While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

??AWhen John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Is the $1 billion Amazon (AMZN) just spent for a doorbell company ludicrous, or genius? This question becomes incredibly pertinent as the battle for the front door heats up.

Transcending cultures since the time of antiquity, a door is a portal to a man's kingdom, his inner space.

Doors were first used inside Egyptian tombs some 5,000 years ago, and the Roman god Janus was the overseer of doors long before Jeff Bezos came along. Doors still continue to encapsulate beginnings, endings, transitions, and time.

A door is first and foremost an entrance. A potential entrance for Amazon to capture market share before the rules of the road are set.

Once entering the main door, hallways are linked with other rooms and other doors that lead to other worlds, which Amazon will pursue once they enter the home.

An open door represents the future and opportunity for a new market. A locked door typifies failure, rejection, and imprisonment. Amazon has created a $700 billion business that stops right outside your door. It's time for them to take the next step.

What would be the monetizing synergies if consumers offer access to that front door and Amazon slowly moves deeper into the house?

The goal is to remove any layers, material or psychological, that stands between Amazon profits and customers.

The door must be beaten down, and convincing consumers its permissible to enter the family sanctuary could fuel another round of tech prosperity and hyper- accelerating tech integration into daily lives.

It is fundamentally impossible to live a practical life in 2018 with analog instruments such as quaint pencil and paper. Consumers are increasingly addicted to technology, and future business applications revolve around harnessing tech acumen which cannot be rooted out retroactively.

The FOMO (Fear of Missing out) phenomenon that has gripped the business world is putting a turbocharger on this trend.

Remember that big tech companies aren't regulated like normal companies and have a built-in license to destroy any industry they desire.

This is immensely bullish for tech stocks. Regulation just cannot keep up. Tech companies believe that they should not be liable or accountable for any unintended consequences. Witness the Russia affair.

By contrast, media companies are harshly regulated by the government, and their content is subject to intense scrutiny. Remember Janet Jackson's infamous "wardrobe malfunction" at the Super Bowl? Unfortunately, media companies do not receive a free pass like the FANG's.

The FANG's free pass has put the family abode directly in the firing line. Alphabet (GOOGL) understands this to full effect; the new $229 Nest Doorbell will be distributed with a free Google Home Mini this spring.

Google Nest was purchased for $3.2 billion in 2014, and was launched by former Apple (AAPL) engineers Tony Fadell and Matt Rogers.

Google Nest has been accused by Ring CEO Jamie Siminoff of stealing their product innovation. Ring is the distinct best of breed in this industry and complements Amazon Key, which automatically opens doors for verified delivery workers.

This was the first adventure into this space by CEO and founder Jeff Bezos and supplements Amazon's Alexa which can cross-integrate with 3rd party devices in over 35,000 unique ways.

In a world where the demarcation of ecosystem lines are clearer and clearer by the day, the FANG's are seducing users into a proprietary closed ecosystem and padlocking anyone that is currently inside.

Facebook (FB) and Google do not sell anything, they just want user time, especially platform user time, to accumulate data to hawk ads to advertisers.

Apple, which does sell something physical, wants customers to buy iPhones, HomePods, and pay for its mish mash of services that integrate under the umbrella of the Apple smart home.

The FANG's have similar yet competing strategies. It is unknown how fast homes will become smart, as we are in the first stage of smartification. But there are a certain set of battleground products such as smart locks, thermostats and security cameras already.

Thermostats are easy to use, and various firms contribute energy rebates for thermostats upgrades.

The $1 billion spent on Ring, or Google's $3.2 billion tab for Nest Labs are FANG's intent to take a major stab at overtaking the place you sleep at night by making it socially acceptable for corporate tech to venture and operate inside houses.

The goal is to create a seamless, automated, enjoyable experience all on one pay tab called the smart home. After a consumer buys multiple products from the same tech company, they investigate further how to connect and integrate all these offerings together.

Thus, the tech climate fiercely focuses on admission into a new ecosystem by any means necessary.

If Amazon can seize the house, it will seize everything that is inside.

Smart homes will not work if the smattering of products and services derive from all different makers. You have to choose a common platform.

