I asked Anthony Scaramucci, CEO and founder of Skybridge Capital, why we should attend his upcoming SALT conference point-blank.

“It’s going to be exciting,” he said.

“How exciting?” I enquired.

“I’ve invited former White House chief of staff General John F. Kelley to be my keynote speaker.” General Kelley, an old friend from my Marine Corps days, fired Anthony after only eight days on the job as Donald Trump’s Press Secretary.

“That’s pretty exciting,” I responded. “Humble too.”

This was the answer that convinced me to attend the May 7-10 SkyBridge Alternative asset management conference (SALT) at the Las Vegas Bellagio Hotel. You all know the Bellagio. That is the casino that was robbed in the iconic movie Oceans 11.

That is not all Scaramucci had to offer about the upcoming event, known to his friends since his college days as “The Mooch”.

Among the other headline, speakers are former UN ambassador Nikki Haley, AOL Time Warner founder Steve Case, artificial intelligence guru Dr. Kai-fu Lee who I have written about earlier, and Carlyle Group co-founder David Rubenstein.

SALT will give seasoned investors to update themselves on the hundreds of alternative investment strategies now in play in the market, raise or allocate money, meet fascinating people, and just plain have fun. Some SkyBridge services accept client investments as little as $25,000. Their end of conference party is legendary.

SkyBridge is led by Co-Managing Partners Anthony Scaramucci and Raymond Nolte. Ray serves as the Firm’s Chief Investment Officer and Chairman of the Portfolio Allocation and Manager Selection Committees. Anthony focuses on strategic planning and marketing efforts.

While I had “The Mooch” on the phone, I managed to get him to give me his 30,000-foot view of the seminal events affecting markets today.

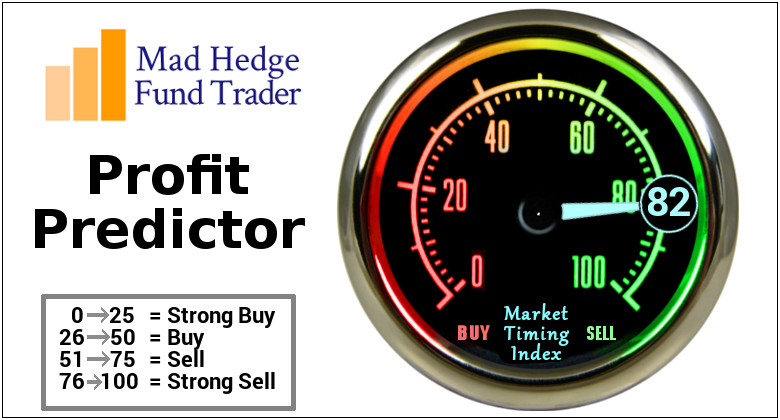

The proliferation of exchange-traded funds and algorithms will end in tears. There are now more listed ETFs than listed stocks, over 3,500.

The normalizing of interest rates is unsustainable, which have been artificially low for ten years now. One rise too many and it will crash the market. The next quarter-point rise could be the stick that breaks the camel’s back (an appropriate metaphor for a desert investment conference).

However, rising rates are good for hedge funds as they present more trading opportunities and openings for relative outperformance, or “alpha.”

There has been a wholesale retreat of investment capital from the markets, at least $300 billion in recent years. The end result will be much higher volatility when markets fall as we all saw in the Q4 meltdown until this structural weakness has been obscured by ultra-low interest rates. The good news is that banks are now so overcapitalized that they will not be at risk during the next financial crisis.

Ever the contrarian and iconoclast, Scaramucci currently has no positions in technology stocks. He believes the sector has run too far too fast after its meteoric 2 ½ year outperformance and is overdue for a rest. Earnings need to catch up with prices and multiples.

What is Anthony’s favorite must-buy stock today? Berkshire Hathaway (BRK/A), run by Oracle of Omaha Warren Buffet, is almost a guarantee to outperform the market. Scaramucci has owned the shares in one form or another for over 25 years.

While emerging markets (EEM) are currently the flavor of the day, Anthony won’t touch them either. The accounting standards and lack of rule of law are way too lax for his own high investment standards.

SkyBridge is avoiding the 220 IPOs this year which could total $700 billion. Many of these are overhyped with unproven business models and inexperienced management. The $100 billion in cash they actually take out of the market won’t be enough to crash it.

SkyBridge Capital is a global alternative investment firm with $9.2 billion in assets under management or advisement (as of January 31, 2019). The firm offers hedge fund investing solutions that address a wide range of market participants from individual investors to large institutions.

SkyBridge takes a high-conviction approach to alpha generation expressed through a thematic and opportunistic investment style. The firm manages multi-strategy funds of hedge funds and customized separate account portfolios, and provides hedge fund advisory services. SkyBridge also produces a large annual conference in the U.S. and Asia known as the SkyBridge Alternatives Conference (SALT).

Finally, I asked Anthony, if he were king of the world what change would he make to the US today? “If I could wave a magic wand, I would reduce partisanship,” he replied. “It prevents us from being our best.” Will he ever go back into politics again? “Never say never,” he shot back wistfully.

With that, I promised to give him a hug the next time I see him in Vegas which I have been visiting myself since 1955 during the rat pack days.

To learn more about SkyBridge, please visit their website here.

To obtain details about the upcoming May 7-10 SALT conference at the Bellagio Hotel in Las Vegas, please click here. Better get a move on. Their discount pricing for the event ends on March 15. Institutional Investors are invited free of charge.