While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

March 18, 2020

Fiat Lux

Featured Trade:

(LOOK FOR A “V” WITH TECH EARNINGS)

(BABA), (BKNG), (EXPE), (TRIP), (NFLX), (SPOT)

(AMZN), (GOOGL), (TWTR), (SNAP), (PINS)

Expect poor earnings results for almost every tech company as a result of the coronavirus.

The base case for the tech industry is that we are already in the middle of a recession.

The main reason for this is the expected demand/supply disruptions in the wake of Covid-19 that will dramatically drive a wedge in the profit potential which could last through mid-summer.

The silver lining is that the recovery will be robust; but we most likely won’t experience that until the 3rd quarter.

In the short-term, the path of least resistance is more weakness in tech shares, as the U.S. has failed to find enough test kits for possible coronavirus positive patients.

This means that the number of patients infected with coronavirus will be backloaded and as the test kits finally find their way to the masses, the number of sick patients will mushroom.

The Norwegian University of Science and Technology has urged all Norwegians to return home citing a “poorly developed healthcare and infrastructure” as the specific reason to vacate U.S. soil.

It is not possible for tech shares to bottom until there is a strong surge of coronavirus, which is almost a given because of the lax preparation and policy missteps beforehand.

The U.S. is now registering over 1,000 cases per day and growing.

My negative assessment was validated by the U.S. Central Bank, who chose to cut interest rates by 100 basis point and the market opened down 12% following the announcement.

The tech market is now pricing in a slew of bankruptcies and the realization of more pain is forcing sellers to take risk off the table at almost any price.

To hammer my point home, in the time of writing this article, the global number infected by coronavirus jumped from 180,000 to 196,000.

From that quick bump up, the coronavirus cases in the U.S. jumped from 4,538 to 5,853.

The revenue softness will bleed into earnings season and some tech stocks will experience a 20% decline in quarterly revenue and others will fare better with a 2% decline.

A broader problem is the disorderly market malfunctioning pervading through market trading.

Desperate rate cuts and multiple circuit breakers halting the flow of trading are ravaging investor confidence in an American economy that is known for its interconnectedness and integration.

The health solution must have a strong element of isolation and disconnection, meaning the U.S. economy will be sacrificed in the short-term.

Just as baffling, the Central Bank is out of ammunition and will not be able to cure future crises.

The U.S. has no choice but to throw financial stimulus after stimulus to keep companies afloat.

The tech firms facing a larger drop off will be Alibaba Group Holding (BABA), the giant China-based e-tailer, and online travel agency stocks Booking.com (BKNG), Expedia Group (EXPE) and TripAdvisor (TRIP).

Online travel companies face dramatic demand reduction and are the first tech product that gets hacked off in a global and fast-spreading pandemic.

Borders are closed, airlines are practically shuttered, and there is no use case for online travel apps when people are “hunkered down” and advised not to leave their homes.

Alibaba bears the brunt of the COVID-19 crisis, given its entrenched operations in the epicenter of the virus’ initial outbreak, they simply won’t be able to access supplies when factories are locked down and logistics are delayed.

Even Amazon noted that their Prime 1-day delivery was in bad shape because of the same reasons, but they have done well selling out of most household products so don't quite face the same trials of poor tech earnings.

Online ad platforms face a reckoning as well, such as Pinterest (PINS), Twitter (TWTR), and Snap (SNAP) who are dependent on brand advertising and will likely face pullbacks.

These second-tier online ad companies face a slide of around 10% year over year.

The heavy hitters will experience their own type of weakness, with Alphabet (GOOGL) and Facebook facing a 5% revenue drop.

Google’s brand advertising business will face pressure and its travel advertising segment (10-15% of total revenue) will endure significant downside.

Amazon.com (AMZN) will only endure low single-digit number weakness in revenue because many consumers turn to e-commerce ordering at home instead of going out.

Netflix (NFLX) and Spotify Technology (SPOT) are likely to experience immaterial disruptions as well as any top of the line premium digital content that can be devoured at home.

“Artists work best alone.” – Said Co-Founder of Apple Steve Wozniak

Global Market Comments

March 18, 2020

Fiat Lux

Featured Trade:

(LOOKING FOR LEVERAGED LONG PLAYS),

(SPY), (INDU), (SSO), (UPRO)

This is a time where everyone is wondering: what is the future of coronavirus and, in turn, the economy?

