While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 14, 2018

Fiat Lux

Featured Trade:

(THURSDAY, JUNE 14, 2018, NEW YORK, NY, GLOBAL STRATEGY LUNCHEON),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, OR TAKING ANOTHER BITE AT THE APPLE),

(AAPL),

(FAREWELL TO DAVID ROCKEFELLER)

What happens after markets test the top end of a range? They test the bottom end of the range. So, the game here is to pick where and when is the next short-term top.

Now that Q1 earnings are out of the way, there is no major positive driver of the market for two more months, until the end of July, when the Q2 earnings start to roll out. And they will be good.

That leaves us only geopolitical shocks and chaos from Washington as the major market influences, and none of those are going to be positive. When traders shift from a focus on earnings to fear, the result is usually negative for share prices.

One major event that occurred last week but was totally ignored by the media was the administration's trade negotiating team scampering back from China completely empty handed. They called his bluff. So, the trade war is still on, it's just moved from the front burner to the back burner. Don't get complacent.

And here is the worrisome issue for the bulls. Q1 earnings were up 25.5% YOY, one of the best in my long career. Revenues accounted for 8.3%, margin improvements 8.1%, new tax breaks 7.6%, and share buybacks 1.5%. This means that 35.6% of the total earnings were from one-time only benefits that aren't going to be there next year.

Given that the global economy is slowing down, revenue and margin improvement will probably drop by half next year. That means the best case for Q1 2019 earnings will show a drop from 25.5% to only 8.2%.

It's not a matter of IF the market will top out, but WHEN. Enjoy the bull move while it lasts. It isn't going to be there next year.

I decided to sit out the current leg up in the market. I didn't think it would be big or sustained enough to squeeze in another round trip. Besides, after shooting out 26 Trade Alerts in April earning an eye-popping 12.54% profit, not only was my staff exhausted, so were the followers.

My year-to-date return stands at a robust 19.30%, my trailing one-year returns have risen to 55.59%, and my eight-year sits at an 295.77% apex.

And remember, the market is making this move in the face of rising oil prices and interest rates, always bull market killers.

Of course, nobody at Apple (AAPL) cares about any of this one wit, as its stock blasted through to new all-time highs every day last week. Steve Jobs' creation is on a race to a $1 trillion market capitalization and was worth $930 billion at the market high. That's when Apple will have the same GDP as Russia or Australia.

The dividend yield has fallen to 1.56%. The company is increasingly being viewed as a luxury brand commanding a much higher multiple than the 9X that it earned when it was perceived as a lowly hardware company. By the way, Ferrari (RACE) has a price earnings multiple of 39X versus Apple's current 16X ex-cash.

I'll be raising my target for the stock from $200 to $220 as soon as I get time to write the report. Steve Jobs must be smiling down from Heaven. By the way, this service first recommended Apple as a strong "BUY" in 2010 when the shares traded at $10. That's a gain of 1,900%. Click here for the link.

Apple's stellar gains were part of a much broader move back into technology, which we expected. It turns out that the semiconductor cycle IS NOT ending after all, as predicted by the neophyte coverage of UBS.

Suddenly, all is forgiven at Facebook (FB), as the shares are now 2% short of an all-time high. Amazon is going from strength to strength, with Amazon Web Services' cloud business now accounting for an impressive $50 billion of sales and is growing at a breakneck 50% a year.

It all goes back to my seminal rule of investing that has worked for my entire 50-year career. While much of the rest of the U.S. economy is slowly fading from the scene, TECHNOLOGY ALWAYS COMES BACK!

The last of the Q1 earnings reports will dribble out this week.

On Monday, May 14, at 3:00 PM, we get a deluge of Feds speakers, now that the quiet period from the last meeting is over.

On Tuesday, May 15, at 8:30 AM EST, we receive the April Retail Sales, which has been red hot as of late. Home Depot (HD), a long-time Mad Hedge favorite, reports.

On Wednesday, May 16, at 8:30 AM, the April Housing Starts. Cisco Systems (CSCO) reports.

Thursday, May 17, leads with the Weekly Jobless Claims at 8:30 AM EST, which remained unchanged last week at 211,000, a 43-year low. At 10:00 AM EST, the April Index of Leading Economic Indicators is released, a compilation of 10 forward-looking statistics compiled by the private Conference Board. Applied Materials (AMAT) reports.

On Friday, May 18, we wrap up with the Baker Hughes Rig Count at 1:00 PM EST. Deere & Co. (DE) reports.

