While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 27, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE MARCH 28 GLOBAL STRATEGY WEBINAR),

(TEN MORE UGLY MESSAGES FROM THE BOND MARKET),

(TLT), (TBT), (USO), (GLD), (GS), (SPY)

(FRIENDS WHO WILL EXECUTE MY TRADE ALERTS FOR YOU)

My next global strategy webinar will be held live from Silicon Valley on Wednesday, March 28, at 12:00 PM EST.

Co-hosting the show will be my friend Bill Davis of Mad Day Trader.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metal, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I also will be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window in which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you yesterday entitled, "Next Bi-Weekly Webinar - March 28, 2018" or click here.

Practically every day, I get emails from readers asking me to take over management of their retirement funds so I can execute my Trade Alerts for them.

With an 80% success rate and average annualized return of 34%, why wouldn't they?

Unfortunately, I have to turn these invitations down.

Watching the market, doing the research for new Trade Alerts, keeping up with a global speaking schedule, and running the Mad Hedge Fund Trader global empire is so demanding that I have little time for anything else.

On top of that, I have my unpaid "hobby" of advising various arms of the United States government, including, the US Treasury, The Federal Reserve, and the Joint Chiefs of Staff. When the call comes from Washington, D.C., to jump, I ask, "How high?"

Any other patriot would do the same.

In any case, actively managing someone else's money would raise conflicts of interest and regulatory problems. I learned early on at Morgan Stanley decades ago to stay miles away from the "gray" areas. Leave those marginal lines of business to competitors.

However there is one way I can help.

Hundreds of qualified, skilled, and well-intentioned financial advisors read this letter every day. They deliver great service and excellent performance for their clients, and don't charge much for the service.

If you think you would benefit from third-party assistance on trade execution, send an email to Nancy at customer support at support@madhedgefundtrader.com and put "FINANCIAL ADVSIOR ASSISTANCE" in the subject line.

Please include your contact information, phone number, age, level of financial sophistication, and assets until management. We will try to hook you up with someone in your area.

I won't be getting anything out of this. I merely wish that readers get the most out of our products and participate in the Mad Hedge Fund Trader global trading and investment community.

Anything I can do to enhance your profits and level the dreadfully uneven playing field with Wall Street is a win for me.

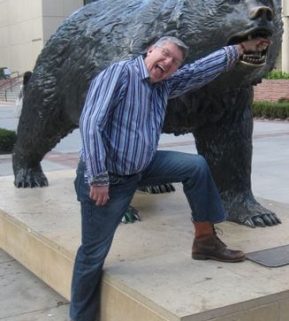

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

March 27, 2018

Fiat Lux

Featured Trade:

(SUDDENLY, INTERACTIVE BROKERS IS A LOT MORE VALUABLE)

(IBKR), (SCHW), (AMTD)

Longtime followers of the Mad Hedge Technology Letter know that I rely on Interactive Brokers (IBKR) for my pricing and execution.

It is fast, accurate, user friendly, and cheap.

Recently, more traders have been discovering these benefits. A lot more.

The halcyon days of January 2018 brought investors euphoria and hockey stick shaped charts.

Bitcoin even tickled the $20,000 mark.

Every risk asset minus interest rate sensitive stock relentlessly exploded skyward.

Then a funny thing happened.

The short volatility industry vanished in the space of one night and unleashed a new epoch of wild market gyrations.

One clear victor rises from the embers of the pandemonium and that is online broker Interactive Brokers Group, founded by Hungarian entrepreneur, Thomas Peterffy.

The all-important gauge of Daily Average Revenue Trades (DARTs), the income stream from generated commission, will hoist the stock to new plateaus.

Total (DART)s rose 14% YOY with historic low volatility in 2017, down 27% from 2016 and (IBKR)'s stock still muscled out performance from $37 to $64, almost doubling.

The recent inflow of February reports indicates fixed-income revenue and currency trading set record highs.

TradeWeb, one of the largest bond trading platforms in the world, reported a 73% February YOY boost of European corporate and financial bonds. Bonds usually are traded via phone, and new trends show the push into electronic trading is advancing unabated.

