While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 15, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 15, 2018, DENVER, CO, GLOBAL STRATEGY LUNCHEON)

(GET READY FOR THE COMING GOLDEN AGE),

(SPY), (INDU), (FXE), (FXY), (UNG), (EEM), (USO),

(TLT), (NSANY), (TSLA)

Mad Hedge Technology Letter

May 15, 2018

Fiat Lux

Featured Trade:

(HARD TIMES AT UBER)

(UBER), (NFLX), (GOOGL), (AMZN), (GRUB)

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950s, and which I still remember fondly.

This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

What I call "intergenerational arbitrage" will be the principal impetus. The main reason that we are now enduring two "lost decades" of economic growth is that 80 million baby boomers are retiring to be followed by only 65 million "Gen Xers."

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and "RISK ON" assets such as equities, and more buyers of assisted living facilities, health care, and "RISK OFF" assets such as bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward six years when the reverse happens and the baby boomers are out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xers being chased by 85 million of the "millennial" generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes.

The middle-class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

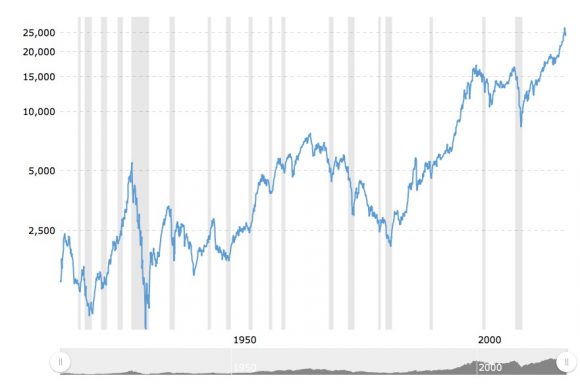

The stock market rockets in this scenario. Share prices may rise very gradually for the rest of the teens as long as tepid 2% growth persists. A 5% annual gain takes the Dow to 28,000 by 2019.

After that, after a brief dip, we could see the same fourfold return we saw during the Clinton administration, taking the Dow to 100,000 by 2030. If I'm wrong, it will hit 200,000 instead.

Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well.

The 100-year supply of natural gas (UNG) we have recently discovered through the new "fracking" technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oilfields is also unlocking vast new supplies.

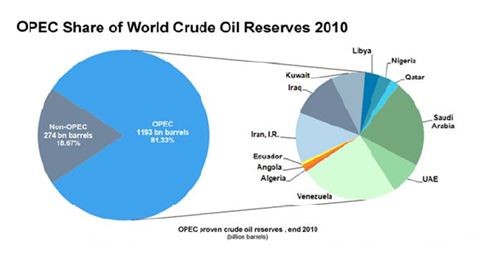

Since 1995, the United States Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC's share of global reserves is collapsing.

This is all happening while automobile efficiencies are rapidly improving and the use of public transportation soars.

Mileage for the average U.S. car has jumped from 23 to 24.7 miles per gallon in the past couple of years, and the administration is targeting 50 mpg by 2025. Total gasoline consumption is now at a five-year low.

Alternative energy technologies will also contribute in an important way in states such as California, accounting for 30% of total electric power generation by 2020, and 50% by 2030.

I now have an all-electric garage, with a Nissan Leaf (NSANY) for local errands and a Tesla Model S-1 (TSLA) for longer trips, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It will also flip the U.S. from a net importer to an exporter of energy, with hugely positive implications for America's balance of payments. Eliminating our largest import and adding an important export is very dollar bullish for the long term.

That sets up a multiyear short for the world's big energy consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive. Of course, it's great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos.

But at the enterprise level this is enabling speedy improvements in productivity that are filtering down to every business in the U.S., lowering costs everywhere.

This is why corporate earnings have been outperforming the economy as a whole by a large margin.

Profit margins are at an all-time high. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development.

When the winners emerge, they will have a big cross-leveraged effect on economy.

New health care breakthroughs will make serious disease a thing of the past, which are also being spearheaded in the San Francisco Bay area.

This is because the Golden State thumbed its nose at the federal government 10 years ago when the stem cell research ban was implemented. It raised $3 billion through a bond issue to fund its own research, even though it couldn't afford it.

I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday.

What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver's seat on these innovations? The USA.

