While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 22, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE MAY 23 GLOBAL STRATEGY WEBINAR),

(CHINA'S BIG TRADE WIN),

(SPY), (TLT), (UUP), (USO), (GLD), (SOYB),

(HOW TO USE YOUR CELL PHONE ABROAD)

My next global strategy webinar will be held live from Silicon Valley on Wednesday, May 23, at 12:00 PM EST.

Co-hosting the show will be Mad Day Trader Bill Davis.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - May 23, 2018" or click here.

My phone started ringing on Sunday afternoon as soon as the futures markets opened in Asia. The U.S. had reached agreement with China on trade and the Dow futures were up 200 points.

Had the next leg of the bull market begun? ?Was it time to buy?

I asked what were the specifics of the deal. There weren't any. I asked about generalities. Those were absent as well.

All they knew was that the U.S. was suspending threatened tariff increases in exchange for a vague Chinese promise to buy more U.S. exports over the long term.

It was in effect a big Chinese win. The development allows the Middle Kingdom to do nothing but stall for time until the next U.S. administration comes to power regardless of which party wins. The Chinese think in terms of centuries, so waiting three more years for a better negotiating backdrop is no big deal.

It vindicates my own call on how the Chinese trade war would play out. After a lot of threats and saber rattling, the administration would achieve nothing, declare victory, and go home.

Traders should NOT be buying this pop in stock prices on pain of death. All that will happen is that stocks will trade back up to the top of the recent range, and then stall out once again as we slide back into slow summer trading. In fact, all we have accomplished is to revisit last week's high in stocks.

Stocks (SPY) weren't buying this trade agreement for two seconds, nor were bonds (TLT), foreign exchange (UUP), gold (GLD), or energy (USO). Not even the agricultural markets were believing it. Soybeans (SOYB), the commodity most affected by the China trade, were up a measly 2.45%. If markets really believed something substantial was afoot they would be limit up three days in a row. I've seen this happen.

It was obvious that little was accomplished when you saw the endless parade of administration officials praising the deals merits. My half century of trading experience has taught me when someone is working so hard to sell you a bridge, you look the other way.

And here is the problem. Beyond cutting-edge technology, there's nothing that China HAS to buy from the U.S. China's largest imports are in energy and foodstuffs, both globally traded commodities.

The oil and gas coming out of America looks pretty much like the Saudi Arabian and Russian kind. U.S. energy infrastructure is already groaning at the seams as it approaches 11 million barrels a day.

To double that from current levels just to fill the trade gap with China would require a multi-decade effort financed with trillions of dollars in private capital just to produce more oil with prices at a three-year high. In other words, it isn't going to happen.

The same is true with agriculture. I doubt there is a single farmer in the country willing to risk his own money to increase production on the back of the China deal. Rainfall is a much bigger concern.

In the end, stocks will eventually rise to new highs by the end of the year, just not right now. And they will do so on the back of the prodigious earnings growth of U.S. companies, which has been expanding at a breakneck pace for nearly a decade.

It is notable that the only major index that hit new highs today was the small cap Russell 2000 (IWM) where the constituent companies essentially do NO trade with China.

To believe otherwise would be giving the cock the credit for the sun rising, which happens every morning like clockwork.

It Worked Again!

I constantly receive emails from readers around the world inquiring how I accomplish this or that in my far-reaching travels around the globe.

After all, I have visited 125 countries over the past 50 years. What's more, I have run the Mad Hedge Fund Trader Global Empire for the past 10 years, on the fly, from a laptop and a cell phone.

Given that Europe is now 20% cheaper than last year, and 40% less expensive than four years ago, an increasing number of you are going to cross the pond for your summer vacation.

That certainly was the case this year, when I saw a substantially larger number of American families traveling with children.

For the first time in decades, I am finding gaggles of American students in train stations backpacking their way around the continent with a Eurail Pass, much like I did in the 1960s.

With the right information, your cell phone can make your trip vastly more enjoyable, while preventing it from becoming wildly expensive. In fact, it is hard to imagine how we got along without them. So here goes:

1) Hardware

U.S. issued phones only work abroad if you have an international SIM card, as do most iPhones. Before you leave, call your cell phone provider and ask if you have an international SIM card in your phone.

Each company has exactly one person who knows how this works. If you don't have one, get one. The person at Verizon is named Maria.

Upon arriving abroad, the truly adventurous remove their American SIM cards and install a local one, signing up for a local plan. This can cut your international bill to as little as $10 a month.

You just reinstall your U.S. SIM card when you return home. However, as SIM cards are too small for me to see, I have yet to attempt this bit of technological acrobatics.

If you keep your U.S. SIM card, to make a call when abroad you have to assume you are still in the United States, since you have a U.S. number.

To call another country in Europe just hold down the "0" in your phone number pad until a + sign appears. Then dial 011 for the international exchange, and the numbers for the local country and city codes.

To call the U.S. from abroad, hold the "0" until a + sign appears, then dial 1, then the area code and number.

2) Roaming

International roaming can cost a fortune. Before I figured out the game, I was spending $500 a week downloading email, newspapers, and research reports. TED talks are the worst, costing at least $25 each to watch over foreign air.

So it is crucial to turn off the roaming feature on your phone. On an iPhone you do this by going into settings, then cellular data, and then turning the cellular data function off. Do this, and you will still be able to receive voice calls, such as from a lost traveling companion in distress.

Here is the key rule: Only access the Internet through the free Wi-Fi at your hotel. Download all your big files, news, email here. This saves you a ton of money.

You will need to turn on you cellular roaming to get your apps to work. But if you have already downloaded the big files, the additional cost to check your stock prices, weather forecast, or the way to a sought-after restaurant will be minimal.

Another tactic is to de spam your email accounts. Find all of those useless, unsolicited marketing emails promising get rich quick schemes, dating opportunities, or male enhancements. Then mark them as spam (unless they are from me). When you do use your cellular roaming, they won't eat up all of your data budget.

Warning: Start doing this every day a month before you leave. That's how much spam is out there. You can always unmark email as spam from senders you like, such as the local public library, when you return home.

American companies finally now offer international plans. This year Verizon is offering 250 MB of data, 250 emails and text messages, and 250 minutes of talk time for $80 a month. This is nowhere near enough, but it is a start.

Every time you cross a border, the local cell phone company will text you with usage and overage rates, which is usually $25 per 100 MB of data, or 10 cents a minute for voice or messaging.

You can find the Americans on a train when their phones all ping at once, often when you cross a bridge, or come out of a tunnel, or land at an airport.

3) Apps

Google Maps can provide perfect, detailed directions on how to reach the most remote destinations, whether you are in the Istanbul Bazaar, the Marrakech Medina, or the back alleys of Rome.

You can choose instructions whether you are on foot or driving. As soon as you arrive at your hotel, type in the address so you can always find home. The really great thing about Google Maps is that, unlike paper maps, it tells you where you are.

Just be careful not to bump into another traveler who is similarly staring at his cell phone to find his way (I walked straight into a concrete lamppost once in Tokyo and almost knocked myself out).

Be sure to download a free flashlight app before you leave home. These are great for navigating your way down dark streets, reading a menu in an ill lit restaurant, or finding the keyhole in your door.

The weather app is indispensable. It will allow you to fine-tune your travel plans up to a week in advance.

Being an ex-Boy Scout, I find a compass app particularly useful. Knowing where magnetic north is comes in handy when using those free tourist maps.

Stock market apps will bring you the assurance that the Mad Hedge Fund Trader Alerts are working well and paying for the entire trip. Remember that the New York Stock Exchange opens at 3:30 PM on the European continent because of the time change.

Travel in Europe is made much easier when you speak seven languages, although it's hard to find a living Roman centurion to practice your Latin. Limited to the King's English?

No problem! Get free language apps for the countries of your destination. Sometimes, the translation of a single word can mean the difference between life and death.

It's better to pay a couple of bucks and get the expanded vocabulary apps so you never come up short. That is how I found out yesterday that "sardi" is a type of Italian pasta unique to Northern Italy, and not a sardine.

You may have your own special apps you use. I like to visit my Tesla occasionally, verifying that it is still in my garage and fully charged. I also like to check the daily output of my solar panels to prove that my house is still standing.

Coming from California, I can never be sure. Google Earth is useless here because the pictures can be up to six months old. They are obviously lacking on satellite time.

4) Security

Identity theft is exploding in Europe, thanks to the close proximity of a hacker's paradise in unpoliced Eastern Europe. Never access your financial accounts through a free public network that is not password protected. It's like leaving your wallet in the middle of Saint Mark's Square in Venice and expecting to find it there an hour later.

Don't even attempt an innocent checking of balances. And I don't mean a password like 123456789. You can count on your accounts getting cleaned out. There is no greater bummer than being told by a hotel clerk that you can't check out because all of your credit cards have been canceled.

If you do need to check your balance on the run, do it only through your cell phone, and only over a cell network (no Wi-Fi), where an extra level of security is provided. The same is true with inter-account transfers. This can be expensive, but it is worth it.

Please note, that in China, the security situation is becoming so severe that many multinationals will not permit employees to bring their laptops. They have adopted "cell phone only" policies in the Middle Kingdom, where the security is so much better.