Unsurprisingly, home security companies sold off on this news, and this new trend has thrown a spanner into the works for firms such as ADT Inc. (ADT) who have curated a 30% market share. They are the first on the chopping block.

This Boca Raton, Florida company specializes in offering security to residential and small business enterprises. They possess far more weight in the industry compared to rivals Johnson Controls International (JCI) and private firm Vivint.

ADT went public in January 2018 and expected to garner a price of $17-$19. ADT is trading below $11 today. Some of the headwinds analysts have previously mentioned are "increased competition", but nobody thought competition would come in the form of the most powerful company ever to be created in the history of mankind - Amazon. Ouch!

Ironically, in January 2016, Vivint, formerly known as??APX Alarm Security Solutions Inc, agreed to cooperate with Amazon and Nest. Vivint Element team is working on its own smart thermostat and the Vivint Ping Camera for front doors.

This is not a coincidence and the mutual connectivity in tech is everywhere. There are fewer degrees of separation between companies and industries than ever before.

Everyone is overlapping to the point where Amazon refuses to sell Google Nest products on its interface and Google stripping YouTube from all Amazon streaming devices. The more successful these smaller players become, the greater chance of a takeover by a more liquid player.

The FANG's have become juggernauts and any remnant of competition is undercut before it can become a threat and neatly placed under the umbrella of their greater visions.

This strategy has been rampant with botched attempts like Mark Zuckerberg's failed purchase of Snapchat (SNAP) for $3 billion in 2013 and Yahoo's failed buy of Facebook for $1 billion in 2006, just before Zuckerberg launched the fabled news feed.

Even though Vivint is not owned by a FANG, Blackstone Group acquired them for more than $2 billion in 2012.

If you look back in time, Amazon should have never become Amazon. Walmart should have bought it before it gained any traction. Same goes for search - Yahoo should have bought out Google before it became Google. Such is the incredible value of 20/20 hindsight.

Siminoff's Ring is now part of Amazon's death star. Ultimately, if doors are associated with privacy and protection and Amazon can successfully maneuver around these certain sensitive elements, its share will go ballistic.

Is That Google Watching?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 6, 2018

Fiat Lux

Featured Trade:

(GETTING AHEAD OF THE TECHNOLOGY CURVE),

(SQM), (GOOGL), (FB), (AAPL)

(ANOTHER REASON FOR APPLE TO GO TO NEW HIGHS, or

THE INCREDIBLE DISAPPEARING US STOCK MARKET),

(NOC), (CSX), (MMM), (UTX), (MSFT), (INTC), (CSCO), (TRV), (GPS), (BBBY), (MCD)

Stay ahead of the curve. That has been my seminal lesson after 50 years of trading the global financial markets.

Stay ahead of the curve, and riches will shower down upon you. Fall behind the curve, and life will become dull, mean, and brutish, and very poorly compensated.

Fortunately, I learned that crucial lesson early on in life. In 1972, when the US left the gold standard, I thought gold had a very bright future, then trading at $34 an ounce. It soared to $900 in seven years. I nailed that peak waiting in a line in Johannesburg to sell the last of my krugerrands.

In 1999, I saw a major crash coming in the Great Dotcom Bubble. I not only turned bearish, I sold my entire hedge fund management company at an enormous premium. Stocks then fell by 80%. Hedge funds died by the thousands.

I am now starting to get an inkling of another major market move.

But first, let me tell you to what extent the most devious, hardest core hedge fund managers are now going to get ahead of the curve.

Want to get a lead on the copper market? How about leasing time on a geostationary satellite to park over the storage facilities of Sociedad Qimica Y Minera (SQM) in Chile, one of the world’s largest producers.

Ore in the pipeline is a fabulous predictor of prices. By the way, (SQM) has risen by 400% in three years.

Stories like this are legion in the hedge fund community. Researchers pick up guys in bars outside of Foxconn factories in China to get a head start on iPhone production.

Another satellite counts ships laid up in Singapore Harbor to predict shipping rates.

I even once relied on a retired KGB officer in Russia to give me the heads up on wheat production there.

Long time readers will remember that I put out a Trade Alert based on this information to buy wheat (WEAT), right after the Mad Hedge Fund Trader was blessed with 50 new subscribers from Italy (I spoke at a conference there).

They made so much money that I received a lifetime’s worth of invitations to pasta dinners in Rome and Milan, which are made out of wheat. Some eight years later and I’m still collecting.

So having established the value of TRULY granular, on-the-ground research, let me tell you what I learned lately.

I was having lunch with a major San Francisco real estate investor the other day, and what I heard blew my mind.

Alphabet (GOOGL) is soaking up office space like there is no tomorrow. In 2017 it was the top lessor of space in the area, taking more than any other private or government entity.

The creation of Sergei Brin and Larry page currently owns or leases 20 million square feet of office space in the entire San Francisco Bay Area, housing some 34,000 workers.

To give you some idea of the scale of these holdings, that is DOUBLE the square footage of the pre-9/11 Twin Towers in New York.

What’s more, Alphabet is looking to DOUBLE this figure within the next five years.

Google already dominates the skyline of its hometown of Mountain View, California, where it already has 20,000 workers. It is negotiating with the City of San Jose for the purchase of a full city block large enough to build a new tower for a further 20,000 workers.

Various Alphabet divisions are spilling throughout the region, as far north as Marin County and as far east as Oakland and Alameda. What’s more interesting is that many of these leases contain options to buy. These are definitely long-term plays.

Other tech titans are similarly expanding, although not at the frenetic rate seen at Alphabet. Apple has 25,000 Bay area employees and is just in the process of moving into its brand new, flying saucer shaped “Donut” headquarters (the vanity address is One Infinite Loop, Cupertino, CA). Fly over it on a clear day in a small plane and you can’t miss it.

Facebook is also enjoying a growth spurt. Half of its 25,000 employees work at its Mountain View headquarters (address: One Hacker Way, Mountain View, CA). It is scouring the landscape for more.

The influx of so many highly paid tech workers in such a confined space has far reaching implications.

Residential real estate prices are through the roof, up 13% YOY, and more than 100% in five years. The local real estate pages have shrunk to nothingness, as everyone is afraid to sell for fear of not being able to get back in.

Traffic is now worse than in Los Angeles. And good luck hiring a cleaning lady, gardener, or housekeeper. You can only hire an experienced nanny if you throw in a free BMW. Every contractor is booked beyond infinity.

And good luck getting your kids into a private school at $40,000 a year each. Applications are outrunning places by 5:1.

The implications for technology share investors is nothing less that mind boggling.

If Alphabet thinks it will more than double its business, it’s safe to assume that the share price will double as well. What is more likely is that the stock will appreciate even more, given the economies of scale and their dominance of the current advertising industry by Alphabet.

It isn’t just the ad people and their programmers who are demanding more space. YouTube, the autonomous driving subsidiary Waymo, and their life sciences spinoff Verily are also growing by leaps and bounds.

I think the conclusion of all of this is pretty obvious. Buy Alphabet and any dip, and then go out and buy some more.

Is Steve Jobs Back?

Now you see it, now you don't.

If you think this was some kind of magic show, you'd be right. For what has been disappearing is the US stock market.

American companies have been buying their own shares back at a frenetic pace, some $5 trillion worth in the last six years. And since the beginning of 2018, that buy back rate has doubled, thanks to the machination of the new tax bill.

If you own stocks, you should feel like you just landed in Heaven.

Mergers and acquisitions have vaporized another $2 trillion of equity.

Some 35% of the American equity markets have gone poof, gonzo, and bye-bye in a mere half a decade

This all compares to a total remain stock marketing capitalization today of $25 billion.

The laws of supply and demand are really quite simple. The fewer shares that are out there, the more valuable the remaining ones become.

It's not like shares go to money heaven when they are bought back.

Companies are not allowed to keep them. Instead, they retire them, increasing the relative ownership of the company for the remaining shareholders, like you and me.

This means there are fewer claims on earnings, and a greater say in the future of the company through increased voting power at shareholder meetings and proxy fights.

The net effect is to improve the firm's financial ratios and boost return on equity and the return on assets. These are all excellent reasons for the shares to trade at higher price earnings multiples and rise in value.

