Were you horrified by the market action in December? The next one could get much worse.

We are all used to market corrections. Live long enough and you will endure hundreds of them.

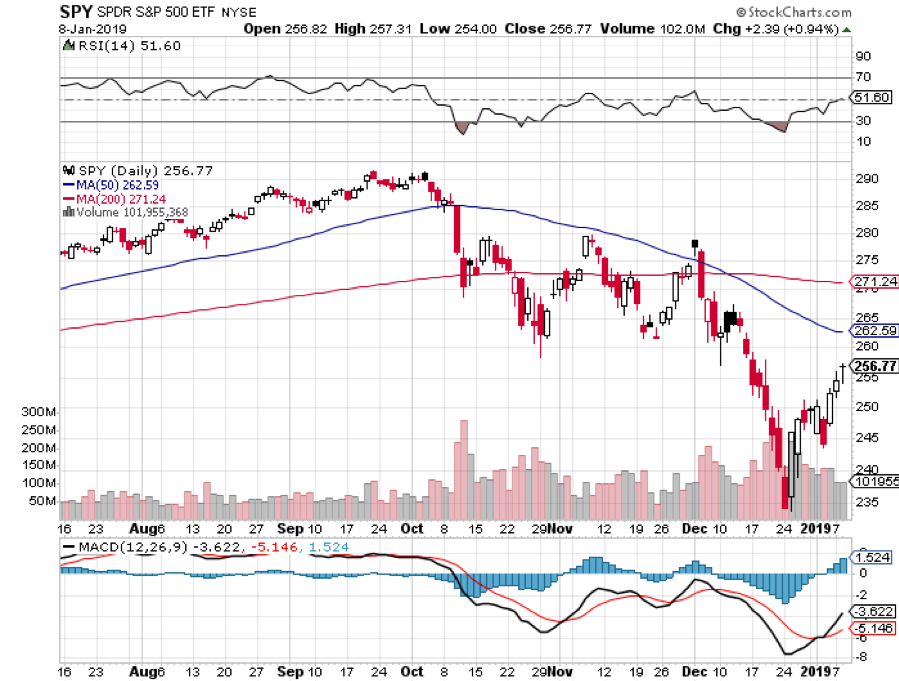

But December? That was a real first class crash, a four times a century event. And to see this occur in the face of solid economic data made it totally unexpected by all. The only analysts predicting a collapse like this one are the ones who have been expecting it daily for the past decade.

To see a 20% decline in NASDAQ and a 50% plunge in market leaders in the face of a 3.2% GDP growth rate and a 3.9% unemployment rate is a first. It makes no sense.

This wasn’t a correction. This was an instance where the market ceased to function and was effectively closed. In fact, it took a conspiracy of several independent forces to get the meltdown we got.

The bottom line here is that this is not your father’s stock market.

The low hanging fruit here is to blame in the high-frequency algorithms. But that is the cheap shot. Algos don’t care which way markets go. They take volatility up sharply, but they take it down as well, as any long-suffering vol player will tell you.

Over time, their market impact is neutral. And algo traders go home 100% in cash every night. That doesn’t explain opening meltdowns of 500 points a day or more. No, there was something much more structural at work.

Human emotions are easy to predict. Take the humans out of the equation and markets can only be read by mainframe computers, at least on a short-term basis. That’s why so many of these market traditions, like “Sell in May and go away,” and the “Santa Claus rally” have quit working.

Only about 10% of today’s daily traders are the breathing kind. The rest are all made of silicon. Even I have come to rely heavily on my own personal algorithms in the Mad Hedge Market Timing Index. It has been worth its weight in gold and saved my bacon many times.

There is no doubt that pure quant strategies have blood on their hands. These funds strictly adhere to rules that have identified the long-term relationships between different asset classes and act accordingly.

For example, when bonds go up, you sell them and buy more stock, but sell more foreign currencies as well, and perhaps pick up some copper as well. All of this is adjusted for risk and volatility. There is thought to be about $1.5 trillion committed to this kind of strategy.