Too many western visitors were getting their entire hard drives copied by these crooks searching for western intellectual property, in addition to the easy pickings among bank accounts.

5) Entertainment

OK, so watching Wheel of Fortune in German, French, or Italian is not your cup of tea. Before you leave home and still have reasonable broadband, download a batch of old movies from iTunes, Netflix, or Amazon to your laptop.

That way, you have something to do in the middle of the night waiting for your jet lag to adjust. Bring a 6-foot HDMI cable and you can change the input channel on your hotel TV, plug in, and watch your flick there.

6) Bandwidth

European bandwidth can vary all over the map, from lightning fast (the Ritz Carlton in Barcelona) to painfully slow (Agadir, Morocco). Europeans just don't seem to grasp how fast apps are growing, and bandwidth demand is accelerating.

More than a few times, I have had to crawl under front desks and reboot routers to get systems working again.

Suffice it to say, the more you pay, the faster your Wi-Fi. If you check into your hotel and see half the residents sitting in the lobby checking their email, it is not a good sign.

Wi-Fi was invented in the U.S., where 2-by-4 wooden studs and 1-inch sheetrock used in construction is common.

Two-foot thick stonewalls typical in historic European city centers (where you will want to stay) are terrible for Wi-Fi range, and it is not unusual to have no access from your room.

If Apple or Microsoft want to upgrade your operating system on the road, wait until you get home. Otherwise, you might crash your system and not be able to use your device until you return home.

7) Tickets

It is now possible to do a search of your next foreign city for coming events while you are on a train, buy tickets online, and show the ticket on your phone to gain admission.

I also have settled a couple of checkout disputes proving that I prepaid hotel stays by displaying proof of payment from my PayPal or bank account.

Incredible, but true.

I will be following this piece up with another on general travel tips in a couple of weeks entitled Travel Tips from a Pro, which I am now working on.

In the meantime, enjoy your trip.

Mad Hedge Technology Letter

May 22, 2018

Fiat Lux

Featured Trade:

(THE BIG WINNERS IN THE SPORTS BETTING DECISION),

(LSE:PPB), (LSE:WMH), (LSE:888), (BYD), (IGT), (SGMS)

"Who knew the blockbuster this year would be a horror show," said Tony Crescenzi, market strategist and portfolio manager at bond giant, PIMCO.

Up to my elbows in the market for the past 50 years, I have seen my share of paradigm shifts transforming the world and markets with it.

The Supreme Court delivered another momentous decision overturning the 1992 decision to ban sports betting in most states.

The aftermath is decisively pro-business with a profusion of domestic and international winners that can bask in the glow of a future windfall swelling the industry coffers to the tune of $150 billion per year.

The estimated amount of illicit sports gambling activity that goes unreported is $150 billion, and that will migrate to official channels, but I bet the sum is vastly higher.

Sports betting is as American as apple pie.

This is highly evident each year with the NCAA men's basketball tournament sucking in eyeballs resulting in more than $5 billion in lost worker productivity.

The annual Super Bowl is practically an institution in this country as well as quarterback Tom Brady's starting spot on Super Bowl Sunday.

Not only is this ruling pro-business, but the verdict is another overwhelming win for technology and the state of Nevada.

Nevada was one of the few states to receive an exemption from the 1992 ruling, and its sports betting books have developed uninterrupted for the past 26 years.

The 26-year head start will mirror Amazon's seven-year head start in the cloud catapulting existing operations to the top of the food chain.

Sports team owners from all the major sports leagues are jumping with joy as the team valuations of each franchise received another boost with fresh capital pouring in like an overflowing dam.

This development effectively creates a digital sports industry operating parallel to the official leagues and will have business synergies galore.

Sports leagues are about to welcome a new tidal wave of viewer interest that seeks to capitalize on the new synergies.

Options derivative contracts on sports games could be another product down the road for this budding industry.

The two best tech companies in position to take the court ruling and turn it into material business are the leading fantasy sports providers DraftKings and FanDuel, which are both private companies.

In 2016, these two companies attempted a merger that would have given the company a 90% monopolistic market share and more than 5 million customers.

The following year, the Supreme Court blocked the merger as DraftKings continued to grow in excess of 8 million users.

Fantasy sports and the entire e-sports genre is experiencing skyrocketing popularity with youth (physical) sports participation falling off a cliff.

New York-based FanDuel and Boston-based DraftKings have a wide-reaching digital footprint in fantasy sports that is supported by rich tech architecture.

The abundance of tech capabilities will make the crossover into sport wagering seamless.

NumberFire, a sports big data company, was bought up by FanDuel in 2015, and has close to 1 million subscribers parsing through its analytics.

