While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 13, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018),

(APRIL 11 GLOBAL STRATEGY WEBINAR Q&A),

(TLT), (TBT), (GOOGL), (MU), (LRCX), (NVDA) (IBM),

(GLD), (AMZN), (MSFT), (XOM), (SPY), (QQQ)

We all had so much fun last year at the Mad Hedge Lake Tahoe Conference that we unanimously voted to meet a year later.

That time is now approaching, and the dates have been set for Friday and Saturday, October 26-27.

Come learn from the greatest trading minds in the markets for a day of discussion about making money in the current challenging conditions.

How soon will the next bear market start and the recession that inevitably follows?

How will you guarantee your retirement in these tumultuous times?

What will destroy the economy first: rising interest rates or a trade war?

Who will tell you what to buy at the next market bottom?

John Thomas is a 50-year market veteran and is the CEO and publisher of the Diary of a Mad Hedge Fund Trader. John will give you a laser-like focus on the best-performing asset classes, sectors, and individual companies of the coming months, years, and decades. John covers stocks, options, and ETFs. He delivers your one-stop global view.

Arthur Henry is the author of the Mad Hedge Technology Letter. He is a seasoned technology analyst, and speaks four Asian languages fluently. He will provide insights into the most important investment sector of our generation.

The event will be held at a five-star resort and casino on the pristine shores of Lake Tahoe in Incline Village, NV, the precise location of which will be emailed to you with your ticket purchase confirmation.

It will include a full breakfast on arrival, a sit-down lunch, and coffee break. The wine serviced will be from the best Napa Valley vineyards.

Come rub shoulders with some of the savviest individual investors in the business, trade investment ideas, and learn the secrets of the trading masters.

Ticket Prices

Copper Ticket - $599: Saturday conference all day on October 27, with buffet breakfast, lunch, and coffee break, with no accommodations provided

Silver Ticket - $1,299: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch and coffee break

Gold Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 26, 7:00 PM Friday night VIP Dinner with John Thomas

Platinum Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Diamond Ticket - $1,799: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, an October 26, 7:00 PM Friday night VIP Dinner with John Thomas, AND an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Schedule of Events

Friday, October 26, 7:00 PM

7:00 PM - Exclusive dinner with John Thomas and Arthur Henry for 12 in a private room at a five-star hotel for gold and diamond ticket holders only

Saturday, October 27, 8:00 AM

8:00 AM - Breakfast for all guests

9:00 AM - Speaker 1: Arthur Henry - Mad Hedge Technology Letter editor Arthur Henry gives the 30,000-foot view on investing in technology stocks

10:00 AM - Speaker 2: Brad Barnes of Entruity Wealth on "An Introduction to Dynamic Risk Management for Individuals"

11:00 AM - Speaker 3: John Thomas - An all-asset class global view for the year ahead

12:00 PM - Lunch

1:30 PM - Speaker 4: Arthur Henry - Mad Hedge Technology Letter editor on the five best technology stocks to buy today

2:30 PM - Speaker 5: John Triantafelow of Renaissance Wealth Management

3:30 PM - Speaker 6: John Thomas

4:30-6:00 PM - Closing: Cocktail reception and open group discussions

7:00 PM - Exclusive dinner with John Thomas for 12 in a private room at a five-star hotel for Platinum or Diamond ticket holders only

To purchase tickets click: CONFERENCE.

Below please find subscribers' Q&A for the Mad Hedge Fund Trader April Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Many of your April positions are now profitable. Is there any reason to close out before expiration?

A: No one ever got fired for taking a profit. If you feel like you have enough in hand - like 50% of the maximum potential profit in the position, which we do have in more than half of our current positions - go ahead and take it.

I'll probably run all of our April expirations into expiration day because they are very deep in the money. Also, because of the higher volatility and because of higher implied volatility on individual stock options, you're being paid a lot more to run these into expiration than you ever have been before, so that is another benefit.

Of course, one good reason to take profits now is to roll into another position, and when we find them, that may be exactly what we do.

Q: What do you think will be the impact of the US hitting Syria with missiles?

A: Initially, probably a 3-, 4-, or 500-point drop, and then a very rapid recovery. While the Russians have threatened to shoot down our missiles, in actual fact they can't hit the broad side of a barn. When Russians fired their cruise missiles at Syrian targets, half of them landed in Iran.

At the end of the day, it doesn't really impact the US economy, but you will see a big move in gold, which we're already starting to see, and which is why we're long in gold - as a hedge against all our other positions against this kind of geopolitical event.

Q: Will 2018 be a bull market or a bear market?

