While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 4, 2019

Fiat Lux

Featured Trade:

(TEN REASONS WHY STOCKS CAN’T SELL OFF BIG TIME),

(SPY)

(SCAM OF THE MONTH CLUB)

Mad Hedge Technology Letter

April 4, 2019

Fiat Lux

Featured Trade:

(A LEGACY TECH COMPANY YOU HAVE TO BUY)

(ADSK)

Having trouble raising capital for your new hedge fund?

Just list Warren Buffet as your “Honorary Chairman.”

That’s what California prison guard Ottoniel Medrano did. To help his marketing efforts, he also claimed that he had $4.8 billion in assets under management as well as massive real estate holdings somewhere in Asia.

Medrano’s International Realty Holdings managed to raise $700,000 from individuals with this scam which he promptly shipped to offshore bank accounts before the Feds shut him down.

When you think you’ve heard everything, something like this pops up. Unbelievable.

You would think that people have heard of “due diligence” by now.

People with famous financial names like Morgan, Rockefeller, Rothschild, Getty, and DuPont often find out they are endorsing things they have never heard of to help someone’s fundraising effort.

I once heard of a guy who got a license plate of GETTY 1 just so he could get free valet parking at restaurants.

More recently, president Donald Trump has faced the same problem.

More than 200 companies in China are marketing products under his name without his permission.

After years of languishing in the courts, one judge finally ruled in his favor, the day after the new president affirmed the long-standing ‘One China Policy.”

Who said being Commander in Chief didn’t have its benefits?

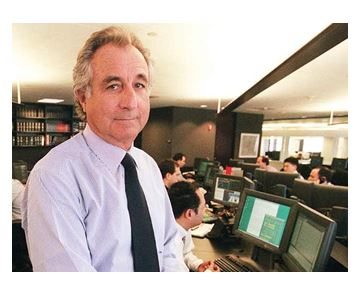

It all brings back unpleasant memories of the Bernie Madoff scandal.

By the way, Bernie has only 123 years left on his sentence. By then he will be 201 years old.

Who knows? Maybe on that low-fat, low-carb prison diet, he’ll make it. He has a better health plan than I do.

I’m only on Medicare.

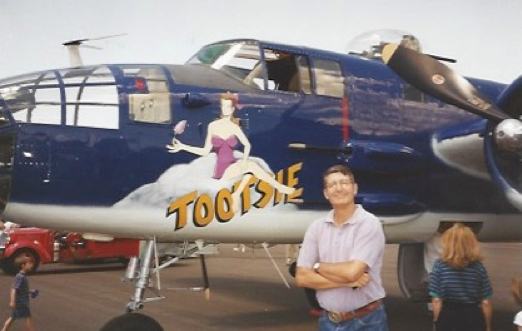

Want to Invest in My Fund?

You cannot accuse Autodesk (ADSK) of ignoring the prodigious migration to digital and full-blown automation.

The company gives credence to the tech theory of taking a pretty darn good software product, repackage it as a subscription, then watch revenues and marginal profitability go through the roof.

Autodesk is one of the original pioneers of AutoCAD, a commercial computer-aided design (CAD) and drafting software application.

Before AutoCAD was introduced, most commercial CAD programs ran on mainframe computers or minicomputers, with each CAD operator working at separate graphics terminal.

Autodesk’s AutoCAD and Revit software are mainly applied by architects, engineers, and structural designers to design, draft, and model buildings.

Being one of the flagbearers of the industry has its perks with Autodesk’s AutoCAD software being involved in world-renowned projects from the One World Trade Center to Tesla electric cars.

Once I roll through their 2018 achievements, it will be impossible not to define this company as part of the cloud aristocracy.