There is a political element to the new golden age as well. Gridlock in Washington can't last forever. Eventually, one side or another will prevail with a clear majority.

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now, but for which nobody wants to be blamed.

That means raising the retirement age from 66 to 70 where it belongs and means-testing recipients. Billionaires don't need the maximum $30,156 annual supplement. Nor do I.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cuts defense spending from $800 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else.

I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up.

A Pax Americana would ensue.

That means China will have to defend its own oil supply, instead of relying on us to do it for them. That's why they have recently bought a second used aircraft carrier. The Middle East is now their headache.

The national debt then comes under control, and we don't end up like Greece.

The long-awaited Treasury bond (TLT) crash never happens. The Fed has already told us as much by indicating that the Federal Reserve will only raise interest rates at an infinitesimally slow rate of 25 basis points a quarter.

Sure, this is all very long-term, over-the-horizon stuff. You can expect the financial markets to start discounting a few years hence, even though the main drivers won't kick in for another decade.

But some individual industries and companies will start to discount this rosy scenario now.

Perhaps this is what the nonstop rally in stocks since 2009 has been trying to tell us.

Dow Average 1908-2018

Another American Golden Age is Coming

Uber has seen a ferocious challenge to its business model of late. It seems everything it touches turns into fool's gold.

It is easy to assign blame to the current CEO, but Dara Khosrowshahi was shoehorned into a difficult situation after previous CEO Travis Kalanick defiantly departed leaving the company in tatters in his wake.

What could go wrong went wrong.

The company was purged of its license to operate in London, which was one of its highest transactional cities.

Uber boasted a ridership of 3.5 million and sub-contracted 40,000 drivers in London that singlehandedly wiped out the Cockney black cab industry.

The land of fish and chips has not exactly been kind to Uber with the British seaside resort city Brighton the next location to excommunicate Uber from its sandy shores.

Uber's massive data breach of 2016, which took Uber a full year to publicly disclose, of 25.6 million names, 22.1 million mobile phone numbers, and 607,000 driver's license numbers was cited as one of the reasons Uber's license in Brighton was discontinued.

Is there a way back for CEO Dara Khosrowshahi?

The future looks turbulent at best.

Khosrowshahi has left no stone unturned carrying out his search for a new CFO. Uber has not had a CFO since 2015, and a CFO is required to shepherd the company through the IPO process.

Prospective candidates will not touch this position with a 10-foot pole.

Several high-profile hopefuls have already rebuffed offers.

It was painfully obvious to onlookers last week at Uber's Elevate conference in Los Angles that Alphabet (GOOGL) is dominating every potential business that Uber desires to penetrate.

Waymo, Alphabet's autonomous driving technology arm, is miles ahead of Uber after developing in secret for many years.

Waymo's self-driving testing began in 2009 while Uber's first test was carried out in September 2016 in Pittsburgh, conceding a seven-year head start to bitter rivals.

Even worse, Uber's trials have been sidelined as of late because of a casualty in the Phoenix program. Arizona is on the verge of removing Uber from possible future tests along with California making Pittsburgh the last place left to consolidate operations.

At the Elevate conference, Khosrowshahi elucidated Uber's roadmap to industry professionals, and his synopsis was largely underwhelming.

Khosrowshahi broke down the future into three easy-to-understand stages.

In the next two to three years, stage one consists of focusing on improving existing algorithms, enhancing ride share transactions, and expanding to different locations widening the companies ride-share footprint.

Stage 1.5 detailed refining its Uber Eats segment seizing further market share from Grubhub (GRUB) and Amazon (AMZN), the two biggest rivals.

In two to five years from now, stage two entails ramping up the e-bike segment through recently acquired e-bike firm Jump.

Lastly, stage three was proposed to happen in five to 10 years and encompass growing a newly minted air-taxi division called Elevate.

Up until today, Uber's core business has been an unmitigated failure of massive proportions.

In the fourth quarter of 2016, Uber hemorrhaged $2.8 billion then followed up the fourth quarter in 2017 with a $4.5 billion loss, a stark reminder that profits are hard to come by in the tech world.

If losses are what investors want, Uber gives it to you in spades.

If it cannot successfully monetize the core business using cars, the e-biking future is dead on arrival.

