When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 2, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GOODBYE THE QUARTER FROM HELL),

(SPY), (INTC), (AMZN), (CSCO),

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON),

(THE HARD/SOFT DATA CONUNDRUM)

Well, that was some quarter! Call it the quarter from hell.

For as long as most traders and investors can remember, they are losing money so far this year. And they promised us such a rose garden!

The S&P 500 made a valiant, and so far successful effort to hold at the 200-day moving average at $256. We saw an unprecedented four consecutive days of 2% moves.

Yet, with all that tearing of hair, banging of heads against walls, and ulcers multiplying like rabbits, the (SPY) dropped only 5 points since January, off 1.8%, a mere pittance. It's been a whole lot of work and stress for nothing.

So far, the (SPY) has been bracketed by the 50-day moving average on the upside at $272, and the 200-day moving average on the downside. It could continue like this for six more months, forming a very long triangle formation with a year-end upside breakout.

Is the market going to sleep pending the outcome of the November midterm congressional elections?

But here's the catch. We now live in the world of false breakouts and breakdowns, thanks to algorithms. It happened twice in February and March to the upside.

What follows false upside breakouts? How about false downside breakdowns, which may be on the menu for us in April.

My bet is that we'll see one of these soon, taking the (SPY) down as low as $246. Then we'll rocket back up to the middle of the range in another one of those up 100-point days.

What will cause such a catharsis? An escalation of the trade war would certainly do it. Or maybe just a random presidential tweet about anything.

That's why I have been holding fire so far on my volatility shorts and more aggressive longs in stocks.

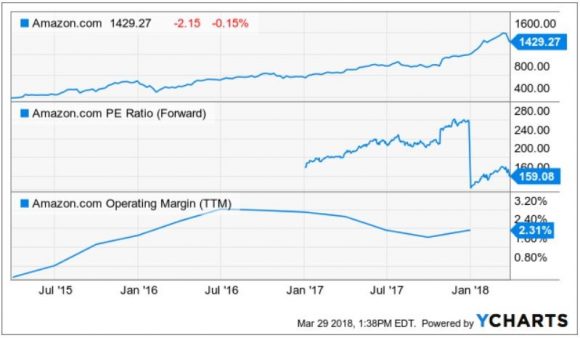

What will I be buying? Amazon (AMZN), which has essentially an unlimited future. Thank the president for creating a rare 16% selloff and unique buying opportunity with his nonsensical talk about antitrust action.

On what exactly does Amazon have a monopoly? Brilliance?

I also will be taking a look at laggard legacy old tech companies such as Intel (INTC) and Cisco Systems (CSCO). And how can you not like Microsoft here (MSFT)?

Of course, the mystery of the week was the strength in bonds (TLT) taking yields for the 10-year Treasury down to 2.75%. This is in the face of a Treasury auction on Wednesday that went over like a lead balloon.

I think it's all about quarter end positioning more than anything. Some hedge funds have big losses in stocks and volatility trading to cover, and what better way to do it than take profits on bond shorts through buying.

I already have started selling into the rally.

The scary thing about the bond action is that it has accelerated the flattening of the yield curve, with the two-year/10-year spread now only 50 basis points.

It also brings forward the inversion of the yield curve. And we all know what follows that with total certainty: a bear market in stocks and a recession.

The data flow for the coming week is all about jobs, jobs, jobs.

On Monday, April 2, at 9:45 AM, we get the March PMI Manufacturing Index.

On Tuesday morning, we receive March Motor Vehicle Sales, which have recently been weak at 17.1 million units.

On Wednesday, April 4, at 8:15 AM EST, the first of the trifecta of jobs reports comes out with the ADP Employment Report, a read on private sector high.

Thursday, April 5, leads with the Weekly Jobless Claims at 8:30 AM EST, which hit a new 49-year low last week at an amazing 210,000.

At 7:30 AM we get the March Challenger Job Cut Report.

