While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

December 3, 2018

Fiat Lux

Featured Trade:

(I BET YOU’VE NEVER HEARD OF HUBSPOT)

(HUBS), (CRM)

Global Market Comments

December 3, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or

THE YEAR EVERYTHING WENT DOWN)

(SPY), (TLT), (COPX), (GLD), (IYR),

(FXE), (EEM), (USO), (IYR), (GM)

Last week saw the sharpest move up in stock prices in seven years. Why doesn’t it feel like it? Maybe it’s because we are all recovering losses instead of posting new profits. The mind has a funny way of working like that.

In fact, 2018 may go down as the year that EVERYTHING went down. Stocks (SPY), bonds (TLT), commodities (COPX), precious metals (GLD), foreign currencies (FXE), emerging markets (EEM), oil (USO), real estate (IYR), vintage cars, fine art, and even my neighbor’s beanie baby collection were all posting negative numbers as of a week ago.

In fact, Deutsche Bank tracks 100 global indexes and 88 of them were posting losses on the year. The normal average in any one year is 27. This is why hedge fund are having their worst year in history (except for this one). When your longs AND your shorts plunge in unison, there is nary a dime to be had. Even gold, the ultimate flight to safety asset has failed to perform.

Theoretically, this is supposed to be impossible. When stocks go down, bonds are supposed to go up and visa versa. So are emerging markets and all other hard assets.

This only happens in one set of circumstances and that is when global liquidity is shrinking. There is just not enough free cash around to support everything. So, the price of everything goes down.

The reason most of you don’t recognize this is that last time this happened was in 1980 when most of you were still a gleam in your father’s eye.

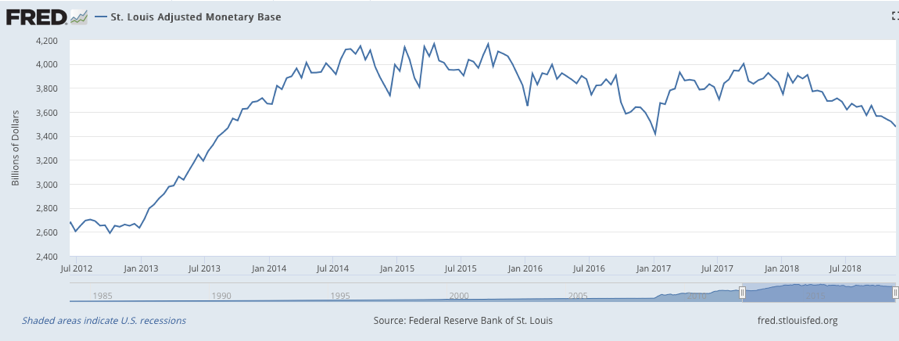

If you don’t believe me check, out the chart below from the Federal Reserve Bank of St. Louis. It shows that after peaking in July 2014, the Adjusted Monetary Base has been going nowhere and recently started to decline precipitously.

This was exactly three months before the Federal Reserve ended the aggressive, expansionary monetary policy known as quantitative easing.

The rot started in commodities and spread to precious metals, agricultural prices, bonds, and real estate. In October, it spread to global equities as well. Beanie babies were the last to go.

Want some bad news? Shrinking global liquidity, which is now accelerating, is a major reason why I have been calling for a recession and bear market in 2019 all year.

They say imitation is the sincerest form of flattery. Perhaps that is why 2019 recession calls are lately multiplying like rabbits. Nothing like closing the barn door after the horses have bolted. I wish you told me this in September.

Disturbing economic data is everywhere if only people looked. The S&P Case-Shiller Home Price Index rate of price rise hit an 18-month low at 5.5%. With housing in free fall nationally further serious price declines are to come. With mortgage rates up a full point in a year and affordability at a decade low, who’s surprised?

General Motors (GM) closed 3 plants and laid off 15,000 workers, as trade wars wreak havoc on old-line industries. It looks like Millennials would rather ride their scooters than buy new cars.

Weekly Jobless Claims soared 10,000, to 234,000, a new five-month high. Not what stock owners want to hear. THE JOBS MIRACLE IS FADING!

October New Home Sales were a complete disaster, down a stunning 8.9% and off 12% YOY. These are the worst numbers since the 2009 housing crash. I told you not to buy homebuilders! They can’t give them away now!

