While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 17, 2020

Fiat Lux

Featured Trade:

(BETTER BATTERIES HAVE BECOME BIG DISRUPTERS)

(TSLA), (XOM), (USO)

Mad Hedge Technology Letter

January 17, 2020

Fiat Lux

Featured Trade:

(WHY ZOOM IS ZOOMING)

(ZM)

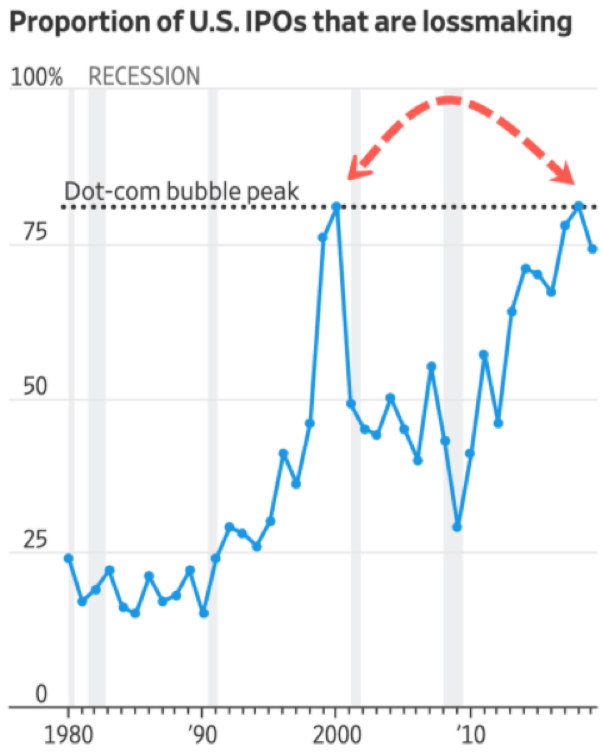

A report from a prominent new source reveals that in the past 12 months, 40% of all US-listed companies were losing money and of these, 17% were tech firms, the highest level since the Dot Com bubble.

That is why software gems like Zoom Video Communications, Inc. (ZM) should be bought and held, never to see the light of day ever again.

The company makes money at such an early stage of their development that it's hard not to get excited about the future.

Readers can indulge themselves in this high caliber tech growth stock, especially after they demonstrated that they are hitting on all cylinders after a high-flying earnings report.

Another prominent new source recently said that this company’s products are “changing the entire landscape” of U.S. business.

Just one instance they have infiltrated deep into real American business is the U.S. Postal Service.

They are starting to deploy Zoom Meetings more broadly across the organization after an extensive proof-of-concept.

The USPS is Zoom’s first major agency and major business win since they received FedRAMP approval in May.

Why did they pick Zoom?

Easy! Simply for Zoom’s high-quality video and audio.

Zoom’s share price cratered 40% since hitting the heights of $102 in July 2019 which was coincidentally the high for most post-IPO tech stocks of 2019.

It was an elevator straight down to no man’s land – but investors would be foolish to paint all hyper-growth companies with the same brush.

Filtering out the wheat from the chaff is critical and Zoom is the stock that still has the gloss on its outside package buttressed by its best-in-show video conferencing software.

There are no other proper alternatives in this sub-sector of software.

The volatility can be extreme making this name difficult to trade and constantly has dips of 7% even though the company crushes expectations.

I called for readers to scoop up shares in the low $60s and the stock is now healthily trading in the upper $70s as we hit the back half of January.

Remember that this company grew 96% just 3 quarters ago and it would be illogical to believe that the stock is being penalized from faltering to 85% today.

The report on January 6th showed a strong quarter as evidenced by a combination of high revenue growth of 85%, with increased profitability and free cash flow of $54.7 million.

They continue to have success with customers of all sizes and one metric that has continued to stick out is customers with more than $100,000 of trailing 12 months revenue – that metric grew 97% from Q3 last year.

Any tech company would give a left thigh for 85% growth in this climate which is why many have resorted to inorganic growth.

Buying growth is not necessarily a bad strategy now but buying growth at this point in the economic cycle naturally means that companies will need to overpay for growth because of expensive valuations.

Zoom is perfectly positioned to outperform in the next 1-3 years.

The advancing runway is wide open with no competition in sight and a generous growth trajectory is firmly on their side.

At some point, this software company could become a takeover target for a larger corporate.

I am impressed with Zoom's superior products, growth prospects, and scalable business model, and the stock’s near-term risk/reward trade-off is mildly bullish after the jump from $62.

There is an actionable and manageable clear path to a $2 billion revenue run rate with strong margin expansion potential and with its flagship product growing around 80-90%, its next growth driver in Zoom Phone could translate well into a meaningful revenue stream.

