When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 16, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE AUGUST 21 GLOBAL STRATEGY WEBINAR),

(WHY CRASHING YIELDS COULD BE SIGNALING AN END TO THE STOCK SELLOFF),

(TLT), (QQQ), (DBA), (EEM), (UUP)

Mad Hedge Technology Letter

August 16, 2019

Fiat Lux

Featured Trade:

(CISCO’S CHINA HIT)

(WEWORK), (CSCO), (FXI)

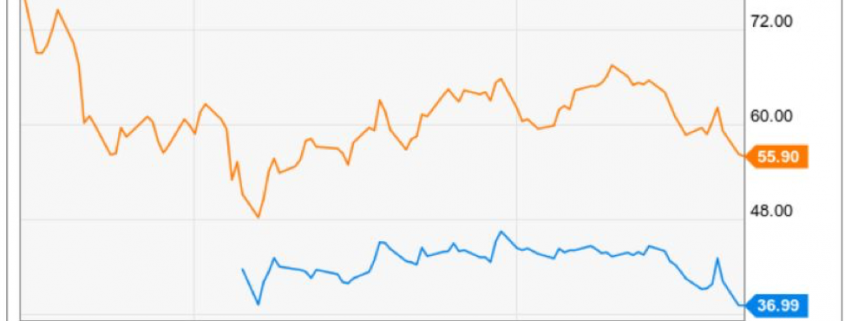

I believe that the entire leg down in the stock market we have seen since July has been driven by a global collapse in bonds yields, a reliable predictor of recessions.

In three weeks, ten-year US Treasury yields have collapsed from 2.15% to 1.46%, ten-year German bunds from -0.20% to -0.72, and Japanese ten-year government bonds have collapsed from -0.10% to -0.25%.

For a once in a half-century observer of the financial markets, I can assure you that these are once in a half-century moves.

Therefore, I can tell you with some news that we are coming to an end in these horrific moves, at least an interim one.

I have charted ten-year US Treasury yields for the five decades that I have been in the market below and we are rapidly approaching a crucial point. That would be the triple bottom at the all-time lows at 1.35%.

If yields bounce there, and they should, you can expect a substantial short-covering rally to ensue in the stock market. That’s why I have been using every dip this week to load up on long positions in the FANGS.

With German bunds at -0.75%, a US bottom at 1.35% may not be the final one. But it was certainly a sign for long players in the (TLT) to take their massive profits, which could take yields back up as high as 1.75%.

Investors around the world have been confused, befuddled, and surprised by the persistent, ultra-low level of long-term interest rates in the United States.

The ten-year all-time low yield of 1.33% is as rare as a dodo bird, last seen in the 19th century.

What’s more, yields across the entire fixed income spectrum have been plumbing new lows. Corporate bonds (LQD) have been fetching only 3.02%, tax-free municipal bonds (MUB) 1.60%, and the iShares IBoxx High Yield Corporate Bond ETF (HYG) a pittance at 5.27%.

Spreads over Treasuries are now inverted, with a two-year yield at 1.50% versus a ten-year yield at 1.46%. always a reliable recession indicator

Are investors being rewarded for taking on the debt of companies that are on the edge of bankruptcy, a tiny 2.0% premium? Or that State of Illinois at 3.0%? I think not.

It is a global trend.

Yikes!

These numbers indicate that there is a massive global capital glut. There is too much money chasing too few low-risk investments everywhere. Has the world suddenly become risk-averse? Is inflation gone forever?

Will deflation become a permanent aspect of our investing lives? Does the reach for yield know no bounds?

It wasn’t supposed to be like this.

Almost to a man, hedge fund managers everywhere were unloading debt instruments last year when ten-year yields peaked at 3.25%. They were looking for a year of rising interest rates (TLT), accelerating stock prices (QQQ), falling commodities (DBA), and dying emerging markets (EEM). Surging capital inflows were supposed to prompt the dollar (UUP) to take off like a rocket.

It all ended up being almost a perfect mirror image portfolio of what actually transpired since then. As a result, almost all mutual funds were down in 2018. Many hedge fund managers are tearing their hair out, suffering their worst year in recent memory.