On Friday, April 6, at 8:30 AM EST, we get the Big Kahuna with the March Nonfarm Payroll Report. Last month brought shockingly weak figures.

The week ends as usual with the Baker Hughes Rig Count at 1:00 PM EST. Last week brought a drop of 2.

As for me, I am headed up to Lake Tahoe, Nev., today for spring break to catch the last of the heavy snow. After a record 18 feet in March, Squaw Valley, Calif., has announced that it is keeping the ski lifts open until the end of May.

Good Luck and Good Trading.

It is the greatest conundrum facing traders, investors, and financial advisors today.

The recent "soft" economic data says the economy is booming, animal spirits are roaring, and the Trump trade is alive and well.

The "hard" data indicates that the economy is fading, fear and uncertainty are rampant, and you should sell everything immediately.

It is the greatest hard/soft divergence in the modern history of the US economy.

What's a poor investor to do?

Get this one right, and you'll make a killing. Get it wrong, and your portfolio will turn to ashes.

The numbers are undeniable.

"Soft" data comprises various poll-driven reports, such as consumer confidence and business surveys. These have been running.

The University of Michigan Consumer Sentiment Index hit a decade high in January and is up enormously YOY. Business surveys of every description are breaking records.

That "hard" data comprises economic reports that measure actual activity, such as retail sales.

These have not rebounded nearly as much as the soft data. Retail sales, housing sales, and the negative wealth effect of a falling stock market have all been turning in in-line or disappointing prints.

Here's a further complicating factor. Soft data is forward looking, while hard data is decidedly backward focused, often turning in numbers that are months old.

As a result, many private economic forecasters, and even different agencies of the US government are coming up with spectacularly diverging economic predictions based on the hard/soft weighting of their models.

The Federal Reserve Bank of New York's model, which gives more weight to the soft data, is currently projecting a 3% gross domestic product "print" this year.

On the other hand, the Federal Reserve Bank of Atlanta's model, which incorporates less soft data, is expecting only a 1% print.

You might as well throw a dart at the wall in a dive bar and pick a number.

Dig deeper into the numbers, and your conclusions can only become more disturbing.

It turns out that the overwhelming bulk of positive sentiment is coming from largely small businesses in red Trump-supporting states. They're clearly drinking the Kool-Aid.

You get almost the opposite result on the East and West Coasts, or in surveys that only look at Fortune 500 companies.

Eventually, only one group will be right. Either the hard data will catch up with the soft data, or it won't.

With November midterm elections getting closer by the day, with no new legislation passed this year, I believe the Trump trade will take MUCH longer to play out than expected.

In fact, a major economy-shifting bill may not pass at all this year.

So don't dump your stocks on pain of death. The bull market in stocks probably has at least another year to run.

Just don't expect too much excitement for the next several months.

Sell every rally AND buy every dip. This is what the pros are doing, with great success, as well as the followers of the Diary of a Mad Hedge Fund Trader.

Is This One Hard, Soft, or Both?

Mad Hedge Technology Letter

April 2, 2018

Fiat Lux

Featured Trade:

(WHY THERE WILL NEVER BE AN ANTITRUST CASE AGAINST AMAZON)

(AMZN), (WMT), (MSFT), (FB), (DBX), (NFLX)

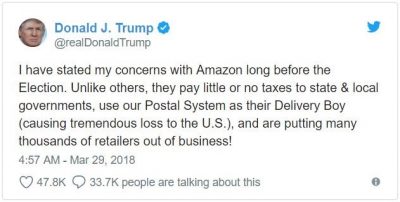

POTUS's Amazon tweet of March 29 has given investors the best entry point into Amazon (AMZN) since the January 2016 sell-off. Since then, the stock has essentially gone up every day.

Entry points have been few and far between as every small pullback has been followed by aggressive buying by big institutional money.

The 200-point nosedive was a function of the White House's dissatisfaction of leaked stories that would find their way into the Washington Post owned by Amazon CEO Jeff Bezos, my former colleague and good friend.

