“Every technological revolution takes about 50 years.” – Said Founder and CEO of Alibaba Jack Ma

Global Market Comments

April 8, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE FLIP-FLOPPING MARKET),

(SPY), (TLT), (TSLA), (BA), (LUV), (DAL)

Easy come easy go.

Flip flop, flip flop.

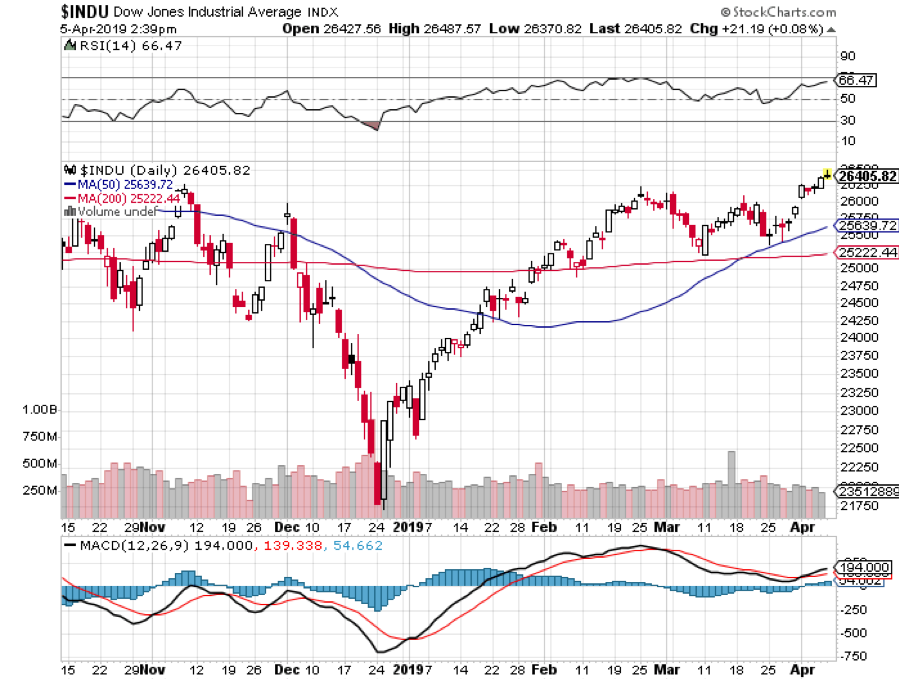

Up until March 25, the bond market was discounting a 2019 recession. Bonds soared and stocks ground sideways. Exactly on that day, it pushed that recession out a year to 2020.

For that was the day that bond prices hit a multiyear peak and ten-year US Treasury yields (TLT) plunged all the way to 2.33%. Since then, interest rates have gone straight up, to 2.52% as of today.

There was also another interesting turn of the calendar. Markets now seem to be discounting economic activity a quarter ahead. So, the 20% nosedive we saw in stocks in Q4 anticipated a melting Q1 for the economy, which is thought to come in under 1%.

What happens next? A rebounding stock market in Q2 is expecting an economic bounce back in Q2 and Q3. What follows is anyone’s guess. Either continuing trade wars drag us back into a global recession and the stock market gives up the $4,500 points it just gained.

Or the wars end and we continue with a slow 2% GDP growth rate and the market grinds up slowly, maybe 5% a year.

Which leads us to the current quandary besieging strategists and economists around the world. Why is the government pressing for large interest rate cuts in the face of a growing economy and joblessness at record lows?

Of course, you have to ask the question of “what does the president know that we don’t.” The only conceivable reason for a sharp cut in interest rates during “the strongest economy in American history” is that the China trade talks are not going as well as advertised.

In fact, they might not be happening at all. Witness the ever-failing deadlines that always seem just beyond grasp. The proposed rate cut might be damage control in advance of failed trade talks that would certainly lead to a stock market crash, the only known measure of the administration view of the economy.

This also explains why politicization of the Fed is moving forward at an unprecedented rate. You can include political hack Stephen Moore who called for interest rate RISES during the entire eight years of the Obama administration but now wants them taken to zero in the face of an exploding national debt. There is also presidential candidate Herman Cain.

Both want the US to return to the gold standard which will almost certainly cause another Great Depression (that’s why we went off it last time, first in 1933 and finally in 1971). The problem with gold is that it’s finite. Economic growth would be tied to the amount of new gold mined every year where supplies have been FALLING for a decade.

The problem with politicization of the Fed is that once the genie is out of the bottle, it is out for good. BOTH parties will use interest rates to manipulate election outcomes in perpetuity. The independence of the Fed will be a thing of the past.

It has suddenly become a binary world. It either is, or it isn’t.

Positive China rumors lifted markets all week. Is this the upside breakout we’ve been looking for? Buy (FXI). While US markets are up 12% so far in 2019, Chinese ones have doubled that.

