When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

October 22, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Watch Out for a Tenfold Increase in IPOs in 2019, as the mega unicorns such as Uber and Airbnb go public. Everyone wants to get stock out the door before the next recession hits. Will it kill the goose that laid the golden egg? Click here.

2) It’s a Big Week for Tech Earnings. Can blowout earnings reports from Amazon and Microsoft end a steep correction? So far, so good. Click here.

3) Chinese Stock Markets Soar 4%. Maybe they have been tipped about a coming deal with the US? Click here.

4) Trump Announces Major New Tax Cut, with the midterm election two weeks off. But even his own party knows nothing about it, and Congress is out of session. With the budget deficit about to break $1 trillion for the first time since the crash markets aren’t buying it, with stocks down and bonds up. Click here.

5) Headless Body in Topless Bar. I’ve been waiting for years to use the most famous newspaper headline in history. Richard Parsons only lasted a month as the new CEO of CBS. Maybe it was the list of pending litigation that made him sick. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADING FOR LAKE TAHOE),

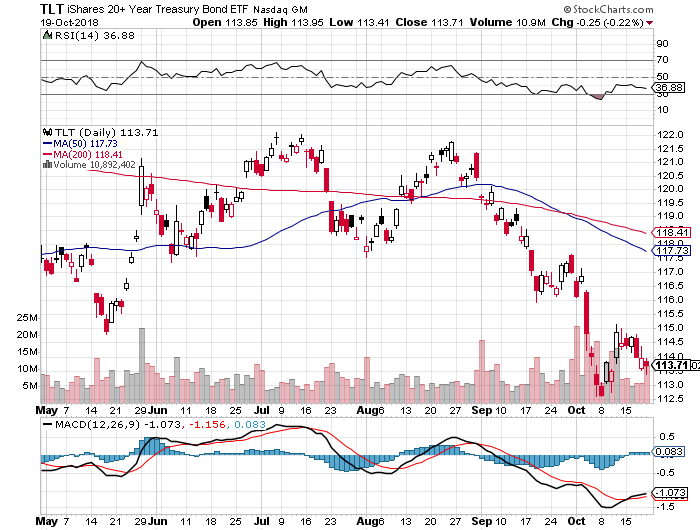

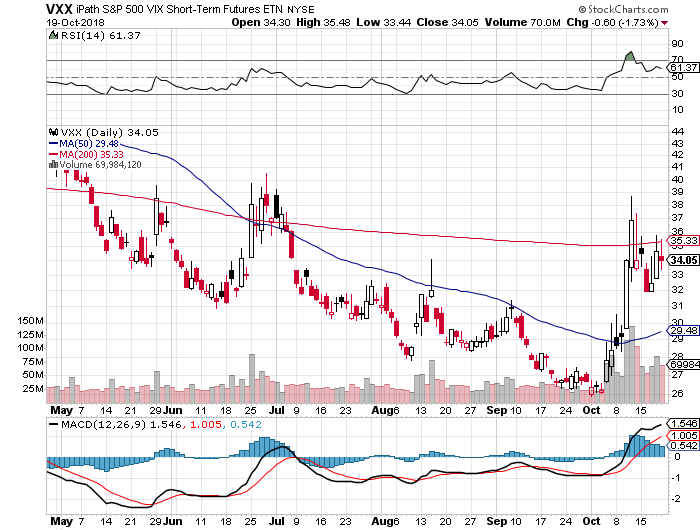

(SPY), (TLT), (VIX), (MSFT), (AMZN), (CRM), (ROKU),

(BRING BACK THE UPTICK RULE!)