Although there are concerns about Amazon's business model, notably its lack of actual profits, there is no impending regulatory action. And, if there is one company that's in hotter water now, it's Facebook (FB), which inadvertently sells every little detail about your personal life to third-party Eastern European hackers.

Amazon's e-commerce business does not violate the Federal Trade Commission Act of 1914 of "deceptive" or "unfair practices."

The American economy has rapidly evolved thanks to hyper-accelerating technology, and the jobs required to support the modern economy have changed beyond all recognition.

The Clayton Antitrust Act of 1914 addressing harmful mergers that destroy competition hasn't been breached either since Amazon has grown organically.

Analyzing the most comprehensive law, the Sherman Antitrust Act of 1890, which was originally passed to control unions, espouses economic freedom aimed at "preserving free and unfettered competition as the rule of trade."

And, in a way, Amazon could be susceptible, but it would be awfully difficult to persuade the U.S. Department of Justice (DOJ) Antitrust Division and would take a decade.

Amazon's business model will change many times over by the time any antitrust decision can be delivered, or even entertained.

Helping Amazon's case even more is the DOJ interpretation of the three antitrust rules. It is the company's duty to first and foremost protect the consumer and ensure business is operating efficiently, which keeps prices low and quality high. Antitrust laws are, in effect, consumer protection laws.

Amazon's e-commerce segment epitomizes the DOJ's perception of these 100-year-old laws.

The controversial part of Amazon's business model is funneling profits from its Amazon Web Services (AWS) division as a way to offer the lowest prices in America for its e-commerce products.

This strategy has the same effect as dumping since it is selling products for a loss, but it is not officially dumping.

POTUS has usually delivered more bark than bite. The steel and aluminum tariffs went from no exceptions to exceptions galore in less than a week. Policies and employees change in a blink of an eye in the White House.

The backlash is a case of the White House not being a huge admirer of Amazon, but individual government workers probably have Amazon boxes stacked to the heavens on their doorsteps.

It is true that Amazon has negatively affected retail business. It is doing even more damage to traditional shopping malls, which it turns out are owned by close friends of the president. The mom-and-pop stores have disappeared long ago. But Amazon could argue this trend is occurring with or without Amazon.

In addition, Walmart (WMT) was the original retail killer, and it currently is morphing into another Amazon by investing aggressively into its e-commerce division. Does the White House go after (WMT) next?

Unlikely.

Amazon didn't create e-commerce.

Amazon also didn't create the Internet.

Amazon also does pay state and local taxes, some $970 million worth last year.

Technology has been a growth play for years.

Investors and venture capitalists are willing to fork over their hard-earned cash for the chance to own the next Google (GOOGL) or Apple (AAPL).

Many investors do lose money searching for the next unicorn. A good portion of these unicorns lose boatloads of money, too.

Spotify, slated to go public soon, is a huge loss-maker and investors will pay up anyway.

Investors went gaga for Dropbox (DBX), already up 40% from its IPO, and it lost $112 million in 2017.

The risk-appetite is hearty for these burgeoning tech companies if they can scale appropriately.

Should investors be prosecuted for gambling on these cash-losing businesses?

Definitely not. Caveat emptor. Buyer beware.

It is true that Amazon pumps an extraordinary percentage of revenues back into product development and enhancement.

But that is exactly what makes Amazon great. It not only is focused on making money but also on making a terrific product.

The bulk of its enhancement is allocated in warehouse and data center expansion. Splurging on more original entertainment content is another segment warranting heavy investment, too, a la Netflix (NFLX). Did you spot Jeff Bezos at the last Oscar ceremony?

Contrary to popular belief, Amazon is in the black.

It has posted gains for 11 straight quarters and expects a 12th straight profitable quarter for Q1 2018.

The one highly negative aspect is profit margins. It is absolutely slaughtered under the current existing model.

However, investors continually ignore the damage-to-profit margins and have a laser-like focus on the AWS cloud revenue.