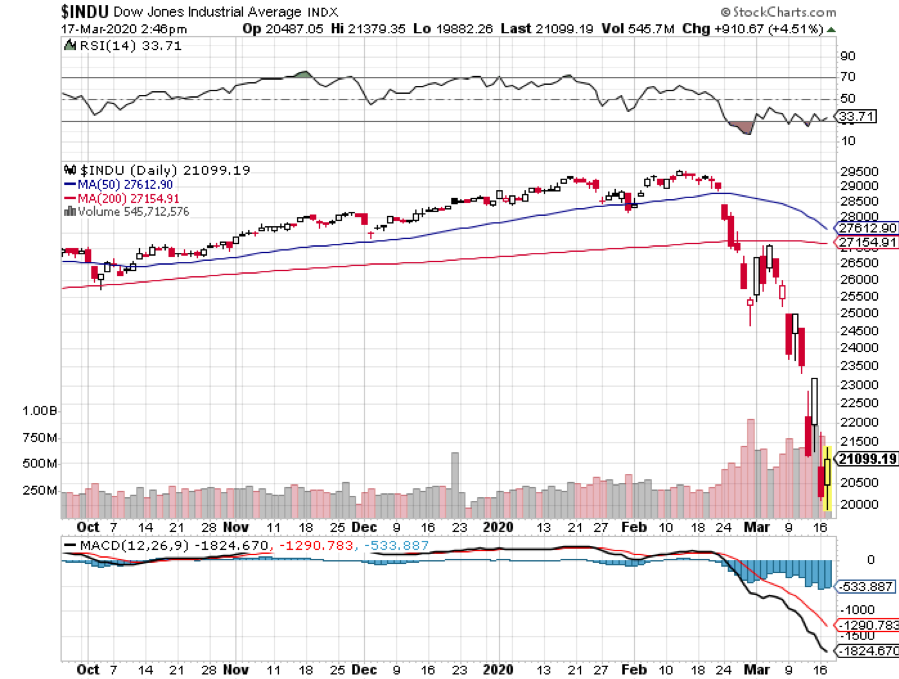

It is highly likely that the stock market will bottom out over the next few weeks and then begin a period of sideways chop in a wide range.

That range could be half the recent loss, a staggering 5,000 points in the Dow Average (INDU), or 500 S&P 500 points (SPX).

The math is quite simple.

With much of the country now on lockdown, Corona cases will keep climbing sharply in the US from the present 5,000 cases. They will keep doubling every three days for the next two weeks, the incubation time for the disease possibly reaching as high as 40,000 cases.

Just in the time it took me to write this piece, the number of cases worldwide jumped from 184,000 to 194,873 (click here for the link).

At that point, everyone who has the disease will become visible and can be isolated. The following week will bring a sharp falloff in the number of new cases, which many traders and investors will read as the end of the epidemic.

Shares will rocket.

The lockdowns and the “shelters in place” will come off. The economy will start to return to normal. Stock investors will pile in.

Then another spike in new cases will take place, prompting a secondary round of shutdowns and another run at the lows.

On top of this, the market will have to digest a coming set of economic numbers that will be the worst in history. All eyes will be on the Thursday Weekly Jobless Claims out at 8:30 AM, that will be our first look at the terrifying layoffs to come.

Our first look at economic growth comes at the end of April when the Q1 GDP is released. Since we had two months of growth before the crash and lockdown, it comes in as high as zero.

Not so with Q2, which could bring in a 5% or more shrinkage in the economy at an annualized rate. No doubt more 1,000 point down days are setting up when these figures are printed.

This is precisely what healthcare officials want to happen. That way, Corona cases can be spaced out over a year, keeping the national civilian and military hospital system from getting overwhelmed.

This is what the future of coronavirus will look like for the economy. Suffice it to say that there are some spectacular long side plays setting up. I’ll cover some of the best ways to play it.

One is the ProShares Ultra S&P 500 (SSO), a 2x long the underlying stock index. Since the all-time high four weeks ago, the (SSO) has cratered by 54.50%.

