When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

February 11, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) What a Round Trip it has Been! Since the tax bill passed in December 2017, the return on the stock market has been ABSOLUTELY ZERO! What we gained in tax breaks we lost in trade wars. Except that now the bill is due with $1.8 trillion in new government borrowing this year. Oops! That is NOT what they promised.

2) NY Fed Slashes Q1 GDP Estimates, to below 2% with more cuts to come. Trade war uncertainty cited as the number one reason. Click here.

3) Remember Those Puerto Rican Bonds? A hedge fund, Tilden Park Capital Management LP, just made an $18 million killing off of the latest restructuring while another got tagged for $6 million. That’s what you get for playing in the deep end of the pool. Leave this high risk/high return game to the pros. Click here.

4) You Finally Got Your Tesla. Now, how do you get it fixed? Some 400,000 new cars this year will perilously overload the company’s infrastructure. Use every piece of bad news to buy more stock. The upside breakout is coming. Click here.

5) Put on Your Hard Hat, Consumer Spending is slowing. That means the recession is near. Fund managers are universally moving into defensive and value stocks. So should you. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET FOR THE WEEK AHEAD, or DON’T STAND NEXT TO THE DUMMY),

(AAPL), (MSFT), (TSLA), (VIX), (TLT), (TBT), (FXI)

(HOW FORTNITE IS TAKING OVER THE GAMING WORLD),

(TTWO), (EA), (ATVI), (NFLX), (FORTNITE)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

February 11, 2019

Fiat Lux

Featured Trade:

(HOW FORTNITE IS TAKING OVER THE GAMING WORLD),

(TTWO), (EA), (ATVI), (NFLX), (FORTNITE)

One idyllic content company reshaping the content landscape as we know it is Epic Games who is the producer of the video game phenomenon Fortnite.

Not only is Epic Games rapidly altering the video game industry by itself, it is also starting to take a bite out of Netflix’s subscriber growth momentum.

The company was established by Tim Sweeney as Potomac Computer Systems in 1991, originally founded in his parents' house in Potomac, Maryland.

The most fascinating nugget of information that came out of Netflix’s most recent earnings call was not that Netflix has already corralled 10% of television screen time in America, but the reason why this percentage is lower abroad is because of Fortnite taking away Netflix’s mojo.

Netflix (NFLX) has lately been asked to measure their content lead to the likes of Hulu, HBO, and the potential Disney streaming product about to hit the market.

But they explicitly confessed they were more worried about Fortnite and the revolution it is spawning.

The key takeaway is that Netflix is not only competing with fellow online content streamers, but video games are more of a threat to them than ever as they compete for the cord cutters and the elusive “cord nevers”.

Cord nevers are consumers who are digital natives who bypassed traditional media channels altogether.

Echoing the stickiness that Netflix has with its younger demographics, the company has targeted mobile screen time as a core driver usurping around 8% of American mobile phone screen time.

And if you thought Netflix was trying to sort out its own Fortnite problem, then how do you think the traditional American video game cohort felt about their own Fortnite problem?

The traditional trio of EA Sports (EA), Activision (ATVI), and Take Two Interactive (TTWO) have been shredded to bits by Fortnite.

Late last year, I gave readers a steer clear synopsis of this company and the latest dead cat bounce in EA and Take Two Interactive should be chances to cut your losses instead of putting more money to work in these names.

Yes, the momentum in Fortnite is that palpable that you stay away from any name that this phenomenon affects.

Activision had no dead cat bounce being the weakest of the three and the stock has gone awry almost halving from $83 to $43 today.

EA’s earnings report was a disaster with their lead title, Battlefield V, doing 1 million fewer sales than the 7.3 million management expected.

During the same holiday season, Take Two Interactive issued a follow-up to a classic that was better than EA’s holiday flagship game called Red Dead Redemption 2 and Activision rolled out another iteration of Call of Duty: Black Ops 4.

Even between the three, the competition was fierce, then throw Fortnite into the mix and comps are getting killed with huge earnings misses penalizing the share prices of this once-vaunted trio.

With the explosion of content in the past several years, consumers are absorbing more content than ever.

Most of this avalanche of content is consumed on mobile phones or televisions, but the behavior varies when you look closer at the different demographics.

Cord cutters total in the low 20 million and are growing 30% annually.

Cord nevers amount to about 30 million growing at 66%.

This all amounts to Americans spending about 12 hours accessing content every day running up to the barrier of natural limits.

That might give consumers some allocated time to sleep, eat, and work, but not much else. We are robotically reliant on content providers to deliver us our fill of daily content.

When automotive technology comes online, it could potentially eke out an incremental 1-2 hours that Americans can stare at their content while being chauffeured around.

How is Fortnite doing financially?

Fortnite earned $2.5 billion in 2018 from a mix of in-game items and passes.

A seasonal Battle Pass is $10, and over 30% of American gamers have purchased this product.

Unlike traditional video gamers who are tied to certain consoles, Fortnite is available on seven platforms: PlayStation 4, Nintendo Switch, Xbox One, PC, Mac, iOS, and Android.

