When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 19, 2020

Fiat Lux

Featured Trade:

(JUNE 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (AAPL), (FXE), (FXA), (BA), (UAL), (AAPL), (MSFT), (BIIB), (PFE), (OXY), (SPCE), (WMT), (CSCO), (TGT)

Below please find subscribers’ Q&A for the June 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What is the best way to buy long term LEAPS for unlimited profits?

A: There is no such thing as unlimited profits on LEAPS; they are specifically limited to about 500% or 1,000%. Most people will take that. The answer is to wait for crash day. That’s when you dive into LEAPS, or during very prolonged sell-offs like we had in February or March. That’s where you get the bang per buck. On a capitulation day, you can pick up these things for pennies.

Q: How do you explain that all the cities and states that had major COVID-19 outbreaks and deaths are controlled by Democrats?

A: That’s like asking why you don’t get foot and mouth disease in New York City. The majority of US cities are Democratic, while the rural areas tend towards Republicans and the suburbs that flip back and forth. So, you will always get these big hotspots in cities where the population density is highest and there is a lot of crowding because that’s where the people are. Covid-19 is a disease that relies on within six-foot transmission. You are not going to get these big outbreaks in rural places because there are few people. Horse, cow, and pig diseases are another story. That is one reason the disease has become so politicized by the president.

Q: What is the time horizon for your picks?

A: It’s really a price function rather than a time horizon. Sometimes, a trade works in a day, other times it’s a month. I try to send out a large number of trade alerts because we have new subscribers coming in every day and the first thing they want is a trade alert. Occasionally, I’ll make 10% in a day and I take that immediately.

Q: I’m a new investor; trading in a pandemic is one thing, but what about other risks like volcanic eruptions, major solar flares, or global war? How do I prepare for one of three of these things in the next 25 years?

A: I’m actually worried about all three of those happening this year. If you lived through 1968, everything bad tends to happen in one year, and bad things tend to happen in threes. This is a year where we’re kind of making it up as we go along because there is no precedent. The playbook has been thrown out. Those who always relied on trading stocks and securities predictable ranges got wiped out.

Q: Beijing has quarantined its population again and canceled flights; is this going to cause the Chinese government to ramp up the blame game with the US?

A: Absolutely, the US is the number one Corona incubator in the world by far. We have 120,000 deaths—China had 4,000 deaths with four times the population. Many countries are blaming us for keeping this pandemic alive and spreading it further. But I don’t think foreign relations are a high priority right now with our current government. That said, it is easier for a dictatorship to control an epidemic than a democracy. In China, they were welding people’s doors shut who had the disease.

Q: Do you think taking away the $600 or $1200 stipend for the unemployed is going to crush the chances for many trying to get back to work?

A: It will. A lot of the stimulus measures only delay collapse by a couple of months. The PPP money was only for 2 months; I know a lot of companies are counting on that to stay in business. Some state unemployment benefits run out soon. Either you’re going to have to start forking up $3 trillion every other month, or you’re going to get another sharp downturn in the economy. Cities are bracing themselves for the worst eviction onslaught ever. Mass starvation among the poor is a possibility.

Q: Where do you place stops on vertical spreads?

A: Since vertical spreads don’t lend themselves to technical analysis, you have to draw a line in the sand—for me, it’s 2%. If I lose 2% of my total capital, or 20% on the total position, then I get the heck out of there and go look for another trade. That’s easy for me to do because I know that 90% of the time my next trade is a winner.

Q: Why did you sell your S&P 500 (SPY) July $330/$320 put spread at absolutely the worst moment?

A: The market broke my lower strike price, which is always a benchmark for getting out of a losing trade. When you go out-of-the-money on these spreads, the leverage works against you dramatically. This market isn’t lending itself to any kind of conventional historic analysis. The market went higher than it ever should have based on any kind of indicator you’re using. When the market delivers once in 100 year moves like we had off the March 23 bottom, you are going to be wrong. However, we immediately made the money back by putting on a (SPY) July $335/$340 put spread with a shorter maturity, and a (SPY) July $260-$$270 call spread. If you’re in this business, you’re going to take losses and be made to look like a perfect idiot, like I did twice last week.

