While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

October 1, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Trade Deal Struck with Canada, saving NAFTA, and stocks rocket. ANY positive news on trade will deliver huge short covering rallies. What a start to Q4! Good thing I reestablished my longs last week. Click here.

2) Money is Still Pouring Into the US. Some $2.2 billion in fund flows poured out of foreign equities and $1.6 billion into US equities in the first half. Everyone wants to come to the Land of Oz. With strong earnings and a robust currency what’s not to like? Click here.

3) General Electric (GE) Dumps Its CEO, after only a year and the stock rockets 17%. It looks like the hedge fund that makes light bulbs still hasn’t found the “ON” switch. Click here.

4) Tesla Cuts Deal with the SEC, and the stock soars 20%. The shorts get burned yet again. Elon Musk will take a two-year vacation from the CEO job but will keep all the others. With the Defense Department now dependent on Musk to get their spy satellites into orbit there was no way the case against him was ever going anywhere. Click here.

5) The 30-Year Mortgage Rate Closes in on 5%, and the “FOR SALE” sign are breaking out like a rash on prom night. This is where government crowding out of private borrowers starts. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or DON’T NOMINATE ME!),

(AMZN), (NVDA), (AAPL), (MSFT), (GLD), (ABX), (GOLD),

(OCTOBER 26-27 MAD HEDGE LAKE TAHOE CONFERENCE)

(ZINC AIR BATTERIES WILL REVOLUTIONIZE ELECTRIC CARS)

(TSLA), (NIO), (FB), (GOOGL), (NFLX)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 1, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD,

or DON’T NOMINATE ME!),

(AMZN), (NVDA), (AAPL), (MSFT), (GLD), (ABX), (GOLD),

(JOIN US AT THE MAD HEDGE LAKE TAHOE, NEVADA,

CONFERENCE, OCTOBER 26-27, 2018)

I have a request for all of you readers. Please do not nominate me for justice of the Supreme Court.

I have no doubt that I could handle the legal load. A $17 copy of Litigation for Dummies from Amazon would take care of that.

I just don’t think I could get through the approval process. There isn’t a room on Capitol Hill big enough to house all the people who have issues with my high school background.

In 1968, I ran away from home, hitchhiked across the Sahara Desert, was captured by the Russian Army when they invaded Czechoslovakia, and had my front teeth knocked out by a flying cobblestone during a riot in Paris. I pray what went on in Sweden never sees the light of day.

So, I’m afraid you’ll have to look elsewhere to fill a seat in the highest court in the land. Good luck with that.

The most conspicuous market action of the week took place when several broker upgrades of major technology stocks. Amazon (AMZN) was targeted for $2,525, NVIDIA (NVDA) was valued at $400, and JP Morgan, always late to the game (it’s the second mouse that gets the cheese), predicted Apple (AAPL) would hit a lofty $270.

That would make Steve Jobs’ creation worth an eye-popping $1.3 trillion.

The Mad Hedge Market Timing Index dove down to a two-month low at 46. That was enough to prompt me to jump back into the market with a few cautious longs in Amazon and Microsoft (MSFT). The fourth quarter is now upon us and the chase for performance is on. Big, safe tech stocks could well rally well into 2019.

Facebook (FB) announced a major security breach affecting 50 million accounts and the shares tanked by $5. That prompted some to recommend a name change to “Faceplant.”

The economic data is definitely moving from universally strong to mixed, with auto and home sales falling off a cliff. Those are big chunks of the economy that are missing in action. If you’re looking for another reason to lose sleep, oil prices hit a four-year high, topping $80 in Europe.

The trade wars are taking specific bites out of sections of the economy, helping some and damaging others. Expect to pay a lot more for Christmas, and farmers are going to end up with a handful of rotten soybeans in their stockings.

Barrick Gold (ABX) took over Randgold (GOLD) to create the world’s largest gold company. Such activity usually marks long-term bottoms, which has me looking at call spreads in the barbarous relic once again.

With inflation just over the horizon and commodities in general coming out of a six-year bear market, that may not be such a bad idea. Copper (FCX) saw its biggest up day in two years.

The midterms are mercifully only 29 trading days away, and their removal opens the way for a major rally in stocks. It makes no difference who wins. The mere elimination of the uncertainty is worth at least 10% in stock appreciation over the next year.

At this point, the most likely outcome is a gridlocked Congress, with the Republicans holding only two of California’s 52 House seats. And stock markets absolutely LOVE a gridlocked Congress.

Also helping is that company share buybacks are booming, hitting $189 billion in Q2, up 60% YOY, the most in history. At this rate the stock market will completely disappear in 20 years.

On Wednesday, we got our long-expected 25 basis-point interest rate rise from the Federal Reserve. Three more Fed rate hikes are promised in 2019, after a coming December hike, which will take overnight rates up to 3.00% to 3.25%. Wealth is about to transfer from borrowers to savers in a major way.

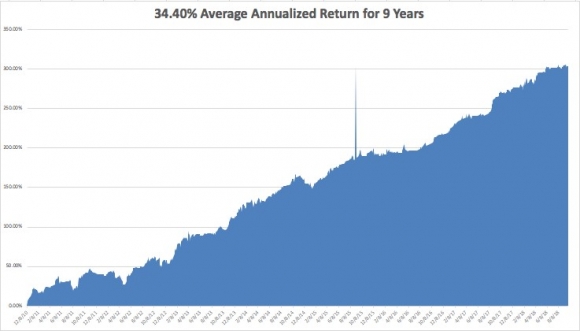

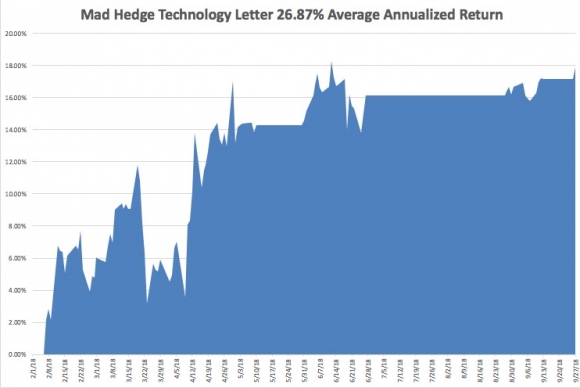

The performance of the Mad Hedge Fund Trader Alert Service eked out a 0.81% return in the final days of September. My 2018 year-to-date performance has retreated to 27.82%, and my trailing one-year return stands at 35.84%.

My nine-year return appreciated to 304.29%. The average annualized return stands at 34.40%. I hope you all feel like you’re getting your money’s worth.

This coming week will bring the jobspalooza on the data front.

On Monday, October 1, at 9:45 AM, we learn the August PMI Manufacturing Survey.

On Tuesday, October 2, nothing of note takes place.

On Wednesday October 3 at 8:15 AM, the first of the big three jobs numbers is out with the ADP Employment Report of private sector hiring. At 10:00 AM, the August PMI Services is published.

Thursday, October 4 leads with the Weekly Jobless Claims at 8:30 AM EST, which rose 13,000 last week to 214,000. At 10:00 AM, September Factory Orders is released.

On Friday, October 5, at 8:30 AM, we learn the September Nonfarm Payroll Report. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, it’s fire season now, and that can only mean one thing: 1,000 goats have appeared in my front yard.

The country hires them every year to eat the wild grass on the hillside leading up to my house. Five days later there is no grass left, but a mountain of goat poop and a much lesser chance that a wildfire will burn down my house.

Ah, the pleasures of owning a home in California!

Good luck and good trading.

We’re Taking Calls Now

Mad Hedge Technology Letter

October 1, 2018

Fiat Lux

Featured Trade:

(ZINC AIR BATTERIES WILL REVOLUTIONIZE ELECTRIC CARS),

(TSLA), (NIO), (FB), (GOOGL), (NFLX)

As Panasonic ramps up its battery production at the Tesla Gigafactory 1 in Sparks, Nevada, the demand and business for renewable energy has never been more robust.

And as the world’s population balloons and man-made pollutants roil the natural ecosphere, business needs an answer to these potential apocalyptic bombshells or there will be nowhere clean enough to live.

Energy security and population growth will have a complicated relationship going forward and cannot be ignored for the sake of mankind.

This isn’t me being a tree-hugging, Birkenstock-trotting, save-the-earth, love and peace-type of guy.

This problem is real and whoever discovers the solution could reap untold profits.

The answer has been found - rechargeable zinc air batteries.

Spearheading this massive initiative is South African-born entrepreneur, sports team owner, Los Angeles Times owner, and more importantly the founder, chairman and CEO of NantEnergy Dr. Patrick Soon-Shiong.

This El Segundo, California-based company presented an utter game changer to the future of the world and the world’s economy.

NantEnergy debuted a rechargeable battery powered by oxidizing zinc with oxygen from the air for commercial use at the One Planet Summit in New York.