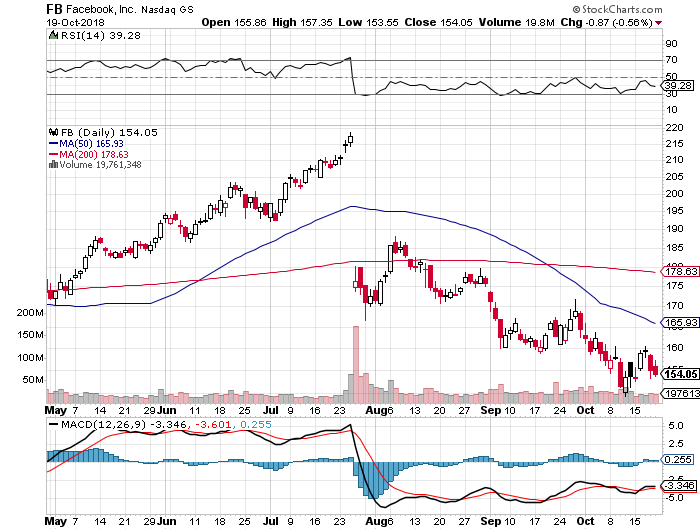

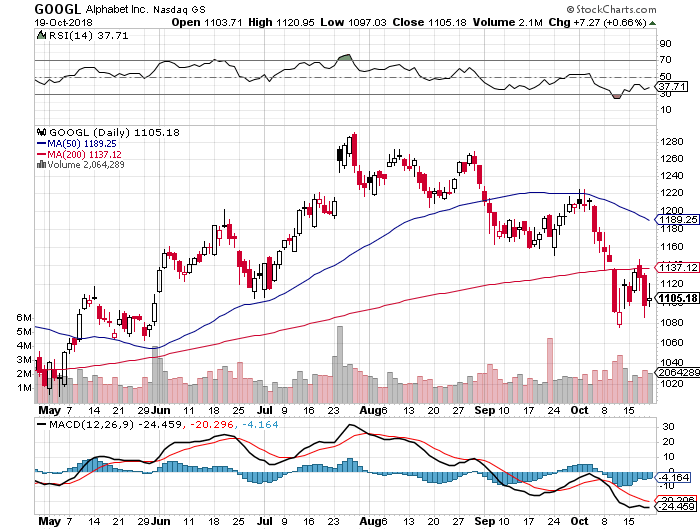

(FACEBOOK’S DARPA DALLIANCE),

(FB), (GOOGL), (AAPL)

“The General” in Georgia, once stolen by Union forces during the Civil War

Global Market Comments

October 22, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADING FOR LAKE TAHOE),

(SPY), (TLT), (VIX), (MSFT), (AMZN), (CRM), (ROKU),

(BRING BACK THE UPTICK RULE!)

There’s nothing like a quickie five-day tour of the Southeast to give one an instant snapshot of the US economy. The economy is definitely overheating and could blow up sometime in 2019 or 2020.

Traffic everywhere is horrendous as drivers struggle to cope with a road system built to handle half the current US population. Service has gotten terrible as workers vacate the lower paid sectors of the economy. Everyone you talk to tells you business is great, from the CEOs down to the Uber drivers.

I managed to miss Hurricane Michael by two days. Hartsfield Jackson Atlanta International Airport was busy with exhausted transiting Red Cross workers. The Interstate from Savanna to Atlanta, Georgia was lined with thousands of downed trees. In Houston mountains of debris were evident everywhere, the rotting, soggy remnants of last year’s Hurricane Harvey.

I managed to score all day parking in downtown Atlanta for only $8. I kept the receipt to show my disbelieving friends at home.

Bull markets climb a wall of worry and this one has been no exception. However, the higher we get the greater the demands on the faithful.

