When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 28, 2018

Fiat Lux

Featured Trade:

(FRIDAY, APRIL 6, INCLINE VILLAGE, NEVADA, STRATEGY LUNCHEON)

(FROM THE FRONT LINES OF THE TRADE WAR),

(AAPL), (AVGO), (QCOM), (TLT),

(HOW THE MAD HEDGE MARKET TIMING ALGORITHM TRIPLED MY PERFORMANCE)

Poke your hand into a hornet's nest and you can count on an extreme reaction, a quite painful one.

As California is the growth engine for the entire US economy, accounting for 20% of US GDP, it is no surprise that it has become the primary target of Chinese retaliation in the new trade war.

The Golden State exported $28.5 billion worth of products to China in 2017, primarily electronic goods, with a host of agricultural products a close second.

In the most devious way possible, the Middle Kingdom targeted Trump supporters in the most liberal state in the country with laser-like focus. California exports 46% of its pistachios to China, followed by 35% of its exported plums, 20% of exported oranges, and 12% of its almonds.

By comparison, California imported a gargantuan $160.5 billion worth of goods from China last year, mostly electronics, clothing, toys, and other low-end consumer goods.

Some $16 billion of this was recycled back into the state via investment in real estate and technology companies.

Anecdotal evidence shows that figure could be dwarfed by the purchase of California homes by Chinese individuals looking for a safe place to hide their savings. Local brokers report that up to one-third of recent purchases have been by Chinese nationals paying all cash.

The Chinese tried to spend more. Their money is thought to be behind Broadcom's (AVGO) $105 billion bid for QUALCOMM (QCOM), which was turned down for national security reasons.

The next big chapter in the trade war will be over the theft of intellectual property, and that one will be ALL about the Golden State.

Also at risk is virtually Apple's (AAPL) entire manufacturing base in China, where more than 1 million workers at Foxconn assemble iPhones, Macs, iPads, and iPods.

The Cupertino, CA, giant could get squeezed from both sides. The Chinese could interfere with its production facilities, or its phones could get slapped with an American import duty.

So far, the trade war has been more bluff than bite. The US duties announced come to only $3 billion on $50 billion worth of trade. China responded with incredible moderation, only restricting $3 billion worth of imports.

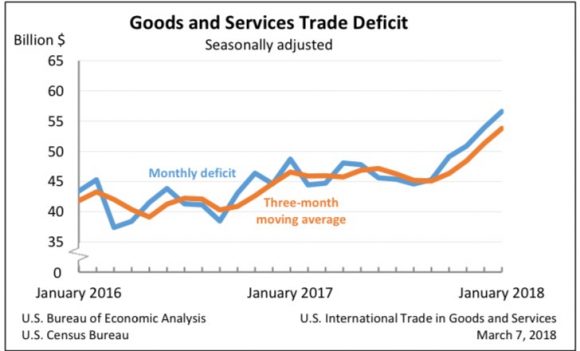

By comparison, in 2017 the US imported a total of $505.6 billion in goods from China and exported $130.4 billion. Against this imbalance, the US runs a largest surplus in services.

The next Chinese escalation will involve a 25% tariff on American pork and recycled aluminum. Who is the largest pork producer in the US? Iowa, with $4.2 billion worth, and the location of an early presidential election primary.

Beyond that, Beijing has darkly hinted that is will continue to boycott new US Treasury bond auctions, as it has done for the past six months, or unload some if its massive $1.6 trillion in bond holdings.

Given the price action in the bond market today, with the United States Treasury Bond Fund (TLT) at a two-month high, I would say that the market doesn't believe that for two seconds. The Chinese won't cut off its nose to spite its face.

In the end, I think not much will come of this trade war. That's what the stock market told us yesterday with a monster 700-point rally, the biggest in three years.

The administration is discovering to its great surprise that its base is overwhelmingly against a trade war. And as business slows down, it will become evident in the numbers as well.

The US was the big beneficiary from the global trading system. Why change the rules of a game we are winning?

Still, national pride dies hard.

I couldn't believe my eyes.

Upon analyzing my performance data for the past year, it couldn't be clearer.