The Semiconductor Index, far and away the most China-sensitive sector of the market, hit a new all-time high. Advanced Micro Devices (AMD), a Mad Hedge favorite, soared 9% in one day. It’s the future so why not? This is in the face of semiconductor demand and prices that are still collapsing. Buy dips.

Verizon beat the world with its surprise 5G rollout. It’s really all about bragging rights as it is available only in Chicago and Minneapolis and it will take time for 5G phones to get to the store. 5G iPhones are not expected until 2020. Still, I can’t WAIT to download the next Star Wars movie on my phone in only ten seconds.

US auto sales were terrible in Q1, the worst quarter in a decade, and continue to die a horrible death. General Motors (GM) suffered a 7% decline, with Silverado pickups off 16% and Suburban SUVs plunging 25%. Is this a prelude to the Q1 GDP number? Risk is rising. You have to wonder how much electric cars are eating their lunch, which now accounts for 4% of all new US sales.

Tesla (TSLA) disappointed big time, and the stock dove $30. Q1 deliveries came in at only 63,000 as I expected, compared to 90,700 in Q4, down 30.5%. I knew it would be a bad number but got squeezed out of my short the day before for a small loss. That’s show business. It’s all about damping the volatility of profits.

By cutting the electric car subsidy by half from $7,500 in 2019 and to zero in 2020, the administration seems intent on putting Tesla out of business at any cost. I hear the company has installed a revolving door at its Fremont headquarters to facilitate the daily visits by the Justice Department and the SEC. Did I mention that the oil industry sees Tesla as an existential threat?

The March Nonfarm Payroll Report rebounded to a healthy 196,000, just under the 110-month average. Weekly Jobless Claims dropped to New 49-Year Low. Whatever the problems the economy has, it’s not with job creation. But at what cost? Of course, we have to cut interest rates!

Boeing successfully tested new software, even taking the CEO for a ride. Maybe it will work this time. Airlines will love it. (BA) shares have already made back half their $80 losses since the recent crash and we caught the entire move. Buy (BA), (DAL), and (LUV).

The Mad Hedge Fund Trader hit a new all-time high briefly, up 15.46% year to date, and beating the pants off the Dow Average. Good thing I didn’t buy the bearish argument. There’s too much cash floating around the world. However, my downside hedges in Disney and Tesla cost me some money when I stopped out. I was late by a day.

We are taking profits on a six-month peak of 13 positions across the GTD and Tech Letter services and will wait for markets to tell us what to do next.

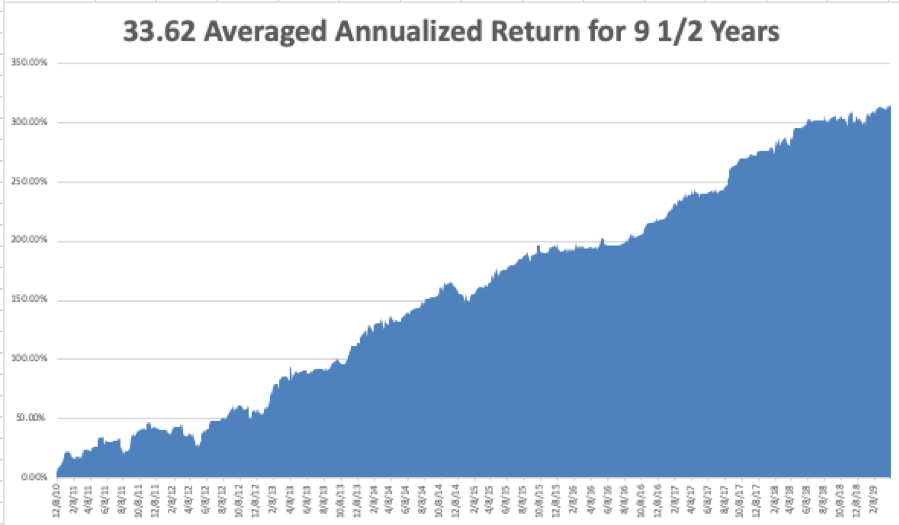

March turned positive in a final burst, up +1.78%. April is so far down -1.76%. My 2019 year to date return retreated to +13.69%, paring my trailing one-year return back up to +26.59%.

My nine and a half year return recovered to +313.83%, pennies short of a new all-time high. The average annualized return appreciated to +33.62%. I am now 80% in cash and 20% long, and my entire portfolio expires at the April 18 option expiration day in 9 trading days.

The Mad Hedge Technology Letter has gone ballistic, with an aggressive and unhedged 40% long, rising in value almost every day. It is maintaining positions in Microsoft (MSFT), Alphabet (GOOGL), and PayPal (PYPL), and Amazon (AMZN), which are clearly going to new highs.

It’s going to be a dull week on the data front after last week’s fireworks.

On Monday, April 8 at 10:00 AM, February Factory Orders are released.

On Tuesday, April 9, 6:00 AM EST, the March NFIB Small Business Optimism Index is published.

On Wednesday, April 10 at 8:30 AM, we get the March Consumer Price Index.

On Thursday, April 11 at 8:30 AM EST, the Weekly Jobless Claims are announced. The March Producer Price Index is printed at the same time.

On Friday, April 12 at 10:00 AM, the April Consumer Sentiment Index is published.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I have two hours until the next snow storm pounds the High Sierras and closes Donner Pass. So I have to pack up and head back to San Francisco.

But I have to get a haircut first.

Incline Village, Nevada is the only place in the world where you can get a haircut from a 78-year-old retired Marine Master Sargent, Louie’s First Class Barbers. Civilian barbers can never grasp the concept of “high and tight with a shadow”, a cut only combat pilots are entitled to. He’ll regale me with stories of the Old Corps the whole time he is clipping away. I wouldn’t miss it for the world.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Hot Tips

April 5, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Trump Makes Another Political Appointment to the Fed. This is becoming the most predictable Fed in history, ultra-dovish all the time with the appointment of former presidential candidate Herman Cain. The groundwork for the next financial crisis is being laid. Click here.

2) The Most Expensive Divorce in History, has Amazon founder Jeff Bezos giving up $36 billion worth of stock to his ex-wife. However, shareholders can rest easy as he retains 100% of the voting stock. Buy (AMZN) on the dip. Click here.

3) Tesla’s Junk Bonds Get Slammed, with yields soaring to 8.37% on disappointing Q1 deliveries. Could be the ideal entry point for starved fixed income yield players. Click here.

4) Samsung Reports 60% Profit Slide, off the back of collapsing semiconductor demand. Click here.

5) China Weakness is Pulling Japan Down Too. More proof that trade wars have unintended consequences. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(APRIL 3 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (VIX), (TSLA), (BA), (FXB), (AMZN), (IWM), (EWU)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 5, 2019

Fiat Lux

Featured Trade:

(APRIL 3 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (VIX), (TSLA), (BA), (FXB), (AMZN), (IWM), (EWU)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 3 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: I’ve gotten a lot of newsletters but not many trades. Why is that?

A: Perfect trades do not happen every day of the year. They happen a few times a year and they tend to bunch up. Most time in the market is spent waiting for an entry point and then piling on 5 or 10 trades rapidly. We’re letting our profits run and waiting for new trades to open up, so just be patient and we’ll get you more trades than you can chew on.

If you have to ask this question, you are probably overtrading. The goal is to make yourself rich, not your broker. The other newsletters that offer a trade alert every day don’t publish their performance as I do and lose money for their followers hand over fist.

Q: Are we on track for a market peak in May?

A: Yes; if we keep climbing up, eventually hitting new highs this month, then we are setting up perfectly for a pretty sharp pullback around May 10th. That would be a good time to get rid of all your longs and put on some short positions, certainly deep in the money put spreads—we’ll be knocking quite a few of those out in the end of April/beginning of May.

Q: Are you worried about the Russell 2000 (IWM) climb?

A: I’m not. If you look at the chart, every up move has been weak, and every down move has been strong. Looking at the chart, it’s still in a clear downtrend dragging all the other markets, and this is because small-cap stocks do poorly in recessions or market pullbacks.

Q: How severe and how long do you see the coming bear market being?

A: If history repeats itself, then it’s going to be rather shallow. The last move down was only three months long and that stunned a lot of people who were expecting a more extreme pullback. I don’t see conditions in place that indicate a radically deep pullback—25% at most and 6-12 months in duration, which won’t be enough to liquidate your portfolio and justify the costs of getting out now and trying to get back in later. They key thing is that there are no systemic threats to the market other than the exploding levels of government borrowing.

Q: If you had the Tesla (TSLA) April $310-$330 vertical bear put spread, would you keep it?

A: Probably, yes, because you have a $15 cushion against a good news surprise and a lot less at risk. I got out of my Tesla (TSLA) April $300-$320 vertical bear put spread because my safety cushion shrank to only $5 and the risk/reward turned sharply against me.

Q: Should we be buying the Volatility Index (VIX) here for protection?

A: Not yet; we still have enough momentum in the stock market to hit all-time highs. After that, you really want to start looking at the VIX hard, especially if we get down to the $12 level. So good thinking, just not quite yet—as we know in the market, timing is everything.

Q: Are you getting nervous about the short Disney (DIS) calls?

A: I’m always nervous, every day of the year about every position, and yes, I’m watching them. You are paying me to be nervous so you can go play golf. We may take a small hit on the calls if the stock keeps rising, but that will be offset by a bigger gain on the call spread we’re long against.