What is wrong with this picture?

Interest rates like these are hinting that the global economy is about to endure a serious nose dive, possibly even re-entering recession territory….or it isn’t.

To understand why not, we have to delve into deep structural issues which are changing the nature of the debt markets beyond all recognition. This is not your father’s bond market.

I’ll start with what I call the “1% effect.”

Rich people are different than you and I. Once they finally make their billions, they quickly evolve from being risk-takers into wealth preservers. They don’t invest in start-ups, take fliers on stock tips, invest in the flavor of the day, or create jobs. In fact, many abandon shares completely, retreating to the safety of coupon clipping.

The problem for the rest of us is that this capital stagnates. It goes into the bond market where it stays forever. These people never sell, thus avoiding capital gains taxes and capturing a future step up in the cost basis whenever a spouse dies. Only the interest payments are taxable, and that at a lowly 1.46% rate.

This is the lesson I learned from servicing generations of Rothschild’s, Du Pont’s, Rockefellers, and Getty’s. Extremely wealthy families stay that way by becoming extremely conservative investors. Those that don’t, you’ve never heard of because they all eventually went broke.

This didn’t use to mean much before 1980, back when the wealthy only owned less than 10% of the bond market, except to financial historians and private wealth specialists of which I am one. Now they own a whopping 25%, and their behavior affects everyone.

Who has been the largest buyer of Treasury bonds for the last 30 years? Foreign central banks and other governmental entities, which count them among their country’s foreign exchange reserves.

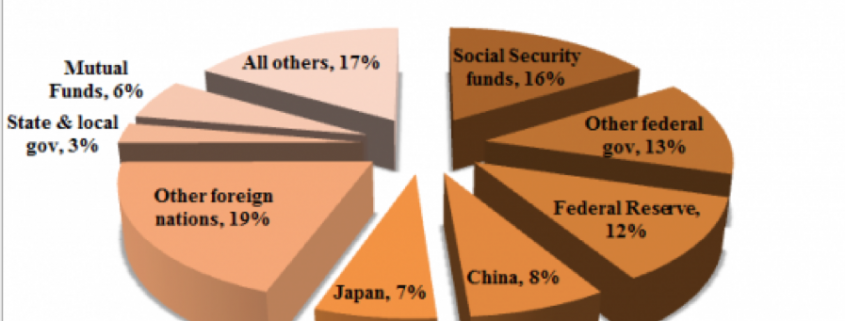

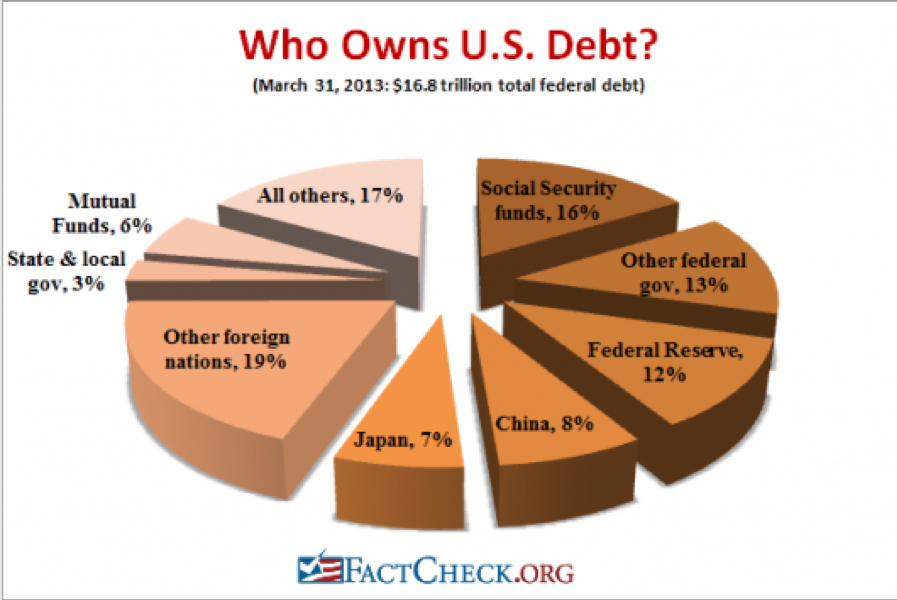

They own 36% of our national debt, with China in the lead at 8% (the Bush tax cut that was borrowed), and Japan close behind with 7% (the Reagan tax cut that was borrowed). These days they purchase about 50% of every Treasury auction.