A: We are still in a bull market, but we may see only half the returns of last year - in other words we'll get a 10% profit in stocks this year instead of a 20% profit, which means it has to rise 12% from here to hit that 10% up by year-end.

Q: What is your take on the ProShares Ultra Short 20+ Year Treasury Bond Fund (TBT)?

A: I am a big buyer here. I think that interest rates (TLT) are going to move down sharply for the rest of the year. The (TBT) here, in the mid $30s, is a great entry point - I would be buying it right now.

Q: How do you expect Google (GOOGL) to trade when the spread is so wide?

A: It will go up. Google is probably the best-quality technology company in the market, after Facebook (FB). We'll get some money moving out of Facebook into Google for exactly that reason; Google is Facebook without the political risk, the regulatory risk, and the security risks.

Q: Are any positions still a buy now?

A: All of them are buys now. But, do not chase the market on any conditions whatsoever. The market has an endless supply of sudden shocks coming out of Washington, which will give you that down-400-points-day. That is the day you jump in and buy. When you're buying on a 400-down-day, the risk reward is much better than buying on a 400-point up day.

Q: What is "sell in May and go away?"

A: It means take profits in all your positions in May when markets start to face historical headwinds for six months and either A) Wait for another major crash in the market (at the very least we'll get another test of the bottom of the recent range), or B) Just stay away completely; go spend all the money you made in the first half of 2018.

Q: Paul Ryan (the Republican Speaker of the House) resigned today; is he setting up for a presidential run against Trump in 2020?

A: I would say yes. Paul Ryan has been on the short list of presidential candidates for a long time. And Ryan may also be looking to leave Washington before the new Robert Mueller situation gets really unpleasant.

Q: What reaction do you expect if Trump resigns or is impeached?

A: I have Watergate to look back to; the stock market sold off 45% going into the Nixon resignation. It's a different world now, and there were a lot more things going wrong with the US economy in 1975 than there are now, like oil shocks, Vietnam, race riots, and recessions.

I would expect to get a decline, much less than that - maybe only a couple 1,000 points (or 10% or so), and then a strong Snapback Rally after that. We, in effect, have been discounting a Trump impeachment ever since he got in office. Thus far, the market has ignored it; now it's ignoring it a lot less.

Q: Thoughts on Micron Technology (MU), Lam Research (LRCX), and Nvidia (NVDA)?

A: It's all the same story: a UBS analyst who had never covered the chip sector before initiated coverage and issued a negative report on Micron Technology, which triggered a 10% sell-off in Micron, and 5% drops in every other chip company.

He took down maybe 20 different stocks based on the argument that the historically volatile chip cycle is ending now, and prices will fall through the end of the year. I think UBS is completely wrong, that the chip cycle has another 6 to 12 months to go before prices weaken.

All the research we've done through the Mad Hedge Technology Letter shows that UBS is entirely off base and that prices still remain quite strong. The chip shortage still lives! That makes the entire chip sector a buy here.

Q: Can Trump bring an antitrust action against Amazon?

A: No, no chance whatsoever. It is all political bluff. If you look at any definition of antitrust, is the consumer being harmed by Amazon (AMZN)?

Absolutely not - if they're getting the lowest prices and they're getting products delivered to their door for free, the consumer is not being harmed by lower prices.

Second is market share; normally, antitrust cases are brought when market shares get up to 70 or 80%. That's what we had with Microsoft (MSFT) in the 1990s and IBM (IBM) in the 1980s. The largest share Amazon has in any single market is 4%, so no there is basis whatsoever.

By the way, no president has ever attacked a private company on a daily basis for personal reasons like this one. Thank the president for giving us a great entry point for a stock that has basically gone up every day for two years. It's a rare opportunity.

Q: How will the trade war end?

A: I think the model for the China trade war is the US steel tariffs, where we announced tariffs against the entire world, and then exempted 75% of the world, declaring victory. That's exactly what's going to happen with China: We'll announce massive tariffs, do nothing for a while, and then negotiate modest token tariffs within a few areas. The US will declare victory, and the stock market rallies 2,000 points. That's why I have been adding risk almost every day for the last two weeks.

Q: Would you be buying ExonMobil (XOM) here, hoping for an oil breakout?

A: No, I think it's much more likely that oil is peaking out here, especially given the slowing economic data and a huge onslaught in supply from US fracking. We're getting big increases now in fracking numbers - that is very bad for prices a couple of months out. The only reason oil is this high is because Iran-sponsored Houthi rebels have been firing missiles at Saudi Arabia, which are completely harmless. In the old days, this would have caused oil to spike $50.

Q: Would you be selling stock into the rally (SPY), (QQQ)?

