While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

March 11, 2019

Fiat Lux

Featured Trade:

(THE BEST TECH PLAY IN HEALTHCARE),

(ISRG), (GOOGL), (JNJ)

Seeking for a great long-term buy and hold tech name?

Then look no further than Intuitive Surgical, Inc. (ISRG).

Intuitive Surgical develops and produces robotic products designed to enhance clinical outcomes for patients through minimally invasive surgery, its most well-known product is the da Vinci surgical system.

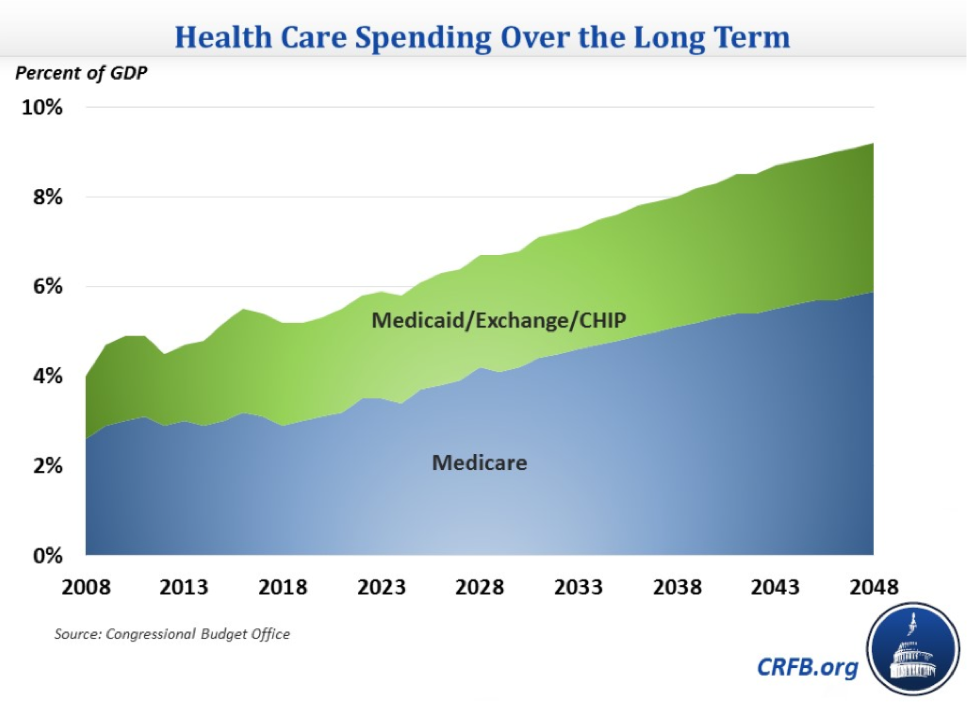

Healthcare is one sector that I have rarely touched on, but not only will this cross-pollination with tech serve a social good, investors have a chance to rake in future profits.

The da Vinci systems and Intuitive Surgical are the best of breed and have had almost zero competition in the past 20 years.

The systems are placed in operating room used for invasive surgery for various types of ailments from cancer to hernia, and the systems were successfully used over one million times for surgery last year.

The da Vinci systems aren’t cheap – they cost $1.5 million and the customers, usually the hospitals, buy the add-ons of extra parts and supplies that inflate the price another $1,900.

As you would expect, net profit margins are compelling, being over 30% which e-commerce companies would give a left leg for translating into numbers that make the company incredibly profitable.

The story of the da Vinci systems starts way back in the 80s with the Defense Advanced Research Projects Agency (DARPA) hoping it could figure out how to offer surgeons the ability to operate remotely on soldiers wounded on the battlefield.

SRI International (SRI), an American nonprofit scientific research institute and organization took the painstaking time to develop the technology.

SRI's intellectual property was eventually acquired in 1994 and incorporated a new company named Intuitive Surgical Devices by the founders.

It took another 4 years for the FDA (Food and Drug Administration) to finally approve usage of the da Vinci Surgical System.

The first available surgery was for general laparoscopic surgery used to address gallbladder disease and gastroesophageal disease.

The next year saw another harvest of approvals with the FDA giving the green light to use the system for prostate surgery.

The approvals started to flow like a waterfall with thoracoscopic surgery, cardiac procedures performed with adjunctive incisions, and gynecologic procedures also approved by the FDA.

Fast forward to 2019 and the company couldn’t be financially healthier looking back at the year of 2018 in review.

Instruments & Accessories revenues came in at $1.96 billion comprising 52.7% of total revenue.

System sales crushed it with $1.13 billion, growth of 30.3% YOY and service sales amounted to $635.1 million up 17% YOY.

And in the latest quarter, Intuitive Surgical reported 19% YOY growth in worldwide da Vinci procedure volumes which contributed to bumping up revenue 18% YOY in the instruments and accessories segment.

The company is seeing the same type of success abroad with foreign revenues totaling $307 million, up 24% YOY.

Intuitive Surgical installed 115 systems in the previous quarter outside of America compared with 86 in the quarter before last.