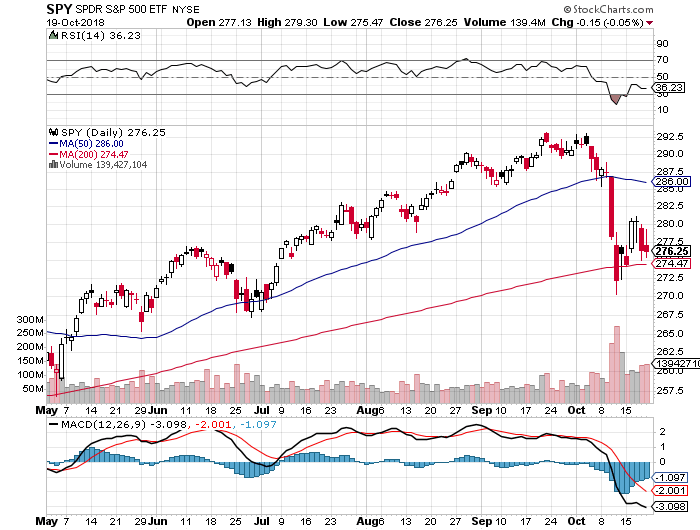

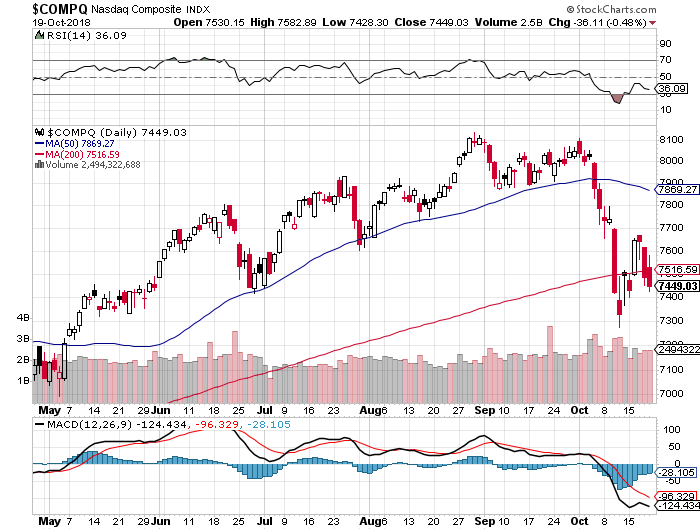

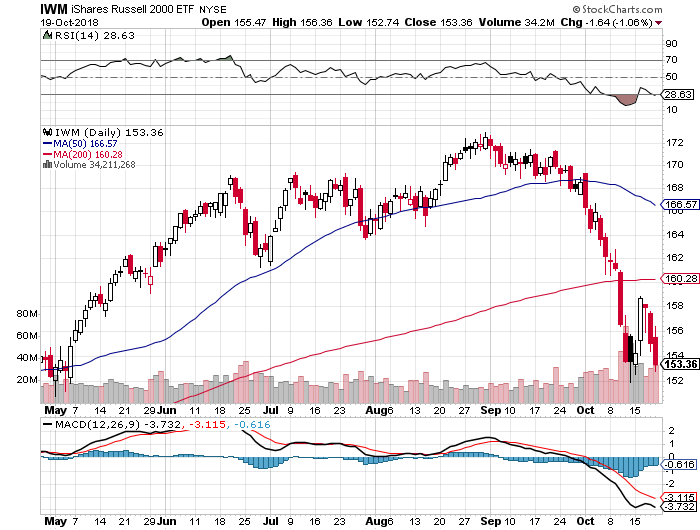

Last week saw my Mad Hedge Market Timing Index plunge to an all-time low reading of 4. I back-tested the data and was stunned to discover that October saw the steepest selloff since the 1987 crash, which saw the average crater 21% in one day.

And while evidence of a coming bear market is everywhere, the reality is that stocks can keep rising for another year. Market bottoms are easy to quantify based on traditional valuation measure, but tops are notoriously difficult to call. Look for one more high volume melt up like we saw in January and that should be it.

Real interest rates are still zero (3.2% bond yields – 3.2% inflation), so there is no way this is any more than a short-term correction in a bull market.