Stage 1.5 is all designer chocolates and fancy roses now because growth and margins remain healthy. However, this industry is fraught with booby traps that I chronicled in the recently published story about Grubhub (GRUB).

Stage three was a division that Khosrowshahi reviewed several times after he took the top job and it made the cut after deep contemplation.

Uber plans to start conducting trials in 2020 in Dallas or Los Angeles with the hope of commercial operations starting in 2023.

This timeline is wishful thinking because regulators would never grant operational authority to Uber in a mere five years when it cannot even succeed on asphalt with its self-driving technology.

Lamentably, Alphabet's co-founder Larry Page has an ace up his sleeve.

Since last October, stealth flight trials have been carried out in New Zealand by firm Kitty Hawk led by Sebastian Thrun one of the creators of Waymo, which is developing autonomous flying taxis.

Kitty Hawk was developed for years in secret and personally backed by Larry Page's personal wealth.

He has already poured more than $100 million of his own money into this venture.

To further develop its business, Kitty Hawk was forced to decamp to New Zealand as the Federal Aviation Administration (FAA) in America lacks a path to certification and commercialization.

New Zealand has embraced the revolutionary start-up, and New Zealand is the first country poised to develop a functional robo air-taxi network.

Kitty Hawk's hopes and dreams rely on the aircraft Cora. Please click here to visit its website for more information.

Cora is an all-electric affair powered by batteries with a 36-foot wingspan.

This meshes perfectly with New Zealand's hope to be carbon free by 2050.

Cora has been manufactured with capabilities of flying at heights up to 2,950 feet and a range of 62 miles.

New Zealand has bet the ranch on aerospace technology allowing even marginal start-ups within its borders such as Martin Jetpack, the first commercially sold jetpack, operating with a flight ceiling of 2,500 feet and sold at a starting price of $150,000.

It is ironic that Uber chose to host an aerial-taxi conference considering it is not the company building the flying taxis.

This is the crux of the problem in which Uber finds itself.

It does not produce anything unique.

The biggest winners that take home the lion's share of the spoils are the firms that create a proprietary product that cannot be replicated easily such as Netflix's original content or Google's advanced search engine.

The heavy lifters gain control and can dictate the path toward monetization.

Page's Kitty Hawk is in the driver's seat with the best technology and Uber's Khosrowshahi recently met with Thrun pitching his idea of partnering up.

Expectedly, Kitty Hawk declined to become buddies because nothing can be gained by collaborating with Uber.

Kitty Hawk stated that it plans to develop an app for its own robo-flights, which could crush Uber's dream of being the end all be all of transportation apps.

At the end of the day, Uber is just an app matching drivers and passengers, and creating this app is highly replicable.

It takes billions upon billions of dollars to build an autonomous aerial taxi from scratch. Uber's inability to produce aircraft gives it little negotiating power down the line.

On that note, Uber announced a partnership with NASA to build an air traffic control system, which would logically be used to construct landing ports similar to a helipad for aircraft to land.

By carving out a sliver of the industry mastering port construction, it gives Uber a narrow entranceway into the future of aero-taxi industry albeit a weaker strategic position than Page's Kitty Hawk.

Another day and another loss to Alphabet. Wave the white flag.

Each loss leads to the need for more funding.

More funding has brought on more losses for Uber in a vicious cycle that has seen Uber's valuation slip at the last round of financing.

In the next five years, onlookers can expect much of the same from Uber - underperformance in the form of accelerated losses from its core ride-sharing business.

Capital is disappearing into a black hole and the monetization of Uber Eats and Jump is nothing about which to boast.

These are side businesses at best.

The road map is wishy-washy at best. Uber's Elevate division could turn out to be lipstick on a pig hyping up the company for its 2019 IPO to attract more dollars - the same reason it needs to recruit a new CFO.

The IPO road show will give Uber a platform to explain how it plans to curtail losses. A miracle is required for Uber to finally turn into a profitable business by the time it goes public.

To visit Uber's Elevate division to watch a video of its version of the future of aerial taxis, please click here.

Kitty Hawk's Cora in New Zealand

_________________________________________________________________________________________________

Quote of the Day

"A computer once beat me at chess, but it was no match for me at kickboxing." - said American comedian Emo Philips.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.