They never sell either, unless there is some kind of foreign exchange or balance of payments crisis, which is rare. If anything, these holdings are still growing.

Who else has been soaking up bonds, deaf to repeated cries that prices are about to plunge? The Federal Reserve which, thanks to QE1, 2, 3, and 4, now owns 13.63% of our $22 trillion debt.

An assortment of other government entities possesses a further 29% of US government bonds, first and foremost the Social Security Administration, with a 16% holding. And they ain’t selling either, baby.

So what you have here is the overwhelming majority of Treasury bond owners with no intention to sell. Ever. Only hedge funds have been selling this year, and they have already done so, in spades.

Which sets up a frightening possibility for them, now that we have broken through the bottom of the past year’s trading range in yields. What happens if bond yields fall further? It will set off the mother of all short-covering squeezes and could take ten-year yield down to match 2012, 1.35% low, or lower.

Fasten your seat belts, batten the hatches, and down the Dramamine!

There are a few other reasons why rates will stay at subterranean levels for some time. If hyper-accelerating technology keeps cutting costs for the rest of the century, deflation basically never goes away (click here for “Peeking Into the Future With Ray Kurzweil.”

Hyper-accelerating corporate profits will also create a global cash glut further levitating bond prices. Companies are becoming so profitable they are throwing off more cash than they can reasonably use or pay out.

This is why these gigantic corporate cash hoards are piling up in Europe in tax-free jurisdictions, now over $2 trillion. Is the US heading for Japanese-style yields of zero for 10-year Treasuries?

The threat of a second Cold War is keeping the flight to safety bid alive and keeping the bull market for bonds percolating. You can count on that if the current president wins a second term.

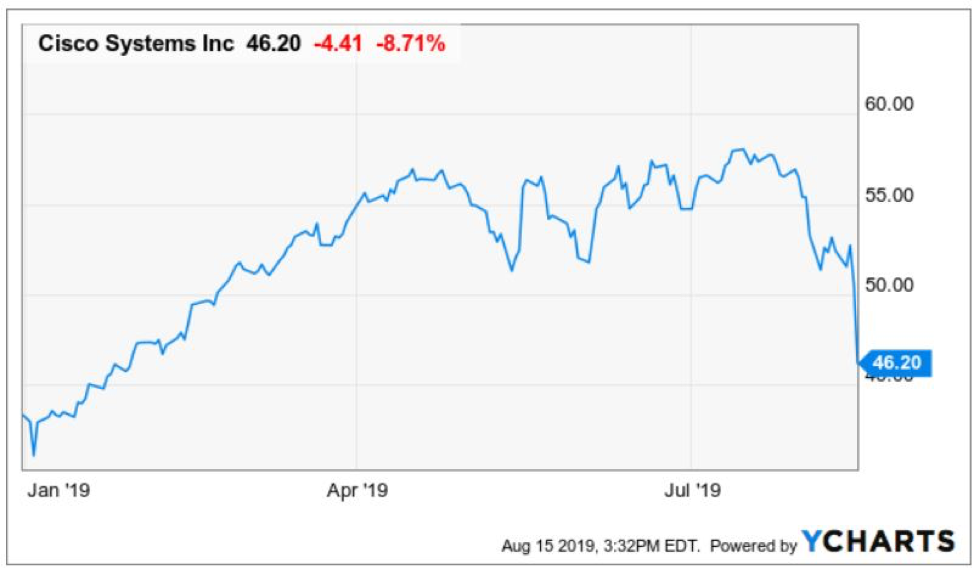

If you believe that the trade war developments have had a negligible effect on the tech companies that operate in mainland China, then you are dead wrong.