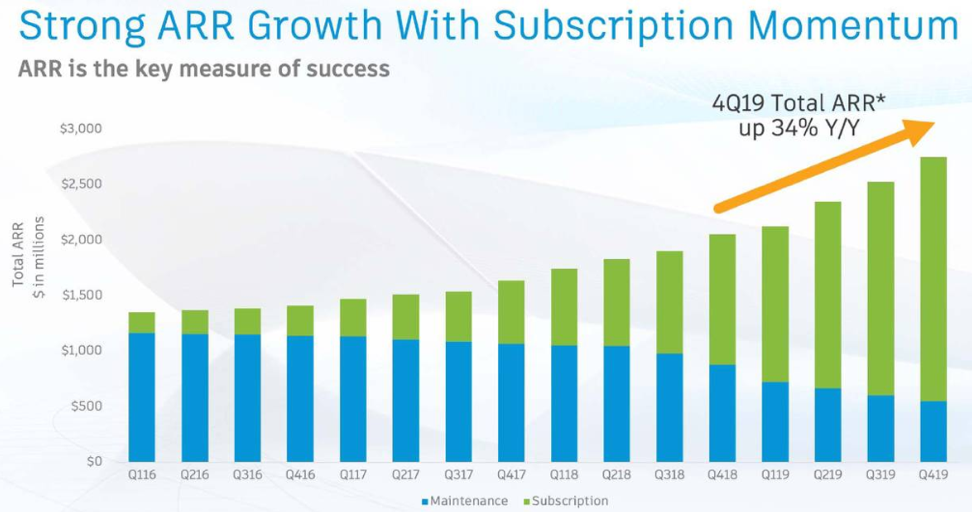

Scrolling through the numbers, my eyeballs pinpoint at the all-important Annual Recurring Revenue (ARR) as the starting point for clues to its success.

(ARR) is a crucial metric used by software-as-a-subscription (SaaS) businesses who define the contract length and the (ARR)’s specific dollar value contracted in return for proprietary software.

You’d be chuffed to bits to discover that Autodesk’s (ARR) delivers 95% of total annual revenue which amounted to almost $2.6 billion in fiscal 2018, a record for this company headquartered in San Rafael, California.

On an annualized basis, (ARR) growth amounted to 34% and billings cruised past the $1 billion mark for the first time last quarter.

Autodesk would be lying if they said subscriber growth isn’t the lynchpin to growing revenue, it certainly is, and they are doing their best to take advantage of this opportunity.

When talking about the strengths, we must look at Autodesk’s AutoCAD software which featured among the top 10 fastest growing skills in technology job searches.

According to Upwork’s latest quarterly index, Revit expertise is highlighted among the top 15 hardest skills for freelancers in the U.S. job market.

Building information modeling (BIM) is a process involving the generation, production, and management of digital representations of physical and functional characteristics of places.

Clayco, an ambitious construction design firm based in Chicago, has been an Autodesk customer for years.

They use BIM 360, Assemble, PlanGrid and Building connective as they are single-mindedly focused on fully embracing the digitization of construction.

BIM adoption remains one of the underlying reasons of investments in the infrastructure space.

An industry-wide cry for adopting BIM drove another seven figured enterprise agreement with a large European infrastructure provider last quarter.

Autodesk doubled the contract with the customer as the company hopes the adoption of BIM for building and managing will enhance the quality of infrastructure projects.

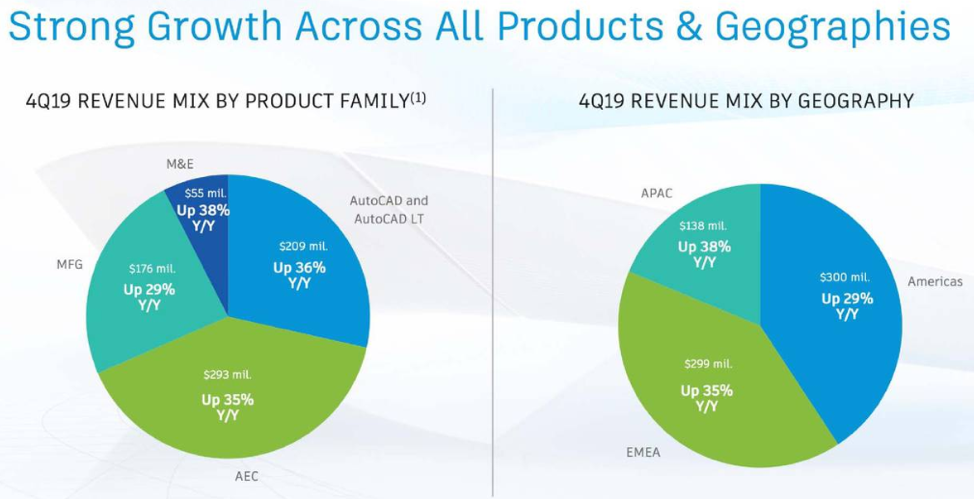

Autodesk’s unique portfolio design tools are allowing them to expand from products like AutoCAD and Inventor into Revit the world’s leading BIM design tool.

On the manufacturing side, generative design and investments in Fusion continue to attract global manufacturing leaders to collaborate with Autodesk.

A vivid example is the cloud agreement signed with Korean automobile maker Hyundai Motor Group who plan to leverage Autodesk’s software to generate innovative car designs.

Taking a microscope to the financials, the average revenue per user (ARPS) increased 17% because of the 13% boost in the number of subscriptions.

The subscription plan subs grew by 291,000 organically.

Continued adoption of BIM 360 solutions gave a 51,000 boost to cloud subs.

