While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Incline Village, NV on Friday, April 6, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Tickets are available for $218.

I'll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada on the sparkling shores of Lake Tahoe. Those who live there already know what it is. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase a ticket, please click here.

Global Market Comments

March 13, 2018

Fiat Lux

Featured Trade:

(WHY LITHIUM IS ABOUT TO REPLACE OIL),

(SQM), (ALM), (FMC), (MLNLF),

(THERE ARE NO GURUS),

(A COW BASED ECONOMICS LESSON)

Mad Hedge Technology Letter

March 13, 2018

Fiat Lux

Featured Trade:

(WHY YOUR HATED CABLE COMPANY IS ABOUT TO DIE),

(AMZN), (NFLX), (APPL), (DIS), (GOOGL), (TWTR), (FB), (ROKU)

Look at any survey of the most despised companies in America and there is always one industry that comes out on top: cable companies such as AT&T, (T), Comcast (CMCSA) and Charter Communications (CHTR).

We all have been reading about cord cutting and the death of cable for years. However, this trend is about to vastly accelerate.

The death of cable is upon us in full force and streaming plays should represent a heavy weight in any aggressive portfolio.

Jerry Seinfeld and David Letterman are two Hollywood names gracing the broadband waves of Netflix (NFLX). Add one more superstar name to the mix as that of former President of the United States, Barack Obama.

Obama has tentatively agreed to produce new content centered on inspirational people and their stories. Add in former First Lady Michelle Obama who also will play a part in compiling the new content. You can expect about half the country to watch it.

Amazon (AMZN) and Apple (APPL) were lining up deals before Netflix scored the arrangement. Music streaming giant Spotify, set to go public later this month, also has a deal on the table with former President Obama to be the face of a presidential playlist.

The bidding war for top content is hugely bearish for traditional media companies such as Disney (DIS), which is subject to stringent regulation from the FCC (Federal Communications Commission). Disney stock has been languishing in the doldrums for years, peaking at $120 in mid-2015. It is still hovering around the $100 level 3 years later.

The recent risk-off move in (DIS) can be attributed to one horrific segment of the business that was its main growth driver for 25 years - ESPN.

In the 1990s, ESPN was a media darling for the ages. It could do no wrong. Its base, mainly young tech-savvy males, loved every piece of content from the daily sports news to the live games that permeated its channels.

Then cord cutters started appearing out of the woodwork and swiftly migrated to (NFLX)'s attractive pricing at $8.99 per month in 2015, which sure beats cable at upward of $100 per month.

Better late than never is that Disney finally announced a unique proprietary streaming service straight to the consumer in 2018. The three years of inaction put the company three years further back in the quickly growing broadband streaming revolution. Disney also stated it will pull all (DIS) content from competitor (NFLX).

Legacy companies have a two-pronged problem: saddled with irrevocable multi-year commitments absorbing capital and a behemoth legacy business in marginal decline that is a headache to shift. Asking the Titanic to suddenly transform into a fancy speedboat is a tough ask for anyone.

The red flags are unbridled in the cable universe. Fox Networks plans to readjust hourly ad load down to 2 minutes within 2 years! Fox has some work to do to whittle down the ad load because last year's hourly ad load clocked in at 13 minutes. Advertising executives indeed feel aghast in what will be known as the first phase of the death of cable. This machination is unquestionably bullish for social media platforms such as Facebook (FB) and Twitter (TWTR) because net ad loads are migrating to millennial eyeballs on those platforms.

Millennials, currently the biggest consumer-ready demographic, are the most advertising-adverse generation ever to exist. Stories of binge-watching (NFLX) are rife, and live sports shows increasingly are found pirated online from Eastern Europe.

TV ratings are rapidly declining to the degree that bottom line growth will be materially harmed. Traditional media is experiencing a cocktail of lethal headwinds that could wipe it out totally. Simply put, commercials negatively affect the user experience and the plethora of options in the streaming world makes it a buyers' market.

(NFLX)'s hyper-accelerating subscriber growth begets higher growth. Love them or hate them, (NFLX) and (AMZN) business models are the architectural blueprints applied to every tech stock. To be condemned as a legacy business is the most damning label in the tech industry.