Cisco is a cautionary tale highlighting that things aren’t running smoothly with its decrease of 25% in annualized revenue from operations in mainland China.

Many of the profit models in China have been swallowed up by the friction between the two governments at the highest level.

The Cisco employee count was sacrificed stateside with the San Jose, California branch implementing a second round of layoffs that will sweep aside 500 more Cisco engineers.

The most damming set of words that epitomized the dire situation that Cisco face is when management said, “we’re being uninvited to bid …We’re not being allowed to even participate anymore.”

The Chinese government has disengaged Cisco from competing in China and that means a whole channel of revenue will be effectively offline for the foreseeable future unless there is substantial rapprochement from the two governments.

Perusing the files of venture capitalist heartthrob WeWork that plans to go public proved that relations with China and doing business is a financial high-wire act.

I will explain.

WeWork’s 350-plus-page IPO prospectus offered insight into the treacherous nature of business exposure in the Middle Kingdom.

Any investor who rummaged through the prospectus has to be dreading the worse because the boobytraps are plentiful.

A cynical take of WeWork’s business tells me they are doomed in China.

Property is in control of a huge swath of Chinese wealth vehicles and commercial property is part of that equation.

According to the filing, WeWork is contracted to 115 buildings across 12 cities in Greater China, about 15% of its total number of facilities.

I envision property law skirmishes of the foreign WeWork against local property landlords and by historical standards, the court system has not been kind to non-Chinese who seek justice in the Chinese court system against Chinese national interests.

WeWork’s management references “higher tariffs, capital controls, new adverse trade policies or other barriers to entry” as possible counterpunches to an already delicate working environment.

The pressure cooker could explode at any point with the higher-ups making heads roll at the corporate level to prove a point at a macrolevel.

Foreign companies are easy targets and WeWork is an American company – a double whammy that could make it a convenient target for the Chinese communist party.

Summing it up, this is not an advantageous time to lever up on the Chinese economy.

Risk control is needed and this smells like a ticking time bomb.

It really shows how the tech landscape has disintegrated for American companies in China.

They were once welcomed with grandeur and hospitality plus the forced technology transfers.

CEOs bit their tongue because the revenue growth surpassed the cons of cyberespionage and outright theft.

With the accumulation of generations of free knowhow, China is now locked and loaded with a tech industry that rivals anyone in the world.

The last item left on the menu are high-grade semi chips which the Chinese have not mastered yet and that might be the last stand for the Americans if they hope to salvage a stunning comeback victory.

If WeWork does manage to go public without the equity market raining down on its parade, it’s an outright sell and stay away.

It’s nothing but a glorified property manager and its interests in China could open up pandora box.

“We are the first species capable of self-annihilation.” – Said CEO of Tesla Elon Musk

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

August 15, 2019

Fiat Lux

EMERGENCY NOTICE ON MACY’S PUT OPTIONS CALLED AWAY

I have received emails today from several followers indicating that their short position in the Macy’s August 16 $23 put options have been called away. These are one leg of the Macys (M) August 2019 $23-$25 in-the-money vertical BEAR PUT spread which I recommended on August 6.

I am responding with an EMERGENCY ALERT because some brokers, notably Charles Schwab, are advising their customers exactly the wrong thing to do. They are telling their customers to take out a huge leveraged margin positions to cover a long position in Macy’s shares at $23 a share. YOU SHOULD NOT FOLLOW THIS ADVICE!

Instead, you should simply tell your broker to exercise you long Macy’s August 16 $25 put options to cover your short Macy’s August $23 put options and take home the maximum potential profit one day before expiration.

Your long Macy’s August 16 $25 put options more than covers any losses in the short Macy’s August $23 put options plus a handsome profit.

Remember, when you are short a put option and it get exercised against you or called away, you automatically own the shares. In the case of the Macy’s August 16 $23 put options, you now own 100 shares for each option contract you were short. Short 57 contracts means you are now long 5,700 shares, worth $91,200 shares in a plunging market.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money put option spread, it contains two elements: a long put and a short put. The short put can get assigned, or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, puts even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.