After a year of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert, and will continue to do so in the future.

Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the performance of my Trade Alert performance has more than tripled, from a 19.99% annual rate to 46.70% (see chart below).

As a result, new subscribers have been beating down the doors trying to get in.

Let me list the high points of having an algorithm looking over your shoulder on every trade.

- Algorithms have become so dominant in the market, accounting for up to 80% of total trading volume that you should never trade without one.

- It does the work of a seasoned 100-man research department in seconds.

- It runs real time and optimizes returns with the addition of every new data point far faster than any human can. Image a trading strategy that upgrades itself 30 times a day!

- It is artificial intelligence driven and self-learning.

- Don't go to a gunfight with a knife. If you are trading against algos alone you WILL lose!

- Algorithms provide you with a defined systematic trading discipline that will enhance your profits.

And here's the amazing thing. My Mad Hedge Market Timing Index correctly predicted the outcome of the presidential election, while I got it dead wrong.

You saw this in stocks such as US Steel, which took off like a scalded chimp the week before the election.

When my and the Market Timing Index's views sharply diverge, I go into cash rather than bet against it.

Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%.

Here are just a handful of some of the elements of the Mad Hedge Market Timing Index analysis real time, 24/7.

- 50- and 200-day moving averages across all markets and industries

- The Volatility Index (VIX)

- The junk bond (JNK)/US Treasury bond spread (TLT)

- Stocks hitting 52-day highs versus 52-day lows

- McClellan Volume Summation Index

- 20-day stock bond performance spread

- 5-day put/call ratio

- Stocks with rising versus falling volume

- Relative Strength Index

- 12-month US GDP Trend

- S&P CoreLogic Case-Shiller US National Home Price NSA Index

Of course, the Trade Alert service is not entirely algorithm driven. It is just one tool to use among many others.

Yes, 50 years of experience trading the markets is still worth quite a lot.

I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously as new data sets become available.

It's All About the Inputs

Thank You, Mr. Algorithm!

Mad Hedge Technology Letter

March 28, 2018

Fiat Lux

Featured Trade:

(HOW THE COBALT SHORTAGE WILL LEAD TO THE $2,000 IPHONE)

(AAPL), (SSNLF), (CMCLF), (FCX), (VALE), (GLNCY), (VLKAY), (BMWYY)

Hello $2,000 iPhone.

Flabbergasted consumers reacted last holiday season when Apple dared offer a $1,000 smartphone.

How confident this company has become!

Well, this is just the beginning.

Apple (AAPL) will be the first smartphone maker to offer a $2,000 phone, and I will tell you why!

The tech industry is going through a cumbersome wave of repricing after several high-profile debacles that have cast the light on the true value of data.

The upward revision of data has seen more players pour into the game attempting to carve out a slice of the pie for themselves.

The reason why tech companies will start offering their products at higher price points is because the inputs are rising at a rapid clip.

Apple's Development and Operations (DevOps) costs to design and maintain this outstanding product is going through the roof.

Apple's DevOps employees earn around $145,000 per year and compensation is rising. Granted, the technology is developing and batteries smaller, but salaries are rising at a quicker relative pace because of the dire shortage of DevOps talent in Silicon Valley.

It's possible that living in a shoebox at $4,200 per month in Mountain View, Calif., is off-putting for potential staff.

The most expensive part of an iPhone X is the OLED screen.

Apple estimated costs of $120 per screen manufacturing the Apple iPhone X. The cost doubled from LCD panels from $60 per screen.

Samsung (SSNLF) has been best of breed for screens for a while, and it is currently working on the next generation of Micro LED tech, which is the next gap up from the OLED displays of today.

Samsung has an inherent conflict of interest with Apple, creating tension between these tech stalwarts. Apple made the contentious decision to procure in-house screens at a secret manufacturing facility in Santa Clara, Calif., to avoid the constant friction.

It's common knowledge that the average price of technology shrinks over time, but the American smartphone industry has defied gravity with expected prices to shoot up 6% to $324 in 2018.

