International Business Machines Corporation (IBM) shares do not need the squeeze of a contentious trade war to dent its share price.

It is doing it all by itself.

Stories have been rife over the past few years of shrinking revenue in China.

And that was during the golden years of China when American tech ran riot on the mainland before the dynamic rise of Baidu (BIDU), Alibaba (BABA), and Tencent, otherwise known as the BATs.

Then the Oracle of Omaha Warren Buffett drove a stake through the heart of IBM shares earlier this year by announcing he was fed up with the company’s direction and dumped a 35-year position.

Buffett unloaded all of his shares in favor of putting down an additional 75 million shares in Apple (AAPL) in the first quarter of 2018.

Topping off his Apple position now sees Buffett owning a mammoth 165.3 million total shares in the resurgent tech company.

Buffett’s shrewd decision has been rewarded, and Apple’s stock has rocketed more than 20% since he jovially declared his purchase in May.

IBM has been a rare misstep for Buffett, who took a moderate loss on his IBM position disclosing an average cost basis of $170 on 64 million shares that Berkshire bought in 2011.

IBM has flatlined since that Buffett interview, and slid around 25% since its peak in mid-2014.

IBM is grappling with the same conundrum most legacy companies deal with – top line contraction.

In 2014, IBM registered a tad under $93 billion in annual revenue, and followed up the next three years with even lower revenue.

A horrible recipe for success to say the least.

In an era of turbo-charged tech companies whose value now comprise over a quarter of the S&P, IBM has really fluffed its lines.

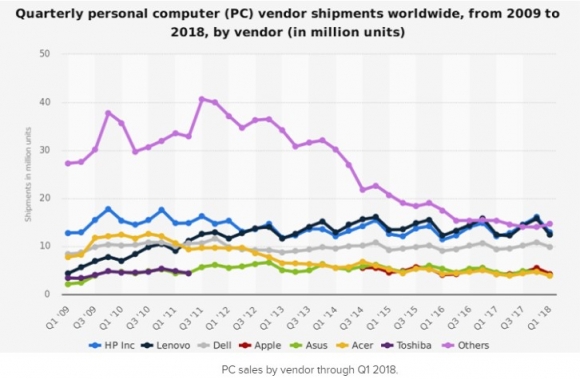

IBM’s prospects have been stapled to the PC market for years.

A recent JP Morgan note revealed the PC market could contract by 5% to 7% in the fourth quarter because of CPU shortages from Intel (INTC).

The report’s timing couldn’t have been worse for IBM.

The PC industry has been tanking for the past six consecutive years unable to shirk shrinking volume.

Intel is another company I have been lukewarm on lately because it is being outmaneuvered by chip competitor Advanced Micro Devices (AMD).

Even worse, this year has been a bad one for Intel’s management, which saw former CEO Brian Krzanich resign for sleeping with a coworker.

The poor management has had a spillover effect with Intel needing to delay new product launches as well.

To read more about my timely recommendation to pile into AMD in mid-August at $19, please click here.

Meanwhile, AMD shares have gone parabolic and surpassed an intraday price of $34 recently.

Investors should ask themselves, why invest in IBM when there are so many other tech companies that are growing, and growing revenue by 20% or more per year?

If IBM does manage to eke out top line growth in 2018, it will be by 1% to 2%, similar to Oracle’s recent performance.

Unsurprisingly, the price action of Oracle (ORCL) for the past year has been flatter than a bicycle ride around Beijing.

Live by the sword and die by the sword.

Thus, the Mad Hedge Technology Letter has been ushering readers into high-performance stocks that will bring technological and societal changes.

If you put a gun to my head and forced me to give sage investment advice, then the answer would be straightforward.

Buy Amazon (AMZN) and Microsoft (MSFT) on the dip and every dip.

This is a way to print money as if you had a rich uncle writing you checks every month.

Legacy tech is another story.

The IBMs and the Oracles of the world are bringing up the tech sector’s rear.

To add insult to injury, the lion’s share of IBM’s revenue is carved out from abroad, and the recent surge in the dollar is not doing IBM any favors.

IBM’s Watson initiative was billed as the savior for Big Blue.

The artificial intelligence initiative would integrate health care data into an actionable app.

The expectations were high hoping this division would drag up IBM from its long period of malaise.

IBM bet big on this division ploughing more than $15 billion into it from 2010-2015, predicting this would be the beginning of a new renaissance for the historic American company.

This game changing move fell on deaf ears and has been a massive bust.

IBM swallowed up three companies to ramp up this shift into the AI world - Phytel, Explorys, and Truven.

The treasure trove of health care data and proprietary analytics systems these companies came with were what this division needed to turn the corner.

These three companies were strong before the buy out and engineers were upbeat hoping Watson would elevate these companies to another level.

Wistfully, IBM Management led by CEO Ginni Rometty grossly mishandled Watson’s execution.

Phytel boasted 160 engineers at the time of IBM’s purchase and confusingly slashed half the workforce earlier this year.

Engineers at the firm even lamented that now, even smaller firms were “eating them alive.”

Unimpressed with the direction of the artificial intelligence division at IBM, many of these three companies’ best and brightest engineers jumped ship.

The inability for IBM to integrate Watson reared its ugly head in plain daylight when MD Anderson Cancer Center in Texas halted its Watson project after draining $62 million.

This was one of many errors that Watson AI accrued.

The failure to quicken clinical decision-making to match patients to clinical trials was an example of how futile IBM had become.

In short, a spectacular breakdown in execution mixed with an abrupt brain drain of AI engineers quickly imploded the prospect of Watson ever succeeding.

In 2013, IBM confidently boasted that Watson would be its “first killer app” in health care.

Internal leaks shined a brighter light on IBM’s subpar management skills.

One engineer described IBM’s management as having “no idea” what they were doing.

Another engineer said they were uncertain of a “road map” and “pivoted many times.”

Phytel, an industry leader at the time focusing on population health management, was bleeding money.

The engineers explained further, chiming in that IBM’s management had zero technical experience that led management wanting to create products that were “simply impossible.”

Not only were these products impossible, but they in no way took advantage of the resources these three companies had at their disposal.

Do you still want to invest in IBM?

Fast forward to today.

IBM is being sued in federal court with the plaintiff’s, former employees at the firm, claiming the company unfairly discriminated against elderly employees, firing them because of their age.

The documents submitted by the plaintiff’s state that “IBM has laid off 20,000 employees who were over the age of 40” since 2012.

This prototypical legacy company has more problems than the eye can see in every nook and cranny of the company.

If you have IBM shares now, dump them as soon as you can and run for cover.

It’s a miracle that IBM shares have eked out a paltry gain this year. And this thesis is constant with one of my overarching themes – stay away from all legacy tech firms with no cutting-edge proprietary technologies and stagnating growth.

A Sad Story of Mismanagement

________________________________________________________________________________________________

Quote of the Day

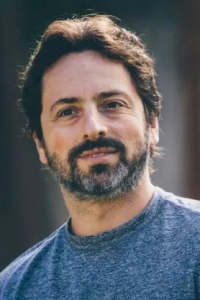

“Some say Google is God. Others say Google is Satan. But if they think Google is too powerful, remember that with search engines unlike other companies, all it takes is a single click to go to another search engine,” said Alphabet cofounder Sergey Brin.