When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 4, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON)

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or NEW ALL-TIME HIGHS AND NEW ALL-TIME HIGHS),

(AAPL), (FB), (AMZN), (MSFT), (TLT)

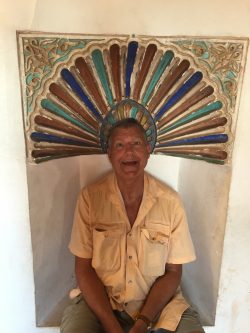

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Philadelphia, PA, at 12:00 noon on Wednesday, June 13, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $238.

I'll be arriving at 11:45 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

Mad Hedge Technology Letter

June 4, 2018

Fiat Lux

Featured Trade:

(THE INNOVATOR'S DILEMMA),

(UBER), (WMT), (SNAP), (MSFT), (GOOGL), (AAPL), (GM), (IBM)

We knew the May Nonfarm Payroll Report was coming in hot when the president leaked the numbers ahead of time. He tweeted that he "Was looking forward to" the numbers hours before the official release.

Last month, when the report was weak, we heard nary a word from Twitter. Just add that to the ever-growing list of unpredictables we traders have to deal with on a daily basis.

As for myself, I was looking for robust numbers last Tuesday when I piled on an aggressive, highly leveraged short position in the bond market, right at the four months highs. When bonds collapsed my reward was a 62.50% profit in only three trading days.

In the blink of an eye, we have made back half of the drop in interest rates prompted by the Italian political crisis. Ten-year U.S. Treasury yields plunged from 3.12% all the way down to 2.75% and are now back up to 2.92%. Bonds have almost fallen three points in three days.

This trade instructs you on the merits of going outright long options instead of more conservative spreads when you expect a very sharp, rapid move in the immediate term.

The result was to take the performance of the Mad Hedge Trade Alert Service to yet another all-time high. Those who signed up at any time in the past 12 months have to be extremely happy.

After one trading day, my June return is +2.94%, my year-to-date return stands at a robust 23.31%, my trailing one-year return has risen to 59.20%, and my eight-year profit sits at a 299.78% apex.

The payroll report suggests that the nine-year economic expansion will easily growth to 10. Never mind that we are putting it all on an American Express card and that our kids are going to have to pick up the tab. For now, it's happy days.

That means my 2018 year-end forecast is alive and well for a (SPY) of 3,000. If earnings continue to grow at a 25% annual rate and you assume a modest 17.5 X, getting there is a chip shot. Next year is another story, when year-on-year growth rates fall to zero.

The jobs report came in at 223,000 versus the three-month average of 175,000, and the Headline Unemployment Rate dropped to 3.8%, a new decade low. Average Hourly Earnings rose to an inflationary 0.3%.

Retail gained 31,0000 jobs, Health Care 29,000, and Construction 25,000. Only Temporary Workers lost 7,800.

The broader U-6 "discouraged worker" unemployment rate fell to 7.6%, a 17-year low.

The major hallmark of the week was an upside breakout of technology. Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), and Facebook (FB) all hit historic highs.

I don't know why tech is breaking out here. Maybe the market is discounting another round of blockbuster quarterly earnings that starts in two months. Possibly the tech growth rate is accelerating at the granular level.

Perhaps there is nothing else to buy. But for whatever reason, tech is going up and I want in. Tech is the secular growth story of our generation and will remain so for the foreseeable future.

The smartest that I have done this year is to start my Mad Hedge Technology Letter in February as it added 60 hours of research into tech companies into our research mix. As a result, the readers are swimming in profits.

This coming week is nearly clueless in terms of hard data releases.

On Monday, June 4, at 10:00 AM, we get May Factory Orders.

On Tuesday, June 5, May PMI Services is announced.

On Wednesday, June 6, at 7:00 AM, the MBA Mortgage Applications come out.

Thursday, June 7, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 11,000 last week from a 43-year low.

On Friday, June 8, at 8:30 AM EST, we get the Baker Hughes Rig Count at 1:00 PM EST, which rose by only 1 last week.

As for me, I will be glued to my TV watching the local Golden State Warriors trounce the Cleveland Cavaliers. That's providing they can overcome LeBron James, who seems to be a force of nature.

Good Luck and Good Trading.

New Highs!

I must confess, innovation can't be taught.

You are innovative, or you aren't. Don't pretend otherwise.

Innovation drives companies to outperform.

The economic environment becomes more cutthroat by the day rendering complacent companies obsolete.

Top-quality innovation leading to outstanding entrepreneurship is a well-traversed theme transcending industries across the American economic landscape.

The reservoir of innovation in 2018 is primarily flowing from one narrow source - the tech sector.

This is the primary motive for many adjacent industries to incorporate tech expertise into existing and commonly ancient legacy systems.

Tech promises laggards a ride atop the gravy chain.

In many instances, these companies are grappling with existential threats from all directions.

The best example is Walmart (WMT), which effectively mutated into the next FANG with its majority stake in Indian e-commerce juggernaut Flipkart. This deal followed its purchase of Jet.com in 2016, which was its first foothold in the e-commerce world.

Traditional companies are becoming tech companies because of the ability to innovate all leads through the fingertips of talented coders.

When all roads lead to Rome, you will have to go through Rome.

The hunger for innovation has had major implications to the financial side of technology.

The story picks up from a recent report disclosing the 2017 remuneration of co-founder and CEO of Instagram competitor Snapchat (SNAP) Evan Spiegel.

The $637.8 million he received in 2017 was the third-highest annual compensation ever to be collected by a CEO.

Snapchat has tanked following its 2017 IPO and the main reason is Facebook is stealing its lunch and leaving Snap the crumbs on which to nibble.