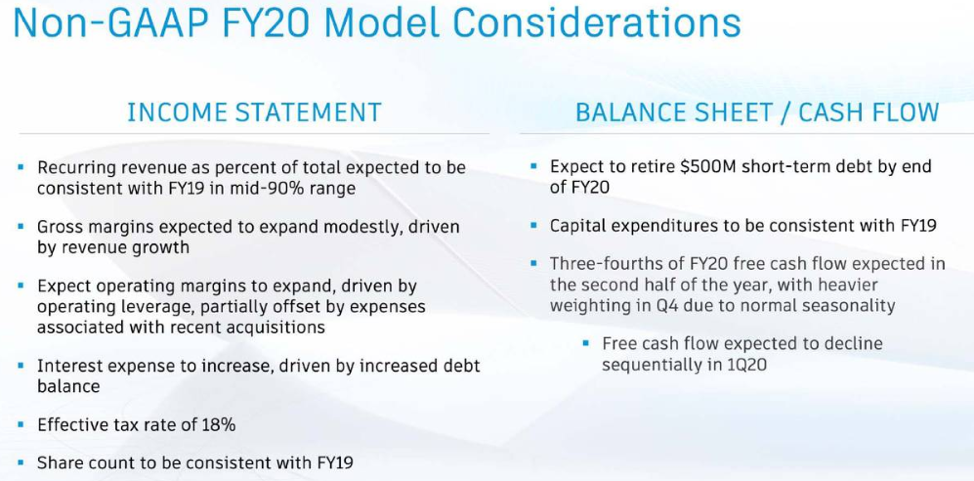

Autodesk is finishing up migrating the maintenance customers to subscription packages.

In Q4, 110,000 customers moved from maintenance to product subscriptions, meaning Autodesk has switched over nearly 800,000 maintenance customers to subscriptions since the inception of the program.

The maintenance plan was abandoned in the fall of 2016 as a way of driving revenue momentum. Before, Autodesk offered software upgrades and the latest product releases for free.

Dramatically shifting to a subscription model has laid the pathway to monetize their software through a monthly recurring payment system.

The company also offers a discounted three-year subscription that 3rd parties can lock in if they are serious about a long-term relationship with Autodesk.

At the end of this month, Autodesk plans to increase the cost of certain subscription plans by between 2.5% and 10% allowing the company to deliver more value to the engineers that religiously rely on Autodesk.

Even though maintenance plan packages are slowly winding down, after this small group’s special discount expires, they will be recommended to join the new subscription program.

As it stands, less than 20% of revenues is generated from the maintenance agreements as the subscription revenue model has furthered Autodesk’s financial interests, effectively executing Autodesk’s growth strategy.

The shift to a cloud-based subscription setup is one of the crucial ways Autodesk has maximized free cash flow and has been a massive catalyst of a profitability surge.

The company is smack in the middle of growth sweet spot benefitting the top line and combined with gross margin expansion, I trust Autodesk shares to be an outsized winner of the cloud aristocracy.

Buy Autodesk on the dip.

"Markets will over value what you can quantify," said Ann Lamont at Oak Investment Partners, referring to the extreme high prices for public companies versus the discount valuations of private ones.

Mad Hedge Hot Tips

April 3, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) See You at the Skybridge SALT Conference in Las Vegas, May 7-10, the Woodstock of alternative asset investors. Learn what the hedge funds are planning next, and it’s a blast. Meet former UN Ambassador Nikki Haley, AOL Founder Steve Case, Carlyle Group co-founder David Rubenstein, and hyper entrepreneur Mark Cuban. Click here.

2) Oil Prices are Going Ballistic, up four days in a row, topping $62 a barrel. OPEC has developed a new short squeeze. It’s going to be hitting the local pump soon, just as the peak driving season is approaching. Click here.

3) US Auto Sales Were Terrible in Q1, the worst quarter in a decade. General Motors (GM) suffered a 7% decline with Silverado pickups off 16% and Suburban SUVs plunging 25%. Is this a prelude to the Q1 GDP number? Risk is rising. Click here.

4) Trump Called Fed Governor on the March Stock Dip. Is this micromanaging, or what? Talk about a free put on the market. Risk on! Click here.

5) Semiconductor Index Hits New All-Time High. Advanced Micro Devices (AMD), a Mad Hedge favorite, soars 9%. It’s the future, so why not? Buy dips. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(WHO WILL BE THE NEXT FANG?)

(FB), (AMZN), (NFLX), (GOOGL), (AAPL),

(BABA), (TSLA), (WMT), (MSFT),

(IBM), (VZ), (T), (CMCSA), (TWX),

(YOUTUBE’S BIG MOVE INTO INDIA)

(GOOGL), (NFLX), (AMZN)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.