In a time of $60 video games, this new freemium model must shake the foundations of the video gaming establishment.

The rise of freemium games could eradicate the console completely.

A $200-300 console seems expensive if games are free on your $100 Android phone.

The worst side-effect of Fortnite for the traditional video game producers is not Fortnite itself.

It’s the fact that this new model has opened up a new can of worms proving this freemium model with no consoles is the key to unlocking gaming audiences with a 24-hour battle royale, free to play, on-demand, in-game currency, season pass model that was thought to be a hopeful wish by industry analysts.

Then the next question is when will the next Fortnite-esque freemium go viral and can these legacy gaming companies alter their model to accommodate this new business model?

Indeed, management must be freaking out. They thought they had a monopoly on the gaming industry but the nimbler and forward-thinking firm has won-out.

Even the most subscribed YouTuber PewDiePie from Sweden is using Fortnite to keep him in the lead for most YouTube subscribers as Indian music YouTube channel T-Series has caught up with his subscriber count that currently totals 84.3 million.

PewDiePie’s lead was cut down to 20,000 and decided to leverage playing Fortnite squad matches to boost his subs.

The upload got over seven million views in a day backing up my thesis that Fortnite has become the hottest media content asset for cord cutters and cord nevers around the world.

As for the video game stocks, don’t touch them until Fortnite trails off.

And if another freemium game comes to the fore that they aren’t on, run for the hills.

Global Market Comments

February 11, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or DON’T STAND NEXT TO THE DUMMY),

(AAPL), (MSFT), (TSLA), (VIX), (TLT), (TBT), (FXI)

When I was a war correspondent (Cambodia, Laos, Iraq, Kuwait, Indonesia), my seniors gave me a sage piece of advice that saved my life many times.

“Don’t stand next to the dummy.”

Don’t go near the guy wearing the Hawaiian shirt, NY Yankees baseball cap, and aviator sunglasses. You want to be dressed in the same color as the troops and blend in as much as possible. Otherwise, the enemy will aim at the dummy and hit you.

As much as I tried, at 6’4” I was never going to blend in anywhere in Asia. So, I went into the stock market instead.

Now 50 years later, I am facing another dummy problem. Except that the next hit I may take will be of the financial kind rather than the metallic one.

The reaction to the Trump tax cuts is going to be far worse than any benefits the privileged class was able to reap from the cuts in the first place. Listening to the proposals aired, I shudder: A maximum 70% tax rate, the end of special estate tax treatment, a millionaire’s surtax, and the banning of corporate share buybacks.

It’s that last one that that will be particularly damaging for the US economy. Often, a company’s best possible investment is in its own shares where returns are frequently higher than possible through investing in their own business. Just think of all those shares Apple (AAPL) bought at $25, now at $170, and Microsoft (MSFT) picked up at $10.

This is one of the only occasions were management and shareholder interests are one and the same. The event is tax-free as long as you don’t sell your shares. And companies don’t have to pay dividends on stock they have retired, boosting profits even further.

The media loves pandering to the most extreme views out there. I know because I used to do it myself. Cooler heads will almost certainly prevail when the tax code is completely rewritten again in two years. Still, one has to worry.

The week had plenty for we analysts and strategists to chew on.

Is the Fed pausing because of political pressure or an economy that is falling apart? Neither answer is good for equity holders. Start cutting back risk while you can. There are lots of bids on the way up, but none on the way down as December showed.

There has lately been a rising tide of weak data to confirm the negative view.

Factory orders nosedived 0.6% in November, the worst in a year. Funny how nobody wants to make stuff ahead of a recession. ISM Non-Manufacturing Index Cratered to 56.7. Should we be worried? Hell, yes! Why are we getting so many negative data points and stocks keep rising?

Farm sector bankruptcies are soaring, hitting a decade high. Apparently, the trade wars and global warming aren’t working for them. Ironically, ag prices are about to take off to the upside when a Chinese trade deal gets done. Buy the ags for a trade.

Tesla (TSLA) cut prices again in a blatant bid for market share and global domination. The low-end Tesla 3 price drops to $42,900. Next stop $35,000. Too bad they laid off my customer support personnel to cut costs. I can’t find my AM radio.

China trade talks (FXI) hit the skids, taking the stock market down with it as an administration official concedes they are “nowhere close to a deal” with the deadline 3 weeks off. Trump desperately needs a deal while the Chinese don’t, who think they can do better under the next president. If you disagree with this view in China, your organs get harvested and sold on the open market.

The European economy is also going down the drain with the EC’s forecast of economic growth cut from 1.9% to 1.3%. The US-China trade war is cited as a major factor. The global synchronizes slowdown accelerates. Looks like they’ll have more time to drink cheap wine and smoke Gauloises.

The Volatility Index (VIX) hit $15 and that seems to be the bottom for the time being. The market was more overbought than at any time since July. Is the “fear gauge” signaling that happy days are here again? I doubt it. Don’t whistle past the graveyard.

