I will explain to everyone why a wonky side effect of coronavirus is supercharging the 5G revolution.

Market valuations reflect the state of expected future cash flows in a company.

Under this assumption, some could argue that most tech companies with staying power are almost a good buy at any price.

No brainers would include a list of Microsoft, Amazon, Apple, and Netflix.

The health scare and the carnage associated with it have brought forward the tech industry as a whole to the forefront of the global economy.

When you mix that with the Fed hellbent on saving everything that has a heartbeat, it sets up conditions for heavy buying in an industry that is going to be king of the global economy anyway.

It is not a question of if, but when and the health phenomenon has accelerated the dramatic migration to tech by showing how business will be conducted in about 15 years.

The change took place in a blistering 4 weeks.

The clearest signal of who is really calling the shots in the equity market is looking at which companies are dragging it up.

Technology is shouldering the responsibility of the equity market by outperforming the broader market with many software companies’ share price higher than before the crisis.

For every Amazon or Microsoft, there is also a Macy’s or JC Pennys showing that this is really a stock pickers market.

We have not only learned that tech companies are critical to our functioning as a society, but that large tech companies will be even more central than before even if they are currently losing gross revenue.

The relative gains to tech stemming from the coronavirus is equal or greater than an innovation of a game-changing product and will double the effect of 5G.

We are setting up for the Golden Age of 5G with tech poised to invade even more of the broader equity market.

One rough estimate notes that the 5G industry is expected to add about $40bn in incremental revenue to the semiconductor industry, add 5X growth in mobile data monthly traffic by 2024, and a $4.2tn boost to global economies from revenue streams connected to 5G in the next ten years.

I do agree that currently, the network effect is working in reverse order, but the positive force multiplier, when the economy is riding high again, cannot be emphasized enough.

Digital revenue streams will effectively be pumped into every nook and crevice of the digital economy because of current modifications to the business environment.

When business does come back online, investors of physical assets will sell what they can at discounted prices to get into the digital ecosystem causing asset prices to explode as investors chase prices to the sky.

Do you remember commercial real estate guru and Colony Capital’s CEO Tom Barrack?

The company hoped to sell as much as 90% of its $20 billion property portfolio of hotels, warehouses, and other commercial real estate by the end of 2021.

They are also another big investor in nursing homes.

A real-estate pioneer who founded Colony in the early 1990s and is the firm’s chief executive and executive chairman, Barrack said he wanted to go “all digital.”

Rejigging the 29-year-old investment company represented an extreme response to the way technologies have been dismantling cash flow for most every type of commercial real estate, and Barrack was met with fierce backlash from entrenched stakeholders regarding the new direction.

Commercial real estate and hotel operators have had to fight against the triple whammy of office sharing WeWork, short-term hotel platform Airbnb, and the coronavirus - a lethal three-part cocktail of malicious forces to the “traditional” model.

The coronavirus has proven Barrack was spot-on with his synopsis, but he wasn’t able to get rid of Colony’s inventory of commercial real estate in the expeditious way he desired.

Other companies have taken a direct hit like 24-Hour Fitness who are pondering filing for bankruptcy, but I could say the same for a slew of companies like Colony Capital.

Another key manifestation of the current economic malaise is that regulators, antitrust, tax, foreign and all of the above are less likely to disrupt big tech companies moving forward considering they may be the only ones able to get us out of a similar crisis in the future.

Government officials will be under rapid pressure to boost GDP levels and crimping big tech is counterintuitive to this overall goal.

I don’t agree with the glass half empty crowd who believes Amazon needs to be clamped down because of dominating retail during the time of the virus - if Amazon didn’t exist, the panic could have accelerated to an uncontrollable level creating anarchy in the streets.

The big boys have pushed soft power as a legitimate policy tool with Apple sourcing over 20 million face masks and is now building and shipping face shields.

Big tech is becoming like a mini-government in its own right.

Granted that thousands of bankruptcies from restaurants, nail salons, and yoga studio will be swept into the dust bin of economic history, but once the next iteration of the economic cycle turns up, tech is about to go gangbusters in a way many never thought imaginable.

Then if you bake a little 5G into the pecan pie, investors are justified to be salivating about the tech industry’s prospects.

Any deep-pocketed investors should be cherry-picking every quality 5G tech play possible because they will be the most supercharged sub-sector of tech once the economy is reset.

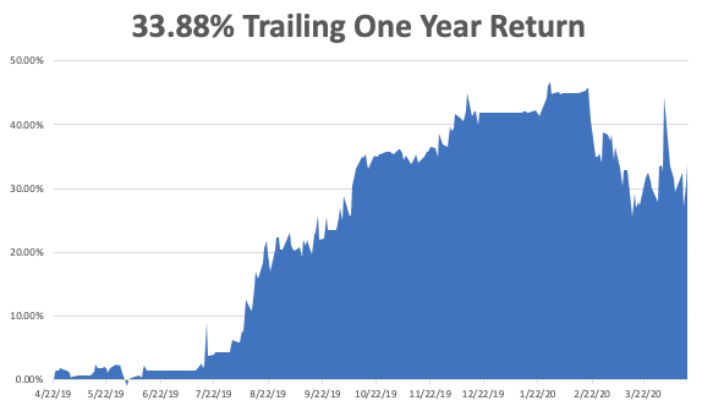

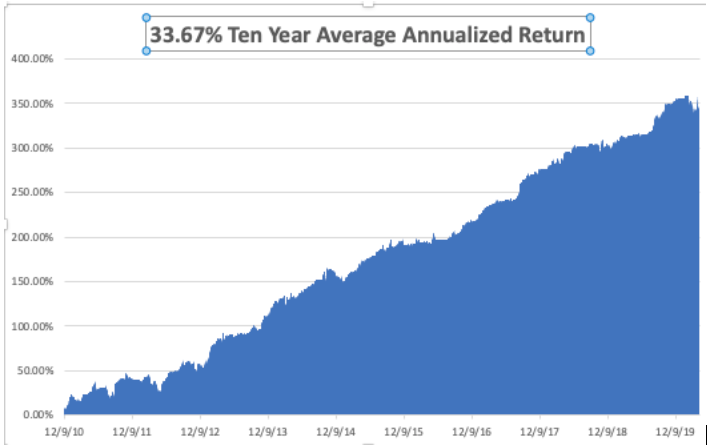

Any long-term investor with a pulse should buy Crown Castle International Corp. (REIT) (CCI) on any and all dips.

They are the largest owner of cell towers owning over 40,000 in the U.S.