. That's because falling prices from 2011 to 2016 caused exploration budgets to fall off a cliff.

Gold production peaked in the fourth quarter of 2015 and is expected to decline by 20% in the following four years.

The industry average cost is thought to be around $1,400 an ounce, although some legacy mines, such as at Barrack Gold (ABX), can produce it for as little as $600.

That is a heartbreaking 3.48% below today's spot price.

So why dig out more of the stuff if it means losing more money?

It all sets up a potential turn in the classic commodities cycle. Falling prices demolish production, and wipe out investors. This inevitably leads to supply shortages.

When the buyers finally return for the usual cyclical macro-economic reasons, there is none to be had, and price spikes can occur which can continue for years.

In other words, the cure for low prices is low prices.

Worried about new supply quickly coming on-stream and killing the rally?

It can take ten years to get a new mine started from scratch by the time you include capital rising, permits, infrastructure construction, logistics and bribes.

It turns out that the brightest prospects for new gold mines are all in some of the world's most inaccessible, inhospitable, and expensive places.

Good luck recruiting for the Congo!

That's the great thing about commodities. You can't just turn on a printing press and create more, as you can with stocks and bonds.

Take all the gold mined in human history, from the time of the ancient pharaohs to today, and it could comprise a cube 63 feet on a side.

That includes the one-kilo ($38,720) Nazi gold bars with stamped German eagles upon them, which I saw in Swiss bank vaults during the 1980's when I was a bank director there.

In short, there is not a lot to spread around.

The long-term argument in favor of gold never really went away.

That involves emerging nation central banks, especially those in China and India, raising gold bullion holdings to western levels. That would require them to purchase several thousand tonnes of the yellow metal!

Sovereign wealth funds from the Middle East have recently been dumping gold to raise money. The 2014 collapse of oil prices has made it impossible to meet their wildly generous social service obligations.

Hint: governments in that part of the world that fail to deliver promises are often taken out and shot.

Venezuela has also been a huge gold seller to head off an economic collapse thanks to the disastrous domestic policies there.

When this selling abates, it also could well shatter the ceiling for the yellow metal.

That's why I have been strongly advising readers to watch the price of Texas tea careful, as both it and gold often move in tandem.

Let me throw out one more possibility for you to cogitate over. Another big winner of rising precious metal prices is residential real estate, which people rush to buy as an inflation hedge. Remember inflation?

Tally ho!

Let's say you had a company that delivered blockbuster products which it sold for the largest margins in the industry and delivered record profits.

Let's also say that it committed spending $280 billion to share buy backs and dividend payouts.

Let's also toss in the fact that this magical company sells at a discount to the rest of the players in the industry, but also to the entire market as a whole.

You would think that such a robust firm would leap 10% on its latest earnings announcement.

But if that was your expectation you'd be wrong. In fact, the shares of Apple (AAPL) plunged by 10%.

Stock markets are recalcitrant, impetuous beasts, and last week was no different. What we got was the tax loss selling I had been predicting for months, it just arrived four weeks late.

The proof is in how ALL stocks fell, not just Apple's. Earnings were irrelevant.

It's painfully obvious that Apple's capricious price action is a result of not being the Amazon (AMZN) growth story that is held up as the poster boy for tech out-performance.

The lead up to the Q4 2017 earnings report served as a minefield for Apple shareholders as a slew of bleak reports about iPhone supply cuts, analyst downgrades, and weak iPhone X demand dominated the rhetoric leading up to the report.

The most outlandish report was published by The Nikkei Asian Review claiming Apple would slash its iPhone X production from 40 million to 20 million units.

The veracity of these reports was never verified.

As investors violently sold the rumors from $180 leading up to earnings, the expectations were diabolically low.

The only scenario in which Apple would disappoint, would be the implosion of key metrics.

The vital takeaways in Q4 were the all-important iPhone ASP (Average Selling Price) which topped estimates at $795 per unit surpassing the expected $755 by a healthy $40 margin.

The increase in ASP indicates that Apple sold a healthy mix of their higher premium iPhones; iPhone X, iPhone 8 and iPhone 8 plus. Analysts punished Apple for selling 3 premium smartphones instead of the customary two, which muddied the sales data and confused analysts to no end.

Ironically enough Facebook (FB), which announced earnings earlier in the day, told the identical story of higher prices per ad and lower ad units. But investors duly rewarded Facebook for focusing on higher quality and were more than happy to pay the extra premium.