The Mad Hedge Market Timing Index is entering danger territory with a reading of 67 for the first time in five months. Better start taking profits on those aggressive leveraged longs you bought in early January. Your best performers are about to take a big hit. The market has since sold off 500 points, proving its value.

There wasn’t much to do in the market this week, given that I am trying to wind my portfolio down to 100% cash as the market peaks.

I stopped out of my short portion in Apple when my stop loss was triggered by pennies. The second I was out, it began a $6 selloff. Welcome to show business.

I used a major 3 ½ point rally in the bond market to put on a new double short position there. The yield on the ten-year US Treasury bond has to plunge to 2.40% in a month, a three-year low, for me to lose money on this position. It’s a bet that I am happy to make.

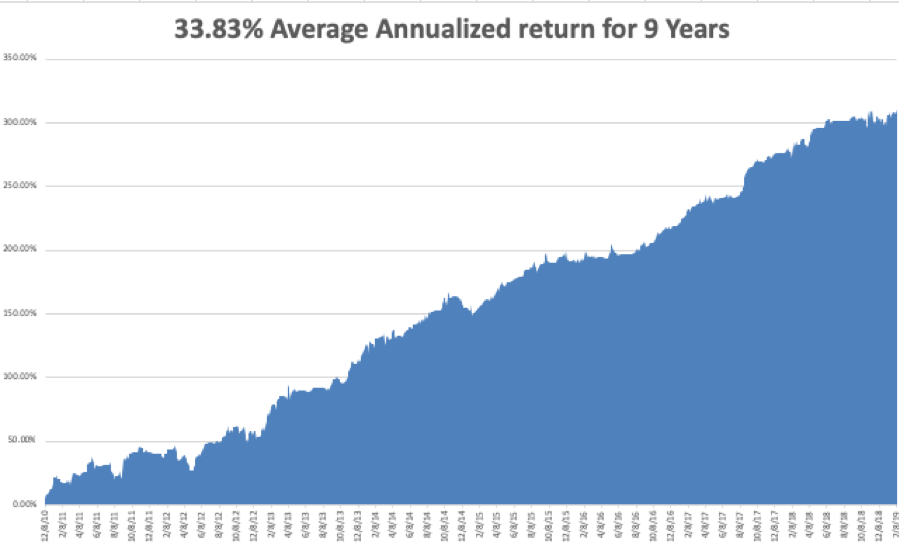

My 2019 year to date return leveled out at +10.03%, boosting my trailing one-year return back up to +35.75%.

My nine-year return maintained +310.17%, a new high. The average annualized return stabilized at +33.83%.

I am now 70% in cash and triple short the bond market.

Government data is finally starting to trickle out now that the government shutdown is over.

On Monday, February 11 there is nothing of note to report. Everything important is delayed.

On Tuesday, February 12, 10:00 AM EST, we get the January NFIB Small Business Index. Earnings for Activision Blizzard (ATVI) are out and should be a complete disaster, along with Twilio (TWLO).

On Wednesday, February 13 at 8:30 AM EST, the all-important January Consumer Price Index is published. Barrick Gold (GOLD) reports.

Thursday, February 14 at 8:30 AM EST, we get Weekly Jobless Claims. We also get December Retail Sales which should be good.

On Friday, February 15, at 8:30 AM EST, the February Empire State Index is out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I will be battling my way through the raging snowstorms of the High Sierras trying to get over Donner Pass to my Lake Tahoe estate. Unless I clear the six feet of snow off the roof soon, or the house will get crushed from the weight as it did three years ago.

Where are all those illegal immigrants hanging out in front of 7-Eleven now that I need them?

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

February 8, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) China Trade Talks Hit the Skids, taking stock market down with it as an administration official concedes they are “nowhere close to a deal” with the deadline 3 weeks off. Trump desperately needs a deal, while the Chinese don’t who think they can do better under the next president. If you disagree with this view in China, your organs get harvested and sold on the open market.

2) The European Economy is Also Going Down the Drain, with the EC’s forecast of economic growth cut from 1.9% to 1.3%. The US-China trade war is cited as a major factor. The global synchronizes slowdown accelerates. Looks like they’ll have more time to drink cheap wine and smoke Gauloises. Click here.

3) Barbie Rocks, boosting sales at Mattel (MAT) and delivering a 33% pop in the stock. Wouldn’t touch this sector on pain of death. Kids' tastes are wildly unpredictable. Just ask mine. Click here.

4) Apple is the World’s Largest Company Once Again, eclipsing Amazon (AMZN) with a market capitalization topping $810 billion. Expect these two and Microsoft (MSFT) to keep trading places in the coming year, but Amazon will eventually win out if Jeff can only put his personal life on hold. Click here.

5) Goodbye to the 747, as the once mainstay of international travel struggles to hang on as a cargo plane. When I saw the first test flight in Everette, WA in 1969, no one could believe it got off the ground. It turns out that two engines are much cheaper to run than four and there have been huge strides made in composite materials. I’ll miss the grand piano on the first class second floor. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(FEBRUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (FXA), (NVDA), (SPY), (IEUR),

(VIX), (UUP), (FXE), (AMD), (MU), (SOYB)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.