Oil plunged again, off 20% in November alone. Is this punishment for Saudi Arabia chopping up a journalist or is the world headed into recession?

It seems we don’t have quiet weeks anymore. Normally, sedentary Jay Powell ripped it up with a few choice words at the New York Economic Club.

By saying that we are close to a neutral rate, the Fed Governor implied that there will be one more rate rise in December and then NO MORE. Happy president. But the historical neutral range is 3.5%-4.5%, meaning there is room for 2-6 X 25 basis point rate hikes to keep the bond vigilantes at pay. Such a card! Thread that needle!

Cyber Monday sales hit a new all-time high, up to $7.3 billion, with Amazon (AMZN) taking far and away the largest share. The stock is now up $300 from its November $1,400 low.

Salesforce, a Mad Hedge favorite, announced blockbuster earnings and was rewarded with a ballistic move upwards in the shorts. Fortunately, the Mad Hedge Technology Letter was long.

The Mad Hedge Alert Service managed to pull victory from the jaws of defeat in November with a last-minute comeback. Add October and November together and we limited out losses to 0.59% for the entire crash.

This was a period when NASDAQ fell a heart-stopping 17% and lead stocks fell as much as 60%. Most investors will take that all day long. I bet you will too. Down markets is when you define the quality of a trader, not up ones, when anyone can make a buck.

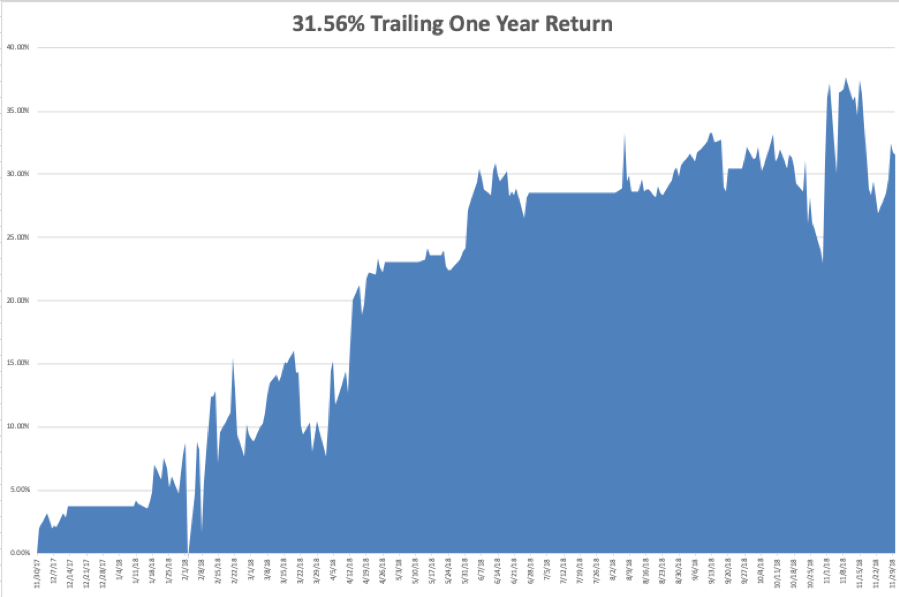

My year to date return recovered to +27.80%, boosting my trailing one-year return back up to 31.56%. November finished at a near-miraculous -1.83%. That second leg down in the NASDAQ really hurt and was a once in 18-year event. And this is against a Dow Average that is up a pitiful +2.9% so far in 2018.