Zoom Phone is the next springboard to further success for this company, meaning there won’t be any cliff edge with future revenue streams.

Anyone that has used Zoom as a product can confirm the veracity of its superior performance standards.

This isn’t the type of stock to trade short-term - the volatility undermines any potential entry points.

If the broader market holds up in 2020, Zoom’s value extraction potential is substantially robust, and shares should reach $90.

Growth stocks can only be pinned down for so long before the beast is unleashed.

Buy this stock on any short-term dip.

“Success is a lousy teacher. It seduces smart people into thinking they can't lose.” – Said Founder of Microsoft Bill Gates

Mad Hedge Biotech & Healthcare Letter

January 16, 2020

Fiat Lux

Featured Trade:

(THE FUTURE OF PRECISION MEDICINE),

(ILMN), (PACB), (RHHBY), (TMO), (QGEN)

Hyper-personalized treatments, otherwise known as precision medicine, have been hailed as one the hallmarks of the healthcare revolution in the past decade.

Although a lot of people don’t see the need for such personalized treatments, a 2017 study by Boston medicine professor Jason Vassy indicated otherwise.

In his paper, titled “Annals of Internal Medicine,” Vassy discussed how his team performed whole-genome sequencing to 100 perfectly healthy adults.

To give you a better picture of how big this project was, whole-genome sequencing involves the analysis of the entire body’s DNA -- yes, all 3 billion pairs of letters found in every individual’s body.

So, you can imagine how tedious and complicated Vassy’s process was and why a lot of people found that to be incredibly pointless, especially since the adults in the study are all “healthy.” More importantly, the naysayers believed that this process would only bring unnecessary panic and anxiety to the subjects.

However, the results shocked them as 20% of the people tested positive for rare, life-threatening conditions that required immediate medical attention.

This prompted more experts to delve deeper into gathering genetic data sets in an effort to bolster the preventive power of genomics. This movement was supported by the National Institutes of Health in 2018 via their “All of Us” project, investing $27 million.

Meanwhile, a Harvard geneticist named George Church founded a similar organization called Nebula Genomics.

Basically, the idea behind precision medicine is very simple: Understanding how your genome works means knowing exactly how to “optimize” your body.

That means health professionals will be able to determine the perfect diet, perfect exercise routine, and of course, the perfect drugs for every patient. You’ll even learn the diseases your body is most susceptible to and how to prevent those.

At the moment, the biotechnology world only has a handful of companies focusing on precision medicine.

One of the leading biotechnology companies in this field is Illumina (ILMN), which focuses on DNA sequencing.

Utilizing its advanced machines, Illumina has been designing treatments to target specific cells in the human body -- and its efforts have been rewarded in recent years.

So far, Illumina stock has been up by 5,791% since its initial public offering back in 2000.

At the moment, Illumina practically controls approximately 80% of the next-generation sequencing space geared towards human genome analysis.

The key to its success is the company’s move to zero in on short-read data sequencing, which has been known as the cheapest, quickest, and most accurate service available in the market.

Since Illumina is one of the top movers in this field, it has easily become the top dog with a long waiting list of clients willing to pay tons of cash for the biotechnology firm’s machines.

While the machines definitely cost a lot upon purchase, Illumina actually earns more from the follow-up revenues generated from all the instances that a biotechnology or research laboratory uses the company’s technology to sequence a genome.

In 2019, Illumina earned $390 million in instrument revenue and $1.73 billion in consumables profit in the first three quarters alone.

Unfortunately, one of Illumina’s efforts to broaden its hold of the market failed.

The company opened 2020 to bad news as regulatory pressures pushed Illumina to shut down its plan to acquire its rival, Pacific Biosciences (PACB), for $1.2 billion.

While no particular reason was officially given by the reviewing bodies, reports indicate that the merger had been delayed due to fears of creating a monopoly.

Nonetheless, many consider this an odd excuse considering that Illumina’s supposed “monopoly” would actually compete directly with Roche (RHHBY).

For comparison, Roche’s market capitalization is $275 billion while Illumina is at $49 billion. In terms of revenue, Illumina earns $3.5 billion annually while Roche rakes in $56.8 billion.

Nevertheless, Illumina has decided to shrug off the rejection and move on to another potentially lucrative deal -- a 15-year partnership with another up and coming next-generation sequencing company: Qiagen (QGEN).

Initially thought to be a surefire acquisition candidate by Thermo Fisher Scientific (TMO) to the tune of $8 billion, Qiagen opted to reject the offer.

Instead, the smaller biotechnology firm has decided to focus on expanding its product portfolio. In the next five years, Qiagen estimates an earnings growth rate of roughly 9.1%.

Between Qiagen and Illumina, the former focuses more on individually customized treatments or “N-of-1 medicine.”

This has become even more pronounced following Qiagen’s acquisition of N-of-One, which raised $12.4 million in funding at the time, in January 2019.

N-of-One provides precision cancer care services. It offers clinical solutions like molecular interpretation to doctors and other healthcare professionals.

Apart from its partnership with Illumina, Qiagen also collaborates closely with NeoGenomics for cancer genetic testing services and DiaSorin for automated TB testing.

We’re in an era of remarkably personalized medical care.

With more and more genetic data made available for analysis, the rare diseases that boggled the minds of the healthcare industry are gradually becoming a thing of the past.

Now, we have access to tools that help with preventive measures to save us from the rare conditions that plagued our predecessors. If you really stop to think about it, targeted medicine just might be the key to immortality -- or at least to a significantly less disease-laden life.

If you’re looking to invest in Illumina or Qiagen stock (or both), the best thing to do is to take advantage of the next price drop.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 16, 2019

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

(WILL UNICORNS KILL THE BULL MARKET?),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

I am always watching for market-topping indicators and I have found a whopper. The number of new IPOs from technology mega unicorns is about to explode. And not by a little bit but a large multiple, possibly tenfold.

Some 220 San Francisco Bay Area private tech companies valued by investors at more than $700 billion are likely to thunder into the public market next year, raising buckets of cash for themselves and minting new wealth for their investors, executives, and employees on a once-unimaginable scale.

Will it kill the goose that laid the golden egg?

Newly minted hoody-wearing millionaires are about to stampede through my neighborhood once again, buying up everything in sight.

That will make 2020 the biggest year for tech debuts since Facebook’s gargantuan $104 billion initial public offering in 2012. The difference this time: It’s not just one company but hundreds that are based in San Francisco, which could see a concentrated injection of wealth as the nouveaux riches buy homes, cars and other big-ticket items.

If this is not ringing a bell with you, remember back to 2000. This is exactly the sort of new issuance tidal wave that popped the notorious Dotcom Bubble.

And here is the big problem for you. If too much money gets sucked up into the new issue market, there is nothing left for the secondary market, and the major indexes can fall by a lot. Granted, probably only $100 billion worth of stock will be actually sold, but that is still a big nut to cover.

The onslaught of IPOs includes home-sharing company Airbnb at $31 billion, data analytics firm Palantir at $20 billion, and FinTech company Stripe at $20 billion.

The fear of an imminent recession starting sometime in 2020 or 2021 is the principal factor causing the unicorn stampede. Once the economy slows and the markets fall, the new issue market slams shut, sometimes for years as they did after 2000. That starves rapidly growing companies of capital and can drive them under.

For many of these companies, it is now or never. They have to go public and raise new money or go under. The initial venture capital firms that have had their money tied up here for a decade or more want to cash out now and roll the proceeds into the “next big thing,” such as blockchain, healthcare, or artificial intelligence. The founders may also want to raise some pocket money to buy that mansion or mega yacht.

Or, perhaps they just want to start another company after a well-earned rest. Serial entrepreneurs like Tesla’s Elon Musk (TSLA) and Netflix’s Reed Hastings (NFLX) are already on their second, third, or fourth startups.

And while a sudden increase in new issues is often terrible for the market, getting multiple IPOs from within the same industry, as is the case with ride-sharing Uber and Lyft, is even worse. Remember the five pet companies that went public in 1999? None survived.

Some 80% of all IPOs lost money last year. This was definitely NOT the year to be a golfing partner or fraternity brother with a broker.

What is so unusual in this cycle is that so many firms have left going public to the last possible minute. The desire has been to milk the firms for all they are worth during their high growth phase and then unload them just as they go ex-growth.

Also holding back some firms from launching IPOs is the fear that public markets will assign a lower valuation than the last private valuation. That’s an unwelcome circumstance that can trigger protective clauses that reward early investors and punish employees and founders. That happened to Square (SQ) in its 2015 IPO.

That’s happening less and less frequently: In 2019, one-third of IPOs cut companies’ valuations as they went from private to public. In 2019, that ratio has dropped to one in six.

Also unusual this time around is an effort to bring in more of the “little people” in the IPO. Gig economy companies like Uber and Lyft have lobbied the SEC for changes in new issue rules that enabled their drivers to participate even though they may be financially unqualified. They were all hit with losses of a third once the companies went public.

As a result, when the end comes, this could come as the cruelest bubble top of all.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.