Q: Who is getting involved down 10%?

A: I would say you’re getting both institutions and individuals involved down 10%. You keep hearing about $5 trillion in cash on the sidelines, and that’s how it’s coming to work. Plus, we have 13 million new day traders gambling away their stimulus checks.

Q: Why have you not put on a currency trade this year?

A: With the incredible volatility of the stock market, there were always better fish to fry. Currencies haven’t moved that much, and you want stocks that are dropping by 80% in two months and gapping up 200% the next two months. So, in terms of trading opportunities, currencies are number three on that list. Would you rather buy Apple (AAPL) for a 75% move, or the Euro (FXE) for a 6% move? My favorite has been the Aussie (FXA) and it has only gone up 20%.

Q: Do you issue trade alerts on LEAPS?

A: I don’t; most trade alerts are short term trades in the next month or two because we have to generate a large number of them. However, in February, March, and April, we started sending out lists of LEAPS. We sent out about 25 LEAPS recommendations. We did ten for Global Trading Dispatch (BA), (UAL), (DAL), ten for the Mad Hedge Technology Letter (AAPL), (MSFT), and five for the Mad Hedge Biotech & Health Care Letter (BIIB), (PFE). Even if you got just one or two of these, you got a massive impact on your performance because they did go up 500% to 1,000% in 2 months, which is normally the kind of return you see in two years. So, getting people to buy all those LEAPS was probably the greatest call in the 13-year history of this letter. I know subscribers who made many millions of dollars.

Q: I am new to trading; other than placing a trade, what do you recommend I get a handle on in the learning process?

A: We do have two services for sale. We have “Options for the Beginner,” and that I would highly recommend, and I’ll make sure that’s posted in the store. You can’t read or study enough. If you really want to go back to basics, read the 1948 edition of Graham and Dodd, where Warren Buffet got his education actually working for Benjamin Graham in the ’40s.

Q: Will Occidental Petroleum (OXY) go bankrupt?

A: No, they have the strongest balance sheet of any of the oil majors, so I would bet they would hang around for some time. They also have no offshore oil, which is the highest cost source of oil. But it’s going to be a volatile time for a while.

Q: Usually the selling is telling me to go away. With this market, the amount of money on the sidelines, is it going to be a stock picker’s market?

A: Yes, like I said the playbook is out the window. Normally, you get a month’s worth of trading in a month, now you get a month's worth in a day or two. So, we’re on fast forward, Corona is the principal driver of the market and no one knows what it’s going to do. The teens were a great index play. The coming Roaring Twenties will be a stock picker’s market because half of the companies will go out of business, while many will rise tenfold. You want to be in the latter, not the former. And index gets you the wheat AND the chaff.

Q: Will there be another opportunity to buy LEAPS?

A: Yes, especially if we get a second corona wave and it slaps the market down to new lows again. There’s a 50/50 chance of that happening. The rate of Corona cases is now increasing exponentially. We had 4,000 new cases in California yesterday.

Q: How do you see Main Street two years from now? Will the battered middle class ever recover?

They will if they move online. I think main street will be empty in two years. Only the largest companies are surviving because they have the cash reserve to do so. And they seem to be able to get government bailout money far better than the local nail salon or dry cleaner. Again, this was a trend that had been in place for decades but was greatly accelerated by the pandemic. I was in Napa, CA yesterday and half of the storefront shops had gone out of business.

Q: What are your thoughts on the spacecraft company Virgin Galactic (SPCE)?

A: Great for day traders, great for newbies, but not real investment material here. I don’t think the company will ever make money. It was just part of the temporary space had. Better to read about it in the papers and have a laugh than risk your own hard-earned money. Elon Musk’s Space X though is a completely different story.

Q: Which is the better buy now: Walmart (WMT), Costco (CSCO), or Target (TGT)?

A: I’d probably go for Target because they have been the fastest to move to the new online order and curb pickup universe. But Costco is also a great play.

Q: When should I buy Tesla?

A: On the next meltdown or down 30% from here, if and whenever we get that. It’s going to $2,500, then $5,000.

Q: With QE infinity, it doesn’t sound like we’ll get to LEAPS country. Do you agree?

A: No, I wouldn’t agree because at some point, the government might run out of money, the bond market won’t let them borrow anymore, and the money that gets approved doesn’t actually get spent because the works are so gummed up. Plus, Corona is in the driver's seat now. What if we’re wrong and we don’t get 250,000 cases by August, but 500,000 cases? 20 million? There are 100 things that could go wrong and get us back down to lows and only one that can go right and that is a Covid-19 vaccine. We’ve essentially been on nonstop QEs for the last 10 years already and the market has managed many 20% selloffs during that time. If we pursue a Japanese monetary policy, we will get a Japanese result, near-zero growth for 30 years.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mount Everest in 1976

Mad Hedge Biotech & Healthcare Letter

June 18, 2020

Fiat Lux

Featured Trade:

(ABBVIE JOINS THE CORONA FRAY),

(ABBV), (REGN), (LLY), (GMAB), (RHHBY), (AMGN), (JNJ), (NVS), (GSK), (MRK), (AZN), (SNY), (AGN), (PFE)

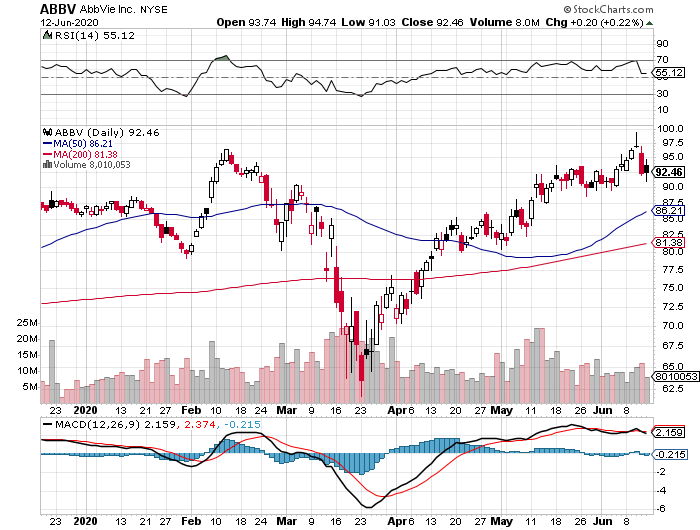

Although late to the party, giant biopharmaceutical company AbbVie (ABBV) is now going all-out on its coronavirus disease (COVID-19) treatment program.

The Illinois-based company, which has a market capitalization of $162.95 billion, aims to come up with a treatment that can block the SARS-CoV-2 coronavirus that causes COVID-19. The drug is currently dubbed 47D11.

AbbVie is working on this cure alongside Netherlands’ Erasmus Medical Center and Utrecht University as well as China’s bio-therapeutics developer Harbour BioMed.

It’s worth noting that AbbVie isn’t the first company to use this approach.

Earlier this year, Regeneron (REGN) announced a similar strategy to beat COVID-19. Its experimental cure, called REGN-COV2, is an antibody cocktail composed of two to three proteins working together to fight off the virus. The company plans to start clinical trials sometime this month.

Aside from AbbVie and Regeneron, Eli Lilly (LLY) is also utilizing the same technology.

In fact, the Indiana-based biotechnology leader already started dosing actual patients with COVID-19 with its experimental treatment, LY-CoV555.

Eli Lilly’s drug was actually developed using the antibodies collected from one of the first patients in the US to recover from the disease.

Using the same approach to find a COVID-19 cure isn’t the only thing Regeneron and AbbVie have in common, though.

To bulk up its oncology pipeline, AbbVie forged a partnership with Danish biotechnology company Genmab (GMAB) earlier this month.

Interestingly, Genmab is the same company behind the clinical progress of the bispecific antibody treatments of both Regeneron and Roche Holding (RHHBY).

AbbVie and Genmab agreed to collaborate on bispecific antibody development to come up with treatments that can target cancer cells and strengthen immune cells. The three drugs included in the deal are epcoritamab (DuoBody-CD3xCD20), DuoHexaBody-CD37, and DuoBody-CD3x5T4.

Aside from the three candidates already lined up, the two companies are also ironing out details on four additional cancer treatments.

The deal is estimated to be worth almost $4 billion, with AbbVie paying $750 million upfront.

On top of that, Genmab will also be entitled to get potential payments of up to $3.15 billion in milestone payments. The four potential cancer treatments could also entitle Genmab with an additional $2 billion.

Since bispecific antibodies are hailed as the “next-generation cancer therapy,” this market continues to attract big names in the industry.

So far, the list of companies working on bispecific antibodies includes Amgen (AMGN), Johnson & Johnson (JNJ), Novartis (NVS), GlaxoSmithKline (GSK), Merck (MRK), AstraZeneca (AZN), and Sanofi (SNY).

Aside from improving its oncology lineup, Abbvie has shown more creativity in diversifying its products.

Throughout the years, AbbVie had been considered as a strictly pharmaceutical company in the past. However, its recent purchase of Allergan set off a series of decisions that showcased the company’s plan to expand its portfolio.

With AbbVie’s revenue reaching $33.3 billion in 2019, several experts disagreed with the company’s decision to buy Allergan (AGN).

However, the move is estimated to add roughly $50 billion to the company’s annual revenue and help AbbVie’s bottom line.

One of the biggest products added to AbbVie’s portfolio is Botox, which has been long-regarded as Allergan’s prized cash cow.

In fact, this widely popular injectible raked in $1.02 billion in sales for Allergan in the fourth quarter of 2019 alone. Another promising product is the dermal filler Juvederm, which brought in $347.3 million in the same period.

Despite the excitement from the newly formed partnerships, a lot of investors remain apprehensive over AbbVie’s future.

These fears are rooted in the doomsday countdown for the company’s blockbuster rheumatoid arthritis drug Humira — and for good reason.

In its 2020 first quarter report, AbbVie recorded $8.6 billion in revenue, indicating a 10.1% jump year over year.

From this, Humira contributed nearly 58% despite the growing number of biosimilar rivals in Europe. In fact, Humira sales reached $4.7 billion, showing a 14.5% climb from the same period last year.

In 2019, experts predicted that Humira is poised to overtake Pfizer’s (PFE) Lipitor as the top-selling drug of all time by 2024.

AbbVie’s rheumatoid arthritis drug is estimated to reach a whopping $240 billion in sales in the next four years.

As expected, biosimilar competition, led by Amgen, has been licking their chops to get a piece of the action for years now, and they would do everything to dethrone AbbVie from its top spot in the autoimmune diseases sector.

Hence, AbbVie implemented two strategies to address this issue.

The first is forestalling the inevitable. In a recent court victory, AbbVie secured patent exclusivity for Humira until 2023.

Although this only leaves AbbVie with three short years to deal with the problem, it’s sufficient period for the company to execute its second plan: “Humira on steroids.”

Since Humira’s patent exclusivity has been a sore issue for AbbVie for years, the company decided to solve it by creating a stronger version of the drug.

The new antibody treatment, called ABBV-3373, is said to be more effective than Humira.

If all goes well in its clinical trials, then this “new Humira” can very well be AbbVie’s next megablockbuster and main moneymaker after 2023.

Humira isn’t the only big seller in AbbVie’s lineup.

