Terrorist attacks, trade wars, and crashing airlines all spell one thing to me.

Travel bargains!

Of course, my first choice for a vacation destination this year was the civil war in Syria, so I could find out on the ground what is really happening out there. In addition, I could shop for a refugee camp in Jordan for one of my non-profits to help support.

Unfortunately, my family was not too hot on this idea, not wishing to buy me back from kidnappers at an inflated price, again (the last time was Cambodia in 1976).

The Joint Chiefs were not too thrilled either. At my advanced age, I simply know too much to fall into the wrong hands. They said I would last a day.

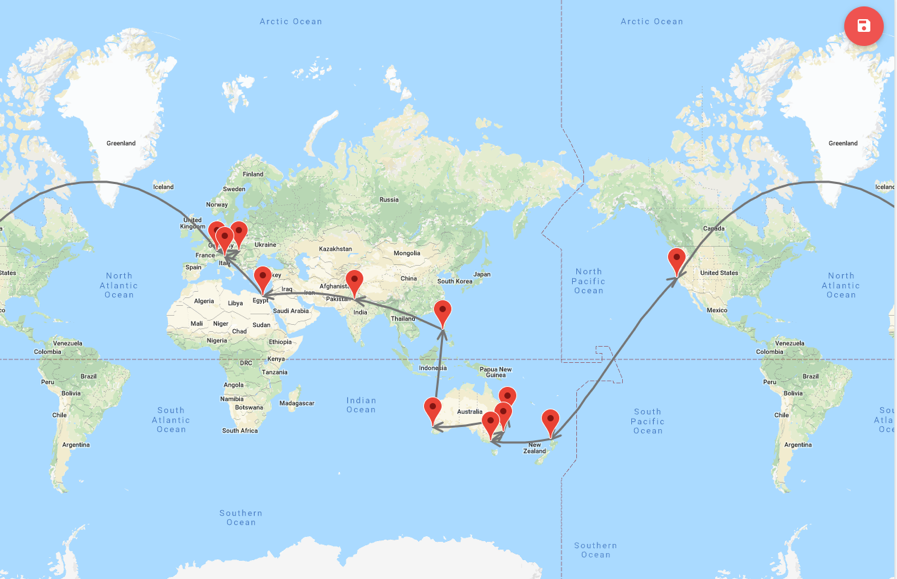

So I compromised. This summer will find me flying around the world to meet my many disparate readers. I’ll be diving on the Great Barrier Reef in Australia, riding elephants near the Taj Mahal in India, and enjoying a dinner cruise on the Nile in Egypt. If you spot someone wearing a fedora hat on a gondola in Venice Italy, it’s probably me.

I’ll end up at my chalet in Zermatt, Switzerland where I traditionally restart my year. Weather permitting, I'll climb the 14,692-foot Matterhorn again. Is it seven times this year, or eight? Otherwise, I’ll rejoin Zermatt Search and Rescue again pulling lost Americans off of Alpine slopes. It seems I’m the only one up there who has a sense of humor.

To make things exciting this year, I’ll have two teenaged daughters into tow, aged 14 and 15. Who said I didn’t like challenges?

The five-star hotels are booked, our passports are loaded with exotic visas, and the limo is waiting outside. The Cessna is fully fueled, and the flight plan filed.

I have worked the hardest in my life the past year, and it is time for a break. I have also put myself through the most grueling training regimen ever, hiking 2,000 miles in torrential rains and snowshoeing another 600, all with a 60-pound pack.

Every year it seems to get harder to keep the calendar at bay.

Along the way I will be meeting with other hedge fund managers, senior government officials, CEOs at major banks and Fortune 500 companies, large institutional investors, and a Nobel Prize winner or two.

Getting out into the real world and soaking up new data and opinions is invaluable in shaping my own global view, and your performance benefits from it.

Since I don’t stumble across these people in my living room, I have to travel the world and seek them out. You can soak up all the online data you want, but nothing beats contact with the real world.

I will be traveling with my laptop and keeping touch with the markets. While 18th century Internet service is passable, the bandwidth can be snail-like. So, unless I see something extraordinary, I will cut back on new Trade Alerts.