As for me, I'll be working in the garden this weekend. It's time to plant the pumpkins if I want nice jack-o-lanterns by Halloween, the tomatoes are thriving, and I will have an ample supply of fresh pepper this coming winter.

Good Luck and Good Trading.

Rolling in the Clover

Mad Hedge Technology Letter

May 14, 2018

Fiat Lux

Featured Trade:

(MEET THE NEW FANG),

(AMZN), (WMT), (FB), (NFLX), (GOOGL), (UBER)

Watching Sotheby's sell off the possessions of David Rockefeller, the memories came flooding back.

A Picasso went for a staggering $115 million, while a Monet fetched $80 million. A leather easy chair estimated at $300 sold for $8,000.

I've seen then all, either at the downtown headquarters of Chase Manhattan Bank, which Rockefeller turned into an art museum, or at dinner parties at his posh Upper East Side mansion.

I was sitting across the desk from Bob Baldwin, the chairman of Morgan Stanley. It was 1982, and I was 30 years old.

He carefully studied my resume in his hand. Then he picked up the phone and hit a button on speed dial to call David Rockefeller.

Rockefeller, the chairman of Chase Manhattan Bank, picked up.

Baldwin said, "I have a John Thomas sitting in front of me." He paused a second, and then hung up.

"He says you're alright," and Bob offered me a job on the spot to get the firm into the international equity business.

That's how I started a long and illustrious career at Morgan Stanley.

I eventually became one of the most successful traders in the company, and at one point accounted for 80% of equity division profits.

It is also where I learned the knowledge that I am passing on to you today through the Diary of a Mad Hedge Fund Trader and my trade mentoring service.

I have David Rockefeller to thank for getting me started.

So, it was with a heavy heart that I learned that he passed away recently at the ripe old age of 101.

Rockefeller was the youngest grandson of oil baron John D. Rockefeller, the founder of the Standard Oil Company. The modern-day spin-offs include ExxonMobil, Chevron, Amoco, and parts of British Petroleum.

The Sherman Antitrust Act was passed specifically to break up Rockefeller's oil refining monopoly.

Rockefeller was America's first billionaire.

Rockefeller could have had an easy life of moneyed leisure in high society.

He chose otherwise.

He grew up in a Manhattan 54th Street mansion attended by armies of nannies and servants, where his parents dressed black tie for dinner every night.

He remembers his doting grandfather, John D., who only gave him dimes "to keep us thrifty."

His mother founded the New York Museum of Modern Art in 1929, for which Rockefeller became chairman in later years.

He took the trouble to get a PhD in Economics from the University of Chicago in 1940, supporting Franklin Delano Roosevelt's deficit spending to end the Great Depression.

The family was horrified, as FDR's 90% maximum tax rate substantially whittled down the family's fortune by the time John Kennedy repealed it in 1962.

I got to know David Rockefeller well during the 1970s when I covered U.S. banking for The Economist magazine, and he spearheaded Chase Manhattan Bank's aggressive international expansion.

Rockefeller became the unofficial ambassador for the brash, unvarnished capitalism of the day. He wreaked establishment.

For a decade, whenever I interviewed major world leaders, such as Zhou Enlai of China, Ferdinand Marcos of the Philippines, Emperor Hirohito of Japan, or Margaret Thatcher of Great Britain, I would often bump into Rockefeller on the way out.

It was a bygone era, when major clients were courted primarily through the social register.

Eventually, international business came to account for 80% of Chase Manhattan's total profits.

It is perhaps fitting that Rockefeller was an early supporter of the construction of the original World Trade Center in downtown Manhattan, just walking distance from his bank.

I used to meet Rockefeller in his cavernous office on the 65th floor of the Chase Manhattan building near Wall Street. He sat behind a polished hardwood desk the size of Montana.

Also known for his immense art collection, almost every floor of the building was decorated with favorite pieces from his personal collection. There was even a Chagall on the way to the men's room.

In perhaps the greatest compliment every paid me, he told me he had 70,000 names in his Rolodex, and I was one of them.

Wow! To be in David Rockefeller's Rolodex! Did you get that mom?

Rockefeller was always charming and gracious to a T. He was the guy who was friendly to everyone, with a great sense of humor, even when he didn't have to be.

He was offered the post of U.S. Treasury Secretary by multiple administrations and turned them down every time. He preferred to spend more time on his prized collection of beetles instead, the largest in the world.

He worked well into his 90s and maintained an office on the 56th floor at Rockefeller Center, which his father had built to create jobs in New York during the Great Depression.