The world is still awash in liquidity

The Fed says they’re still raising rates four times in a year no matter what the president says. Look for a 3.25% overnight rate in a year, and 4% for three months funds. If inflation rises to 4% at the same time, real rates will still be at zero.

There certainly has not been a shortage of things to worry about on the geopolitical front. After Saudi Arabia was caught red-handed with video and audio proof of torturing and killing a Washington Post reporter, it threatened to cut off our oil supply and dump their substantial holding of technology stocks.

Tesla made another move towards the mass market by accelerating its release of the $35,000 Tesla 3. Production is now well over 6,000 units a month.

If you had any doubts that housing was now in recession, look no further than the September Existing Home Sales which were down a disastrous 3.5%. In the meantime, the auto industry continues to plumb new depths. In some industries, the recession has already started.

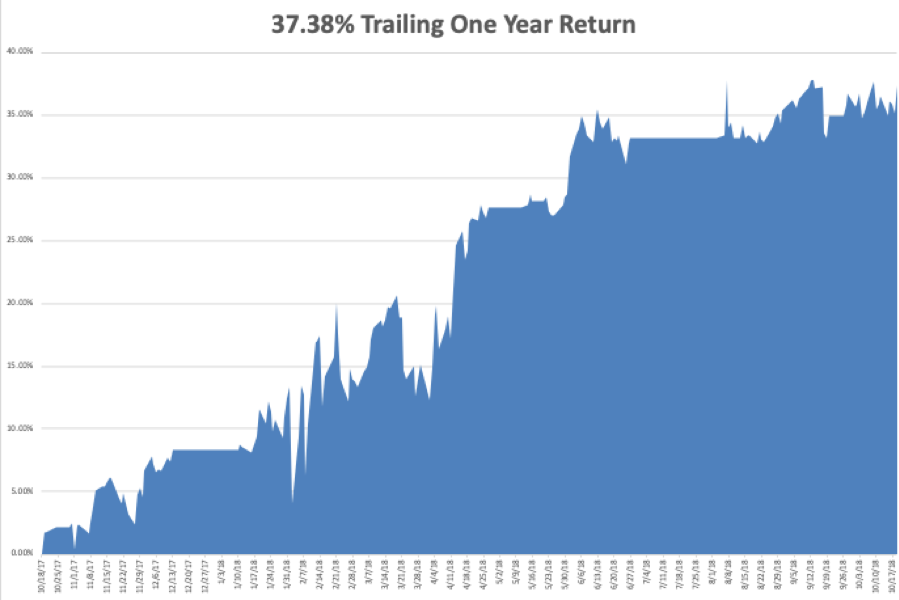

We have been killing it on the trading front. My 2018 year-to-date performance has bounced back to a robust 29.07%, and my trailing one-year return stands at 35.37%. October is up +0.68%, despite a gut-punching, nearly instant NASDAQ swoon of 10.50%. Most people will take that in these horrific conditions.

My single stock positions have been money makers, but my short volatility position (VXX), which I put on early, refuses to go down, eating up much of my profits.

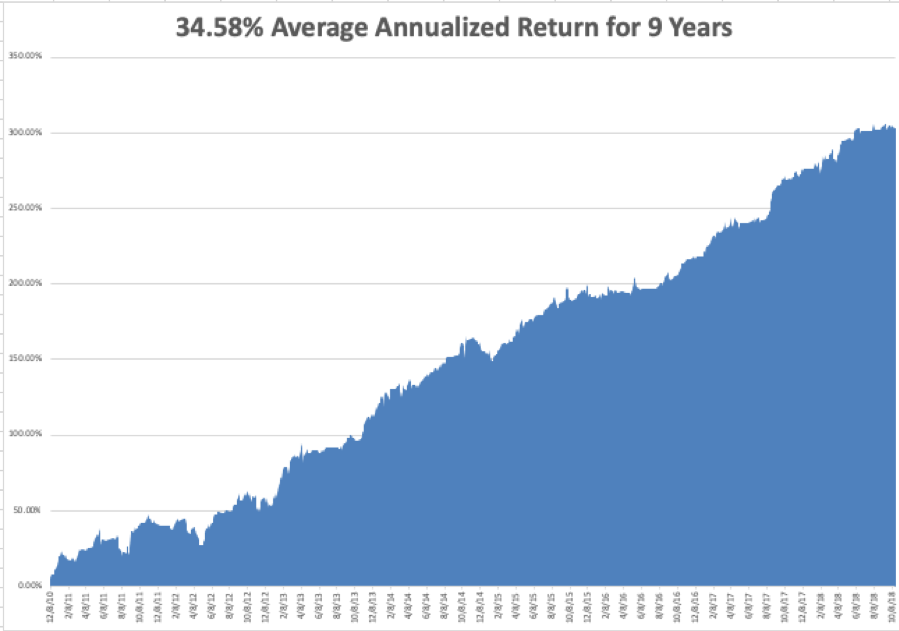

My nine-year return appreciated to 305.54%. The average annualized return stands at 34.58%. Global Trading Dispatch is now only 44 basis points from an all-time high.

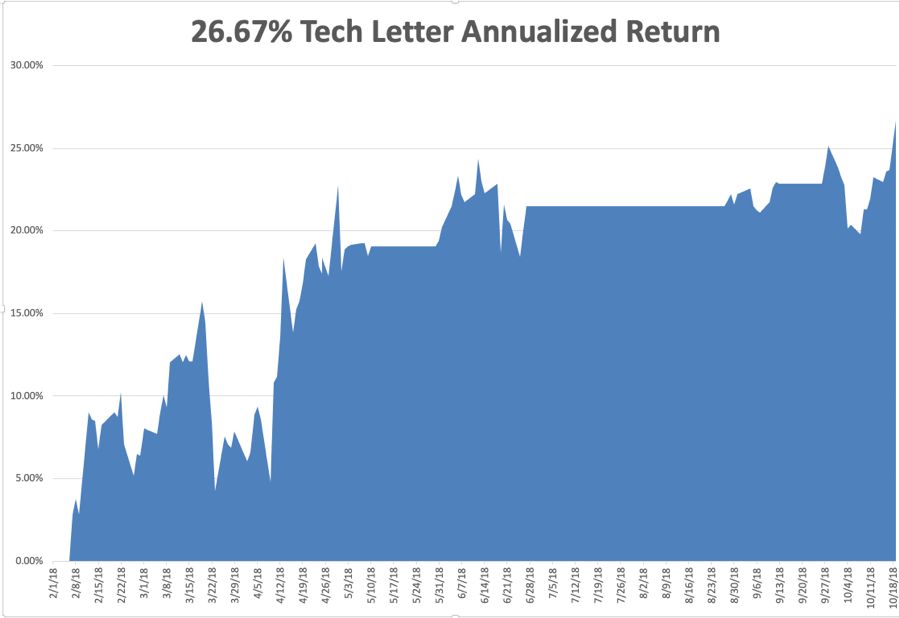

The Mad Hedge Technology Letter has done even better, blasting through to a new all-time high at an annualized 26.67%. It almost completely missed the tech meltdown and then went aggressively long our favorite names right at the market bottom.

I’d like to think my 50 years of trading experience is finally paying off, or maybe I’m just lucky. Who knows?

This coming week will be pretty sedentary on the data front, with the Friday Q3 GDP print the big kahuna. Individual company earnings reports will be the main market driver.

Monday, October 22 at 8:30 AM, the Chicago Fed National Activity Index is out. 3M (MMM), and Logitech (LOGI) report.

On Tuesday, October 23 at 10:00 AM, the Richmond Fed Manufacturing Index is published. Juniper Networks (JNPR), Lockheed Martin (LMT), and United Technologies report.