You can't blame corporate America for falling into a narcissistic love affair with its own shares.

For a start, because the S&P 500 (SPY) up 400% from its March, 2009 bottom, they have been fantastic investments.

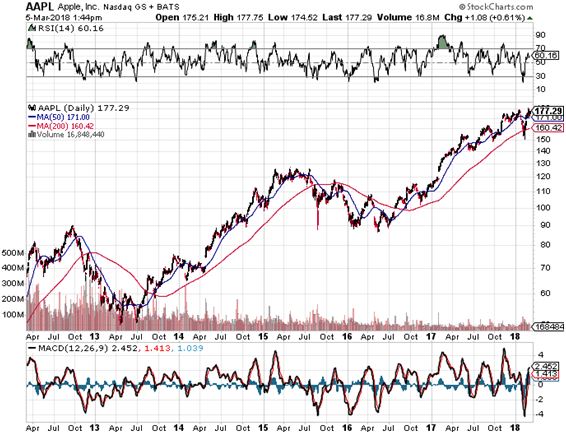

Take a look at Apple (AAPL), with the largest buyback program in absolute dollar terms by miles. Since it announced its share repurchase plan in late 2012 the value of its stock has skyrocketed some 262%.

According to their latest announcement, the firm is committed to buying back another $170 billion worth of stock, or 68% of its current $250 billion cash hoard.

Anyone who thinks this money is coming home to create new jobs is smoking California largest export crop.

The same is true for most other big names.

The bottom line here, ironically, is that companies can make more money buying back their own shares than investing in their own core businesses, even with technology firms.

Expect this to continue. Looking in the only in the rear-view mirror with your foot firmly on the accelerator has proved a successful management strategy for decades.

It not like senior management solely have the interests of shareholders at heart either. The bulk of their personal compensation is usually tied to stock options in their own firms' stocks.

More aggressive corporate share buybacks pave the path to high prices and personal enrichment beyond the dreams of Croesus.

That has enabled a continuously rising stock market to mint more billionaires than you can count, even though the beneficiaries had no idea what markets were going to do.

It's like the cock taking credit for the rising sun.

No wonder I have such a tough time chartering a personal jet these days!

Take a look at the share prices of some of the most ambitious buyers of their own stock.

Bed Bath & Beyond (BBBY) has purchased 50% of its outstanding float, at one point delivering a 400% gain in its shares, even though its core retail business sucked.

The Travelers Company (TRV) has removed a mind boggling 60% of its shares from the market, delivering another 400% gain in the shares.

Gap, Inc., a member of another dying industry, which bought back some 55% of its shares, saw prices jump some 800% at the top.

Wasn't it Calvin Coolidge who, our 30th president, who said that, "The business of America is business."

The reality is that the business of America is buying shares.

You can also blame interest rates, which have stayed at ultra-low levels for the past nine years, thanks to the Federal Reserve's aggressive quantitative easing programs.

Back in the day, when overnight interest rates were at 6%, large companies maintained substantial cash management divisions to administer their excess funds.

No more. It doesn't take a lot of talent to bring in a zero return. And cutting a few green eyeshades was always a popular cost cutting measure.

It's not like shares go to money heaven when they are retired.

Largest Share Repurchase Programs 2010-2017

Industrials

Northrop Grumman (NOC) - 50%

CSX Corp. (CSX) - 29%

3M Co. (MMM) - 25%

United Technologies (UTX) - 25%

Technology

Microsoft (MSFT) - 30%

Intel (INTC) - 30%

Cisco (CSCO) - 32%

Consumers

Travelers (TRV) - 60%

Gap (GPS) - 55% (GPS)

Bed Bath & Beyond (BBBY) - 50%

McDonald's (MCD) - 36%

The Business of America is Buying Shares?

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 5, 2018

Fiat Lux

SPECIAL STEEL ISSUE

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT STEEL)

(X), (GM), (WEAT), (AAPL), (JPM), (BA), (K),

(THE FIRST TRADES IN THE TRADE WAR HAVE BEEN FIRED AND YOU GOT HIT),

(X), (F), (GM), (TM)