The Apple iPhone X raw costs were around $400 per phone. There is zero chance that a next gen, enhanced Apple smartphone will cost this low ever again.

Confirming this trend are Chinese smartphones retail prices rising at 15% last year.

The cost of memory, DRAM and NAND chips, rose dramatically this past year. As more memory is designed into these devices, the costs keep trending higher.

Lithium-ion batteries only add up to 1% to 2% of OEM (Original Equipment Manufacturers) cost and probably only bumps up the cost of iPhones incrementally.

The more skittish situation is the EV (Electric Vehicles) snafu.

Volkswagen (VLKAY) announced it will transform its entire fleet of 300 models into electrified versions by 2025.

In order to achieve this lofty objective, Volkswagen has earmarked $25 billion for batteries from Samsung, LG, and Contemporary Amperex. Volkswagen hopes to have 16 up and running (EV) factories by 2022, up from three today.

The goal is unattainable because of a lack of in-house battery production.

CEO Matthias Muller said the reason for not manufacturing in-house batteries was, "Others can do it better than we can."

Muller will rue the decision down the line as a myriad of companies migrate toward in-house solutions, giving firms more control over the process and overhead.

More importantly, Muller will have to rely on the ebb and flow of rising cobalt prices.

A battery for an (EV) ranges between $8,000- to 20,000, comprising the largest input for the (EV) makers such as Tesla (TSLA) and Ford (F).

Making matters worse, companies cut from all cloth are hoarding cobalt reserves based on anticipating the potential demand.

This phenomenon will cause all big tech players to replenish any reserves of base materials immediately.

Apple has had chip shortage problems in the past. This year is even worse than 2017, with NAND and DRAM chip supply trailing the demand by 30%. Tech companies have been hastily locking down contracts in advance to ensure the necessary materials to produce their flashy gadgets.

Lithium battery demand is expected to rise 45% between 2017 and 2020, and there has been no meaningful large-scale investment into this industry.

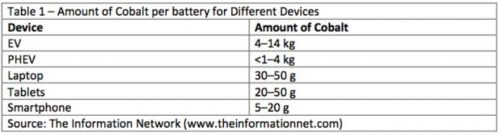

Battery production made up 51% of cobalt demand in 2016 and will hit around 62% by 2022.

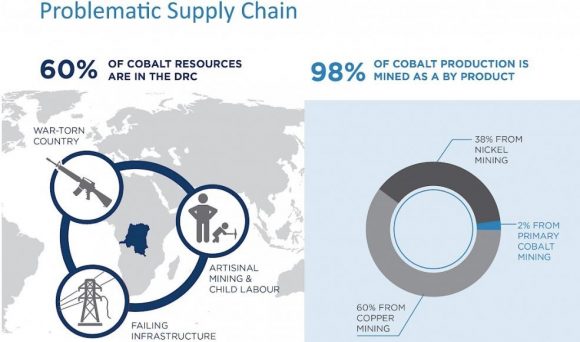

Compounding the complexity is 60% of global cobalt production is found in one country - the Democratic Republic of the Congo (DRC).

DRC is a hotspot for geopolitical fallout and its history is littered with civil war, internal conflict, and poor infrastructure.

The 21st century will be dependent on a chosen group of valuable materials. Cobalt is shaping up to be the leader of this pack and is needed in a plethora of business applications such as EV, lithium-ion batteries, and PCs.

Cobalt is vital in metallurgical applications that include aerospace rotating parts, military and defense, thermal sprays, prosthetics, and much more.

The DRC recently proposed a revised mining law increasing taxes on cobalt and other precious metals. The legislation has yet to be written into stone and would certainly jack up the price of cobalt.

Glencore's (GLNCY) management has noted this mining tax is "challenging" at a time it is just completing its Katanga expansion.

Katanga has the potential to become the largest global copper and cobalt producer.