It's clear that Apple analysts are on a witch hunt, and their herd mentality exacerbates negative investor sentiment.

A total revenue beat of $88.3 billion represented an increase of 13% YOY. iPhone unit sales missed marginally at 77.3 million units from an expected 80 million units.

However, the minuscule 1% drop was made up by the higher ASP verified by the revenue beat.

Apple's tax rate was 25.5% before the new tax bill was passed. The new tax rate going forward will be 15%, creating a massive windfall.

Luca Maestri, Apple's CFO, stated that Apple plans to reduce its cash balance to "approximately zero," meaning that the $285.1 billion in cash reserves will be put to use in the form of dividends and buy backs.

Other metrics that had the potential to spoil the earnings report included expected forward guidance, and even though the street were expecting $65 billion, $60-62 billion was seen as already baked into the price. Anything below that would be worrisome.

Apple announced just that, going forward with $60-62 billion in revenue guidance and no wonder Apple was up 3.4% after market directly following the earnings report.

The last significant commentary in the company call was information about iPhone X demand. Analyst after analyst asked a belabored Tim Cook the same question, and he repeatedly noted that Apple does not disclose specific iPhone model sales.

However, Cook did say "If you look at 8 Plus in particular to provide a little color there, it has gotten off to the fastest start of any Plus model. That for us was a bit of a surprise, and a positive surprise at that."

Tim Cook's commentary implicitly made out that Apple had great demand for its expensive smartphones and the overall ASP vindicates this strategy because the potent numbers show customers are meaningfully upgrading to newer and more expensive iPhones.

Keep in mind that many iPhone users abroad also pay for their iPhone per monthly installments, pushing up the raw ASP.

It was shocking that analysts repeatedly asked the same question about the iPhone X demand. Apple is not just an iPhone X company. Apple has an incredibly powerful ecosystem.

Its iOS 11 operating system is the natural choice with which to integrate all Apple products, and this ecosystem is incredibly sticky. If you are running a small business, as I am, having a range of different devices connected with each other is incredibly useful.

Another important point overlooked by Wall Street was Apple's service businesses that is accelerating. This includes Apple Music, iCloud, the Apple store, and the soon to be HomePod. Apple Music subscriptions were up an amazing 75% YOY. Conversion rates are the highest since the launch of the service more than a decade ago.

Tim Cook delved into the service side of the business and characterized the performance as a "phenomenal quarter on iPad, on the Mac, on Services, on Apple Watch, and on iPhones. I mean we're literally, we're firing on all cylinders."

Going forward, Apple will emphasize the service income streams, and this should command a higher multiple for the entire company, especially if it reaches 20-25% of gross revenue. The growth rate for Apple services in the current quarter was strong at 24%.

The Apple store set an all-time record. The iCloud is a service that continues to advance at "strong double digits," and has already become the size of a Fortune 100 company on a stand-alone basis.

The service side of the business revenue was $8.5 billion and looks to substantially outperform in 2018. The margins are growing nicely in this segment and across all service offerings. The number of paid subscriptions reached over 210 million at the end of the September quarter, an increase of 25 million in the last 90 days.

Apple profit margins came in at 37.9%, slimmer than the 38.9 percent expected. This is staggering for a smartphone company of this size. Most consumer electronic product companies see margins quickly erode due to fierce competition. The margin guidance of between 38%-38.5% remains sturdy and shows Apple's ability to sell premium products.

The last potential hiccup were the China numbers, and Apple was vindicated when it proved that rumblings of weakness were unsubstantiated. Apple returned to brisk growth in the China region growing at strong double-digits at 12%.

To say investors are confused over what to do about Apple shares is an understatement. On one hand, bears point out at the lack of innovation and revolutionary products that dazzle the investor community.

However, the bulls point to the double-digit revenue growth that gives the stock its foundations, along with returning capital to shareholders in the form of dividends and buybacks.

The bottom line is that apple announced no disastrous news, and with the ultra-low expectations coming into the earnings report, is a strong buy amid the backdrop of healthy global economic expansion.

Apple has huge margins for a consumer electronic goods company and the enormous cash flow means Apple has many levers they can pull in the capital structure scheme of things.

The stock is extremely cheap at 14X forward PE. By the way, the multiple has dropped a full point and a half in the last two weeks, which should entice institutional investors to dive in.