It also has the capability to store energy.

Not only is this technology and product cutting edge, but it has the cost basis to support broad-based scalability and adoption.

Ramkumar Krishnan, chief technology officer of NantEnergy claimed this revolutionary battery can “deliver energy for $100 per kilowatt-hour (kWh).”

Lithium-ion batteries have been the mainstay choice for clean energy or clean enough energy since 1992, and its usage varies in cost from $300 to $500 kWh.

Tesla, with its phalanx of superior engineers, has been able to suppress that cost all the way down to a level between $100 to $200 kWh level.

NantEnergy has already registered more than100 related patents in its name and envisions a $50 billion addressable market.

I believe the addressable market is substantially bigger.

For all the hoopla about lithium-ion batteries, there are severe drawbacks in its usage and application.

Let’s concisely run down the pitfalls of batteries of this ilk.

Once out the factory door, the performance starts to go downhill.

Lithium-ion batteries react poorly to high temperatures.

These batteries become inoperable if completely discharged.

There is a slight chance a battery could burst into flames and burn off your face.

Simply put, lithium-ion batteries incorporate cobalt, an extremely toxic material hazardous to human health.

If a Samsung Galaxy smartphone explodes, cover your mouth to avoid inhaling the cobalt-laced fumes.

Dr. Soon-Shiong characterized this new technology as the “holy grail” of renewable energy.

Wide-scale adoption would bring the need for cobalt to its knees.

No longer would tech companies need to scramble to secure a sufficient amount of cobalt supply from the deepest reaches of the Congo jungle.

It would be the end of cobalt as we know it.

At first, lithium would be required for a stopgap measure while engineers refine the battery on its way to a full-fledged zinc alone battery.

The lithium placeholder would only be temporary.

The clean energy movement must be grinning widely as the potential to finally do away with cobalt from renewable energy has pronounced social and economic consequences.

An estimated 1.4 billion people still live in the dark and do not have access to electricity.

This technology is being tested in villages in Africa and desolate communities in Asia as we speak.

The absence of electricity isolates these undeveloped communities in third-world Africa and Asia without access to health care, education, and technology.

It’s hard to kick-start your life as a sprouting little kid when you’re lost in the dark half the time.

Importing fossil fuel to put these communities online is unfeasible and just plain too expensive for communities that have a dire shortage of capital.

Currently, NantEnergy’s rechargeable zinc air batteries are online in 110 villages located in nine Asian and African countries.

The batteries have been combined to establish a microgrid system powering entire areas.

The company will start delivery this product next year widening its type of use to telecommunications towers.

The next step after that would be the home energy storage market targeting California and New York as the first American cities.

Engineers have pointed out that this development could transform the electric grid into a “round-the-clock carbon-free system.”

In addition, with cooperation with Duke Energy, a major utility, NantEnergy’s batteries have been powering communications towers in America for the past six years.

The design is mind-boggling utilitarian - plastic, a circuit board, and zinc oxide wrapped up in a briefcase-size shell.

One charge can offer 72 hours of battery life.

The charging process is easy - electricity from solar installations is stored by converting zinc oxide to zinc and oxygen.

The discharge process is straightforward, too - the system produces energy by oxidizing the zinc with air.

The pursuit of energy reduction is in full throttle, and this is the next leg up for energy aficionados.

Your lithium-ion-run Tesla could become a legacy company in a matter of years if this technology disrupts Elon Musk’s brainchild.

Lately, Musk has been falling behind the eight ball with fresh innovators hot on his heels.

This is the latest company to enter into its market even though still in the incubation stage.

Competitors have popped out of nowhere and are coming for his bacon.

Shanghai headquartered electric car manufacturer Nio (NIO) went public and raised more than $2 billion.

Even though it is not yet a threat to Tesla, it shows that Tesla isn’t the only game in town anymore.

In any case, NantEnergy has the magic to unlock the “holy grail” of renewable energy. And if it can promise on its cost projections, I see no reason why this won’t be furiously adopted by corporations worldwide.

As it is, America has been losing out in the Congo, as China has cornered the cobalt market there.

And, as the evolution of fracking technology quelled the Middle-East situation, it could also have the same effect in the Congo.

More excitingly, it could put online an additional 1.2 billion new customers to devour iPhones and watch Netflix (NFLX).

Companies such as Facebook (FB) and Alphabet (GOOGL) have been developing a way for these remote and poverty-prone places to use Internet from a satellite.