Among these, you can include “risk parity traders” of the kind pioneered by my friend Ray Dalio in the 1990s. (Ray will tell you how he did it in his fascinating book, Principals, out last year). Ray, by the way, is one of the top performing money managers over the last 30 years.

Trend followers pour more gasoline on the fire. If you sell, they will sell more, creating these massive 100 handle days in the S&P 500 (SPY).

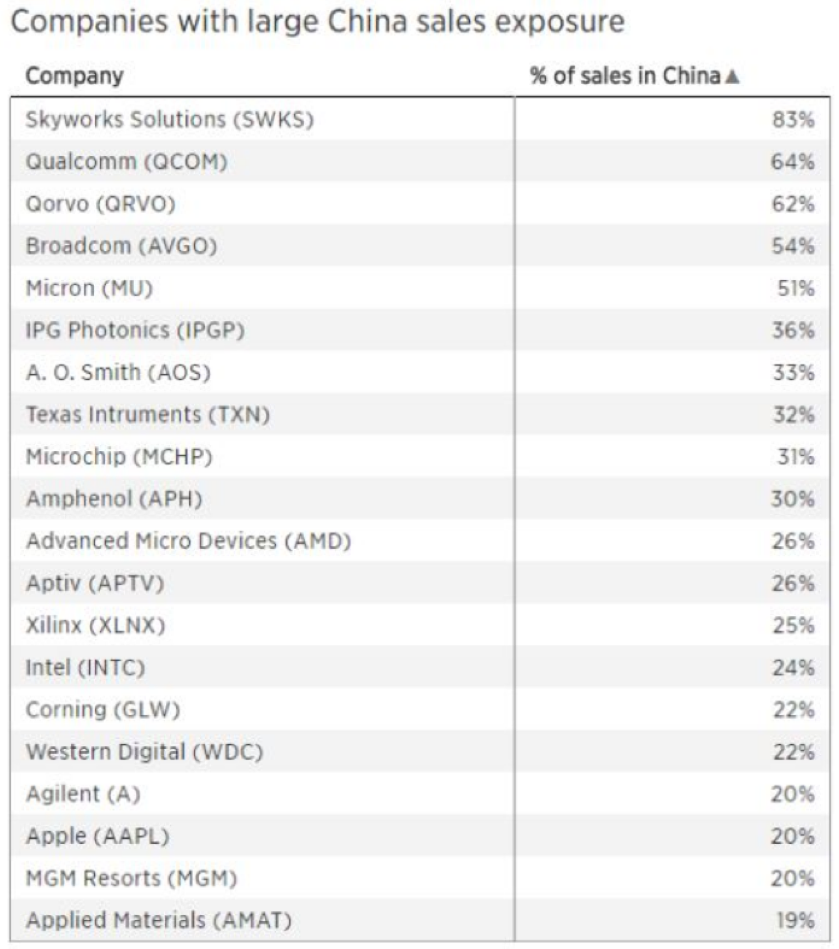

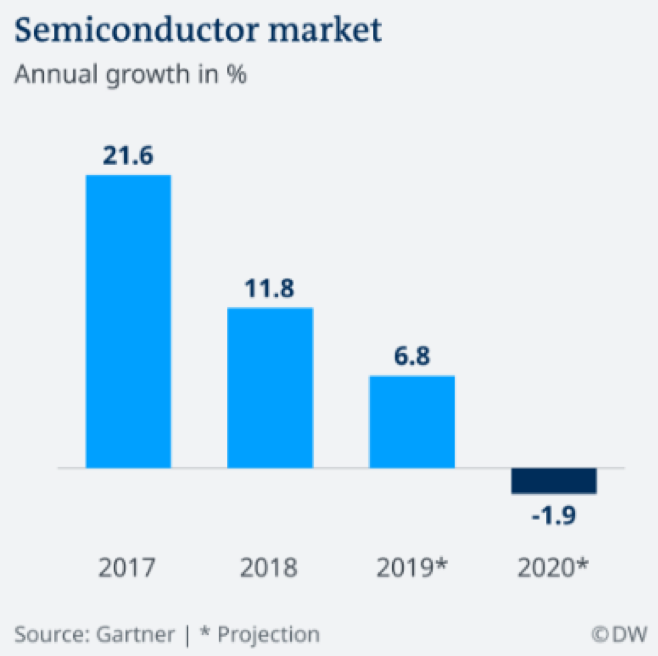

Heightening fears was a never-ending torrent of bad news out of Washington. Two out of three key cabinet positions were emptied by presidential firings and remain unoccupied. Trade talks with China came to an impasse. It was not what investors wanted to hear.

All of this set up the perfect storm for December.

