The only good thing to be said about last week is that it only lasted four days. If it had been open a fifth, the Dow Average (INDU) might have fallen another 800 points.

This is the first time since 1972 that every single asset class lost money for the year, and we were in the heat of an oil shock back then.

To earn money to pay for college, I was running a handy little business buying junk heap Volkswagen Beetles in California, getting them repainted in Mexico, and then selling them for huge profits in Los Angeles. That’s me, ever the entrepreneur.

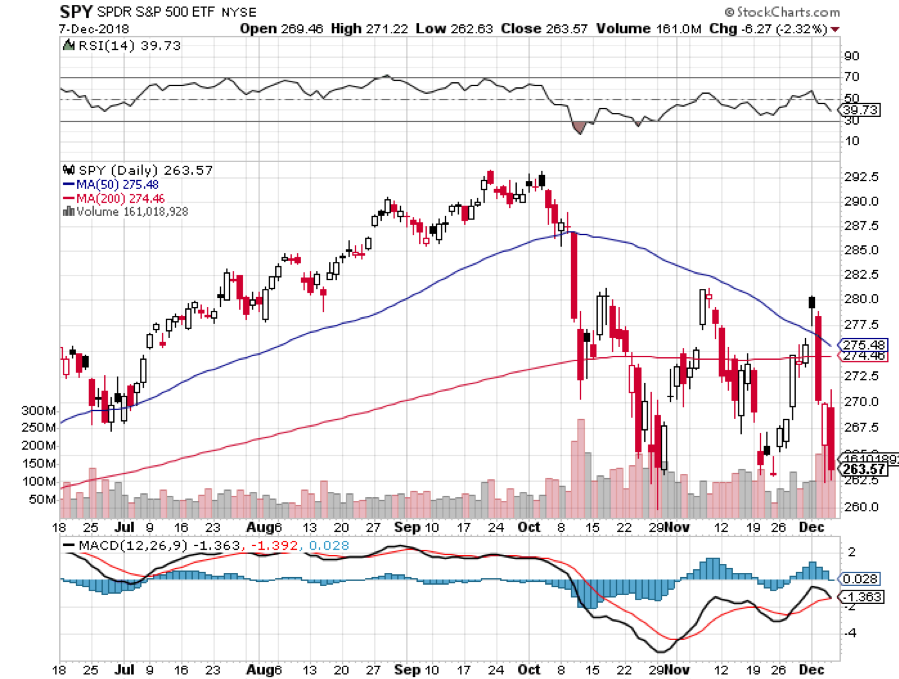

As it was, three consecutive 800-point drops are the sharpest selloff we have seen since the 1987 crash. But despite all the violence and handwringing, the market is exactly where it was nearly two months, six months, ten months, and one year ago.

Talk on the street is rife of hedge funds blowing up, fat finger trades, and algorithms run wild. This could be the first stock market correction untouched by human hands.

What we have seen is some of the most extreme volatility in history with no net movement. And you wonder why institutions are so relaxed.

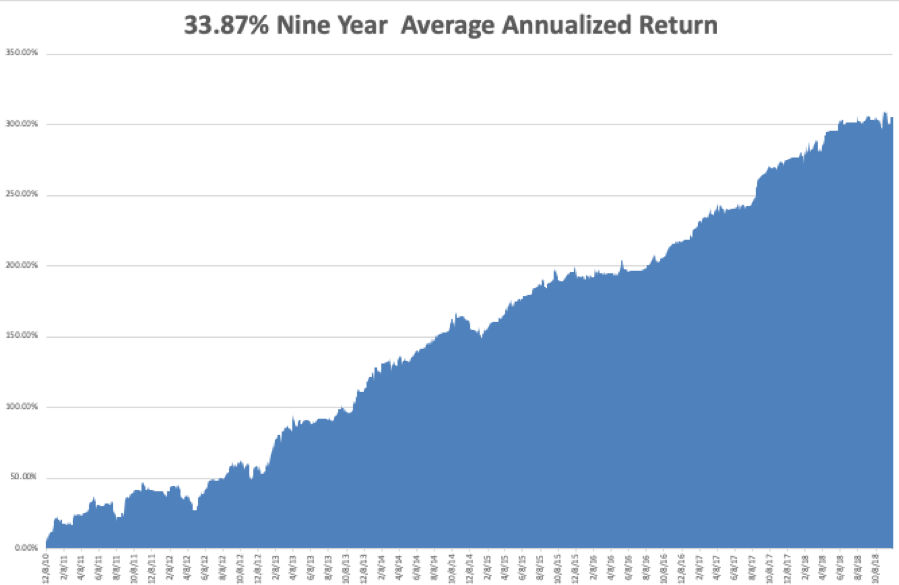

Let’s face it, we have all had it way too easy way too long. Who makes an average annualized return of 33.87% for 10 years? Oops, that’s me.

What happens next? One more dive to truly flush out the last of the nervous leveraged longs and then the long-promised Christmas rally.

Remember, markets will always do what they have to do to screw the most people, and that would be stopping traders out of their positions and then closing the year at multi-month highs.

Apple (AAPL) in particular was pummeled mercilessly, besieged by analyst downgrades almost every day. Steve Jobs’ creation is now down a stunning $65, or $27.9%. It dropped 40% when Steve died. I’m sure both Apple and Warren Buffet are in there soaking up stock every day with the shares at a half-decade earnings multiple low and laughing all the way to the bank.

But here’s the problem with that logic. Fundamentals can be very dangerous in an out-and-out panic. As my friend John Maynard Keynes used to say, “Markets can remain irrational longer than you can remain liquid.” Apple and Warren Buffet can wait out this correction, but can you, especially if you are a trader? If the stock falls further, they’ll just buy more.