Instagram, using a cunning strategy of cloning Snap's best features, single-handedly bludgeoned Snap's share price cutting it by half after the successfully launched IPO.

Snap has been an unequivocal sell on the rallies stock since the inception of the Mad Hedge Technology Letter and the disastrous redesign did no favors either.

My first risk off recommendation was Snapchat and at the time it was trading at $19. To revisit the story, please click here.

Microsoft (MSFT) is a great stock because it posts accelerated revenue and earnings, while Snapchat is a terrible company because it produces accelerated losses and lousy user growth.

A company almost 100 times smaller than Microsoft should not be struggling to grow.

It's a failure of epic proportions.

Small companies expand briskly because the law of numbers is leveraged in their favor and the tiniest bump of additional business has a larger effect on the bottom line.

As it stands, Snapchat lost $373 million in 2015, and followed that up with a disastrous $514 million loss in 2016, and a gigantic $3.45 billion loss in 2017.

Losses accelerated by 800% but annual revenue only doubled last year.

It was no shocker that the poor relative performance resulted in the sacking of 100 Snapchat developers.

Smart people would assume an annual salary of this magnitude (Spiegel's) would be the result of excellent performance.

Why else would a CEO get a lavish payout?

I'll explain.

The demand for tech knows no bounds.

In this environment, venture capitalists will pay up for brilliant ideas.

The problem is that brilliant ideas don't grow on trees.

The few cutting-edge ideas have stacks of money thrown at them.

In this sellers' market, founders can cherry-pick the best financing deal that will enrich them the quickest and empower them the most.

Multiple offers have become the norm just as with the Silicon Valley housing market.

The consequences are the premium for these brilliant ideas keeps rising and investors keep paying higher prices without a second thought.

Therefore, founders and CEOs are opting for the financial packages that offer them bulletproof voting shares, allowing the innovators to control operations to the very last detail.

The founders are responsible for leading innovation, and investors are offering glorious pay terms for this innovation because it can't be substituted. Low-quality tech has less of a premium because the technology can easily be rebranded and substituted.

Technology from the ground up is slowly being automated away leaving runaway valuations the norm.

Giving the keys to the Ferrari makes sense as tech companies formulate long-term strategies based on scale. And securing job security without the threat of an activist takeover offers peace of mind for CEOs who are focused on the daily grind.

Knowing their baby won't get stolen from the carriage goes a long way in tech land.

Venture capitalists are reticent about following through with proper governance because they do not want to alienate the innovators who could choose to stop innovating.

These investors also know that tech is the least regulated industry in the world, so it's better to turn a blind eye to cunning growth strategies that push the border of regulation.

The competition to fund these emerging tech companies is borderline criminal.

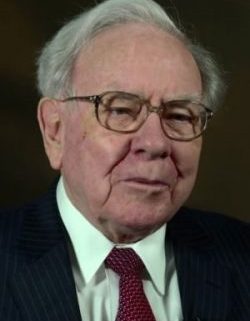

Uber declined a $3 billion investment by no other than the Oracle of Omaha Warren Buffett.

Buffett described himself as a "great admirer" of Uber CEO Dara Khosrowshahi.

Uber is one of the most unlikely Warren Buffett investments because it doesn't create anything and burns cash faster than a Kardashian.

Buffett's faith in Uber underscores the reliance on tech to fuel the stock market to new heights.

Buffett also admitted mistakes on missing out on Alphabet (GOOGL) and Apple (AAPL).

Rightly so.

Then add in the mix of SoftBank's $100 billion vision fund that just announced an upcoming sequel with another $100 billion vision fund.

Where is all this money flowing into?

Of the tech companies that went through an IPO last year backed by venture capitalist money, 67% relinquished superior voting rights to key founders, a rise of 54% since 2010.

Compare that to non-tech companies that only allow 10% to 15% of CEOs to institute a voting structure that will put them in charge indefinitely.

In many instances, the persona of these ultra-famous tech CEOs has taken on a life of its own.

Elon Musk, CEO of Tesla, is the most prominent example of a celebrity tech innovator milking every possible penny from his shareholders and is not shy about flaunting it.

News has it that Musk needs to go back to the well for another stage of financing later this year.

Don't worry, the money will be there in this climate.

Buffett's rejection was due to losing out to SoftBank, which beat out Buffett to invest in Uber.

SoftBank just announced a $3.35 billion investment into GM's (GM) autonomous driving unit called Cruise enhancing the best big data portfolio in the world.

At this pace, CEO of SoftBank Masayoshi Son will have a piece of every major big data company in the world.

This all bodes well for tech equities as the insatiable hunt for emerging, innovative tech spills over into daily equity market driving up the prices for all the top innovating public companies such as Salesforce, Amazon, Microsoft and Netflix.

Buffett, down on his luck after being shafted by Uber, picked up more Apple shares.

He sold all his IBM (IBM) shares after reading the Mad Hedge Technology Letter advising him to stay away from legacy companies.

Smart move, Warren. You can pick up the tab for our next lunch date.

If you have a few billion to throw around, expect multiple offers over the asking price for any high-grade tech innovation.

The going rate is shooting through the roof and you might NEVER be able to sack the founder.

Caveat emptor.

_________________________________________________________________________________________________

Quote of the Day

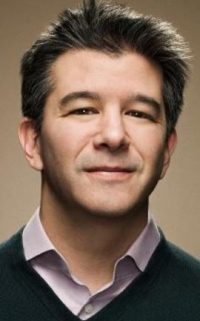

"We knew that Lyft was going to raise a ton of money. And we went (to their investors): 'Just so you know, we're going to be fund-raising after this, so before you decide whether you want to invest in them, just make sure you know that we are going to be fund-raising immediately after.' " - said former CEO and founder of Uber Travis Kalanick when asked how he copes with competition.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.