It's true that Apple sells an expensive smartphone and the prices are not for the faint of heart. However, this is completely justified by the quality of the product, which costs about $400-500 to produce. Quality products command higher prices period and it's a testament to Apple's creations that consumers are still willing to cough up the cash.

Buy low, sell high, it sounds like a winning business strategy to me.

What to do about Apple? The answer is to buy it with both hands once this indiscriminate market correction runs its course. I am sticking to my 2018 target of $200 a share.

To learn more about this extraordinary company please visit their website by clicking here.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 2, 2018

Fiat Lux

Featured Trade:

(MORGAN STANLEY TAKES THE LEAD),

(MS), (GS), (GLD), (FCX), (FXE), (FXY),

(REVISITING THE FIRST SILVER BUBBLE),

(SLV), (SLW)

It's a good thing that the #MeToo movement wasn't around 35 years ago. For if it was, Morgan Stanley would have been publicly humiliated in the press daily.

The firm was an "old boy" network on steroids. Employees with skirts definitely worked overtime in those prehistoric days.

However firms evolve over the vast expanse of time. Back then, Morgan Stanley was a 1,000 man private partnership hidden away in the old General Motors building on Avenue of the Americas. Today it is a 50,000 member global behemoth bang on Times Square.

The share price has changed a bit too. The average cost of my original partnership shares is 25 cents. They closed at $57 today.

And like Warren Buffet, I never sold my shares so I wouldn't have to pay the capital gains taxes. In fact, my shares cost far less than the company's quarter stock dividend is today.

It wasn't always like this. Morgan drank the Kool-Aide big time during the 2000's real estate bubble. When the bill came due the firm almost went under, with the stock trading down to $5 (which was still 20 times more than my cost). Only a government bailout in the form of the TARP kept my former partners from losing everything.

The Morgan Stanley of today is a shadow of its former self in other ways. There are no more wild practical jokes, BSD's, Masters of the Universe, or Liar's Poker.

I can't imagine the heads of the various equity trading desks meeting at my Sutton Place coop apartment to play high/low poker once a week, as they once did for years.

No one bets the ranch anymore. Morgan Stanley has become boring. However, boredom has a silver lining as it also brings stability, and stock investors absolutely love stability. As incredible as it may sound, Morgan Stanley has become the safe play on Wall Street.

While investors considered the immense trading profits the firm once made as coming out of a black box, fee-based earnings are predictable and reliable as a coupon stream.

You can see this newfound boredom in the firm's employee compensation. A decade ago it was 78% of investment banking revenue, compared to only 18% now. In my day, the janitor wouldn't work for that.

You can thank my late mentor, Barton Biggs, for planting the seeds of the modern firm in the early 1980's. For it was he who founded the firm's fee-based asset management division which is the great wellspring of profits today. Since 2005, Wealth Management's share of profits has leapt from almost nothing during my tenure to 25% to 45% now.

Mortgage loans to customers collateralized by their shareholdings is currently the second largest source of profits. These didn't even exist in my day (Lou Ranieri at Salomon Brothers had the lock on this business back then).

Morgan Stanley has learned some hard lessons along the way. It was forced by the Dodd-Frank financial regulation act to massively recapitalize. No more 40:1 leverage. 10:1 is much safer.

As a result, its capital position has more than doubled from $35 billion during the dark days of the 2008 crash to $77 billion today. Profit margins are the highest since the Dotcom Bubble top in 1999. The firm is even now crafting products and services aimed at the growing band of wealthy Millennials. Sobriety is in.

Goldman Sachs on the other hand has stuck to the old wild west ways. Its earnings remain volatile, as several recent disappointing quarters of bond trading losses have attested to. The firm is now significantly smaller than Morgan, and its share price has been punished accordingly, lagging the heady appreciation of Morgan shares.

Here's the main reason I love my old firm. It is in the catbird seat for what I call the "Exploding Deficit" trade, whereby all future investment is driving by the prospect of rising inflation.

Banks are absolutely in the sweet spot for this strategy, as are gold (GLD), commodities (FCX), and foreign currencies (FXE), (FXY).

Add all this up and you have my explanation for sending out a Trade Alert for a long position in Morgan Stanley yesterday. It won't be the last one.

As for those poker nights, I think some of you guys out there still owe me a couple of grand.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.