They would need electricity first to power their devices unless Mark Zuckerberg has found a way to use a smartphone without electricity.

NantEnergy’s renewable batteries have already cut the need of 1 million lithium-ion batteries, and warded off the need to release 50,000 metric tons of carbon dioxide since 2012.

California is the flag-bearer in renewable energy policy by forcing its populace to be at 100% carbon-free electricity by 2045.

Musk is on record by saying he expects to break the 100-kWh level, which would contribute to better power storage and expedited electric vehicle (EV) adoption.

In contrast, energy storage analyst Mitalee Gupta at GTM Research has retorted that he’s “unsure $100/kWh is achievable this year.”

Musk, being a naturally optimistic entrepreneur, sets targets then does everything he can to break them.

Either way, two South African born visionaries are doing their part to crater the cost per kWh in the renewable energy market, and Elon Musk might not be the biggest disruptor from South Africa.

Time will tell if this market will become zinc-based or lithium-based – the higher-grade technology eventually wins out spelling doom for Musk.

But it appears that Musk has other things to worry about now.

NantEnergy plans to inaugurate a battery manufacturing facility in California next year.

As for Tesla, buy the car and not the stock.

And for Nio, don’t buy the car or the stock.

Disrupting the Disrupter

Tickets for the Mad Hedge Lake Tahoe Conference are selling briskly. If you want to obtain a ticket that includes a dinner with John Thomas and Arthur Henry you better get your order in soon.

The conference date has been set for Friday and Saturday, October 26-27.

Come learn from the greatest trading minds in the markets for a day of discussion about making money in the current challenging conditions.

How soon will the next bear market start and the recession that inevitably follows?

How will you guarantee your retirement in these tumultuous times?

What will destroy the economy first, rising interest rates or a trade war?

Who will tell you what to buy at the next market bottom?

John Thomas is a 50-year market veteran and is the CEO and publisher of the Diary of a Mad Hedge Fund Trader. John will give you a laser-like focus on the best-performing asset classes, sectors, and individual companies of the coming months, years, and decades. John covers stocks, options, and ETFs. He delivers your one-stop global view.

Arthur Henry is the author of the Mad Hedge Technology Letter. He is a seasoned technology analyst and speaks four Asian languages fluently. He will provide insights into the most important investment sector of our generation.

The event will be held at a five-star resort and casino on the pristine shores of Lake Tahoe in Incline Village, NV, the precise location of which will be emailed to you with your ticket purchase combination.

It will include a full breakfast on arrival, a sit-down lunch, coffee break. The wine served will be from the best Napa Valley vineyards.

Come rub shoulders with some of the savviest individual investors in the business, trade investment ideas, and learn the secrets of the trading masters.

Ticket Prices

Copper Ticket - $599: Saturday conference all day on October 27, with buffet breakfast, lunch, and coffee break, with no accommodations provided

Silver Ticket - $1,299: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch and coffee break

Gold Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 26, 7:00 PM Friday night VIP Dinner with John Thomas

Platinum Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Diamond Ticket - $1,799: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, an October 26, 7:00 PM Friday night VIP Dinner with John Thomas, AND an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Schedule of Events

Friday, October 26, 7:00 PM

7:00 PM - Exclusive dinner with John Thomas and Arthur Henry for 12 in a private room at a five-star hotel for gold and diamond ticket holders only

Saturday, October 27, 8:00 AM

8:00 AM - Breakfast for all guests

9:00 AM - Speaker 1: Arthur Henry - Mad Hedge Technology Letter editor Arthur Henry gives the 30,000-foot view on investing in technology stocks

10:00 AM - Speaker 2: Brad Barnes of Entruity Wealth on "An Introduction to Dynamic Risk Management for Individuals"

11:00 AM - Speaker 3: John Thomas - An all-asset class global view for the year ahead

12:00 PM - Lunch

1:30 PM - Speaker 4: Arthur Henry - Mad Hedge Technology Letter editor on the five best technology stocks to buy today

2:30 PM - Speaker 5: John Triantafelow of Renaissance Wealth Management

3:30 PM - Speaker 6: John Thomas

4:30-6:00 PM - Closing: Cocktail reception and open group discussions

7:00 PM - Exclusive dinner with John Thomas for 12 in a private room at a five-star hotel for Platinum or Diamond ticket holders only

To purchase tickets, click: CONFERENCE.

“Cleverness is a gift, kindness is a choice,” said founder and CEO of Amazon Jeff Bezos.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.