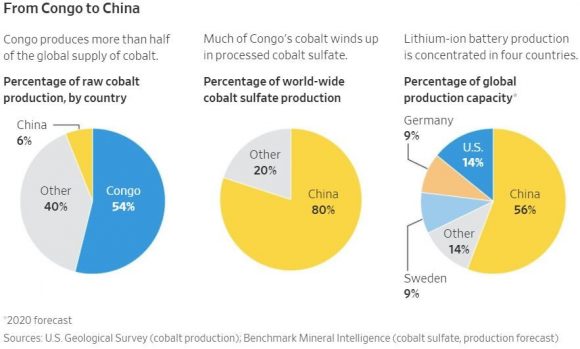

Copper is equally important to cobalt since cobalt production is a by-product of copper and nickel mining. Only 2% of cobalt results directly from cobalt mining, and 60% via copper mining, and 38% via nickel mining.

Last year, Freeport-McMoRan (FCX) was dangling its cobalt project to outside investors in the DRC but was unable to fetch a premium price.

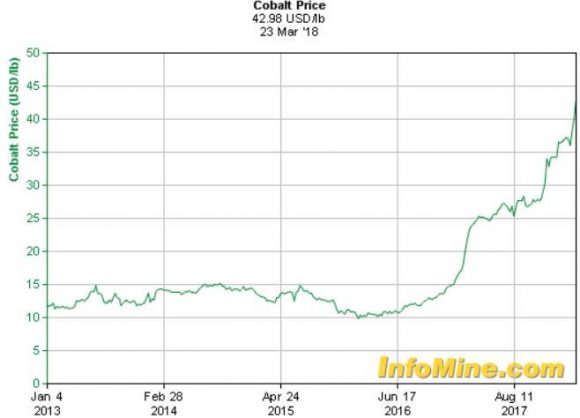

In a blink of an eye, China Molybdenum Co. (CMCLF) swooped in and (FCX) accepted an offer of $2.65 billion. (FXC) used the sale to pay down debt while the price of cobalt has taken off to the moon.

It gets worse, China owns 80% of refined global cobalt production and 90% of its operations are in the DRC.

China is attempting to corner the cobalt market in the DRC, gaining a stranglehold on future technological devices, (EV)s, and big data.

The keys to future technological hegemony lie in the jungles of the DRC, and China has the first mover advantage and backing of the communist party as (CMCLF) strives to be a global leader in cobalt production.

China has smartly wriggled its way down to the bottom of the supply chain capturing cobalt resources, and if a trade war ensues, China can simply cut off cobalt supply lines to whomever.

There is nothing CFIUS or Donald Trump can do.

America's 14% of global cobalt production will be insufficient to produce the new (EV)s, iPhone 11s, gizmos and gadgets that American consumers demand for daily life.

Analysts expected Apple to acquire some supplementary companies that will aid in expansion following the overseas repatriation.

A thriving software outfit or a company of cloud developers would have sufficed. However, reports streaming in that Apple has entered into negotiations to buy a five-year supply of cobalt directly from miners for the first-time underscore where Apple's priorities lie.

Cobalt demand expects to increase by 30% from 2016 to 2020.

Apple is scared it will be locked out of the cobalt market or forced to pay ludicrous prices for its cobalt needs.

Considering the price of cobalt has quadrupled since June 2016, and smartphones are 25% of the cobalt market, it's a strategically prudent move by Apple's CEO Tim Cook in light of BMW (BMWYY) announcing the need of 10X more cobalt by 2025.

Going forward anything comprised of cobalt-based technology will garner a higher premium resulting in higher prices for consumers including that $2,000 iPhone.

(FCX) is a must buy for those who believe precious metals are the foundation to all future technology. Other intriguing names include Brazilian company Vale S.A. (VALE), and Glencore, the largest Swiss company by revenue.

Or if you have the cash, plunk it down on a cobalt mine in the DRC. But only if you're insane.

__________________________________________________________________________________________________

Quote of the Day

"Heavier-than-air flying machines are impossible." - Lord Kelvin, President of the Royal Society, in 1895

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Fort Worth, TX on Monday, June 11, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Tickets are available for $248.

I'll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in New Orleans, LA on Tuesday, June 12, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Tickets are available for $268.

I'll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown restaurant. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Philadelphia, PA on Wednesday, June 13, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Tickets are available for $238.

I'll be arriving at 11:45 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.