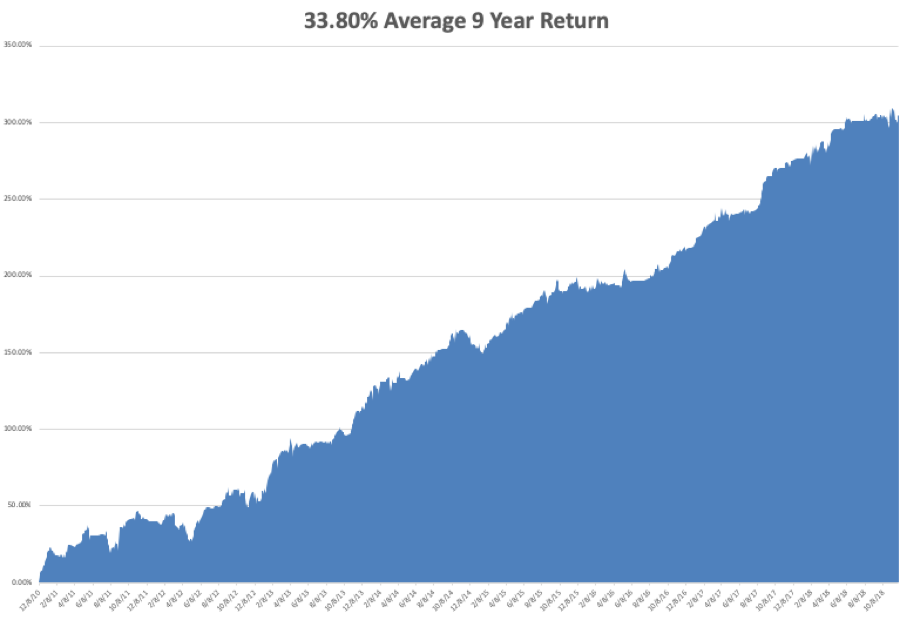

My nine-year return recovered to +304.27. The average annualized return revived to +33.80.

The upcoming week is all about jobs reports, and on Friday with the big one.

Monday, December 3 at 10:00 EST, the November ISM Manufacturing Index is published. All hell will break loose at the opening as the market discounts the outcome of the Buenos Aires G-20 Summit.

On Tuesday, December 4, November Auto Vehicle Sales are released.

On Wednesday, December 5 at 8:15 AM EST, the November ADP Private Employment Report is out.

At 10:30 AM EST the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, December 6 at 8:30 AM EST, we get the usual Weekly Jobless Claims. At 10:00 AM we learned the November ISM Nonmanufacturing Index.

On Friday, December 7, at 8:30 AM EST, the November Nonfarm Payroll Report is printed.

The Baker-Hughes Rig Count follows at 1:00 PM. At some point, we will get an announcement from the G-20 Summit of advanced industrial nations.

As for me, I’ll be driving my brand new Tesla Model X P100D which I picked up from the factory yesterday. I’ll be zooming up and down the hills and dales of the mountains around San Francisco this weekend.

I’ll also be putting to test the “ludicrous mode” to see if it really can go from zero to 60 in 2.9 seconds and give passengers motion sickness. I will go well equipped with air sickness bags which I lifted off of my latest Virgin Atlantic flight.

Talley Ho!

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

If you are on the prowl for a cloud-based software company with super-charged growth that is still in the early stages, then I have the one for you.

HubSpot (HUBS) sells online marketing software.

They are the one-stop for CRM (client relationship management), email and sales automation, pretty landing pages, social media marketing, keyword research, website analytics, and lead generation tools all on one platform.

In general, HubSpot targets the SMEs (small and medium enterprises) and offers an intuitively designed product adding value to over 50,000 firms.

They even have a freemium package allowing newbies to sample the power the software tools possess.

This service starts its pricing at $50 per month for the basic package and it may not seem like much.

But then there are the add-ons that guarantee lead to a wave of additional upselling - a boon to quarterly revenue.

The initial price base is usually followed with price increases into the thousands because business needs more contacts to slot into its data silos and features to harness elaborate marketing campaigns.

This is all the cost of doing business and signals that HubSpot has the ability to carve out even more revenue than the starter packages they offer.

If companies are moaning about the boost in costs, I would lash back and say the added costs are warranted because of the enticing surge in productivity that scaling and better tools offer marketers leading to higher performance.

Plus, HubSpot isn’t the only cloud-based software company offering add-on tools to massage the customer’s demands.

These demands are multiplying by the day as marketing software becomes more complicated and sellers require hybrid-solutions to seal the deal with the end-buyer.

Sequentially, HubSpot’s revenue is expanding ferociously up 35% from last quarter.

On a 3-year basis, HubSpot has demonstrated it can uphold a furious pace of growth averaging a 42% growth rate during this time.

The company is still smallish with a market capitalization of $5 billion, but that won’t last for long as revenue expansion will reward shareholders with a higher share price.

Some of the positives from this marketing software is that its quality is highly competitive with other industry players such as Infusionsoft.

There will be certain companies that fit different software as marketing software is incredibly diverse.

The way that developers approach certain tools will naturally result in a different product altogether.