Amazon's AWS segment could be a company in itself. Cloud revenue last quarter was $5.11 billion, which handily beat estimates at $4.97 billion.

Amazon's cloud revenue is five times bigger than Dropbox's.

The biggest threat to Amazon is not the administration, but Microsoft (MSFT), which announced amazing cloud revenue numbers up 98% QOQ, and has grown into the second-largest cloud player.

(MSFT) is equipped with its array of mainstay software programs and other hybrid cloud solutions that lure in new enterprise business.

(MSFT) has the chance to break Amazon's stranglehold if it can outmuscle its cloud segment. However, any degradation to Amazon's business model will not kill off AWS, considering Amazon also is heavily investing in its cloud segment, too.

Lost in the tweet frenzy is this behemoth cloud war fighting for storage of data that is somewhat lost in all the political noise.

This is truly the year of the cloud, and dismantling Amazon is only possible by blowing up its AWS segment. The more likely scenario is that AWS and MSFT Azure continue their nonstop growth trajectory for the benefit of shareholders.

Antitrust won't affect Amazon, and after every dip investors should pile into the best two cloud plays - Amazon and Microsoft.

__________________________________________________________________________________________________

Quote of the Day

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 29, 2018

Fiat Lux

Featured Trade:

(IS IT ALL OVER FOR ARTIFICIAL INTELLIGENCE?),

(GOOGL), (TSLA), (NVDA), (LRCX), (AMD), (BOTZ),

(CHINA'S COMING DEMOGRAPHIC NIGHTMARE)

Take a look at the worst performing stocks of the past two weeks and they all have one theme in common: artificial intelligence.

You can trace the beginning of the move back to the Arizona crash by an Uber AI autonomous driven car that killed a pedestrian.

As all those who have studied chaos theory in mathematics, it's like the proverbial butterfly that flapped its wings in a Brazilian rain forest, which then triggered a typhoon in Japan.

Never mind that the pedestrian was jaywalking at night wearing dark clothes. AI is supposed to see this. My guess is that only a sensor failure could have caused the accident, a dud $5 part, which means it has nothing to do with AI.

This is the second autonomous driving death in three years. The last one, involving a Tesla Model S-1 in Florida, didn't see the back of a white truck while driving into the sun, and crashed into it, killing the driver.

And here is the problem if you are a trader or investor.

Autonomous driving has been a major theme in the entire tech sector for the past two years.

You can start with the car companies, Tesla (TSLA), Uber, and Google's (GOOGL) Waymo, and extend all the way out through the entire ecosystem.

That would include the chip makers, NVIDIA (NVDA), which is suspending its autonomous program, Intel (INTC), Advanced Micro Devices (AMD), and the chip equipment maker Lam Research (LRCX).

So, is it game over for these companies? Is it time to pick up our marbles and play elsewhere (there is nowhere else)?

I don't think so.

Let's look at the hard numbers involving automobile accidents. During the same three-year period that AI cars killed two people, human drivers killed a staggering 100,000, and left millions with injuries.

So there is absolutely no doubt that AI is the superior technology. AI-driven cars don't text while driving, drink, take drugs, drive while tired, overdo it with an afternoon of wine tasting in Napa Valley, or look down at their cell phones, as did the safety driver in the ill-fated Uber car in Phoenix.

AI is not just a self-driving car theme. It is permeating every aspect of the modern economy and will continue to do so at an accelerating pace. It is no one-hit wonder.

All that is happening now is that AI and tech stocks in general are backing off from grievously overbought conditions.

As we approach the next round of earnings reports in a month, the market focus rapidly will shift back from tedious and distressful technicals. That's when they will rocket again.

There is an old market term for the current state of technology stocks. It is known as a "Buying Opportunity."

I haven't been able to touch stocks I love for months because they were completing upward moves of 50% to 300% over the past two years.

They have just become touchable once again.

To watch the video of the Phoenix crash and the expression of the clueless safety driver, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.