While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 10, 2020

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES IN TODAY’S MARKET),

(SPY), (VIX), (VXX), (AAPL), (CCL), (UAL), (WYNN)

Today, we saw the largest point loss in market history, the first use of modern circuit breakers, and individual stocks down up to 40%. Ten-year US Treasury bond yields cratered to 0.39%. Virtually the entire energy and banking sectors vaporized.

What did I do? I did what I always do during major stock market crashes.

I took my Tesla out to get detailed. When I got home, I washed the dishes and did some laundry. And for good measure, I mowed the lawn, even though it is early March and it didn’t need it.

That’s because I was totally relaxed about how my portfolio would perform.

There is a method to my madness, although I understand that some new subscribers may need some convincing.

I always run hedged portfolio, with hedges within hedges within hedges, although many of you may not realize it. I run long calls and puts against short calls and puts, balance off “RISK ON” positions with “RISK OFF” ones, and always keep a sharp eye on multi-asset class exposures, options implied volatilities, and my own Mad Hedge Market Timing Index.

While all of this costs me some profits in rising markets, it provides a ton of protection in falling ones, especially the kind we are seeing now. So, while many hedge funds are blowing up and newsletters wiping out their readers, I am so relaxed that I could fall asleep at any minute.

Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome.

This is second nature for most hedge fund managers. In fact, the larger ones will use top of the line mainframes powered by $100 million worth of in-house custom programming to produce a real-time snapshot of their thousands of positions in all imaginable scenarios at all times.

If you want to invest with these guys feel free to do so. They require a $10-$25 million initial slug of capital, a one-year lock-up, charge a fixed management fee of 2% and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 50 pages of disclosure documents. If you have ever sued a previous manager, forget it. The door slams shut. And, oh yes, the best performing funds are closed and have a ten-year waiting list to get in. Unless you are a major pension fund, they don’t want to hear from you.

Individual investors are not so sophisticated, and it clearly shows in their performance, which usually mirrors the indexes less a large haircut. So, I am going to let you in on my own, vastly simplified, dumbed-down, seat of the pants, down and dirty style of risk management, scenario analysis, and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,000 a year subscription fee and that’s it. And I’m not choosy. I’ll take anyone whose credit card doesn’t get declined.

To make this even easier, you can perform your own analysis in the excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch. You can just download it and play around with it whenever you want, constructing your own best-case and worst-case scenarios. To make this easy, I have posted this spreadsheet on my website for you to download by clicking here. You have to be logged in to access and download the spreadsheet.

Since this is a “for dummies” explanation, I’ll keep this as simple as possible. No offense, we all started out as dummies, even me.

I’ll take Mad Hedge Model Trading Portfolio at the close of March 9, 2020, the date of a horrific 2,000 down day in the Dow Average. This was the day when margin clerks were running rampant, brokers were jumping out of windows, and talking heads were predicting the end of the world.

I projected my portfolio returns in three possible scenarios: (1) The market collapses an additional 5.3% by the March 20 option expiration, some 8 trading days away, (2) the S&P 500 (SPX) rises 10% by March 20, and (3) the S&P 500 trades in a narrow range and remains around the then-current level of $2,746.

Scenario 1 – The S&P 500 Falls Another 5.3% to the 2018 Low

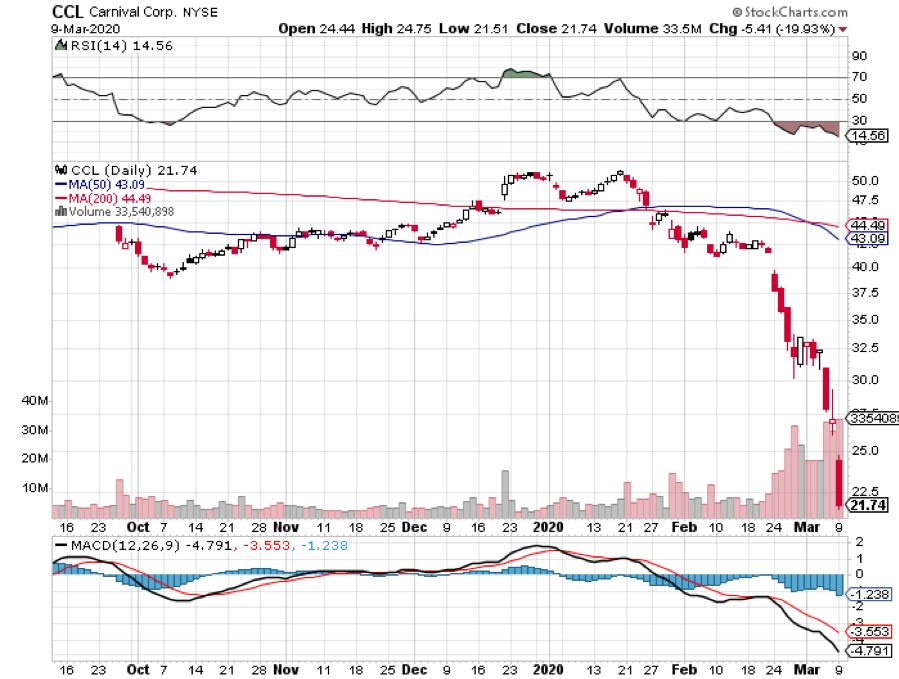

A 5.3% loss would take the (SPX) down to $2,600, to the 2018 low, and off an astonishing 800 points, or 23.5% down from the recent peak in a mere three weeks. In that situation the Volatility Index (VIX) would rise maybe to $60, the (VXX) would add another point, but all of our four short positions (AAPL), (UAL), (CCL), and (WYNN) would expire at maximum profit points.

In that case, March will end up down -3.58%, and my 2020 year-to-date performance would decline to -6.60%, a pittance really compared to a 23.5% plunge in the Dow Average. Most people would take that all day long. We live to buy another day. Better yet, we live to buy long term LEAPs at a three-year market low with my Mad Hedge Market Timing Index at only 3, a historic low.

Also, when the market eventually settles down, volatility will collapse, and the value of my (VXX) positions double.

Scenario 2 – S&P 500 rises 10%

The impact of a 10% rise in the market is easy to calculate. All my short positions expire at their maximum profit point because they are all so far in the money, some 20%-40%. It would be a monster home run. I would go back in the green on the (VXX) because of time decay. That would recover my March performance to +1.50% and my year-to-date to only -1.42%

Scenario 3 – S&P 500 Remains Unchanged

Again, we do great, given the circumstances. All the shorts expire at max profits and we see a smaller increase in the value of the (VXX). I’ll take that all day long, even though it cost me money. When running hedge funds, you are judged on how you manage your losses, not your gains, which are easy.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETFs, are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to say in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. And let’s face it, politics is a major influence this year. Thanks Joe Biden for that one day 1,000 point rally to sell into, when I established most of my shorts and dumped a few longs.

Keep the number of positions small to keep your workload under control. Imagine being Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $10 a barrel? That’s a gimme.

What if there is an American attack on Iranian nuclear facilities to distract us from the Coronavirus and stock market carnage? That might take you all two minutes to figure out. The Federal Reserve launches a surprise QE5 out of the blue? I think you already know the answer.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. Therefore, I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways. I do this on a regular basis.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times, no matter what the market does. You can’t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb-proof. You never know when a flock of black swans is going to come out of nowhere or another geopolitical shock occurs causing the market crash.

"Legalize gay Marijuana," said a bumper sticker seen in Northern Nevada.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

March 9, 2020

Fiat Lux

Featured Trade:

(WHY ZOOM HAS BEEN ZOOMING)

(ZM), (VMW), (JNJ), ($COMPQ)

One man's heaven is another man's hell.

Zoom Video Communications (ZM) is the hero of video conferencing software.

Few companies are navigating the coronavirus situation better than Zoom. Their better-than-expected fourth-quarter earnings and forecast is a great omen for the coronavirus driving future demand for the company’s remote-work tools.

Even without the coronavirus, the company is doing spectacularly.

(ZM) delivers best in show teleconferencing services including video meetings, voice, webinars and chat across desktop and mobile devices, and has been the beneficiary of the dreaded coronavirus that has quarantined workers forcing them to rely on Zoom’s video app tools.

The virus has bolted by the 100,000 customer mark with at least 3,500 Corona deaths.

The panic has been overblown, and the same hysteria has seeped into the broader tech market triggering deep selloffs in almost every tech company.

The elevated awareness and adoption of the company’s video conferencing platform will allow the company to post an even better performance next quarter.

The migration into the company’s free app remains robust and it is unclear whether those users can be converted to paying ones. However, paid growth is still hitting on all cylinders.

Revenue crushed it at 78% to $188.3 million from $105.8 million a year ago.

In total, sales in 2019 were $622.7 million, up 88% year-over-year.

Zoom Communications is attracting more influential customers with 81,900 accounts with at least 10 employees, a 61% uptrend from the past year.

VMware Inc. (VMW) and Johnson & Johnson (JNJ) are two of Zoom’s largest accounts.

Zoom's first-quarter revenue guidance was strong as well predicting between $199 million and $201 million.

Another growth lever will be the mobile segment which has signed up more than 2,900 accounts with more than 10 employees in its first year after launch and will shortly be available in 18 countries.

Total operating margins surpassed expectation of 10%, by more than doubling, to 20.4%.

Ultimately, Zoom's robust Q4 results and guidance underline the company's smooth pathway to elevated revenue drivers as the world goes into pandemic mode because of Covid-19.

It was somewhat underwhelming that management cited a limited revenue benefit from the situation with a go-forward increase in costs as usage increases.

That could have been sorted out more delicately and keeping costs down is one of management’s responsibilities.

The positives still outweigh any minor negatives as the company has been able to capitalize by seizing mind share and expanding the funnel.

Zoom Communications has not been able to escape the recent volatility in shares as the 12% boost from a positive earnings report was met with a 13% haircut the following day as the broader Nasdaq was pummeled.

The Covid-19 virus is delivering agony to investors as the swings are simply hard to trade in and out of.

Making it even more difficult is fogging clarity breeding uncertainty stoking wild risk-off moves even when the central bank announced an emergency half-point rate cut.

The current issue is that short term, markets can behave as irrational as ever and trading algorithms are programmed to digest headlines by not only the volume but the potency and relevancy as well.

If every news wire sent out a story that free money was dropping from the sky, the market would be up 10% irrespective of whether it is true or not.

That is the world we live in where over 85% of the trading decisions and volume are executed by automated software and the exaggeration doesn’t discriminate in which direction it trends in.

So, we are stuck in this negative feedback loop where national headlines are almost entirely concentrated on the coronavirus and that is mainly the data that is fed into short-term trading algorithms.

Unfortunately, the tech market weakness is becoming a self-fulfilling prophecy and new headlines of Northern Italy being quarantined and New York announcing a state of emergency is poised to be the next catalyst for a volatile upcoming trading week ahead.

Short-term traders need to understand that this isn’t just a “buy the dip” event and the deep in the money call spreads that had cushions of 8-10% were blown out in just a few days.

Long term investors should be using every dramatic selloff to add slightly to their positions incrementally lowering their cost basis.

It is hard to know when the coronavirus phenomenon will pass by but at the speed in which we are trending, U.S. school cancelations and further cities and states announcing highly negative events are in the pipeline for next week.

The bottoming event could eventually come in the form of US Corona cases topping 10,000 or cancelling the Olympics in Tokyo, but until then, the negative health headlines appear to be the new normal for the short-term and until we are fully washed out.

“A founder is not a job, it's a role, an attitude.” – Said Founder and CEO of Twitter Jack Dorsey

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.