55 of these new systems were installed in Europe, 31 in Japan, and nine in Brazil.

Procedure growth is forecasted to expand between 13-17%, fueled by U.S. general surgery and procedures.

Unfortunately, the stock sold off after earnings because adjusted operating expenses are expected to rise 20-28% reminding investors that the stock can’t always move up in a straight line.

The harm to operating margins is a tough pill to swallow in the short-term, but that does not take away the gloss from this leading tech company.

Intuitive Surgical plans to branch out from the da Vinci systems with its new Ion system, a robotic-assisted bronchoscope awaiting FDA clearance, a revolutionary way to kill cancer cells inside the lung.

After decades of unbridled market leadership, there are a few icebergs ahead in the distance in the form of competition.

Verb Surgical, a collaboration between Johnson & Johnson (JNJ) and Alphabet (GOOGL), will enter the healthcare robot surgery market in 2020.

Johnson & Johnson recently indicated it will splurge $3.4 billion in cash for Auris Health, a robotics startup with a device to perform lung biopsies that could compete with Intuitive Surgical’s Ion system.

Auris Health was approved by the FDA in March 2018 for this device that performs lung biopsies and Intuitive Surgical promptly sued citing patent infringement.

Auris Health was established by the co-founder of Intuitive Surgical Dr. Frederic Moll who pioneered the field of surgical robotics but left Intuitive in 2003 after 8 years there.

Intuitive could rub up on some more competition in the future, that is a stark possibility, but the pathway to profits are still open as the company rolls out different systems, services, and has the capital to fund new directions.

Hospitals that already have existing relationships with Intuitive will be less inclined to switch over to competing services if they are satisfied with the quality, service, and price points of the equipment.

This will help Intuitive build on the current strong momentum and ensure their products are in the pipeline to be adopted by the next batch of future demand.

Shares of the company are sky-high and expensive with a PE multiple of 55.

The big investment into R&D is in no doubt to fend off the potential competition around the corner, but I view that as a net positive.

It would be logical to wait for a pullback to buy shares, this one is a keeper.

“We think coding should be required in every school because it's as important as any kind of second language.” – Said CEO of Apple Tim Cook

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Well, that was some week!

After moving up in a straight line for ten weeks, markets are now doing their best impression of a Q4 repeat.

The transports Index (XTN), the most important leading indicator for markets, has been down for 11 straight days, the worst run in 40 years.

And now for the bad news.

Look at a long term chart for the S&P 500 (SPY) and the head and shoulder top practically leaps at you and grabs you by the lapels (that is, if you are one of the few who still wears a suit).

It makes you want to slit your wrist, jump off the nearest bridge, or binge watch all nine seasons of The Walking Dead. It neatly has the next bear market starting around say May 10 at 4:00 PM EST, a rollover point I put out two years ago.

However, hold that move! As long as we have a free Fed put under the market in the form of Jay Powell’s “patience’ policy, we are not going to have a major crash any time soon. That is 2021 business.

It's more likely we trade in a long sideways range until the economy finally rolls over and dies. So when we hit my first (SPY) downside target at the 50-day moving average at $269, which is a very convenient 5% down from the recent top, could well bounce hard and I might add some longs in the best quality names. It all sets of my dreaded flatline of death scenario for the rest of 2019.

Last week saw an unremitting onslaught of bad news from the economy.

The February Nonfarm Payroll report came in at a horrific 200,000 when 210,000 was expected, sending traders to man the lifeboats. The headline Unemployment Rate dropped 0.2% to 3.8%. Average Hourly Earnings spiked 11 cents to $27.66, a 3.4% YOY gain and the biggest pop since 2009.

Construction lost 31,000 jobs, while leisure and Hospitality added no jobs at all. The stunner is that the U6 long term structural “discouraged worker” unemployment rate dropped an amazing 0.8% to 7.4%, the sharpest drop on record. Fewer jobs, but at higher wages is the takeaway here, the exact opposite of what markets want to hear.

US Construction Spending fell off a cliff, down 0.6% in December. It seems that nobody wants to invest ahead of a recession.

The dollar soared (UUP), and gold (GLD) got hammered. You can blame the slightly stronger GDP print on Thursday the week before, which came in at 2.2% instead of 1.8%. As long as Jay doesn’t raise interest rates this is just a brief short covering rally for the buck.

China cut its growth forecast from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus hasn’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip.

US Trade Deficit hit ten-year high at $59.8 billion for December, and a staggering $419 billion for the year. It’s funny how foreigners stop buying your goods when you declare war on them. Even Teslas (TSLA) are being stopped at the border in China. Who knew?

New trade tariffs hit US consumers the hardest adding $69 billion to their annual bill. Falling real earnings and rising costs is hardly a sustainable model. Will someone please tell the president?

US growth is fading, says the Fed Beige Book, slowing to a “slight to moderate rate”. The government shutdown is the cause. With Europe already in recession, I’ll be using rallies to increase my shorts. Sell (SPY) and (IWM).

The European Central Bank axed its growth forecast sharply, from 1.7% to 1.1%. Stimulus to renew on all front, including more quantitative easing. It’s just a matter of time before their recession pulls the US down. Sell the Euro (FXE).

You lost $3.7 trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion.

The Mad Hedge Fund Trader actually gained ground last week, thanks to profits on our short positions rising more than our offsetting losses on our longs.

I have doubled up my overall positions, finally taking advantage of the rollover in all risk assets from a historic ten-week run to the upside. I added shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) against a very deep in-the-money long in Freeport McMoRan (FCX) the world’s largest copper producer.

The thinking here is that with China the only economy in the world that is stimulating its economy and the planet’s largest copper consumer, copper makes a nice long side hedge against my short positions.

The Mad Hedge Technology Letter is happily running a short position is Apple (AAPL) which is now almost at its maximum profit point. We only have four days to run to expiration when the position we bought for $4.60 will be worth $5.00.

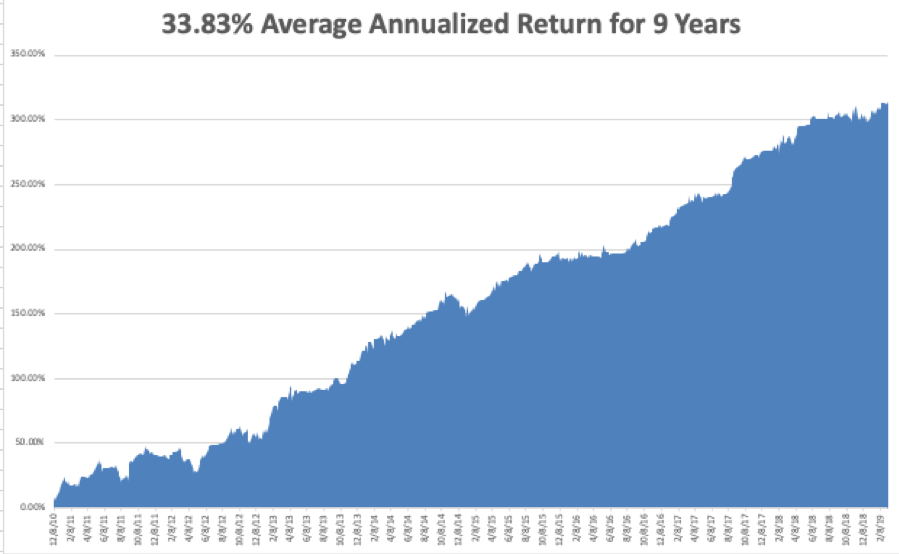

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started out negative, down -0.84%, thanks to a wicked stop loss on Gold (GLD). We had 80% of the maximum potential profit at one point but left the money on the table at the highs.

My 2019 year to date return ratcheted up to +12.84%, a new all-time high and boosting my trailing one-year return back up to +29.92%.

My nine-year return clawed its way up to +312.94%, another new high. The average annualized return appreciated to +33.83%.

I am now 50% in cash, 20% long Freeport McMoRan (FCX), and 10% short bonds (TLT), 10% short the S&P 500, and 10% short the Russell 2000.

We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 11, at 8:30 AM EST, January Retail Sales is ut.

On Tuesday, March 12, 8:30 AM EST, the February Consumer Price Index is published.

On Wednesday, March 13 at 8:30 AM EST, the February Durable Goods is updated.

On Thursday, March 14 at 8:30 AM EST, we get Weekly Jobless Claims. These are followed by January New Home Sales.

On Friday, March 15 at 9:15 AM EST, February Industrial Production comes out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be headed to the De Young Museum of fine art in San Francisco to catch the twin exhibitions for Monet and Gaugin. When it rains every day of the week, there isn’t much to do but go cultural.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Good Trades are Getting Harder to Find

“For myself, I am an optimist. It does not seem to be much use being anything else,” said British WWII Prime Minister, Winston Churchill.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

March 8, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) The Jobs Report is a Disaster, with the February Nonfarm Payroll Report at a minuscule 20,000 and against an average of 210,000. The headline unemployment rate drops to 3.8%. The jobs market has clearly peaked, so the recession is coming. Put on your hard hat and batten down the hatches. Click here.

2) Stocks Get Hammered, on news of the jobs report. Transports are now down 11 days in a row. All major indexes were down every day this week for the first time since 2016. The dreaded head and shoulders top for the entire ten-year bull market is forming. Click here.

3) You Lost $3.7 Trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion. Get a job. Click here.

4) Equity Fund Flows the Worst since 2008, with $60 billion in redemptions so far in 2019. Not that I’m trying to get you to choke on your coffee and doughnut this morning, but cash is fleeing the stock market at a record pace. Maybe you should too. Click here.

5) The Rich People Shortage Worsens, at least if you are trying to sell a high-end home. Over 500 homes are for sale in Manhattan for over $10 million each. What? You don’t have a helicopter landing pad on your roof? Horrors! That is so down market. Get another job. Click here.

Published today in the Mad Hedge Global Trading Dispatch:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.