A return to "normal" levels of volatility will propel online brokers to new heights. Low volatility diminishes trade volume while increased volatility spurs on trading volume.

As more trading traverses to digital platforms, the digitization of buying and selling stocks and the advent of crypto trading will entice risk-adverse Millennials to pile into risk assets.

Numbers show that Millennials have an affinity for options trading, suggesting the dynamic short termism of options provides the experiential thrill they seek in life.

Interactive Brokers was voted best of breed of online brokers in 2018 by the prominent financial publication Barron's. This annual edition gives the skinny on online trading platforms and a rough guide to which service best suits each investor.

I single out (IBKR) as a stellar company because the e-broker industry is experiencing a mammoth period of consolidation amid a price war.

E-brokers such as Fidelity slashed its commission rates from $7.95/trade to $4.95/trade in February 2017. As trading becomes commoditized, it's a race to the bottom and whoever is a volume leader with the best platform technology will be the last one standing.

This trend all favors (IBKR) which is positioned for scale like the FANGs. If customers do not possess the scale, the ultra-cheap commissions are unavailable.

The backdoor strategy here is the access e-brokers have to customer data flows. The treasure trove of trade flow data will become even more valuable with the upward re-pricing of data following the Cambridge Analytica mess.

Online brokers profit off customers' data by selling the information to High Frequency Traders (HFT) that input the data into evolving proprietary algorithms, which legally front run retail and institutional money.

(IBKR) fits (HFT) like a glove and the synergies are robust. The most lucrative accounts derive from the new batches of prop desks and hedge funds that trade heavily, desiring the best online platform technology for minimal slippage and smooth execution. (HFT)s trade in milliseconds and comprise 60% to 70% of daily trading volume, signifying immense bullishness for (IBKR).

The strategy so far is a winner, increasing customer accounts by 25% YOY, up to 483,000 in Q4 2017. Profit margins benefited as well, rising 15% to 71% YOY.

The second part of (IBKR)'s handiwork is net interest. Margin accounts due to fractional banking allow brokers to lend to clients. Any serious trader is using leverage to amass profits. At the height of financial malpractice in 2007, too-big-to-fail banks boasted leverage of 50x.

Total customer equity elevated by 46% YOY to $124.80 billion. IBKR also profits from the cash sitting in its own accounts, which accumulate higher relative returns from higher interest rates.

(IBKR)'s margin rates are lowest in the industry and still incredibly lucrative.

Every time the Fed raises the Fed funds rate, (IBKR) can ring in the cash register. The Fed is on an aggressive quantitative tightening agenda and a good omen for the upcoming earnings' report.

The trends ongoing in this industry overwhelmingly favor (IBKR). The shift to mobile will become more pervasive. Only a few years ago, mobile platforms were arcane and unintegrated with desktop platforms, forcing traders to disregard the mobile method.

Times have changed and (IBKR) cannot find enough developers to head its operations. The shortage of talented developers is causing a backlog of new projects, but this highlights the growing emphasis on its trading platform technology.

Offerings don't stop at trading execution. (IBKR) has built out a robo-advising service called IB Asset Management and via iBot, an A.I. assistant, traders can use prop-desk level algorithms to nimbly dip in and out of positions. The analytical features to dissect price data is breathtaking these days and will satisfy chart lovers.

The runway is long as the eye can see because many of these offerings can be transformed into reoccurring subscription services. Furthermore, brokers make money if the market ascends or declines as long as traders do something to stockpile data.

Other competitors to consider are Charles Schwab (SCHW), which recently acquired optionsXpress and TD Ameritrade (AMTD), which purchased Scottrade for $4 billion. (AMTD) cut 1,100 employees in the St. Louis, MO, branch lately and, in return, will replace them with a handful of techies to work on platform enhancement.

The broad-based consolidation reflects the grab for market share since many of the players have come to terms with the market's obsession for scale. Implementing scale directly means snagging more client accounts as the marginal cost per client barely budges with the tech infrastructure already established for all the big players.

__________________________________________________________________________________________________

Quote of the Day

"I think there is a world market for maybe five computers." - IBM Chairman Thomas J. Watson, 1943

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.