The week started with such promise in the euphoria and afterglow of the G-20 Summit in Buenos Aires. It only lasted 24 hours when we discovered that nothing the administration said was true, all refuted by the Chinese when they got home to Beijing.

On Thursday, we learned that while the president’s team was negotiating, they arrested of the scion of one of China’s top tech companies while changing planes in Canada for a vacation in Mexico. It was equal to arresting the number two at Apple.

That little tidbit alone was worth a drop of 1,600 Dow points. As a result, half of all senior executive visit to the Middle Kingdom were instantly cancelled. Who wants to have “Hostage” listed on their resume?

If that were the only thing to worry about, the market would have bounced back sharply the next day and we would all be back in the Christmas mood.

But it’s not. Recession forecasts are starting to multiply like rabbits.

The Fed is growing cautious with 4 of 12 districts reporting slowing growth, said the Wednesday Beige Book report. The word “tariffs” is mentioned 39 times and is cited as a major reason for the lack of business clarity, and therefore capital investment for 2019.

The bond market is calling for a recession as “inversion” become the word of the year. The 2 year-10 years spread has shrunk to 12 basis points, an 11-year low, while the 3 year-5 year is already inverted. Massive short covering of bonds by hedge fund has ensued.

The ensuing bond melt-up was the most extreme in years as heavily short hedge funds ran for the sidelines. Now that they’re out, it’s safe to sell short again.

The November Nonfarm Payroll came in at a weak 155,000, but headline unemployment still hugs a half-century low. I saw the first really solid evidence of a recession when I drove by a high-end housing project in an upscale neighborhood and saw that it was abandoned with all equipment and tools removed. The developer obviously froze construction to get out of the way of a rapidly slowing economy.

In fact, things have gotten so bad that they may start getting good again. Instead of raising rate three times like clockwork in 2019, the Fed may adopt a “one and done” policy in December. That is where the bond market received its recent shot of adrenaline.

I doubt it as our nation’s central bank is a profoundly backward-looking organization. If the economy was hot a year ago, that means interest rates have to be raised today.

When will someone start spiking the eggnog? An awful lot of people are starting to discount a 2019 recession no matter what the administration says. If the Santa Claus rally doesn’t start this week, it will be too short to notice.

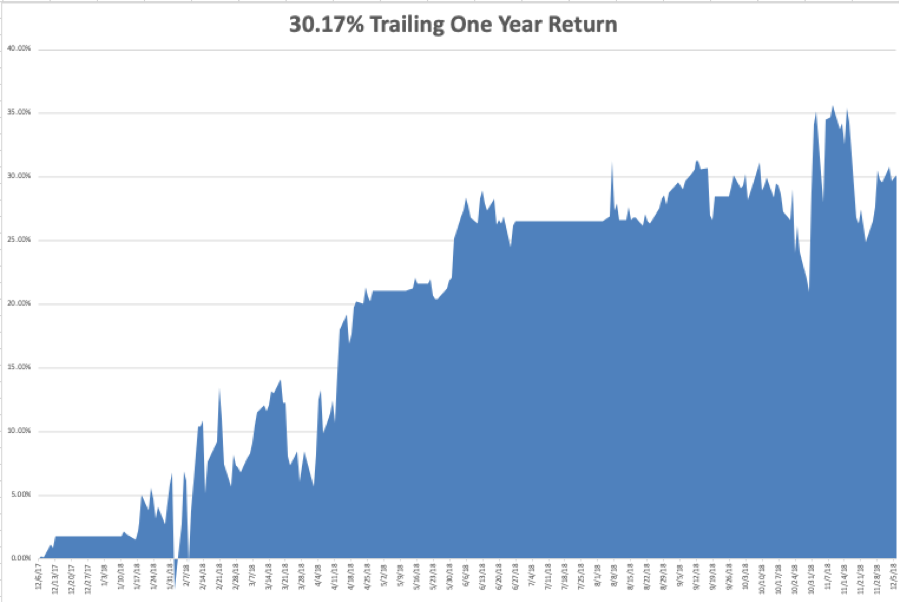

My year-to-date return recovered to +28.42%, boosting my trailing one-year return back up to 30.17%. December is showing a modest gain at +0.62%. That last leg down in the NASDAQ really hurt and was a once-in-18-year event. And this is against a Dow Average that is down a miserable -1.6% so far in 2018.

My nine-year return nudged up to +304.89. The average annualized return revived to +33.87.

The upcoming week is light on data after last week’s fireworks. The CPI is the big one, out Wednesday. Hopefully, that will give us all time to attend our holiday parties.

Monday, December 10 at 8:30 AM EST, the November Producer Price Index is out.

On Tuesday, December 11, November Producer Price Index is out.

On Wednesday, December 12 at 8:30 AM EST, the all-important November Consumer Price Index is released, the most important read we have on inflation.

At 10:30 AM EST, the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, December 13 at 8:30 AM EST, we get the usual Weekly Jobless Claims.

On Friday, December 14, at 8:30 AM EST, we learn November Retail Sales.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I will be spending my weekend assembling the ski rack for my new Tesla model X P100D. I’ll be damned if I can get the pieces to fit together, and what is this extra bag of parts for? I hope the car is made better than this!

As for my VW trading business from 46 years ago, repair work done on US registered cars in Mexico was then subject to a 20% import duty. When the customs officer leaned against the car to ask if I had any work done recently, I fibbed. As he walked away I notice to my horror that the front of his pants was entirely covered with fresh green paint.

I never went back. Stocks looked like a better bet.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader