When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

May 15, 2020

Fiat Lux

Featured Trade:

(WHY UBER IS BUYING GRUBHUB),

(GRUB), (UBER)

To understand the unintended consequences of the Fed’s helicopter money to U.S. capitalism, we can put a magnifying glass over Uber’s (UBER) recent takeover attempt of Grubhub (GRUB) as what’s in store for not only the tech sector but the wider public markets.

Zombie companies parade around Europe and Japan because of an era of low interest rates and cozy bank relationships that keep these companies from dying out.

To read more about Allianz Economic Advisor Mohamed El-Erian’s take on zombie companies – click here.

It’s not a surprise that Japan and Europe are highly unproductive, and innovation ceases to exist when capital is being tied up in marginal companies with management happy to let capital slosh about without adding extra added value.

I get it that the Fed is trying to “save” the wider U.S. economy by bringing out the bazookas and even by buying junk-graded debt which was once seen as heresy.

But what we have now are inferior companies that will never turn a profit masquerading as real companies that would be on life support if not for cheap capital.

In almost every instance, the only winners are the executive management who pillage the system and cash out when they are allowed to sell their stock.

U.S. Representative for Rhode Island David Cicilline hit the nail on the head when he described the fluid situation by focusing on two of the bad apples, saying “Uber is a notoriously predatory company that has long denied its drivers a living wage. Its attempt to acquire Grubhub — which has a history of exploiting local restaurants through deceptive tactics and extortionate fees — marks a new low in pandemic profiteering.”

Uber is a taxi service that undercompensates its highest expense - the driver, and Grubhub delivers restaurant food but rips off the restaurants in doing it.

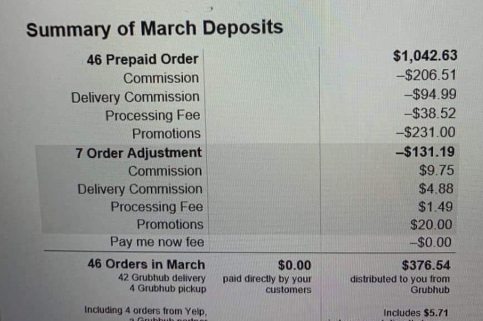

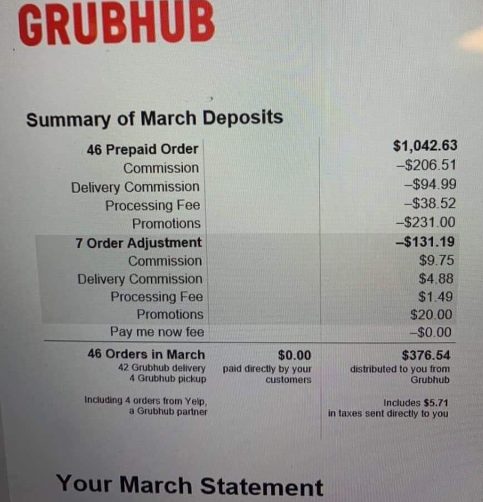

I defined exorbitant delivery fees as up to 40% which Grubhub is infamous for charging.

Yes, even with predatory practices, they cannot turn a profit.

Now, in this new normal of coronavirus, it would be a miracle to make any operational headway.

Uber’s attempted market grab is a giant red flag.

My guess is that they are doing this in order to jazz up the balance sheet and concoct some ridiculous new metric showing a pathway to growth.

By adding growth to revenue, Uber would be able to preach “growth” even if it’s of bad quality.

I thought the tech market was done looking through to grow by essentially killing off the “WeWork model.”

However, Uber is going for a model that is one notch above that model and repurposing it as something actually meaningful, which of course, it’s not.

They are already in litigious hell regarding driver’s remuneration, and that will not die down and could even destroy Uber.

Uber has in fact ignored California state orders to reclassify its drivers as employees and have appealed the court’s decision.

The New York state government has validated my theory of these fly-by-night delivery outfits being a net negative for business and society.

The New York City Council compared food ordering apps Grubhub and UberEats to blood-sucking parasites this week before passing emergency legislation aimed at helping struggling restaurants lower delivery costs during a precarious time.

During the state of emergency, a new vote passed capping food ordering and delivery app fees at 15% in delivery fees and 5% “other” takeout order fees.

To read more about this decision by the New York City Council – click here.

This was done to give some power back to the restaurants that have been getting fleeced.

The balance sheet shows the whole story with Uber's net loss totaling more than $8.5 billion in 2019 and in February, they reported a net loss of $1.1 billion in the fourth quarter.

Let me remind readers that Grubhub posted a net income loss of $27.7 million for the last reported quarter as well.

As it turned out, Grubhub rejected Uber’s offer believing it didn’t meet their valuation of the company.

It would appear natural that a predatory company with no competitive advantage would set a market premium that would align with their borderline extortionate ways.

Do not own either one of these companies – there are far better ones out there in tech and no need to scrounge at the bottom of the barrel.

Monthly Grubhub bill for Chicago Pizza Boss During the Epidemic

“My goal was never to make Facebook cool. I am not a cool person.” – Said Co-Founder and CEO of Facebook Mark Zuckerberg

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 15, 2020

Fiat Lux

Featured Trade:

(WHY CONSUMER STAPLES ARE DYING),

(XLP), (PG), (PEP), (PM), (WMT), (AMZN),

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Mad Hedge Biotech & Healthcare Letter

May 14, 2020

Fiat Lux

Featured Trade:

(JOHNSON & JOHNSON’S BIG CORONA PLAY)

(JNJ), (MRNA)

One of the world’s biggest biotechnology and healthcare companies did not reach this status by betting on unproven strategies, but Johnson & Johnson (JNJ) recently made a huge gamble on an experimental vaccine for the deadly coronavirus disease (COVID-19).

Going all-in on this bet, JNJ committed to co-fund with Biomedical Advanced Research and Development Authority (BARDA) the development of a coronavirus vaccine. The two companies pledged over $1 billion for the manufacture of this experimental treatment.

Why is this a big deal?

Drugmakers typically wait to receive positive results before they even consider breaking ground on facilities designed to mass-produce any potential drug.

JNJ and BARDA’s move means there will be warehouses full of this coronavirus vaccine candidate even before we find out whether or not it can successfully prevent COVID-19.

Simply put, Johnson & Johnson decided to mass-produce a vaccine without any proof that it could even be effective.

The company is so confident about this that it believes it could hit the market by 2021 -- a stunning claim considering that it generally takes three to seven years, and at times even longer, to push a vaccine from the initial stage to market launch.

Although claiming such an incredibly short timeline is generally laughable, the FDA has been quite flexible when it comes to efforts to fight the pandemic.

Realistically speaking though, JNJ is unlikely to win this race.

While the giant drugmaker is obviously one of the most promising companies to join this fight, several companies are already further along in their efforts to find a COVID-19 vaccine.

A good example is Moderna (MRNA), which recently started Phase 1 of its clinical trials for a potential COVID-19 vaccine.

The company, which is working with the National Institutes of Health, will determine the safety and ability of its vaccine to trigger an immune response in the patient’s body. To date, there are 45 volunteers involved in this trial. Each of them will receive two doses of Moderna’s experimental vaccine.

Even if JNJ fails to make a fortune from its COVID-19 vaccine candidate, the company still has what it takes to ride out the pandemic and subsequent economic crisis. Actually, it has the ability to come out practically unscathed.

Throughout its 133-year history, (JNJ) has been a steady company that managed to survive six significant recessions so far.

A good example of its resilience was demonstrated during the Great Recession in 2008 up to 2009.

While the S&P 500 Index dropped by as much as 57%, (JNJ)’s shares fell by a maximum of 35%. With firm leaders and adjusted operational earnings growth, the company actually recorded an average earning-per-share growth of 7% from 2007 to 2009.

The company has also consistently paid and even continuously raised its dividend for the past 57 consecutive years -- a track record that can reassure even the most skittish investor.

A huge part of its success is the diversity of its portfolio, with several segments ready to pick up the slack if one sector begins to falter. (JNJ) has its hands on various segments including pharmaceuticals, medical equipment, and of course, consumer goods.

(JNJ) staples like Tylenol, Visine, Band-Aid, Neutrogena, and its line of baby products are the types of purchases that people need in good and bad times. These company brands offer a strong foundation for JNJ even in a recession. If you think about it, consumers rarely go about their days without using at least one JNJ product.

A review of (JNJ)’s performance in the rough years in the past paints a picture of a company strong enough to overcome this looming recession. In fact, it’s easy to believe the company’s fiscal guidance for 2020 which projects a 5.5% growth in sales and expanding margins.

Only a handful of companies can be considered “recession-proof,” and (JNJ) is definitely a part of that select few. Investing in this dependable business is a solid choice.

For more about (JNJ), please visit their website at https://www.jnj.com. For more about Corona vaccine winners, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.