While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 2, 2019

Fiat Lux

Featured Trade:

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

(COFFEE WITH RAY KURZWEIL), (GOOG)

Mad Hedge Technology Letter

October 2, 2019

Fiat Lux

Featured Trade:

(IT’S TIMES UP FOR GRUBHUB)

(GRUB), (UBER)

I have never been one to run with the pack.

I’m the guy who eternally marches to a different drummer, not in the next town, but the other hemisphere.

I would never want to join a club that would lower its standards so far that it would invite me as a member. (Groucho Marx told me that just before he died).

On those rare times that I do join the lemmings, I am punished severely.

Like everyone and his brother, his fraternity mate, and his long-lost cousin, I thought bonds would fall this year and interest rates would rise.

After all, this is normally what you get in the eleventh year of an economic recovery. This is usually when corporate America starts to expand capacity and borrow money with both hands, driving rates up.

Of course, looking back with laser-sharp 20/20 hindsight, it is so clear why fixed income securities of every description have refused to crash.

I will give you 10 reasons why bonds won’t crash. In fact, they may not reach a 3% yield for decades.

1) The Federal Reserve is pushing on a string, attempting to force companies to increase hiring, keeping interest rates at artificially low levels.

My theory on why this isn’t working is that companies have become so efficient, thanks to hyper-accelerating technology, that they don’t need humans anymore. They also don’t need to add capacity.

2) The U.S. Treasury wants low rates to finance America’s massive $22.5 trillion and growing national debt. Move rates from 0% to 6% and you have an instant financial crisis, and maybe even a government debt default.

3) Constant tit-for-tat saber-rattling by the leaders of China and the United States has created a strong underlying flight to safety bid for Treasury bonds.

The choices for 10-year government bonds are Japan at -0.25%, Germany at -0.50%, and the U.S. at +1.62%. It all makes our bonds look like a screaming bargain.

4) This recovery has been led by consumer spending, not big-ticket capital spending.

5) The Fed’s policy of using asset price inflation to spur the economy has been wildly successful. But bonds are included in these assets, and they have benefited the most.

6) New rules imposed by Dodd-Frank force institutional investors to hold much larger amounts of bonds than in the past.

7) The concentration of wealth with the top 1% also generates more bond purchases. It seems that once you become a billionaire, you become ultra conservative and only invest in safe fixed-income products. The priority becomes “return of capital” rather than “return on capital.”

This is happening globally. For more on this, click here for “The 1% and the Bond Market.”

8) Inflation? Come again? What’s that? Commodity, energy, precious metal, and food prices are disappearing up their own exhaust pipes. Industrial revolutions produce deflationary centuries, and we have just entered the third one in history (after No. 1, steam, and No. 2, electricity).

9) The psychological effects of the 2008-2009 crash were so frightening that many investors will never recover. That means more bond buying and less buying of all other assets.

10) The daily chaos coming out of Washington and the extreme length of this bull market is forcing investors to hold more than the usual amount of bonds in their portfolios. Believe it or not, many individuals still adhere to the ancient wisdom of owning their age in bonds.

I can’t tell you how many investment advisors I know who have converted their practices to bond-only ones.

Call me an ornery, stubborn, stupid old man.

Hey, even a blind squirrel finds an acorn once a day.

The jury is out, and heads could roll.

That is what the tech market has been telling us and that is why I am slapping a conviction sell rating on the struggling online food delivery company GrubHub (GRUB).

The gig economy has been found out and the industry is about to have their free lunch taken away.

Many tech companies handling cheap labor by employing key workers as independent contractors are about to lose their shirt.

Considering that GrubHub cannot make the unit economics work in their favor when times are good, what do you think will happen if they have to start paying overtime, healthcare, and bonuses to full-time drivers?

Unfortunately for GrubHub, you cannot just strip out the driver in the business model, someone needs to get the hot tacos from point A to point B and back.

Along with higher labor costs, delivery fees are on the verge of cratering because of elevated competition.

GrubHub doesn’t have a monopoly in this industry and restaurants continue to complain that the likes of Postmates, DoorDash, GrubHub and Uber (UBER) Eats rip them off leaving the restaurants with their necks just above water.

GrubHub is so pitiful that they have had to resort to nefarious tactics condemning a failing business model.

Investors should aggressively short the stock or avoid it at all costs.

What type of tricks has GrubHub been up to?

If you hadn’t heard already, Senator Chuck Schumer was in contact with the CEO of GrubHub Matt Maloney over fraudulent fees the food-delivery giant has been charging restaurants nationwide and demands full refunds for cheated customers.

GrubHub was charging restaurants fees for phone calls that didn’t result in food orders and the company admitted wrongdoing.

The company responded by offering only 60 days’ worth of refunds even though this dark practice had taken place for years.

The exploitation took place because of in-house algorithms that calculate fees, which restaurants say can range between $5 and $9 for a single phone call.

GrubHub recently refunded one New York City restaurant vendor over $10,000 for the fraud, covering fees going back to 2014.

GrubHub agreed to extend the refund to 120 days of ill-gotten fees, but many regulators have said this is still not enough.

Then if you didn’t think that was bad, GrubHub had its hand in anti-competitive tactics that sum up the plight of the company.

GrubHub has been creating fake websites, impersonating third party restaurants by undercutting them to take control over their own web sites then taking a larger cut of commissions.

The company says that the fake websites are “a service” for clients, but when the cybersquatting has been to the detriment to the restaurant, using this point of leverage to swindle restaurants out of more fees and sometimes charging them more than 400% of the actual cost.

This insane move has strained relations and murdered trust between GrubHub and outside vendors while making it extraordinarily difficult to take back control over their website.

As you would expect, GrubHub is monetarily incentivized to control the thoroughfare.

A GrubHub spokesman commented saying there would be “no changing of our algorithm” but from how I see it, the writing is on the wall, the equity in the company is in a vicious spiral downward.

It’s hard to make money in restaurants but GrubHub is overreaching big time.

Invest in this company at your peril and avoid all online food delivery platforms, they are simply ghastly investments.

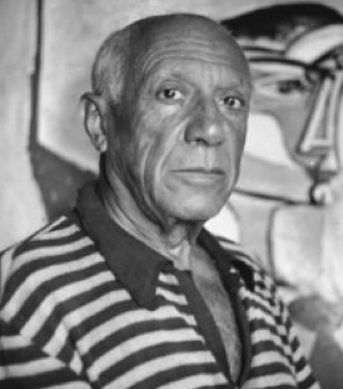

“Computers are useless. They can only give you answers.” – Said Artist Pablo Picasso

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.