On Wednesday, October 24 at 10:00 AM, September New Home Sales will give another read on entry-level housing. At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report. Advanced Micro Devices (AMD), Ford Motor (F), and Microsoft (MSFT) report.

Thursday, October 25 at 8:30, we get Weekly Jobless Claims. Alphabet (GOOGL) and Intel (INTC) report.

On Friday, October 26, at 8:30 AM, a new read on Q3 GDP is announced.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I am headed up to Lake Tahoe this week to host the Mad Hedge Lake Tahoe Conference. The weather will be perfect, the evening temperatures in the mid-twenties, and there is already a dusting of snow on the high peaks. The Mount Rose Ski Resort is honoring the event by opening this weekend.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 22, 2018

Fiat Lux

Featured Trade:

(FACEBOOK’S DARPA DALLIANCE),

(FB), (GOOGL), (AAPL)

How far will society and government allow tech companies to adventure before there is some blowback?

Honestly, it’s hard to say when to put the shackles on these companies that are getting too powerful for their own good.

Tech companies have been pedal to the medal pushing the limitations of what the human world can offer.

The hoard of profits showered on the tech giants is one thing, but should they be held accountable for the unintended consequences that there robot-like profit-making operations dump on society?

Each company has chosen different ways to deploy the capital. Apple decided to reward shareholders by executing a $100 billion share buyback program.

The stock has performed great this year.

Apple (AAPL) and CEO Tim Cook have been keen to show a trustful face among a growing phalanx of data misusers.

Facebook (FB) has used the surplus capital to build a secretive research center modeled after the Defense Advanced Research Projects Agency (DARPA) called Building 8.

DARPA is an agency of the United States Department of Defense responsible for the development of emerging technologies for military use.

The division of the government was launched in 1958 by United States President Dwight D. Eisenhower to counteract the Soviet launching of Sputnik 1 in 1957.

DARPA smartly partnered together with America’s business leaders, academia, and other talents dotted around the government and military branches to develop projects that would broaden the frontiers of technology and science far beyond immediate U.S. military current needs.

Building 8 met the real world for the first time when its first product Portal, a vertically-shaped display screen attached to a smart camera, debuted with befuddlement.

How does a company that just announced a breach of 50 million accounts, after a torrid string of mishaps which made a mockery of Facebook’s use of big data, launch a device that gives Facebook unfettered access into the confines of one’s personal home?

A Facebook spokesman said that Facebook will “use this information to inform the ads we show you across our platforms. Other general usage data, such as aggregate usage of apps, etc., may also feed into the information that we use to serve ads.”

Executives at Facebook know that this product would be a commercial write-off, but the sunk cost associated with this project forced them to throw it on the market with reckless abandon.

And at the end of the day, some data is better than no data at all and that is what the earth’s existence is boiling down to.

So, if you thought that Facebook might finally decide to stop being your effective cyber-stalker, you are wrong.

And this is all just the beginning, it gets a lot worse than this, let me explain.

In fact, Facebook’s Building 8 was led by the former Director of the Defense Advanced Research Projects Agency Regina Dugan.

The more I sniff around, the more I see her pawprints everywhere she went.

Dugan used her elite role at DARPA to score a job at Google’s (GOOGL) Advanced Technology and Projects (ATAP) group before she jumped ship to Facebook’s secretive research center Building 8.

Dugan’s tenure at DARPA from 1996 to 2012 meant she was privy to the LifeLog project which was developed for just one year and subsequently shut down.

This program was cancelled after heavy criticism from activists advocating privacy and rightly so.

But, was this program really shut down?

Lifelog was a program with the mission to effectively record all of an individual’s physical movements, conversations and everything they listened to, ate, read and bought.

Everything!

The premise of this program was to cultivate a permanent searchable record of one’s life.

The daredevil program was light years ahead of its time predating the iPhone, tablet, and the current wave of populism engulfing the free world.

Back then, the weaponizing of consumer technology was largely absent from the world, and the top brass of DARPA surely wasn’t naïve enough to believe that this technology could only be applied to create an epic cyber-diary of one’s life.