Q: When is the quarterly option expiration?

A: It was on March 15 and the next one is June 21. This is an off-month expiration coming up on April 18th, and that’s only 12 trading days away.

Q: If you get a hard Brexit (FXB) in the next few weeks, what will happen to the pound?

A: It’s risen about 10% in the last few weeks on hopes of a Brexit outright failure. If that doesn't happen, the pound will get absolutely slaughtered.

Q: If China (FXI) is stimulating their economy, will that eventually help the U.S.?

A: Stimulus anywhere in the world always gets back to the U.S. because we’re the world’s largest market. So, yes, it will be positive.

Q: Would you consider trading UK stocks under Brexit fail?

A: Yes, and there is a UK stock ETF, the iShares MSCI United Kingdom ETF(EWU) and you’re looking at a 20%-25% rise in the British stock market if they completely give up on Brexit or just have another election.

Q: What are your thoughts on the China trade war?

A: The Chinese are in no rush to settle; that’s why we keep missing deadline after deadline and all the positive rumors are coming from the U.S. side. It’s looking more like a photo op trade deal than an actual one.

Q: If we get a top in stocks in May, how far do you expect (SPY) to go?

A: Not far; maybe 5% or 10%, you just have to allow all the recent players who got in to get out again, and if the economy slows to, say, a 1% rate in Q1, that’s not a panicky type market. That’s a 10% correction market and what we’ll probably get. If the economy then improves in Q2 and Q3, then we may go back up again to new highs. We seem to have a three quarter a year stock market and therefore, a three quarter a year stock market. Q1 is always a write off for the economy.

Q: Do you still like Amazon (AMZN)?

A: Absolutely, yes—it’s going to new highs. And it’s also starting to make a move on the food market, cutting prices at Whole Foods, which it owns, for the 3rd time this year. So, it’s moving on several fronts now, including healthcare. There’s at least a double in the company long term from these levels, and a triple if they break the company up.

Q: If you bought the stock in Boeing (BA) instead of the option spread, would you stay long?

A: I would, yes. It’s a great company and there's an easy 10% move in that stock once they get the 737 MAX back off the ground again which they should do within the month.

Q: What do you think about food stocks with big name brands like Hershey (HSY)?

A: I’ve never really liked the food industry. It’s really a low margin industry. You’re looking at 2% a year earnings growth against the big food companies vs 20% a year growth in tech which is why I stick with tech. My advice is always to focus on the few sectors that are the best 5% of the market and leave the dross for the index funds.

Q: With the current bullish wave in the market (SPY), what sector/stocks do you think have the most momentum to break out another 10% to 15% gain in the next one to three months?

A: The next 10% to 15% in the market will only happen after we drop 5-10% first. I believe this is the last 5% move of the China trade deal rally and after that, markets will fall or go to sleep for six months.

Q: Do you expect 2019 to be more like 2018 or 2017? We know you are predicting the (SPX) will hit an all-time high of 3000 in 2019. Do you think it zooms up to a blow-off top in Q2/Q3 and then pulls back in Q4, like 2018? Or, do you expect a steadier ascent with minor pullbacks along the way (like 2017), closing at or near the year's highs on Dec 31? This guidance will really help.

A: I think we have made most of the gains for 2019. Only the tag ends are lifted. We have already hit the upside targets for most strategists, and mine is only 7% higher. After that, there is a whole lot of boring ahead of us for 2019 and the (VIX) should drop to $9. After complaining about horrendous market volatility in December, traders will beg for volatility.

Good Luck and Good Trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Mad Hedge Hot Tips

April 4, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Verizon Beats the World With 5G Roll Out. It’s really all about bragging rights, available only in Chicago and Minneapolis, and it will take time for 5G phones to get to the store. 5G iPhones are not expected until 2020. Click here.

2) Tesla Disappoints, and the stock dives $30. Q1 deliveries came in at only 63,000 as I expected, compared to 90,700 in Q4, down 30.5%. I knew it would be a bad number but got squeezed out of my short the day before for a small loss. That’s show business. It’s all about damping the volatility of profits. Click here.

3) Weekly Jobless Claims Drop to New 49-Year Low. Whatever the problems the economy has, it’s not with job creation. But at what cost. Click here.

4) Greenmailer Carl Icahn Unloaded LYFT, a huge 2.7% stake in the company right before the IPO. Does he know something we don’t? Don’t get in the way of a smart man. Click here.

5) Boeing Successfully Tests New Software. Maybe it will work this time. Airlines will love it. Buy (BA), (DAL), and (LUV). Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(TEN REASONS WHY STOCKS CAN’T SELL OFF BIG TIME),

(SPY)

(SCAM OF THE MONTH CLUB)

(A LEGACY TECH COMPANY YOU HAVE TO BUY)

(ADSK)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.