Other blockbusters include cancer drug Imbruvica, which recorded $1.2 billion in revenue in the first quarter, up by 20.6% compared to the same period last year. Another cancer drug, Venclexta, is also performing well, bringing in $317 million in net revenue.

AbbVie has been boosting its next-generation treatments as well.

So far, two more Humira-like drugs stand out --severe plaque psoriasis medication Skyrizi and rheumatoid arthritis treatment Rinvoq.

Skyrizi’s annual sales are projected to grow from $1 billion to hit $4.4 billion by 2025, with the numbers going higher than $7.4 billion in the following years.

Rinvoq is expected to bring in $3.7 billion in sales by 2025 and increasing to reach $5.9 billion after that.

Right now, AbbVie appears to be oddly cheap as its shares are trading at only 9 times its expected earnings this year. This is possibly due to the anxiety over the loss of Humira’s patent exclusivity by 2023.

As AbbVie has shown in the past months, it has solid plans on how to deal with the impending loss. Its acquisition of Allergan, partnership with Genmab, and development of the “next Humira” all prove that claim.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 18, 2020

Fiat Lux

Featured Trade:

(TESTING TESLA’S SELF DRIVING TECHNOLOGY),

(TSLA)

(TESTIMONIAL)

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie.

Well, if it’s good enough for Steph, then it’s good enough for me.

Last week, I received a call from Elon Musk’s office to test the company’s self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader.

I did, and prepare to have your mind blown!

I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the East San Francisco Bay Area mountains. Suddenly the salesman reached over a flicked a lever on the left side of the driving column.

The car took over!

There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could. It does especially well at night or in fog, a valuable asset for senior citizens whose night vision is fading fast.

All that was required was for me to touch the steering wheel every two minutes to prove that I was not sleeping.

The cars do especially well in rush hour driving, as it is adept at stop and go traffic. You can just sit there and work on your laptop, read a book, or watch a movie on the built in 4G WIFI HD TV.

When we returned to the garage, the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way.

The range is 290 miles, which I can recharge at home at night from a standard 220-volt socket in my garage in seven hours. When driving to Lake Tahoe, I can stop half way at get a full charge in 30 minutes. The new chargers operate at a blazing 400 miles per hour.

The chassis can rise as high as eight inches off the ground so it can function as a true SUV.

The “ludicrous mode,” a $10,000 option, takes you from 0 to 60 mph in 2.9 seconds. However, even a standard Tesla can accelerate so fast that it will make the average passenger carsick.

Here’s the buzzkill.

Tesla absolutely charges through the nose for extras.

The 22-inch wheels, the third row of seats to get you to seven passengers, the premium sound, the leather seats, and the self-driving software can easily run you $30,000-$40,000.

A $750 tow hitch will accommodate a ski or back rack. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory.

It’s easy to see how you can jump from an $84,990 base price to a total cost of $162,500, including taxes, for the ultra-luxury Performance model, as I did.

My company will be purchasing the car under Section 179 of the International Revenue Code. The car qualifies because it weighs over 6,000 pounds and is therefore a truck under the new tax law.

This allows me to deduct the entire $162,500 cost of the vehicle upfront, plus the maintenance and insurance costs for the entire life of the car. However, I will have to maintain a mileage log as a hedge against any future IRS audits.

Ironically, Section 179 was enacted as a subsidy for consumer purchases of the eight mile per gallon Hummer, which was originally built by AM General and owned by General Motors (GM).

After several attempts to sell, the division failed, production was permanently shut down. However, the tax subsidies live on for any like designed vehicle.

It looks like I’ll have to buy two Teslas this year.

As for “drop dead’ curb appeal, nothing beats the Model X. Buy the stock on every 20% dip. My original cost is $16.50 a share and it topped $1,000 last week.

It’s another way of saying “buy the shares and you get the car for free.”

Thanks for Your Subscription!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.