Because I was one of a handful of Morgan Stanley officers who spoke fluent Japanese, I was recruited to the team that sold Rockefeller Center to the Japanese for $1.3 billion in 1989. It was one of the largest real estate transactions in history at that time.

The last time I saw Rockefeller was at a gala black tie event for his 90th birthday at the Museum of Modern Art, where tables were selling for $90,000 a piece.

Rockefeller used the event to announce a staggering $100 million gift to the museum.

So, thank you David Rockefeller for all your help, and a life well lived.

They don't make them like you anymore.

You will be missed.

"It's easier to get out of Cuba than to get out of Facebook," said a market analyst.

Yes, it's Wal-Mart (WMT).

No, I'm not making this recommendation because they let you park your RV in their parking lots at night for free.

And no, I'm not smoking California's biggest cash crop either (it's not grapes).

I predicted as much in my recent research piece, "Who Will Be the Next FANG?" by clicking here.

It is the dawn of a new era with the world absorbing yet another FANG to add to the list of Facebook (FB), Alphabet (GOOGL), Amazon (AMZN), and Netflix (NFLX).

As the tech world powers on to new heights, nothing can slow down these juggernauts.

Let's face it - companies are more lucrative when technical expertise is ramped up and infused into the business model.

Ground zero of the tech movement - Silicon Valley - has helped supercharge the economy and prodigious earnings' results support this thesis.

New innovations will fuel the next level up in the tech arm's race but more crucially, so will new geographical locations.

Instead of throwing a dart at a world map, the locations are a no-brainer because tech scavenger hunts orbit around one idiosyncrasy and that is scale.

Scalability is a sacred word in the tech world.

If a start-up cannot scale up, investors can't imagine future profits, entrepreneurs can't imagine growth, and funding dries up.

End of story.

For instance, Amazon's business model does not mesh kindly with pint-sized Iceland.

Not because Amazon discriminates against Iceland's culinary delicacy of sheep testicles but because the population is only around 330,000 people.

Scale equals success.

Indisputably, every country with an Amazon-esque business is being bid up because big tech firms know how to digitally monetize, effectively out-sourcing an incredibly profitable business model that has worked unabated for the developed world for the past decade or two.

The heightened awareness of existential survival is pitting foreign money against each other in far-flung places jostling for the same digital assets after a decade of cheap financing enriching tech companies.

Remember that first mover advantage leads to dominance in the datasphere because the volume of data is directly correlated to the bottom line.

Examples are rife around the world, for instance Amazon's $580 million purchase of Souq.com, described as the Amazon of the Middle East headquartered in Dubai and the biggest e-commerce site in the Arab world.

E-commerce commands a paltry 2% of sales in the region. That number is poised to explode as digital-savvy, tech Millennials reach peak consuming age and the migration to mobile erupts.

A preemptive strike is usually the most compelling strategy for large cap tech as it pushes out the smaller players, which lack the resources to compete.

Even the corporate offices of Walmart (WMT) in Bentonville, Arkansas, would wholeheartedly agree with me after doling out for its new toy.

Yes, Walmart acquired a 77% share in the Amazon of India, Flipkart, for $16 billion after the real Amazon failed to cut a deal with the most famous e-commerce unicorn in India.

This new development is a game changer.

India is a country that tech executives pinpoint as the future because of its massive population, economic growth, and economic potential foreign investors hope to tap up.

The International Monetary Fund (IMF) has anointed India as the fastest growing economy in 2018, and the 7.4% growth this year will follow with an even sturdier 7.8% in 2019.

Amazon has been well aware of India's ascent. Its CEO Jeff Bezos pledged to invest more than $5 billion in India and Amazon began its e-commerce operation in 2013.

Amazon's early entrance into the Indian e-commerce industry has paid off grabbing 31% of market share putting it in second place behind Flipkart's 40%, according to big data firms.

The Indian e-commerce space was $20 billion in 2017, and by 2019, expect that number to grow to $35 billion.

Walmart CEO Doug McMillon noted that by 2026, the Indian e-commerce industry will surpass $200 billion. When it comes to clothing and fashion, Flipkart has a 70% share in India.

Even more valuable than the economic growth is the new pipeline of tech talent that will help Walmart compete with Amazon.

The Trump administration's crackdown on H-1B visas that Silicon Valley utilizes to bring developers to American shores has forced American tech companies to implement a work-around.

Essentially, the only difference now will be that the past recipients of H-1B visas will be sitting in an air-conditioned office in Bengaluru, India, until the visa documents come through.