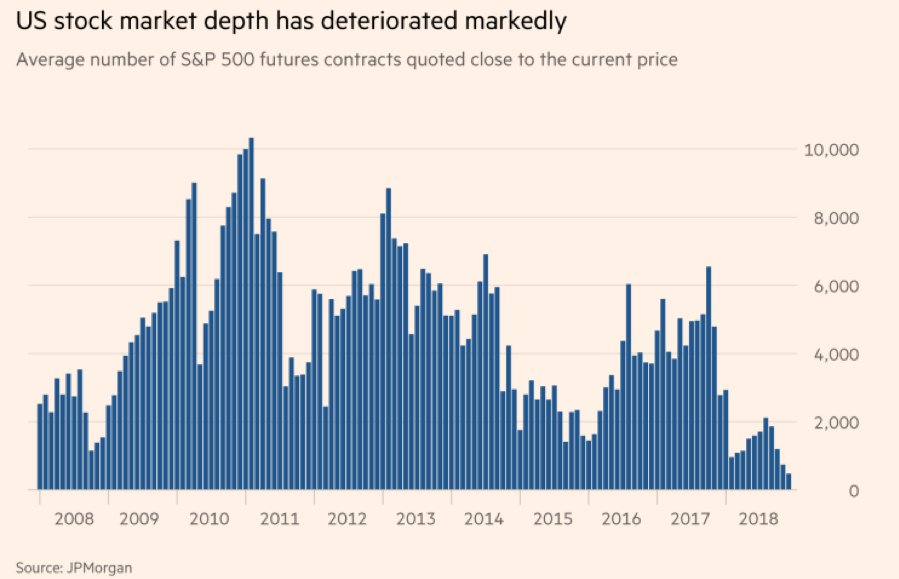

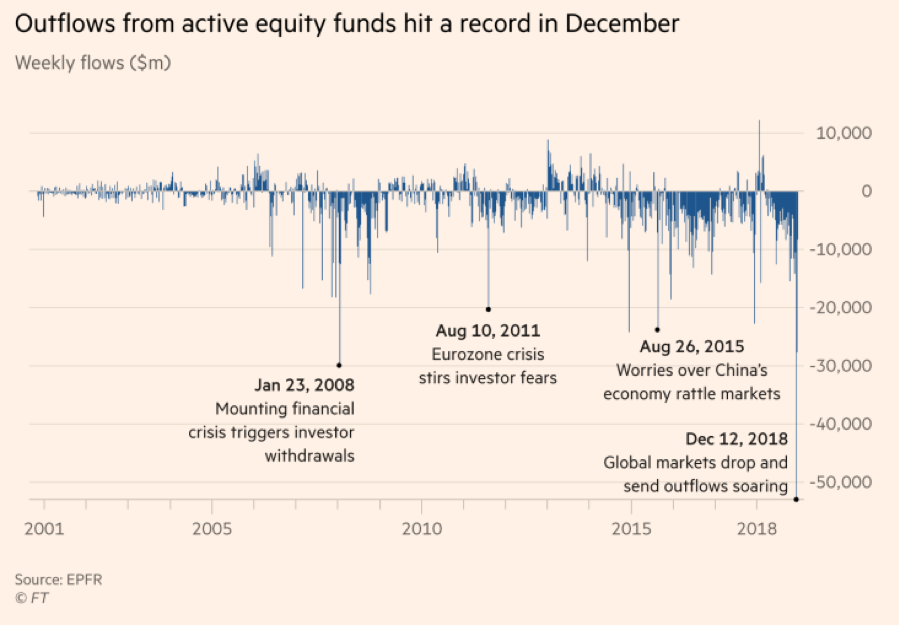

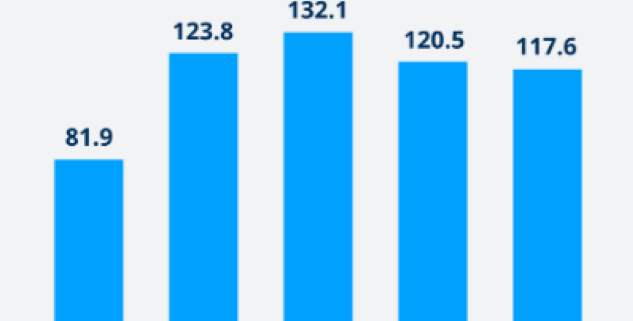

Equity mutual fund redemptions hit a record $53 billion in early December. Market liquidity dramatically shrank as players took off for the holidays, as seen on the chart below. Liquidity during the second half of December was thinner than the worst days of the 2008 financial crisis.

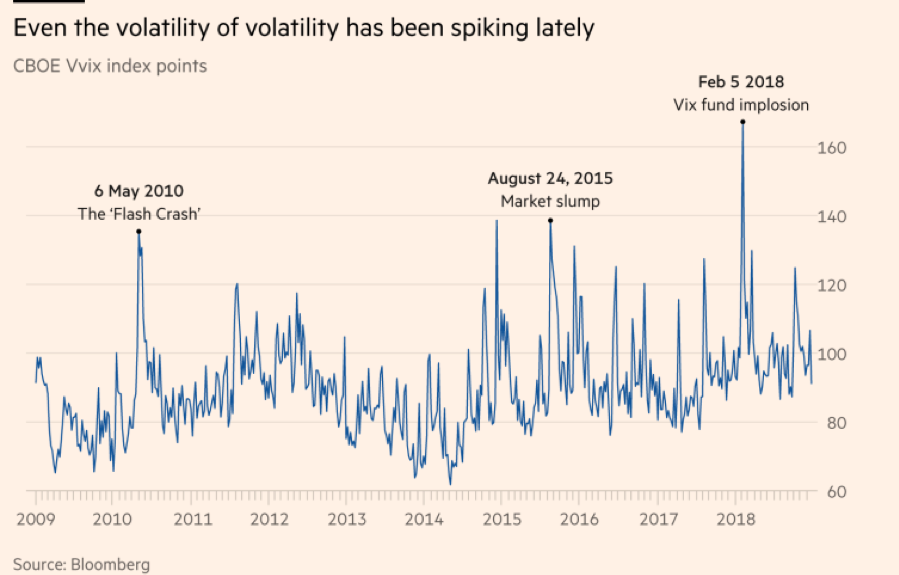

A two-decade-long flight of capital from the floor of the New York Stock Exchange was also a factor. The inevitable result was for the Volatility Index (VIX) to take a run at its highs for the year.

If you wanted to sell anything in size, it could only take place at throwaway prices. It all culminated in the notorious Christmas Eve Massacre which saw a 1,000-point range day in the Dow Average in a holiday-shortened trading day. If it had been a full day it might have been down 2,000 points.

Don’t expect any respite from these strategies any time soon. In fact, we could see worse moves ahead. The current administration believes in a free market, non-interventionist approach to securities markets. That means no new regulation.

The same thing happened in the run-up to the 2008 crash when Christopher Cox (brother of my old boss at Morgan Stanley, Archie Cox) was basically told to go play golf instead of regulate.

Welcome to the new age of investing. The bottom line for all of us traders and investors is that we are going to have to pedal a lot harder to earn our crust of bread….or become a computer.