Hiring Bill Ackman is probably the only move that would be worse. Anyone not betting the ranch on broadband streaming is quickly banished to investor purgatory with the likes of GameStop Corp. (GME).

Tech is starting to get priced as a luxury. Gone are the days of disheveled mopheads joining forces in a shabby Los Altos, Calif., garage as did Steve Jobs and Steve Wozniak. Groundbreaking tech is power, and big tech knows it.

As much as I would like to rain on (NFLX)'s parade, I cannot. Investors only look at one number as they do with many other tech companies. The company's license to spend gobs of cash on new content revolves around subscriber growth.

Last year was full of whispers that (NFLX)'s domestic mojo would start to neutralize. Quarter over quarter estimates came in at 1.29 million new domestic subscribers, and international estimates were expected to net 5.10 million. Domestic net adds were almost 35% higher than guidance at 1.98 million.

International net add growth is viewed as the source of a long runway, and it did not disappoint, beating QOQ guidance by 20% with 6.36 million new net adds. Overall, total net adds beat QOQ estimates by 23.2% and is the biggest reason (NFLX) is up over 70% in 2018.

Where does this all lead?

Do not buy any media stock without a thriving streaming business. The shift in buying power from baby boomers to tech-reliant younger generations will exacerbate cord cutting, and users will naturally deviate toward online streaming.

The most popular streaming services in 2017 were (NFLX) and (AMZN), which should be part of every investor's portfolio. Google (GOOGL) has YouTube, which also is no pushover. Another wild card is smart TV company Roku (ROKU), which is the (FB) of smart TVs and procures revenue from ad load. (ROKU)'s active accounts are up 44% year over year, and revenue per user has increased more than 30% YOY.

If you look down the road, the legacy companies that can smoothly transform into streaming content companies will be rewarded by investors but stocks such as (DIS) are in a wait-and-see mode.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 12, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TEFLON MARKET THAT WON'T QUIT),

(AAPL), (FB), (FXE), (TLT), (FXY),

(HOW TO HANDLE THE FRIDAY, MARCH 16 OPTIONS EXPIRATION), (FXE), (FB)

Note to Paid Subscribers: We migrated to a new dedicated server last weekend to accommodate a much larger volume of business and greater paid content. This will require you to login in to the site. If you lost your login ID or password please send an email to Nancy at customer support at support@madhedgefundtrader.com and put ?Login? in the subject line.

I hate using worn out, hackneyed cliches like "Teflon market" or "Goldilocks," but it was one heck of a Teflon Goldilocks market last week.

The FANG's truly went bananas.

Stocks had every excuse for the wheels to fall off.

The president's chief economic advisor resigned. The US declared the most ferocious trade war since the 1930's, which should cut US GDP growth by 0.5%. The administration appeared to be lurching from one disaster to the next.

And it all turned out to be yet another fabulous buying opportunity, and a chance to go solidly "RISK ON".

As I expected.

It is another demonstration of an old trading nostrum that has served me faithfully for half a century. If you throw bad news on a market and it fails to fall, you buy it.

With the buckets of bad news poured on the market it should go ballistic.

And so it has.

If you were long technology stocks like (INTC), (AAPL), (FB), short US Treasury bonds (TLT), and short the Euro (FXE), as I have been begging, pleading, and beseeching you to do, you just saw one of your best trading weeks of the year.

And guess what? It's going to get a lot better. We still have two months of seasonal buying before stocks depart for the normal summer correction. And you can make a lot of money in two months.

What really poured gasoline on the fire was a blockbuster February Nonfarm Payroll Report, up some 313,000. That is 120,000 over expectations. The Headline Unemployment Rate remained steady at 4.1% a ten year low.

The real crusher was that this frenetic rate of job creation caused Hourly Wages to go up only 0.1%, or essential zero, meaning that inflation is nowhere to be seen anywhere. It was a number that left economists everywhere scratching their heads.

The December and January reports were revised upward by 54,000 jobs.

Construction was up by 61,000, Retail was up 50,000, and Professional and Business Services up by 50,000. No doubt a big chunk of this was prompted by deficit financed tax cuts.

The only sector showing job losses was in Information Technology, down some 12,000.