Flipkart has a deep pipeline into the best engineering schools in India and the staff of more than 30,000 employees work on Indian wage levels.

This deal is one of the biggest talent grabs of tech developers the world has ever seen. And this group has the know-how of building an Amazon-style digital marketplace platform from zero.

The Flipkart investment comes after Walmart's purchase of Jet.com, an e-commerce company based in Hoboken, New Jersey.

The $3.3 billion purchase of Jet.com in 2016 was the beginning of Walmart's digital strategy, and it has come a long way in a very short time.

Walmart is now a vaunted member of the FANG group and has a new army of developers to back up this claim.

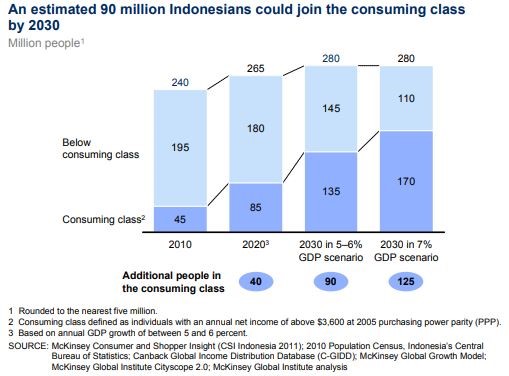

Glancing at the opportunities to scale, Indonesia is clearly the runner-up behind India.

Indonesia has been tagged as a tech new battleground with a population of 260 million in 2016 and growing.

The country has a medium age of 28, meaning this young population could turn into a reliable source of new tech developers who traditionally are young and digital natives.

Economic prosperity has been welcomed with open arms to this tropical island nation. It is poised to become the seventh largest economy by 2030, up from its rank of No. 16 today, creating a burgeoning middle class with newfangled discretionary spending.

The rural migration to urban environments will add another 90 million people living in Indonesian cities by 2030, while Internet access is growing by 20% each year in Indonesia.

Goldman Sachs recently issued a note to investors citing Indonesia's unbridled potential.

Capital is pouring into Indonesia at a breakneck speed with Alibaba investing $1.1 billion into Tokopedia, the Amazon of Indonesia.

Companies are coming to the stark realization that the domestic low hanging fruits have been picked, and aging developed countries are turning to undeveloped regions of growth to advance business objectives.

This is why South East Asia has been bombarded with an onslaught of Japanese, Korean, and Chinese investments and not only in the tech sector.

The Far East powerhouse countries are battling each other in Southeast Asia for consumer goods, infrastructure, high speed trains, and of course technology.

Uber just sold its Southeast Asian ride-sharing asset Grab to China's DiDi Chuxing and SoftBank for $2 billion.

The Southeast Asian region is one of the hottest places to make a deal because of a lack of FANG occupancy.

Walmart sold off on the Flipkart news because of the potential impairment to margins, but this move is a long-term positive for Walmart shareholders.

Flipkart does not turn a profit and Walmart is still solely judged by earnings. Unfortunately, it does not receive the same license to focus on growth like Tesla, Amazon, and Netflix.

However, I have a hunch that down the road, investors will agree this move by Walmart's McMillon was as shrewd as can be.

Like the colonial powers of yore, India and Southeast Asia are likely to be divvied up.

American companies already own more than 70% of market share in India e-commerce.

India is the biggest democracy in Asia and a staunch ally of the United States.

India's frosty relationship with China due to border spats and communist origins will stunt China's ability to take over and expand in India.

However, Southeast Asian countries are more likely to go the way of Cambodia, which is reliant on Chinese money to fund new initiatives, hamstrung by Chinese debt up to its eyeballs, and acquiesced political capital to the Mandarins.

Chinese investment's path of least resistance is Southeast Asia. This progression will be facilitated by the sizable Chinese expat population that resides in Indonesia, Vietnam, Thailand, Philippines, Myanmar, Laos and Cambodia.

Long-term shareholders of Amazon and Walmart will be rewarded. However, expect a few more Indians walking around Bentonville, Seattle, and Hoboken.

_________________________________________________________________________________________________

Quote of the Day

"My life is now a constant assessment of whether what's happening in real life is more entertaining than what's happening on my phone." - said television host Damien Fahey.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 11, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON),

(MAY 9 BIWEEKLY STRATEGY WEBINAR Q&A),

(FB), (MU), (NVDA), (AMZN), (GOOGL),

(TLT), (SPX), (MSFT), (DAL),

(MAD HEDGE DINNER WITH BEN BERNANKE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.