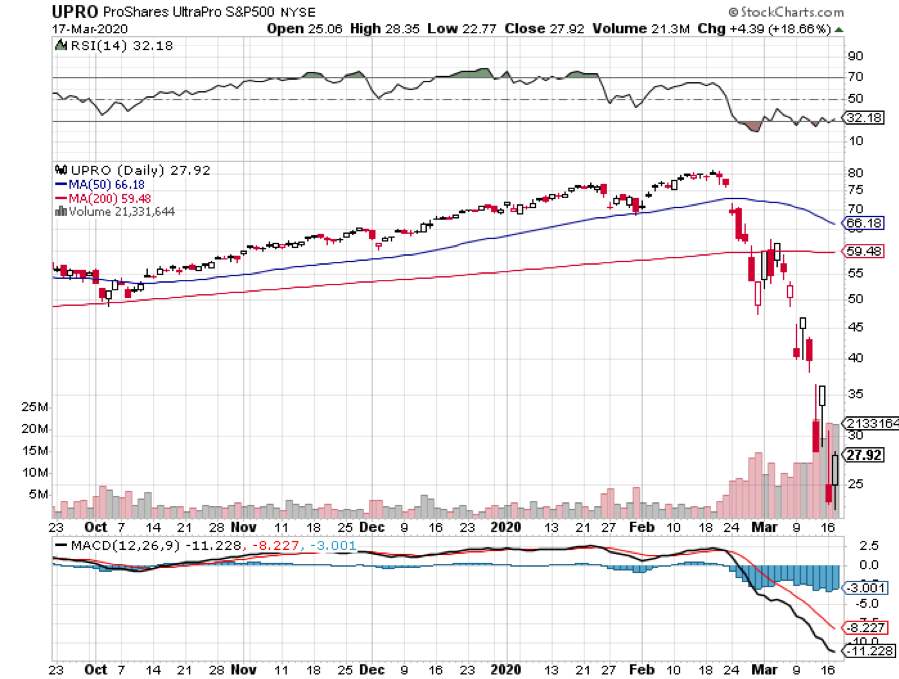

Another is the ProShares Ultra Pro S&P 500 (UPRO), a 3x long the underlying stock index. Since the all-time high four weeks ago, the (SSO) has cratered by an eye-popping 74.40%.

Needless to say, the velocity of these instruments is enormous, and the bid offered spreads wide. If you want your “E-ticket” ride for the stock market, this is it. Trade these with extreme caution.

Get a piece of either one of these and the gains can be huge. The (SSO) has to jump by 120% to the old high, while the (UPRO) needs to soar by 290%.

Good Luck!

This Morning’s Traffic Report

The San Francisco Rush Hour

My Kind of Stockpile

Mad Hedge Biotech & Healthcare Letter

March 17, 2020

Fiat Lux

Featured Trade:

(THERMO FISHER SCIENTIFIC BECOMES A MAJOR CORONA PLAYER),

(TMO), (QGEN)

Thermo Fisher Scientific (TMO) recently executed a strategic move that effectively transformed itself into a major coronavirus disease (COVID-19) player overnight.

The lab tools giant opened the month of March with a bang as it announced an $11.5 billion acquisition deal with Dutch company Qiagen (QGEN).

The transaction also includes Thermo Fisher’s assumption of Qiagen’s debts worth $1.4 billion, with the US biotechnology company paying roughly $43 per share. The deal is anticipated to be closed by the first half of 2021.

And just like that, Thermo Fisher has positioned itself at the forefront of the potential pandemic threatening to push the global economy to a recession.

What does this transaction mean to the race to solve the looming coronavirus pandemic?

Thermo Fisher and Qiagen make quite a good pair. The Massachusetts giant is a major manufacturer and developer of the CDC-approved scientific equipment used to detect Covid-19 in the US.

Meanwhile, Qiagen provided the equipment used during the SARS and swine flu outbreaks years ago.

In the past weeks since the Covid-19 outbreak, the company has been quietly working on tests for the Wuhan coronavirus as well. The latest update on this front is that Qiagen already shipped test kits for evaluation for the deadly epidemic to four hospitals in China.

Although it’s highly unlikely that Thermo Fisher splurged on an 11-figure deal for the sole purpose of getting ahead in finding the cure for the latest virus epidemic, Qiagen’s promising progress on that particular endeavor possibly nudged the big biotechnology company’s decision along.

Obviously, coronavirus test kits would eventually be huge sellers in the months and even years ahead. However, Thermo Fisher’s interest in this deal goes deeper than that.

Qiagen is a strategic addition to Thermo Fisher and could be a steady revenue source, and one of the key reasons for this collaboration is the complementary nature of both businesses.

Geographically speaking, Thermo Fisher and Qiagen can also conveniently cross-sell from each other’s existing lineups.

The Dutch company’s life sciences and molecular diagnostics solutions are expected to boost Thermo Fisher’s broader set of diagnostic offerings. Hence, this consolidation could potentially amount to approximately $200 million in savings every year in the next few years.

This isn’t the first time that Thermo Fisher wielded its huge cash flow to expand its growth segments.

In 2014, Thermo Fisher executed a $13.6 billion acquisition of genetic testing company Life Technologies. Working hand in hand, the two companies managed to contribute a 44% boost in revenue from $16.9 billion that year to $24.4 billion by 2018.

Just last year, Thermo Fisher snapped up one of the newest and most promising players in the gene therapy sector. Paying $1.7 billion to acquire Brammer Bio, the biotechnology giant secured the expansion of its cell and gene therapy pipeline.

With a free cash flow of roughly $3.9 billion in the past 12 months, the company still has room for additional acquisitions.

Amid all the major moves Thermo Fisher executed in the past five years though, the company has remained consistent in producing a strong bottom line.

Since the deal with Qiagen was announced, Thermo Fisher disclosed that it plans a 16% increase to its quarterly dividend to reach 22 cents per share compared to its current 19 cents. Moreover, the company expects a 14% growth in the next five years and projects to keep up its strong segmental performance.

Although the company’s growth level may not be as enticing for growth investors, its impressive diversification makes it an attractive investment.

Its broad mix of income from numerous segments combined with steady profits allows Thermo Fisher to provide investors the much-needed predictability and stability.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.