The sports big data movement was christened by Bill James who coined the study of statistics in baseball as sabermetrics. That was the platform used by the Oakland Athletics' General Manager Billy Beane that later developed into a movie and book called Moneyball written by Michael Lewis starring Brad Pitt.

FanDuel was able to poach an entire team of sports tech developers when Zynga 365 Sports went bust after a few sports titles failed to stick and FanDuel picked up 38 of the 42 leftover developers in 2015.

DraftKings has pounced its increasing headcount from 425 to 700 at its Boston headquarters taking advantage of the new legislation to ramp up the required staff.

Plundering talent across the pond, too, leaving no stone unturned is a statement of intent.

DraftKings anointed Sean Hurley, who cut his teeth as head of U.K. B2B sports betting technology supplier Amelco and niche online sports book Whale Global, as its new head of sportsbook.

Tapping the U.K. for sports tech talent makes sense.

The U.K. legalized sports betting in 1961. The Brits bet more than $20 billion last year.

There is an affluence of sports betting tech know-how for hire in Europe. American companies would be naive not to pursue staff reinforcements at a time when companies are fortifying talent levels.

Thus, opening up an extensive market full of sports-crazed fans gives U.K. firms a tasty new opportunity to pursue with existing foundations in place.

Upon the announcement, online sports book outfit 888 Holdings (LSE:888) exploded 15% on the London Stock Exchange.

It's subsidiary 888sport was the first foreign company to receive a license to operate by the Nevada Gaming Commission in 2013.

Paddy Power Betfair (LSE:PPB), based in Dublin, is another company poised to benefit and has launched a takeover bid for FanDuel to seize further gains in market share.

Discussions are ongoing.

This all comes after buying U.S. headquartered Draft, a fantasy sports rival, for $48 million.

There are obvious synergies between fantasy sports and sports betting as they both process ample amounts of data that help set the odds for each game.

Online sports betting is another industry that is waiting for Artificial Intelligence (A.I.) to enhance the betting products, creating a plethora of new business opportunities.

British firms use the same in-game add-on product strategy that is popular with e-gaming franchises such as Fortnite.

In-game bets allow gamblers to wager on specific events within a game such as the first scorer of a soccer match or the first player to receive a yellow card.

Niche betting has proved hugely popular.

Paddy Power has already made inroads in America with a horseracing and greyhound racing TV channel and sportsbook called TVG and an online casino in the state of New Jersey.

Cross-border talent poaching will heat up as premium dollars are up for grabs favoring the first movers that can retain business.

The last clear-cut U.K. winner is William Hill (LSE:WMH), which already has an outsized presence in America by way of its purchase of three Nevadan sports books: Lucky, Leroy's, and Club Cal Neva, for a grand total of $53 million.

The deal gave William Hill an 11% market share of sports book revenues in Nevada. The British bookmaker's sports book can be seen dotted all over Las Vegas and Reno thoroughfares.

CEO of William Hill, Philip Bowcock chimed in saying America will benefit with an injection of "100,000 new jobs" stateside, and consumer safety will increase with the need to bet under the table swept into the dustbin of history.

The U.S.-based fantasy sports powerhouses, U.K.-based sports betting sites, and the State of Nevada are the unwavering victors.

The last stratum of indirect winners are the companies that manufacture sports betting equipment.

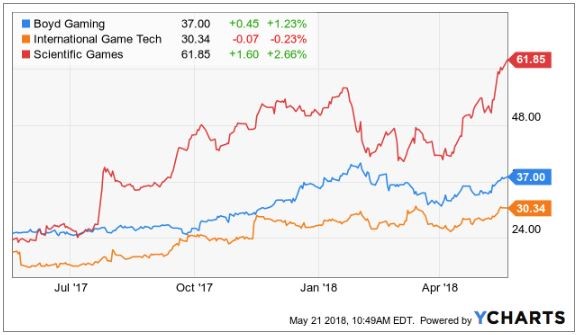

No doubt that states will likely set up brick-and-mortar sports betting establishments. Companies such as Boyd Gaming (BYD), Scientific Games Corporation (SGMS), and International Game Technology (IGT) could see a nice revenue bump stemming from the equipment they manufacture.

_________________________________________________________________________________________________

Quote of the Day

"Cybersecurity is not only a question of developing defensive technologies but offensive technologies, as well," said President of the United States Donald J. Trump.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 21, 2018

Fiat Lux

Featured Trade:

(JOIN ME ON THE QUEEN MARY 2 FOR THE MAD HEDGE JULY 11, 2018 SEMINAR AT SEA),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or NO TRADE),

($INDU), (SPY), (TLT), ($TNX), (CPB)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.