The U-6 broader "discouraged worker" jobless rate stayed at 8.2%.

Overall, the total size of the workforce jumped by 806,000, the largest gain since 1983.

It was essentially a perfect report.

I would be remiss in not remembering the nine-year anniversary of the end of the stock market crash on March 9, 2009.

In those days, the S&P 500 futures were wildly swinging at 100 points a pop. The Nonfarm Payroll Reports were then printing horrifying losses of 700,000 a month.

As the bad news always seemed to come out on Sundays, you could buy a put option at the Friday afternoon close and it would be up 400% at the Monday morning opening. We raked the profits in. Those were the days!

I turned bullish a week later and have remained so ever since. How times have changed.

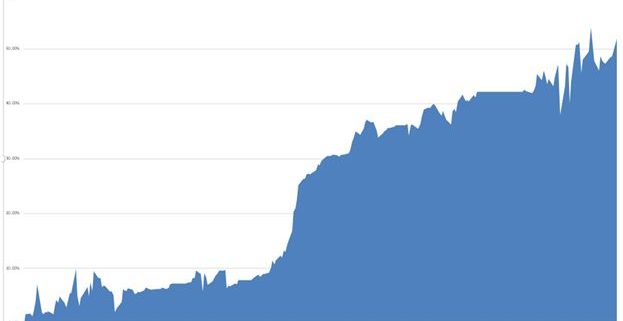

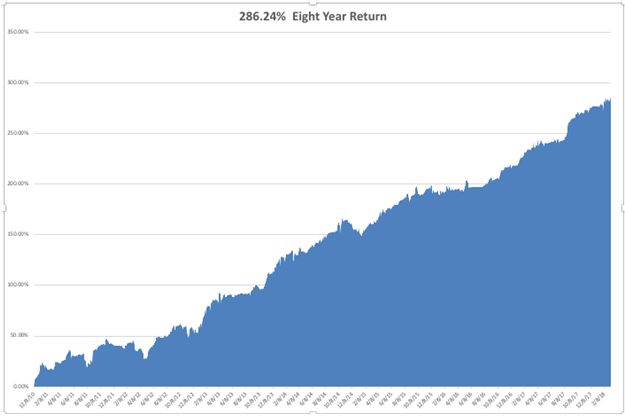

It was another great week for the Mad Hedge Fund Trader Alert Service, almost clawing our way all the way back to another new all-time high. We only need to make another 1.95% and we'll be there, hopefully sometime next week.

A double position in Apple (AAPL) really gave us a turbocharger, with that stock just short of a new all-time high, and up $10 from our last "BUY". The Iron Condor in Facebook (FB) will expire at its maximum profit point on Friday.

We already took profits in our short in the US Treasury bond market (TLT) on a quick 48-hour turnaround. The short position in the Euro is firing on all cylinders.

Mercifully, we got out of your short in the Japanese yen (FXY) at cost as a risk control measure. It looks like those who kept the positon will get the maximum profit there anyway.

Having survived the February nightmare, I now feel invincible.

This coming week is fairly subdued on the data front.

On Monday, March 12 nothing of note is released.

On Tuesday, March 13 at 8:30 AM we learn the all-important February Consumer Price Index to see if inflation really is asleep. This has recently become one of the most important numbers of the month.

On Wednesday, March 14, at 8:30 AM EST, we get February Retail Sales.

Thursday, March 15 leads with the Empire State Manufacturing Survey at 8:30 AM EST. Weekly Jobless Claims are announced at the same time.

On Friday, March 16 at 8:30 AM EST we get the February Housing Starts.

At the close we undergo a Quadruple Witching in the options market with several monthly series expiring today.

At 1:00 PM we receive the Baker-Hughes Rig Count, which saw a small rise of only one last week.

As for me, I am going to be shopping for a new Steinway Grand Piano. I have made so much money this year that it's time to upgrade and go for the max with a Model D concert grand piano!

Good luck and good trading!

Mad Hedge Technology Letter

March 12, 2018

Fiat Lux

Featured Trade:

(WHERE ALL THAT TAX CUT MONEY WENT)

(CISCO), (MSCC), (MCHP), (SWKS), (JNPR), (AMAT), (PANW), (UBER), (AMZN)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.