If a company takes almost 20 years and still isn’t profitable - it probably never will.

Granted, tech firms are given a Rapunzel-length leash to collect users, scale out the product, refine algorithms to industry standard, and build up the engineering team.

I know this takes time – it doesn’t happen in one day.

After whipping up a frenzy of momentum and venture capitalists claiming stakes, tech stocks usually go public.

This is the common process of what it takes to construct a Silicon Valley tech firm, and there are no shortcuts to this long hard slog.

And if after almost 20 years, amid a nine-year bull market, a tech firm in the most dominating sector in the world cannot figure how to be in the black, investors should stay away from this company in droves.

SurveyMonkey (SVMK), who recently achieved a blockbuster IPO, were the rock stars of the tech world for one day and one day only.

The stock peaking after the first trading day is a ghastly signal and ominous sign.

Their fifteen minutes of fame is all they will get because this practically ex-growth company has no indicators of a rosier future.

The company went public at $12 per share and even that was too generous.

The stock took off like a banshee, on the verge of overshooting the $20 level before falling back to grace.

The stock is now trolling around $13, and on the verge of heading to the purgatory of single digits.

What caused such a swan dive after such a promising start?

On the surface, everything looks like peaches and daffodils – a growing Silicon Valley cloud company even with Facebook spin doctor Sheryl Sandberg on the board.

The optics pass all the marks.

But wait a second, looking at the nuts and bolts, it’s crystal clear why this stock has been throttled back.

The first half of 2018, SurveyMonkey presided over a tepid 3% of paid user growth.

Yes, SurveyMonkey is growing, but not by much.

In this same period, the company lost $27.2 million and this was after an annual 2017 loss of $24 million.

Profitability isn’t exactly their forte.

The 14% of revenue growth the company secured was done after taking a machete and gutting margins to appear pretty for the IPO.

And it’s painfully obvious that SurveyMonkey is failing at converting the freemium users into paid converts.

The online survey doesn’t exactly have the highest barriers of entry.

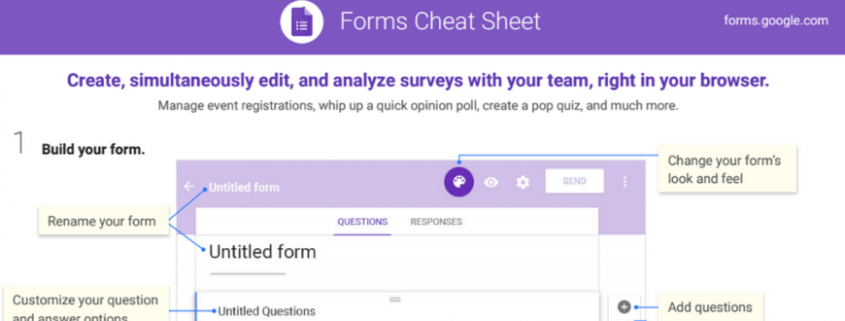

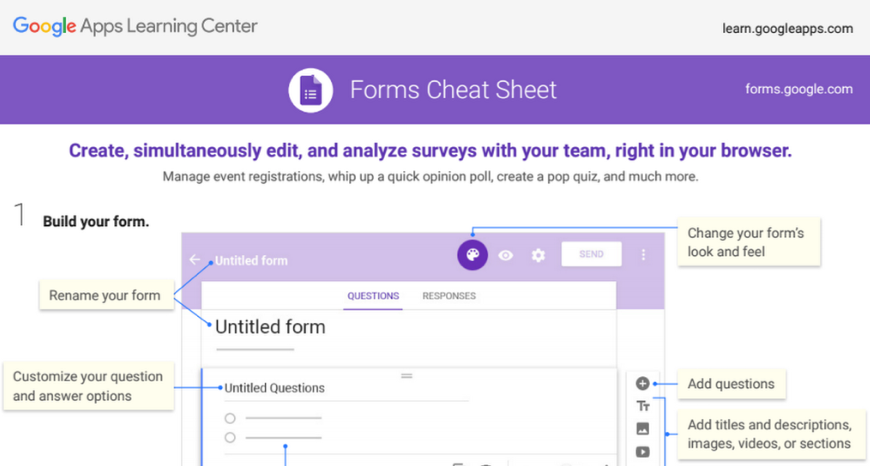

Google (GOOGL) Forms is the competitor in this space offering straightforward free surveys with basic analysis.

The tool is highly functional.

The pricing structure to SurveyMonkey’s individual membership is presented as a luxury service like the US postal service.

The individual service costs $384 per year and rises all the way up to the bloated price of $1,188 per year.

Any individual paying $1,188 per year for this needs to check themselves into a mental hospital.

Google Forms could easily undercut this pricing model by offering survey tool packages for a fraction of this amount.

The “team plan” is also laughable by charging $75 per month for up to three users, and this type of plan is capped at an exorbitant $225 per month.

Let’s remember that Microsoft offers Microsoft Office 365 Personal for an annual total of $59.99 and is million times more useful.

This annual subscription comes with premium versions of Word, Excel, PowerPoint, OneDrive, OneNote, Outlook, Publisher, and Access.

The OneDrive cloud service includes 1 terabyte (TB) of cloud storage.

Just by this simple comparison, it is easy to see which service is of value and which service is building castles in the sky.

With the explosion of service-as-a-software (SaaS) apps flooding desktops, I imagine the paid version of SurveyMonkey would be first on the chopping block due to its overly ambitious pricing.

In this strategy, the company is more concerned about milking as much as they can from each existing paid user instead of juicing up the core user base.

Effectively, this is a poor management decision, and the company is harming the growth of the potential paid usership base by robbing all incentive to convert to the paid version.

As Netflix masterfully proved, draw in the eyeballs at a lower price, build up the service to an optimum quality level, and subscribers never leave.

The opposite strategy is an indirect way of management believing the product is not good enough or the niche is too small to perpetualize a solid relationship.

And since growth numbers aren’t accelerating, there is infinitesimal reason to even consider investing in this fading company.

SurveyMoney has also racked up the debt - $317 million of it to be precise putting its debt $100 million over total revenue in 2017.

They were burning cash quickly and only had $43 million left in the coffers.

Part of the rationale for going public was a way to pay down debt.

Another chunk of proceeds from the IPO will be used to pay taxes.

The company has no innovative roadmap going forward and using the cash to pay down existing obligations shows the anemic level of intent from this company.

The silver lining in this company is that the losses of $76.4 million in 2016 were pared back in 2017.

In the IPO prospectus, SurveyMonkey noted that most unpaid customers do not become paid customers.

Even though the product is useful and it’s a long-time favorite of mine, the stock is a different animal.

There was not much meat in the prospectus and most of it were dry bones.

The IPO day was buoyed by the $40 million in stock venture-capital arm of Salesforce (CRM) pocketed, but that short-term boost has faded quickly as investors have dissected this company in every which way.

Use their free survey tools but avoid paying for the paid version and don’t buy the stock.

There are many other fishes in the sea.

NO IPO FOR GOOGLE FORMS