In any case, Dugan conveniently was employed by Google and Facebook and her knowledge of Lifelog was fluid, deep and comprehensive.

Unintended consequences are rife and, if I connect the dots, it appears that DARPA’s Lifelog found new spawning grounds in Silicon Valley’s richest companies, or at least two of them.

There is no way to know for sure, but monetizing Lifelog’s cyber-record technology to harness it as a tool to collect personal information for the use of digital ad targeting has rained profits down on these two companies.

Building 8 is serving up round two of its DARPA-esque mission by announcing that they have built a prototype producing an armband that will facilitate the understanding of oral language “through a person’s skin.”

It was in January 2017 when Dugan took the stage in San Jose at a conference to announce this project.

It was mostly dismissed as fantasy and something out of science fiction.

Well, it’s one more step closer to being rolled out in mass market form.

The way the language process works is that vibrations allow for the roots of words to be transformed into silent speech.

If scientists manage to do this, it would give deaf people a new lifeline giving them the capability to understand what people are saying without the need for lip reading.

However, on the other side of the coin, the technology could be modified to aid spies in eavesdropping if the range of the vibrations allows them to.

The second project announced by Dugan that same night in San Jose was Facebook’s bold attempt of a noninvasive brain sensor designed to turn thoughts into text.

This would require brain surgery to install a sensor, and the plan for this technology is for people to access devices from their brain without the need to physically or orally communicate with it.

I suspect that Facebook would collect the data from this brain sensor and the sensor would be in contact with the Facebook infrastructure sharing the performance and state of operations.

If the sushi hits the fan and a person dies from the sensor, Facebook would need to analyze the specific details in the malfunction.

What a scary thought.

Facebook adopting the DARPA blueprint from its halted project of Lifelog to respawn similar technology that painstakingly retrieves as much data about our lives as possible is the first step to something substantially bigger.

However, the digital ad business has made Facebook and Google insanely rich and they want an encore.

I am surprised that other Silicon Valley cash-rich companies avoid tapping up the offspring of other military-grade technology to join the profit parade.

Apparently, there has been zero backlash from it.

If Facebook somehow manages to roll-out a commercialized brain sensor giving Mark Zuckerberg access to our minds, I wonder what on earth could round three entail for Zuckerberg…

Nothing is impossible.

Facebook’s Building 8 - First Product

“What’s dangerous is not to evolve.” – Said Founder and CEO of Amazon Jeff Bezos

“The next time we have a global economic crisis it will be much worse than in 2008. There will be money printing and war. The whole system will collapse. You don’t want to own government bonds and cash. Equities don’t do well, but at least you still have the ownership of companies. Precious metals do well in that environment, and so does oil,” said Mark Faber, publisher of the Gloom, Boom, and Doom Report.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

October 19, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

2) Will Saudi Arabia Dump Their Technology Holdings, in response to the Khashoggi murder? Some tech traders think so. Hey, if you boycott Middle Eastern countries that cut off the fingers of journalists you won’t be able to go anywhere. Click here.

3) Subprime Debt is Making a Big Comeback. Another sign of a long-term market top. Some people will do anything for yield in this low return world. Click here.

4) September Existing Home Sales Down a Disastrous 3.5%, a 2 ½ year low. If you had any doubts the housing boom is well and truly over. Click here.

5) The Algorithms Are Coming After You. Actually, this letter has been written by an algorithm for the last ten years, I just haven’t told you yet. Fooled you! The San Francisco conference scene has turned to all AI all the time. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(LAST CHANCE TO BUY TICKETS NOW FOR THE MAD HEDGE LAKE TAHOE CONFERENCE FOR OCTOBER 26-27)

(FIVE STOCKS TO BUY AT THE BOTTOM),

(AAPL), (AMZN), (SQ), (ROKU), (MSFT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.