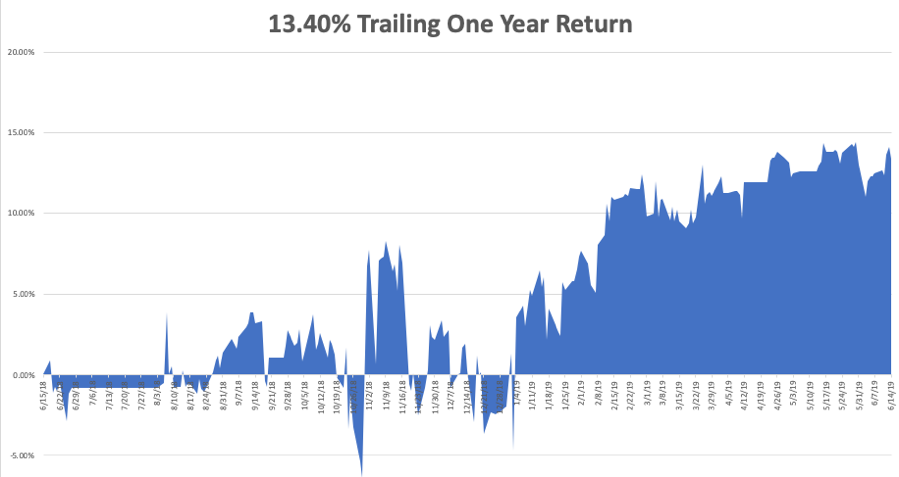

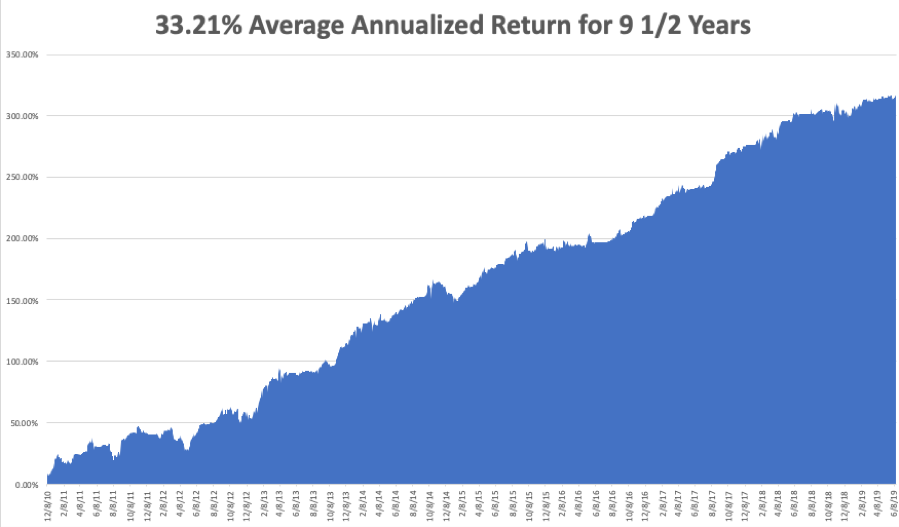

After running up a 315% return in nine and a half years and beating 99.9% of the hedge funds in the industry, I deserve a break. I need to spend some time alone on a mountaintop, communing with the spirits, attempting to discover the new long-term market trends through the mist.

While on the road, I will continue writing my newsletter, giving you my daily dose of market insight. I will also be re-running some of my favorite research pieces from the past when my travel schedule does not allow Internet access.

This is to expose my thousands of new subscribers to the golden oldies and to remind the legacy readers who have since forgotten them.

I will be back in San Francisco in early August, glued to my screens once again for another year of toil in the salt mines. In the meantime, please feel free to email me.

Mad Hedge Technology Letter author Arthur Henry and Mad Day Trader Bill Davis will be working straight through the summer. No rest for the wicked!

In the meantime, I shall be raising a glass to all of you at dinner, the loyal readers of The Diary of a Mad Hedge Fund Trader. Salute! Prost! Kampai, and Cheers! Thanks for making this letter a huge success!

If you want to take the opportunity to meet me in person, please find my strategy luncheon schedule below. To purchase tickets for the luncheons, please go to my online store here and click on “LUNCHEONS”, and select the country and city of your choice.

Friday, June 21 12:30 PM Auckland, New Zealand

Monday, June 24 12:30 PM Melbourne, Australia

Tuesday, June 25 12:30 PM Sydney, Australia

Wednesday, June 26 12:30 PM Brisbane, Australia

Friday, June 28 12:30 PM Perth, Australia

Sunday, June 30 12:30 PM Manila, Philippines

Tuesday, July 2 12:30 PM New Delhi, India

Friday, July 5 12:30 PM Cairo, Egypt

Monday, July 8 12:30 PM Venice, Italy

Wednesday, July 10 12:30 PM Budapest, Hungary

Friday, July 19, 3:00 PM Zermatt, Switzerland

I look forward to seeing you there, and thanks for supporting my research.

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader