While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 19, 2020

Fiat Lux

Featured Trade:

(HOW TO HEDGE YOUR CURRENCY RISK),

(FXA), (FXE), (FXC), (FXB), (UUP)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 18, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRADE ALERT DROUGHT)

(SPY), (TLT), (MSFT), (BA), (TSLA), (MGM)

Like it or not, we have a trade alert drought on our hands.

I just ran the numbers on 200 potential trades in stocks, bonds, foreign exchange, commodities, precious metals, and real estate, and there was not a single one that was worth executing.

They all had one thing in common: for taking huge risks, there were only paltry profits on offer. Even with a 90% success rate, I would still lose money.

And here is the problem. Massive quantitative easing from the US Federal Reserve is keeping the prices of all assets artificially high. But fears of a global Coronavirus pandemic are keeping all prices capped. The spread between the bid and the offer is only 3%. That is not enough to make an honest living, nor even a dishonest one.

I’ve seen all this before. The US in 1974, Tokyo in 1989, NASDAQ in 1999 presented similar trading dilemmas. The outcome is always the same. Prices always go up much longer than expected and then are followed by horrific crashes. Only when the last dollar is sucked in do trends change.

So, for right now, I would rather do nothing than something. We are in a contest to see who can make the most money with the fewest drawdowns, not to see who can strap on the most trades. The latter makes your broker rich, not you.

Cash is a position, it is an opinion, and it has option value. A dollar at a market top is worth $10 at a market bottom. Opportunity cost is not to be underestimated.

For the time being, everything depends on the Coronavirus. It is universally believed that the Chinese data is wildly inaccurate, possible by tenfold. The risks to the markets are similarly underestimated by US investors.

That became screamingly clear to me after returning from a trip halfway around the world where my temperature was taken every time I crossed a border and planes had to be sterilized before boarding

So, the smart game here is to be patient and learn some discipline. Wait for the market to come to you. This is a year when it will be incredibly difficult to make money and extremely easy to lose it.

All trade alert droughts end. Whether it will be sooner or later is anyone’s guess.

China is planning massive stimulus, to get the economy back on track. GDP could drop from 6% to 0% and maybe -6% thanks to the Coronavirus. A borrowing stampede is underway as shut down companies seek to address hemorrhaging cash flow.

Tesla (TSLA) exploded again to the upside, up 10% at the opening. The company has become a good news factory. The German government stepped in to subsidize a massive Gigafactory there. I won’t touch the stock here, but my long terms target is still $2,500.

Tesla finally took my advice and launched a $2 billion common stock offering at these lofty prices. It should be $5 billion. They can retire all their debt, including the convertible bonds, and with no dividend they can operate at a zero cost of capital. Elon Musk is taking $10 million of the deal. He took $100 million of the last offering. Buy (TSLA) on dips. Losses pile up for the short-sellers. Tesla always does the right thing after trying everything else out first.

The Fed’s Jay Powell cheers the economy but warned that the Coronavirus could become a factor. He also cautioned about a federal deficit that will top $1 trillion this year.

With the economy growing at a 2.2% annual rate, it’s below the Obama era growth. Did anyone notice that he said he would trim back QE by reigning in the repo program initiated last fall? Risk in the stock market is now extremely high.

Apple (AAPL) and Microsoft (MSFT) are now 10% of the entire stock market and are wildly overbought. Such incredible concentration is a typical sign of a topping market. Virtually all the stocks Mad Hedge has been recommending for the last decade are at new all-time highs. Be careful what you wish for.

Household Debt soared hitting a 12-year high. It’s up $601 billion to $14 trillion. It’s pedal to the metal for consumer spending, another classic market-topping indicator. What happens when the bill comes due and interest rates rise?

MGM (MGM) canceled guidance as the Coronavirus upends their business. High-end Chinese gamblers won’t show up to lose gobs of money at the gaming tables if they can’t get here. The epidemic has put the whole gaming industry into turmoil. Call me after new virus cases peak in China. Avoid (MGM).

Boeing had no net deliveries of aircraft in January, the first time since 1962, but the stock rose anyway. That tells me the bottom is firmly in. Buy (BA) on dips. When will the suffering of one of America’s best-run companies, accounting for 3% of GDP, end?

Despite the fact that we may be facing the end of the world, the Mad Hedge Trader Alert Service managed to maintain new all-time highs. I came out of my last position in Boeing (BA) to beat the ex-dividend day and a possible call on my short February $280 calls.

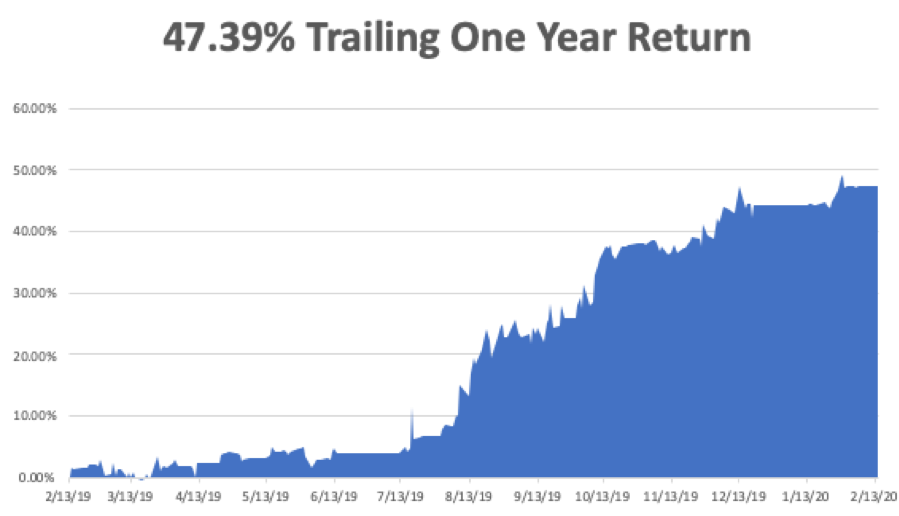

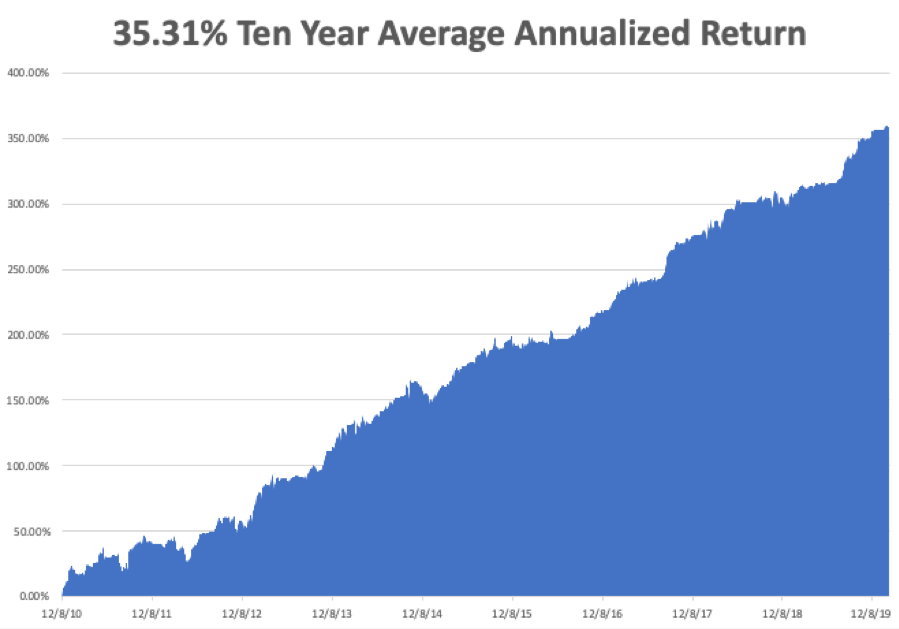

My Global Trading Dispatch performance rose to a new high at +359.00% for the past ten years. February stands at -0.04%. My trailing one-year return is stable at 47.39%. My ten-year average annualized profit ground back up to +35.31%.

All eyes will be focused on the Coronavirus still, with deaths over 1,800. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Tuesday, February 18 at 8:30 AM, the NY State Manufacturing Index for February is released.

On Wednesday, February 19, at 9:30 PM, January Housing Starts are out.

On Thursday, February 20 at 8:30 AM, Weekly Jobless Claims come out. The February Philadelphia Fed Manufacturing Index is announced.

On Friday, February 21 at 10:30 AM, January Existing Home Sales are printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be driving back from Lake Tahoe, where I spent the long weekend catching up on the markets. There was virtually no snow, amazing for February, but great hiking.

Since I will be dropping 7,200 feet from Donner Pass and I have the new expended range Model X, I will be able to make it the 220 miles home on a single charge.

In two years, I’ll be able to make the 440-mile round trip on a single charge when the new Tesla Cyber truck comes out. Of course, people will think I’m nuts and my kids have refused to be seen in the cutting edge vehicle, but when did that ever stop me?

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

February 14, 2020

Fiat Lux

Featured Trade:

(DATA TELLS THE WHOLE STORY)

(FB), (GOOGL), (NFLX), (AMZN), (EBAY), (TWTR)

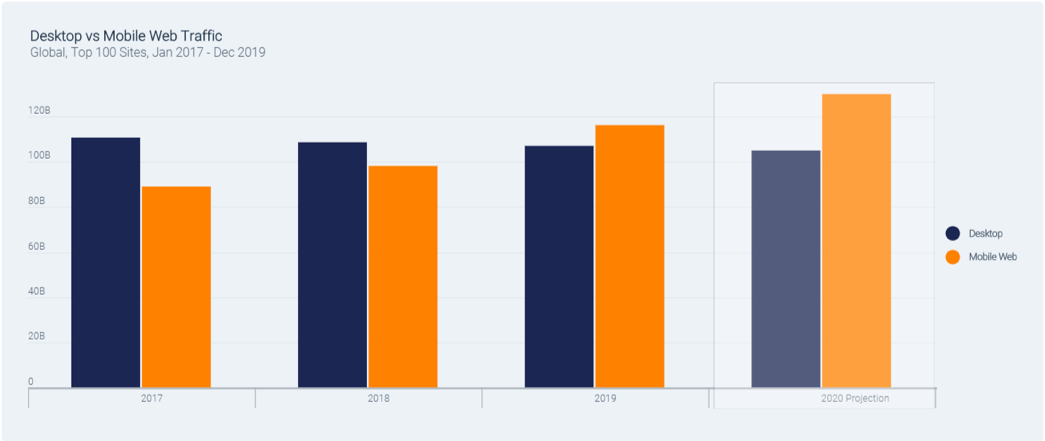

Behavioral trends have a sizable say in which tech companies will outperform the next and a recent report from SimilarWeb offers insight into how much users navigate around the monstrosity known as the internet.

The optimal way to comprehend the trends are from a top-down method by absorbing the divergence between desktop traffic and mobile traffic.

It’s no secret that the last decade delivered consumers a massive leap in mobile phone performance in which tech companies were able to neatly package applications that acted as monetization platforms by offering software and services to the end-user.

Thus, it probably won’t shock you to find out that desktop traffic is down 3.3% since 2017 as users have migrated towards mobile and the trend has only been exaggerated by the younger generations as some have become entirely mobile-only users.

All told, the 30.6% expansion in mobile traffic has penalized tech firms who have neglected mobile-first strategies and one example would be Facebook (FB), who even though has a failing flagship product in Facebook.com, are compensated by Instagram, who is showing wild growth numbers.

The fact that mobile screens are smaller than desktop screens means that users are staying on web pages not as long as they used to – precisely 49 seconds to be exact.

This trend means that content generators are heavily incentivized to frontload content and scrunch it up at the top of the page. This also means that sellers who don’t populate on Google’s first page of search results are practically invisible.

The high stakes of internet commerce are not for the faint of heart and numerous companies have complained about algorithm changes toppling their algorithm-sensitive businesses.

Even using a brute force analysis and investing in companies that are in the top 15 of internet traffic, then the companies that scream undervalued are Twitter (TWTR) and eBay (EBAY).

Twitter is a company I have liked for quite a while and is definitely a buy on the dip candidate.

The asset is the 7th most visited property on the internet behind the likes of Instagram, Google, Baidu, Wikipedia, Amazon, and Facebook.

This position puts them just ahead of Pornhub.com, Netflix, and Yahoo.

And if you take one step back and analyze traffic from the top 100 sites, traffic is up 8% since 2018 and 11.8% since 2017 averaging 223 billion visits per month.

Rounding out the top 15 is eBay who I believe is undervalued along with Twitter - these two are legitimate buy and holds.

Ebay was the recipient of poor management for many years and they are now addressing these sore points.

Certain content is suitable for mobile such as adult sites, gambling sites, food & drink, pets & animals, health, community & society, sports, and lifestyle.

And just over the last year or two, other categories are gaining traction in mobile that once was dominated by desktop such as news and media, vehicle sites, travel, reference, finance, and others.

Many consumers are becoming more comfortable at doing more on mobile and spending more to the point where people are making large purchases on their iPhones.

The biggest loser by far was news - they are losing traffic in droves.

Traffic at the top 100 media publications was down 5.3% year-over-year from 2018 to 2019, a loss of 4 billion visits, and down by 7% since 2017.

Personally, I believe the state of the digital news industry is in shambles, and Twitter has moved into this space becoming the de facto news source while pushing the relevancy of news sites down the rankings.

Facebook and Twitter are essentially undercutting the news by forcing news companies to insert them between the reader and the news company because they have strategized a position so close to the user’s fingertips.

The negative sentiment in news is broad based on popular news, entertainment news and local news all showing decreases of more than 25%.

Finance and women’s interest news categories are the only ones showing positive traffic growth.

The state of internet traffic growth supports my underlying thesis of the big getting bigger and the subsequent network effect stimulating further synergies that drop straight down to the bottom line.

The top 10 biggest sites racked up a total of 167.5 billion monthly visits in 2019, up 10.7% over 2018 and the remaining 90 largest sites out of the top 100 only increased 2.3%.

This has set the stage for just five gargantuan tech firms to become worth more than $5 trillion or 15.7% of the S&P 500’s market value and 19.7% of the total U.S. stock market’s value.

Now we have real data backing up my iron-clad thesis and these cornerstone beliefs underpins my trading philosophy.

Many of the biggest wield a two-headed monster like Google who has Google.com and YouTube video streaming and Facebook, who have Facebook.com and Instagram.

It doesn’t matter that Facebook has lost 8.6% of traffic over the past year because Instagram compensates for Facebook being a poor product.

And if you are searching for another Facebook growth driver under their umbrella of assets then let’s pinpoint chat app WhatsApp who experienced 74% year-over-year traffic.

Beside the news sites, other outsized losers were Yahoo’s web traffic shrinking by 33.6% and Tumblr, which banned adult sites in 2018, leading to a 33% loss in traffic.

If I can sum up the data, buy the shares of companies who are in the top 15 of internet traffic and be on the lookout for any dip in eBay or Twitter because they are relatively undervalued.

“Some people don't like change, but you need to embrace change if the alternative is disaster.” – Said Founder and CEO of Tesla Elon Musk

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.