Specifically, I favor the centralization of HubSpot’s tools.

The holistic nature of HubSpot’s software makes the sum of the parts more valuable.

Online marketing is not just a one-day fly-by-night operation. Industry professionals would admit it’s an arduous grind. They must commit to one platform because HubSpot has made it hard to hop around.

Specifically, I like that HubSpot locks up companies with 1-year contracts instead of a rolling month-to-month contract that encourages companies to jump ship whenever there is an incremental upgrade elsewhere.

This has the effect of smoothing over revenue with the recurring billing helping the CFO plan the future allocation of the company and, most importantly, retaining its core customer base.

HubSpot also charges for technical support topping up its revenue by deciding to avoid giving this service for free. Professional guidance shouldn’t be free and, in digital marketing, you pay for what you get, period.

Catering towards its lower-end customers, HubSpot offers a comprehensive training and extensive support material making the platform easy to maneuver around from the get-go.

HubSpot is also integrated into Salesforce showing that it doesn’t have to be the star of the show all the time but can play the role of supporting actor just as well.

Revenue is revenue.

But I would personally go even further and claim that HubSpot’s functionality not only blows Infusionsoft’s, an online marketing competitor, out of the water, but it pushes omnipotent Salesforce (CRM) to its limits.

All of this means that HubSpot is predicted to surpass revenue of $500 million in 2018 after posting revenue of $375 million last year.

HubSpot doubled sales revenue in just two years.

Even though they are expanding from a small base and is blown out of the water by Salesforce on this metric, they are doing exactly what companies this size should be doing in the tech industry.

Stalling growth like over at Venice Beach at Snapchat’s (SNAP) headquarter is a bona fide red flag.

Accelerating revenue is the most pivotal deal-clincher for investors and separates the men between the boys.

Technology is one of the few industries in the economy that have a panoply of companies able to accomplish this feat.

Like it or not, online marketing is one section of tech that is not going away.

Have you realized the heavy stream of emails alerting you to different services and products?

There is a high chance those emails originated from HubSpot and this trend is not going away.

Marketing email volume will only climb until the cost of emails rises substantially which I highly doubt.

Technology is getting cheaper and so is the cost of running a business because of this technology.

Being able to offer poignant tools to its customer base has led to a heavy dose of R&D spending increasing 63% YOY. Even with these higher expenses, HubSpot was able to deliver a stellar EPS beat last quarter posting 17 cents when the consensus was a minuscule 5 cents, beating the forecast by more than three times.

The future looks rosy for this company because we are just in the early innings of the digital revolution for smaller companies.

They will have to migrate or die out.

Even the IT staff at the Mad Hedge Fund Trader has integrated HubSpot into our bevy of software tools and there are no complaints.

The bottom line is that HubSpot grew its customer base 40% YOY to over 52,500.

That is hard to beat.

On the downside, lower average revenue per customer is a concern. The 4% drop is not in tune to what growth companies should demonstrate but I believe the reacceleration of investment into its marketing tools will bear fruit and elevate this dragging number.

That being said, the $9,959 per customer is not a shabby figure at all, and a certain reversion to the mean was due to take place at some point. I would be worried if this drop happened at a much lower average number.

When you delve deeper into the numbers, it appears as if the culprit was HubSpot offering too many teaser starter packages to lure in new business.

Therefore, a slight pricing hiccup for this online marketing company is a one-off and can easily be rectified by upselling its pricing packages from a more advantageous starting point.

HubSpot doesn’t need to dig deeper into the lower end of the bush league and pull out all the nasties.

Moving forward, the roadmap looks fruitful as HubSpot plans to migrate from the smaller companies to higher end and more lucrative business boding well for margin expansion and future average revenue per customer.

This will feedback growing capital into its R&D to develop even more shiny tools for these more advanced marketers.

Shares of HubSpot are a little frothy at this point, and if shares pull back to $120, it would serve as a premium entry point.

Online marketing works well and new business will be up for grabs as a whole slew of companies pivot towards online marketing giving HubSpot a chance to slice off another massive chunk of business powering up annual revenue.

If you have a small business and are considering traversing into the world of online marketing, then visit HubSpot’s website at https://www.hubspot.com

“There’ll always be serendipity involved in discovery.” – Said Founder and CEO of Amazon Jeff Bezos

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.