A: Not yet. I think the market has more to go on the upside, but you can still expect a lot of inter-day volatility depending on what comes out of Washington.

Q: Do you ever use stops on your option spreads?

A: I use mental stops. They don't take stop losses on call spreads and put spreads, and if they did they would absolutely take you to the cleaners. These are positions you never want to execute on market orders, which is what stop losses do. You always want to be working the middle of the spread. So, I use my mental stop. And when we do send out stop loss trade alerts, that's exactly where they're coming from.

Q: Will the Middle East uncertainty raise the price of oil?

A: Yes, if the Cold War with Iran turns hot, you could expect oil to go up $10 or $20 dollars higher, fairly quickly, regardless of what the fundamentals are. It's tough to be blowing up oil supplies as a great push on oil prices. But that's a big "if."

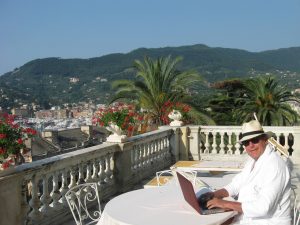

Hello from the Italian Riviera!

Mad Hedge Technology Letter

April 13, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018)

We all had so much fun last year at the Mad Hedge Lake Tahoe Conference that we unanimously voted to meet a year later.

That time is now approaching, and the dates have been set for Friday and Saturday, October 26-27.

Come learn from the greatest trading minds in the markets for a day of discussion about making money in the current challenging conditions.

How soon will the next bear market start and the recession that inevitably follows?

How will you guarantee your retirement in these tumultuous times?

What will destroy the economy first: rising interest rates or a trade war?

Who will tell you what to buy at the next market bottom?

John Thomas is a 50-year market veteran and is the CEO and publisher of the Diary of a Mad Hedge Fund Trader. John will give you a laser-like focus on the best-performing asset classes, sectors, and individual companies of the coming months, years, and decades. John covers stocks, options, and ETFs. He delivers your one-stop global view.

Arthur Henry is the author of the Mad Hedge Technology Letter. He is a seasoned technology analyst, and speaks four Asian languages fluently. He will provide insights into the most important investment sector of our generation.

The event will be held at a five-star resort and casino on the pristine shores of Lake Tahoe in Incline Village, NV, the precise location of which will be emailed to you with your ticket purchase confirmation.

It will include a full breakfast on arrival, a sit-down lunch, and coffee break. The wine served will be from the best Napa Valley vineyards.

Come rub shoulders with some of the savviest individual investors in the business, trade investment ideas, and learn the secrets of the trading masters.

Ticket Prices

Copper Ticket - $599: Saturday conference all day on October 27, with buffet breakfast, lunch, and coffee break, with no accommodations provided

Silver Ticket - $1,299: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch and coffee break

Gold Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 26, 7:00 PM Friday night VIP Dinner with John Thomas

Platinum Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Diamond Ticket - $1,799: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, an October 26, 7:00 PM Friday night VIP Dinner with John Thomas, AND an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Schedule of Events

Friday, October 26, 7:00 PM

7:00 PM - Exclusive dinner with John Thomas and Arthur Henry for 12 in a private room at a five-star hotel for gold and diamond ticket holders only

Saturday, October 27, 8:00 AM

8:00 AM - Breakfast for all guests

9:00 AM - Speaker 1: Arthur Henry - Mad Hedge Technology Letter editor Arthur Henry gives the 30,000-foot view on investing in technology stocks

10:00 AM - Speaker 2: Brad Barnes of Entruity Wealth on "An Introduction to Dynamic Risk Management for Individuals"

11:00 AM - Speaker 3: John Thomas - An all-asset class global view for the year ahead

12:00 PM - Lunch

1:30 PM - Speaker 4: Arthur Henry - Mad Hedge Technology Letter editor on the five best technology stocks to buy today

2:30 PM - Speaker 5: John Triantafelow of Renaissance Wealth Management

3:30 PM - Speaker 6: John Thomas

4:30-6:00 PM - Closing: Cocktail reception and open group discussions

7:00 PM - Exclusive dinner with John Thomas for 12 in a private room at a five-star hotel for Platinum or Diamond ticket holders only

To purchase tickets click: CONFERENCE.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 12, 2018

Fiat Lux

Featured Trade:

(THE REAL ESTATE CRASH COMING TO A MARKET NEAR YOU),

(THE FALLING MARKET FOR KIDS)

Mad Hedge Technology Letter

April 12, 2018

Fiat Lux

Featured Trade:

(THE BIG PLAY IN AUTONOMOUS DRIVING WITH APTIV),

(APTV), (Waymo), (TSLA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.